- Home

- »

- Medical Imaging

- »

-

Nuclear Imaging Equipment Market Size, Share Report, 2030GVR Report cover

![Nuclear Imaging Equipment Market Size, Share & Trends Report]()

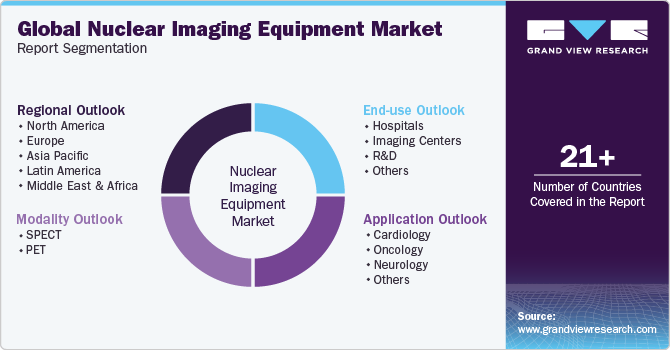

Nuclear Imaging Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Modality (SPECT, PET), By Application (Cardiology, Oncology), By End-use (Hospitals, Imaging Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-187-7

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nuclear Imaging Equipment Market Summary

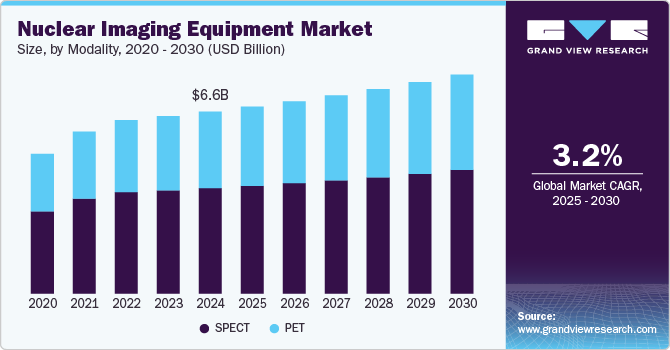

The global nuclear imaging equipment market size was estimated at USD 6.58 billion in 2024 and is projected to reach USD 7.91 billion by 2030, growing at a CAGR of 3.23% from 2025 to 2030. The market is being driven by several factors such as the increasing prevalence of cancer worldwide, technological advancements, clinical applications, and research, and increasing nuclear medicine imaging procedures.

Key Market Trends & Insights

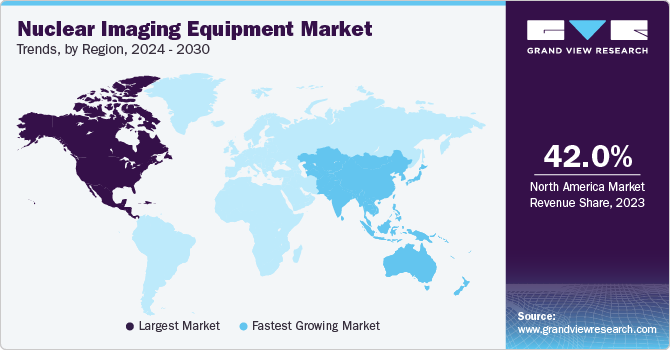

- The North America nuclear imaging equipment market held a dominant position, capturing a significant share of 42.82% in 2024.

- The U.S. nuclear imaging equipment market is growing, driven by the increasing prevalence of cancer and advancements in imaging technologies like PET and SPECT.

- Based on modality, the single photon emission computed tomography (SPECT) segment dominated the market with the largest revenue share of 57.88 % in 2024.

- Based on application, the oncology segment dominated the market with the largest revenue share of 48.99% in 2024.

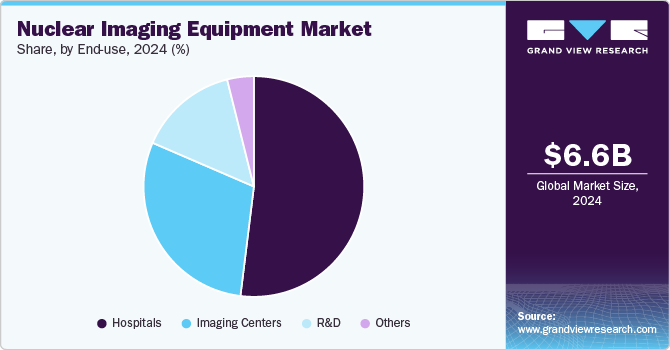

- Based on end-use, the hospitals segment captured the largest revenue share of 51.96% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.58 Billion

- 2030 Projected Market USD 7.91 Billion

- CAGR (2025-2030): 3.23%

- North America: Largest market in 2024

According to the International Agency for Research on Cancer, by 2025 the worldwide cancer prevalence is expected to reach 50,550,287 from 19,292,789 in 2020.

