- Home

- »

- Biotechnology

- »

-

Nucleic Acid Labeling Market Size And Share Report, 2030GVR Report cover

![Nucleic Acid Labeling Market Size, Share & Trends Report]()

Nucleic Acid Labeling Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Kits, Reagents), By Type, By Method (Enzymatic, Chemical), By Application (Sequencing), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-252-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Nucleic Acid Labeling Market Summary

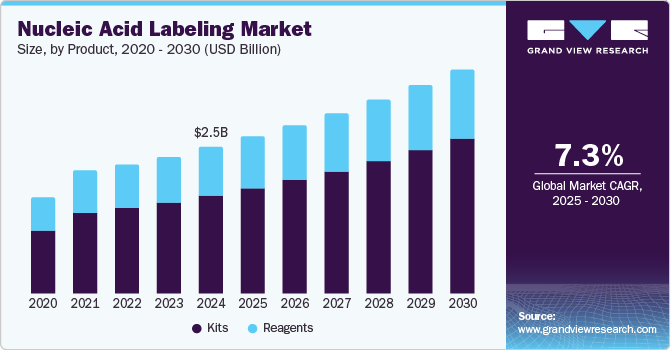

The global nucleic acid labeling market size was estimated at USD 2.46 billion in 2024 and is projected to reach USD 3.75 billion by 2030, growing at a CAGR of 7.3% from 2025 to 2030. The increasing application of nucleic acid-based diagnostics across various healthcare domains drives market growth worldwide.

Key Market Trends & Insights

- The North America nucleic acid labeling market dominated the global market with a revenue share of 39.8% in 2024.

- The nucleic acid labeling market in U.S. dominated the North America market with a revenue share of 88.4% in 2024.

- The Asia Pacific nucleic acid labeling market is expected to register the fastest CAGR of 9.5% in the forecast period.

- Based on product, kits dominated the market with a revenue share of 66.8% in 2024.

- In terms of type, radioisotope/radioactive labelling led the market with a revenue share of 80.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.46 billion

- 2030 Projected Market Size: USD 3.75 billion

- CAGR (2025-2030): 7.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Notably, the rising focus on cancer risk management, diabetes diagnostics, and prenatal testing has underscored the importance of these technologies for precise disease detection and management. In the U.S., the prevalence of diabetes among adults reached 11.5% in 2023, affecting approximately 31.9 million individuals. The increasing reliance on nucleic acid diagnostics for effective disease management and early detection is crucial for improving patient outcomes.The worldwide prevalence of genetic disorders has heightened the demand for nucleic acid analytics, compelling healthcare professionals to invest in advanced diagnostic tools. According to a 2023 study in Aging and Public Health, the number of adults with at least one chronic disease will surge by 99.5%, from around 71.5 million in 2020 to 142.7 million by 2050. This burgeoning need for sophisticated diagnostic technologies emphasizes the role of nucleic acid labeling in addressing emerging health challenges and enhancing patient care.

Moreover, advancements in genomic research are fuelling demand, as ongoing developments in genomics and enzymology necessitate sophisticated labeling techniques for precise analysis. By 2024, the prevalence of chronic diseases is anticipated to rise, with approximately 42% of Americans expected to live with two or more chronic conditions, as reported by the CDC. This trend reinforces the demand for innovative genomic research and associated labeling techniques, highlighting the critical role of nucleic acid labeling in the pursuit of effective therapies and personalized medicine approaches.

The increase in healthcare expenditure, particularly in developed regions, supports the adoption of advanced diagnostic technologies. Rising costs associated with managing chronic diseases have led to increased funding for innovative diagnostic solutions. In the U.S., healthcare spending continues to rise significantly each year, reflecting a broader trend that fuels the demand for nucleic acid labeling solutions. This ongoing investment in healthcare innovation is pivotal for facilitating improved disease management and enhanced health outcomes for patients globally.

Product Insights

Kits dominated the market with a revenue share of 66.8% in 2024. The demand for DNA detection and purification kits has surged. Advanced labeling kits enable swift diagnostics, reducing hospital visits and infection risks. Manufacturers are innovating to develop customized kits for various applications, enhancing their market appeal. The rising incidence of genetic disorders and the emphasis on early disease diagnosis further drive the necessity for these essential healthcare solutions.

Reagents are expected to grow rapidly over the forecast period. Reagents are vital in diverse labeling protocols, including chemical and enzymatic methods, driving advancements in diagnostics, drug discovery, and genomic research. The growing demand for precise and efficient labeling in healthcare, coupled with continuous improvements in reagent formulations, further accelerates their adoption in laboratories and research institutions.

Type Insights

Radioisotope/radioactive labelling led the market with a revenue share of 80.6% in 2024. This method is especially beneficial for research and diagnostic applications requiring precise nucleic acid tracing and quantifying. Radiolabeled nucleotides provide enhanced sensitivity compared to non-radioactive options, making them optimal for hybridization assays and sequencing. The growing focus on genomics and personalized medicine is further increasing the adoption of these techniques.

Due to its sensitivity, safety, and versatility, non-radioactive labelling is projected to register substantial growth over the forecast period. Methods such as fluorescent tagging eliminate hazards associated with radioactivity and offer similar detection sensitivity with shorter exposure times. Their enhanced stability and ease of handling make them increasingly preferred in diagnostics and therapeutic research.

Method Insights

Enzymatic methods held the largest revenue share of 69.7% in 2024. Enzymatic labeling techniques, such as PCR and end-labeling, enable precise incorporation of labeled nucleotides into nucleic acids during synthesis. This approach is highly beneficial for generating probes in diagnostics and research, allowing for accurate detection and purification. Moreover, advancements in enzyme technology improve the efficiency and reliability of these methods.

Chemical methods are expected to experience lucrative growth over the forecast period. Methods involving incorporating fluorescent tags and biotin are crucial for laboratory processes such as DNA sequencing and microarray analysis. Their reliable and reproducible results make them ideal for routine research and diagnostics. Furthermore, advancements in chemical labeling technologies enhance sensitivity and specificity, allowing for customized labeling strategies to meet specific experimental needs.

Application Insights

Polymerase chain reaction (PCR) dominated the market and accounted for a share of 35.4% in 2024. PCR is critical for DNA amplification, facilitating the detection and analysis of genetic material, particularly in infectious diseases and genetic disorders. The increased adoption of PCR testing during the COVID-19 pandemic, accompanied by technological advancements, has improved sensitivity and specificity, further promoting its application in clinical settings and research laboratories.

Sequencing is anticipated to witness the fastest CAGR of 8.4% over the forecast period. Advancements in next-generation sequencing (NGS) technologies have transformed genomic research by enabling rapid, high-throughput sequencing of entire genomes at significantly lower costs and reduced time than traditional methods such as Sanger sequencing. This capability supports personalized medicine, cancer research, infectious disease diagnostics, and complex genetic data analysis, establishing NGS as essential in modern biology and clinical applications.

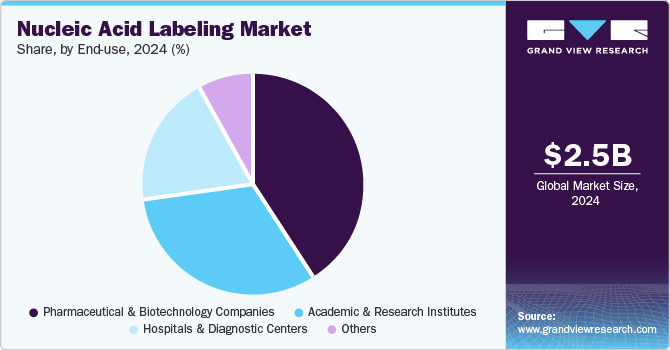

End-use Insights

Pharmaceutical & biotechnology companies led the market and accounted for a share of 41.2% in 2024. These companies utilize nucleic acid labeling to develop targeted therapies and conduct genomic research, crucial for comprehending complex diseases. Rising investments in R&D, especially in genomics and proteomics, drive this demand. Furthermore, the increase in chronic diseases underscores the need for innovative diagnostic tools, positioning nucleic acid labeling as vital for effective therapies and advanced healthcare solutions.

Academic & research institutes are projected to grow rapidly from 2025 to 2030. These institutions employ nucleic acid labeling for critical applications, including gene expression analysis, RNA sequencing, and PCR, essential for elucidating genetic functions and disease mechanisms. Increased funding for research initiatives and a heightened emphasis on personalized medicine stimulate demand, while expanded R&D activities in life sciences necessitate innovative labeling techniques.

Regional Insights

The North America nucleic acid labeling market dominated the global market with a revenue share of 39.8% in 2024. North America boasts a strong healthcare infrastructure, considerable investments in research and development, and a prominent presence of leading market players. The region excels in molecular diagnostics and personalized medicine, stimulating demand for innovative labeling techniques. Government support and funding for genomics research further enhance growth, positioning North America as a key hub for nucleic acid labeling technologies.

U.S. Nucleic Acid Labeling Market Trends

The nucleic acid labeling market in U.S. dominated the North America market with a revenue share of 88.4% in 2024. The country’s emphasis on personalized medicine and the rising incidence of genetic diseases demand effective nucleic acid labeling techniques. Substantial government funding for biomedical research promotes innovation and improves accessibility to advanced diagnostic tools, further advancing the field of genetic research and patient care.