Nuclear imaging equipment examples, include PET and SPECT scanners, they stand as highly efficient tools in medicine. They serve diverse purposes, from diagnosing cancer to studying organ function and assessing brain irregularities. Their efficacy lies in generating detailed internal images and facilitating precise diagnoses and treatment strategies. These technologies have markedly propelled advancements in medical science.

Furthermore, technological advancements in these modalities are expected to propel market growth. In June 2022, Siemens Healthineers introduced the Symbia Pro.specta, a SPECT/CT system that has received both the CE mark and FDA clearance. This system integrates advanced SPECT and CT imaging technologies. Notable features include a low-dose CT capable of capturing up to 64 slices, offering impressive detail in imaging. Additionally, it includes automatic SPECT motion correction, enhancing image clarity, and streamlining the examination process with an intuitive, automated workflow that guides users through decision-making steps.

The rise in chronic diseases globally is anticipated to drive the use of nuclear imaging equipment. Conditions such as cancer, cardiovascular problems, neurological disorders, and metabolic issues are increasingly prevalent worldwide. Nuclear imaging technologies, such as PET and SPECT scanners, hold a crucial role in diagnosing and monitoring these chronic diseases. For instance, PET scans are efficient in cancer diagnosis, detecting tumors, assessing their severity, and tracking treatment responses. Similarly, in cardiovascular diseases, these imaging equipment are vital for evaluating blood flow, detecting blockages, and assessing heart function. Moreover, in neurology, nuclear imaging aids in diagnosing conditions like Alzheimer's disease and other neurodegenerative disorders by visualizing brain metabolism and abnormalities.

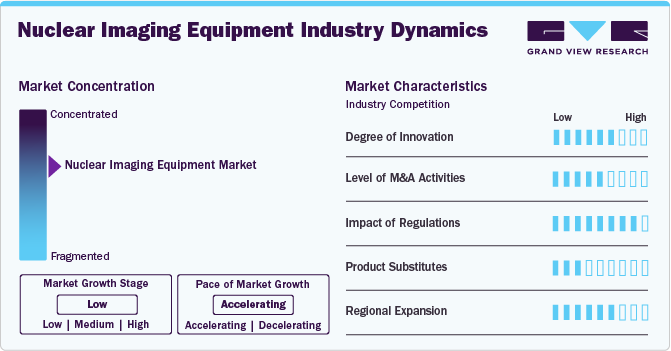

Market Concentration & Characteristics

The market growth stage is low, and the pace is accelerating. The nuclear imaging equipment market has shown steady growth owing to technological advancements, increased occurrences of chronic illnesses, and an aging population. PET and SPECT modalities have become pivotal in diagnosing and monitoring conditions such as cancer, cardiovascular diseases, and neurological disorders. Manufacturers of nuclear imaging equipment are involved in developing new technologies to ensure their systems meet evolving diagnostic standards. One prevalent strategy involves integrating advanced imaging software and artificial intelligence algorithms. This combination is gaining popularity for its ability to heighten the precision and efficiency of nuclear imaging equipment.

Companies are strategically pursuing mergers and acquisitions to enhance their market presence and broaden their product portfolios. For instance, in April 2022, Mediso Ltd announced the acquisition of Bartec Technologies Ltd, a UK-based company specializing in the supply, installation, and support of Nuclear Medicine and Molecular Imaging equipment and accessories. This acquisition is expected to strengthen Mediso’s position in the UK and Ireland markets.

The market has achieved a high degree of innovation, owing to remarkable technological advancements that have positioned it at the forefront of medical diagnostics. Integrating with AI, implementing advanced detector technologies for enhanced image quality, and minimizing radiation exposure for patients are key contributors to this progress. Furthermore, a surge in the development of hybrid imaging systems is another factor to this, as they seamlessly combine nuclear imaging with modalities such as computed tomography (CT) or magnetic resonance imaging (MRI), offering a consolidated and comprehensive source of both anatomical and functional information in a single scan.

Companies involved in the manufacturing of nuclear imaging equipment are actively engaging in integration through merger and acquisition activities. This strategic approach aims to augment technological capabilities, broaden market reach, and ensure competitiveness in the continuously evolving healthcare landscape.

The influence of regulatory policies on nuclear imaging devices is significant. Governments and regulatory bodies globally enforce various stringent guidelines to uphold the safety, efficacy, and quality of nuclear imaging technologies. These regulations cover a range of aspects, including radiation safety standards, device performance, and manufacturing practices.

Within the market, the presence of product substitutes offers healthcare providers compelling alternatives to consider for their diagnostic technology investments. The advancements in non-nuclear imaging modalities, such as magnetic resonance imaging (MRI) and computed tomography (CT), serve as noteworthy substitutes. These alternative technologies have experienced significant improvements in resolution, speed, and versatility, strategically positioning them to effectively compete with specific aspects of nuclear imaging.

The geographical reach of nuclear imaging equipment exhibits a moderate to high level of expansion, primarily driven by increased adoption in developed economies like the U.S. and Japan. However, in underdeveloped or developing economies, the adoption of nuclear imaging equipment is comparatively lower due to factors such as limited healthcare access, inadequate regulations, and underdeveloped healthcare infrastructure.

Modality Insights

The single photon emission computed tomography (SPECT) segment dominated the market with the largest revenue share of 57.88 % in 2024. A key contributing factor is the cost-effectiveness associated with SPECT equipment and procedures. Compared to PET scanners, SPECT scanners are generally more economical to install and operate, thus increasing their accessibility across various healthcare settings. This affordability extends the adoption of SPECT technology to a wider array of healthcare facilities, including smaller clinics and hospitals with limited resources. Furthermore, SPECT imaging utilizes different radiotracers and imaging agents in comparison to PET, offering distinct advantages in specific diagnostic tests.

Positron emission tomography (PET) is anticipated to grow at the fastest rate from 2025 to 2030. Advancement in PET imaging technology is a significant factor contributing to the market growth. PET scanners offer higher resolution images and deliver more precise metabolic information, which holds immense importance across various specialties like oncology, neurology, and cardiology.

Ongoing research and developmental studies primarily concentrate on refining PET imaging techniques. For instance, in November 2023, a small-scale study conducted by researchers at the National Institutes of Health showcased the potential of positron emission tomography (PET) scans in identifying individuals at risk of developing Parkinson's disease or Lewy body dementia. This research highlights PET scans can help in early detection and risk assessment for these diseases.

Application Insights

The oncology segment dominated the market with the largest revenue share of 48.99% in 2024. This is due to the growing prevalence of cancer worldwide and advanced nuclear imaging technology, notably PET and SPECT have seen significant expansion owing to their unmatched capability to thoroughly examine the molecular traits specific to cancer. Furthermore, these imaging modalities facilitate ongoing research in oncology. They aid in the development and evaluation of new cancer treatments and therapies by providing insights into the tumor's behavior, metabolism, and response to experimental drugs.

The cardiology segment is expected to grow at the fastest rate from 2025 to 2030. The rising incidence of cardiovascular diseases (CVDs) coupled with the increased awareness regarding nuclear imaging's diagnostic capabilities is anticipated to fuel market growth. For instance, as per the World Health Organization (WHO), CVDs stand as the primary cause of global mortality, approximately 17.9 million lives annually. This prevalence shows the significance of nuclear imaging in comprehensively addressing the challenges posed by cardiovascular diseases.

End-use Insights

The hospitals segment captured the largest revenue share of 51.96% in 2024. Hospitals are adopting nuclear imaging equipment at an increasing rate. In February 2023, Skåne University Hospital in Sweden installed GE Healthcare's advanced SPECT/CT scanner, the StarGuide system. The comprehensive nature of hospitals allows for a wider array of medical services in one place, making nuclear imaging more accessible to a diverse patient population.

Moreover, hospitals often manage more complex cases, where the detailed diagnostic precision of nuclear imaging, like PET and SPECT scans, holds immense importance in accurate diagnosis and treatment planning. In addition, hospitals typically have larger budgets and resources compared to standalone imaging centers, enabling sustained investment and operation of these advanced imaging technologies.