Europe Nucleic Acid Labeling Market Trends

Europe nucleic acid labeling market held substantial market share in 2024, driven by robust research and development in biotechnology and pharmaceuticals. With extensive academic collaborations, government funding for genomic studies, rising healthcare expenditures, and a focus on molecular diagnostics, the region’s established companies and innovative startups bolster the competitive landscape.

The nucleic acid labeling market in Germany is expected to grow in the forecast period. The country boasts numerous prestigious academic institutions and research facilities that foster innovation in genomics and molecular diagnostics. Increased government funding for healthcare and R&D initiatives bolsters advancements in nucleic acid technologies. Germany’s strong healthcare infrastructure and rising demand for personalized medicine also drive the adoption of nucleic acid labeling techniques, enhancing competition.

Asia Pacific Nucleic Acid Labeling Market Trends

The Asia Pacific nucleic acid labeling market is expected to register the fastest CAGR of 9.5% in the forecast period. Countries in the region are experiencing substantial growth fueled by increased research in genomics and personalized medicine. The rising incidence of genetic disorders intensifies the demand for effective diagnostic tools. Furthermore, local manufacturers are introducing innovative solutions tailored to regional requirements.

The nucleic acid labeling market in China dominated the Asia Pacific market in 2024. China is witnessing significant investments in biotechnology research and development, driven by a commitment to enhancing healthcare outcomes through advanced diagnostic tools. The rising prevalence of genetic diseases necessitates accurate testing methods. Government initiatives supporting genomics research further promote innovation and accessibility to state-of-the-art technologies in the sector.

Key Nucleic Acid Labeling Company Insights

Some key companies operating in the market include PerkinElmer; F. Hoffmann-La Roche Ltd; GE Healthcare; Thermo Fisher Scientific Inc.; Promega Corporation; among others. The industry is marked by substantial R&D investments, technological advancements, and strategic collaborations, including mergers and partnerships to meet the demand for personalized medicine.

-

F. Hoffmann-La Roche Ltd specializes in innovative diagnostic solutions, including nucleic acid labeling products. The company emphasizes advancing molecular diagnostics through cutting-edge technologies for precise genetic mutation detection, thereby facilitating personalized medicine and effective disease management across multiple therapeutic areas.

-

Promega Corporation is a provider of life science research tools, offering reagents and kits for nucleic acid labeling. Its diverse product range supports PCR, sequencing, and gene expression analysis, enhancing genomic research and improving healthcare outcomes.

Key Nucleic Acid Labeling Companies:

The following are the leading companies in the nucleic acid labeling market. These companies collectively hold the largest market share and dictate industry trends.

- PerkinElmer

- F. Hoffmann-La Roche Ltd

- GE Healthcare

- Thermo Fisher Scientific Inc.

- Promega Corporation

- New England Biolabs

- Enzo Biochem Inc.

- Vector Laboratories, Inc.

- Merck KGaA

- Agilent Technologies, Inc.

Recent Developments

-

In October 2024, the FDA approved Thermo Fisher Scientific’s Oncomine Dx Target Test as a companion diagnostic for Servier’s VORANIGO®, enabling patient identification for the first targeted therapy for Grade 2 IDH-mutant glioma.

-

In September 2024, QIAGEN launched the QIAcuityDx Digital PCR System for clinical oncology testing, enhancing precision with absolute quantitation. This all-in-one instrument streamlines workflows, reduces costs, and supports minimal residual disease monitoring across North America and the EU.

-

In September 2024, Promega introduced a novel enzyme that minimized stutter artifacts in forensic DNA analysis, enhancing accuracy in mixed sample profiling, and filed a patent for this groundbreaking polymerase.

-

In April 2024, New England Biolabs launched the Monarch Mag Viral DNA/RNA Extraction Kit, enhancing viral nucleic acid recovery for sensitive detection, compatible with various automated platforms and sustainable practices.

Nucleic Acid Labeling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.63 billion

Revenue forecast in 2030

USD 3.75 billion

Growth rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, type, method, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

PerkinElmer; F. Hoffmann-La Roche Ltd; GE Healthcare; Thermo Fisher Scientific Inc.; Promega Corporation; New England Biolabs; Enzo Biochem Inc.; Vector Laboratories, Inc.; Merck KGaA; Agilent Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nucleic Acid Labeling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nucleic acid labeling market report based on product, type, method, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits

-

Reagents

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Radioisotope/Radioactive Labelling

-

Non-radioactive Labelling

-

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Enzymatic

-

TdT

-

T4 RNA Ligase

-

T4 PNK

-

DNA Polymerase

-

Others

-

-

Chemical

-

Periodate

-

EDC

-

Nonspecific Crosslinkers

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sequencing

-

Microarray

-

In Situ Hybridization

-

Blotting Techniques

-

Polymerase Chain Reaction

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Diagnostic Centers

-

Academic & Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.