The R&D institute segment is expected to witness the fastest CAGR from 2025 to 2030. R&D institutes act as innovation centers, continuously exploring and enhancing imaging methods and equipment. Their research efforts receive consistent funding from various channels, including government, private, and corporate sources, driving their advancements.

Furthermore, the widening applications of nuclear imaging beyond traditional diagnostics contribute to the expansion of R&D institutes. These centers venture into various fields like drug development, neuroscience, cardiovascular research, and oncology, expanding the utility and importance of nuclear imaging technologies.

Regional Insights

In 2024, the North America nuclear imaging equipment market held a dominant position, capturing a significant share of 42.82%. This trend is expected to continue throughout the forecast period. A key factor driving the growth of the nuclear imaging equipment market in North America is the rising incidence of cancer, which has led to an increased demand for advanced imaging technologies such as PET (Positron Emission Tomography) and SPECT (Single Photon Emission Computed Tomography) systems. These imaging tools play a crucial role in the early detection of cancer, accurate staging, and monitoring of treatment progress. Their ability to provide precise and timely diagnostic information has made them essential in contemporary healthcare, contributing to the sustained demand for nuclear imaging equipment in the region.

U.S. Nuclear Imaging Equipment Market Trends

The U.S. nuclear imaging equipment market is growing, driven by the increasing prevalence of cancer and advancements in imaging technologies like PET and SPECT. These systems are crucial for accurate diagnosis and treatment monitoring. In addition, U.S. regulatory bodies are supporting innovation in the market. For example, in June 2023, Mediso received FDA clearance for its InterView XP and InterView FUSION software, designed for multimodality image processing (PET, SPECT, MRI, CT). These tools streamline workflows in nuclear medicine, promoting the development of advanced products and boosting market growth.

Europe Nuclear Imaging Equipment Market Trends

Europe nuclear imaging equipment market is experiencing significant growth, driven by substantial investments in research and development from both public and private sectors. The demand for healthcare devices, particularly in response to the increasing prevalence of cancer, is a key factor behind this expansion. According to the European Commission, new cancer cases grew by 2.3% from 2020 to 2022, reaching 2.74 million, while cancer-related deaths rose by 2.4%, as reported by the European Cancer Information System (ECIS). Estimates suggest that 31% and 25% of European men and women respectively will be diagnosed with cancer before age 75, with 14% of men and 9% of women expected to die from the disease before that age. These rising cancer rates are driving the demand for advanced imaging technologies, such as nuclear imaging equipment, essential for early detection, precise diagnosis, and treatment monitoring. The increasing focus on cancer care and the need for innovative diagnostic tools are expected to further propel the growth of the nuclear imaging market in Europe.

The UK nuclear imaging equipment market is experiencing significant growth, driven by factors such as rising cancer prevalence, advancements in technology, and increasing awareness of diagnostic imaging. The demand for sophisticated imaging modalities like PET and SPECT is on the rise, as these tools play a critical role in the early detection, treatment planning, and monitoring of various diseases.

For instance, in October 2023, a USD 35.70 million total-body PET imaging platform was launched in the UK through a partnership among the Medicines Discovery Catapult, the Medical Research Council, and Innovate UK. The National PET Imaging Platform features two full-body PET scanners, enabling early disease detection with enhanced sensitivity and offering valuable insights for diagnosing and treating complex diseases, thus improving drug discovery processes.

France nuclear imaging equipment market is highly competitive, with key players such as Siemens Healthineers, GE Healthcare, and Koninklijke Philips N.V. leading the way. Intense competition drives innovation in products and services. The growing cancer burden in France is a major factor boosting the demand for nuclear imaging technologies. In 2022, the International Agency for Research on Cancer (IARC) reported 483,568 new cancer cases, with breast cancer being the most prevalent, contributing to 66,328 new cases. Additionally, France’s high healthcare spending ensures access to advanced diagnostic tools, further supporting market growth. The upcoming launch of United Imaging’s uMI 550 PET/CT system in August 2024 is also expected to significantly drive market expansion in the country.

The nuclear imaging equipment market in Germany is experiencing significant growth, driven by advancements in imaging technologies and increasing demand for precise diagnostics. Key modalities such as PET, SPECT, and hybrid imaging systems are gaining popularity for their ability to provide detailed insights into a wide range of medical conditions, especially cancer. The introduction of innovative radiotracers, like Gallium-68 (Ga-68) Fibroblast Activation Protein Inhibitor (FAPI) PET imaging in January 2023, has further enhanced tumor detection and staging, positioning Germany as a leader in molecular imaging. These technological advancements are fuelling the growth of the nuclear imaging equipment market in the country.

Asia Pacific Nuclear Imaging Equipment Market Trends

Asia Pacific nuclear imaging equipment market is expected to witness significant growth, driven by increasing healthcare expenditure, a growing prevalence of chronic diseases, and the rising adoption of advanced imaging technologies. Countries like China, India, and Japan are at the forefront of this market expansion due to their large patient population and investments in healthcare infrastructure.

In China, the rapid expansion of PET-CT scanners, particularly in oncology centres, reflects the country's growing investment in advanced medical imaging. The uEXPLORER PET/CT system was initially installed at Zhongshan Hospital, and by September 2023, 16 installations were completed across the country, as noted by the Journal of Nuclear Medicine. With an expected annual increase of 6-7 units, United Imaging Healthcare's uExplorer system enhances diagnostic precision, reducing both scan times and radiation exposure. This state-of-the-art scanner significantly improves cancer detection, exemplifying China's shift towards cutting-edge imaging technologies for more efficient healthcare.

The nuclear imaging equipment market in China is poised for significant growth, driven by the increasing demand for advanced diagnostic technologies, especially in oncology. A notable development in the market is the partnership between Blue Earth Diagnostics and Sinotau Pharmaceutical Group, announced in October 2023. This collaboration aims to introduce flotufolastat F 18 (Posluma), a PSMA-PET imaging agent, to China for prostate cancer detection. The radiopharmaceutical targets prostate-specific membrane antigens (PSMA), providing enhanced imaging capabilities that improve diagnostic accuracy, particularly for patients undergoing treatment for prostate cancer or those with suspected recurrence. This advancement is expected to fuel further growth in China’s nuclear imaging market.

Japan nuclear imaging equipment market is significantly driven by the aging population, particularly in nuclear neurology, as the prevalence of neurological disorders like dementia and Parkinson's disease rises. This has increased the demand for advanced imaging technologies such as PET (Positron Emission Tomography) and SPECT (Single Photon Emission Computed Tomography), which provide crucial diagnostic insights for cognitive impairments and movement disorders. While PET is widely adopted, SPECT continues to play a key role, especially in assessing brain function in stroke and epilepsy patients. For example, in March 2021, cerebral perfusion SPECT/CT was extensively used to detect blood flow changes in ischemic stroke patients, offering valuable information when structural imaging could not identify functional impairments.

Latin America Nuclear Imaging Equipment Market Trends

The nuclear imaging equipment market in the Latin America is experiencing steady growth, fueled by the rising prevalence of chronic diseases such as cancer and cardiovascular conditions, along with advancements in medical technology. Key imaging modalities, including PET (Positron Emission Tomography), SPECT (Single Photon Emission Computed Tomography), and hybrid imaging systems, are gaining popularity for their ability to offer early-stage diagnostics and monitor treatment progress with high precision. The increasing demand for non-invasive diagnostic tools is encouraging healthcare providers to adopt these advanced technologies. Key countries like Brazil, Mexico, and Argentina are leading the market, benefiting from growing healthcare investments, enhanced infrastructure, and government efforts to expand access to quality care. Moreover, the rising focus on cancer detection and the introduction of advanced radiopharmaceuticals are expected to further drive the market. As healthcare spending continues to grow and more medical centers upgrade their diagnostic equipment, the nuclear imaging market in Latin America is set for sustained expansion.

Middle East & Africa Nuclear Imaging Equipment Market Trends

Middle East & Africa nuclear imaging equipment market is experiencing notable growth, driven by the increasing adoption of advanced diagnostic technologies like PET/MRI. In September 2022, Egypt’s Misr Radiology Center (MRC) became the first to introduce PET/MRI technology, transforming the diagnosis of complex diseases. By combining the metabolic data from PET scans with detailed anatomical images from MRI, PET/MRI enhances diagnostic accuracy, particularly in cases such as epilepsy, brain tumors, and neurodegenerative diseases. This hybrid imaging system is especially valuable in pediatric cases, where the radiation exposure from PET/CT is less desirable.

Major markets in the MEA region, including South Africa, Saudi Arabia, the UAE, and Kuwait, are witnessing a rise in cancer and neurological conditions, driving the demand for more precise diagnostic tools. Governments and private hospitals are also investing heavily in nuclear imaging technologies, improving healthcare infrastructure across the region. PET/MRI’s ability to assess diseases like pelvic cancers, prostate cancer, and neurodegenerative conditions, as well as its effectiveness in evaluating inflammatory lesions, makes it increasingly preferred over traditional PET/CT in many cases.

Key Nuclear Imaging Equipment Company Insights

Competition among manufacturers of nuclear imaging equipment devices is high owing to the continuous evolution of technology and the increasing demand for advanced diagnostic capabilities in the healthcare sector. Key industry players, including prominent names such as Siemens Healthineers, Koninklijke Philips N.V., Mediso, Canon Medical Systems Corporation and GE HealthCare, engage in intense competition to secure market share and sustain technological leadership. For instance, in January 2024,GE Healthcare entered into a partnership to acquire MIM Software, an international leader in delivering medical imaging analysis and artificial intelligence (AI) solutions across radiation oncology, molecular radiotherapy, diagnostic imaging, and urology. These solutions cater to imaging centers, hospitals, specialty clinics, and research organizations globally. Through this acquisition, GE Healthcare aims to utilize MIM Software's expertise in imaging analytics and digital workflow, applying them across different care domains to expedite innovation. This strategic move is expected to set GE Healthcare apart by enhancing its solutions for the well-being of patients and healthcare systems on a global scale.

Key Nuclear Imaging Equipment Companies:

The following are the leading companies in the nuclear imaging equipment market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Siemens Healthineers

- Koninklijke Philips N.V.

- Canon Medical Systems Corporation

- Mediso

- Cubresa Inc.

- Shimadzu Corporation

- United Imaging Healthcare Co

Recent Developments

-

In July 2024, The Shanghai United Imaging Healthcare Co., LTD announced the installation of the first PET/CT scanner in Mexico, located at the Instituto Nacional de Pediatría.

-

In June 2024, GE Healthcare enhanced its technology portfolio with the introduction of the MINItrace Magni, a compact cyclotron designed for reliable in-house production of commercial PET tracers and radiometals; the Omni Legend 21 cm, a performance-driven PET/CT system aimed at addressing the increasing demands of healthcare systems across various care areas; and Clarify DL, a new deep learning reconstruction technology that provides clear, accurate, and seamless imaging.

-

In February 2024, GE Healthcare and MedQuest Associates (MedQuest) announced a 3-year collaboration aimed at delivering excellence in patient care. This partnership combines GE Healthcare's innovative technologies with MedQuest's infrastructure and resources, enhancing the optimization of multi-site outpatient imaging networks for success. The collaboration underscores a commitment to providing access to advanced healthcare solutions while prioritizing patient care and satisfaction.

-

In May 2023, Koninklijke Philips N.V., Elekta, and Mercurius Health announced a 3-year agreement, under which Philips and Elekta installed the diagnostic & therapeutic oncology equipment and aligned informatics solutions at Mercurius Health’s newly-acquired Robert Janker Klinik cancer center in Bonn, Germany.

-

In April 2022, Mediso Ltd announced the acquisition of Bartec Technologies Ltd, a UK-based company specializing in the supply, installation, and support of Nuclear Medicine and Molecular Imaging equipment and accessories. This acquisition is expected to strengthen Mediso’s position in the UK and Ireland markets.

-

In June 2022, Siemens Healthineers introduced the Symbia Pro.specta, a SPECT/CT system that has received both the CE mark and FDA clearance. This system integrates advanced SPECT and CT imaging technologies. Notable features include a low-dose CT capable of capturing up to 64 slices, offering impressive detail in imaging.

-

In November 2022, Canon, Inc. decided to establish an entirely new subsidiary, which would be called Canon Healthcare USA, INC. Canon boosted the development of medical business by expanding its position in the American medical market.

Nuclear Imaging Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.75 billion

Revenue forecast in 2030

USD 7.91 billion

Growth rate

CAGR of 3.23% from 2025 to 2030

Actual period

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Modality, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE HealthCare; Siemens Healthineers; Koninklijke Philips N.V.; Canon Medical Systems Corporation; Mediso; Cubresa Inc.; Shimadzu Corporation; United Imaging Healthcare Co

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nuclear Imaging Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nuclear imaging equipment market report based on the modality, application, end-use, and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

SPECT

-

PET

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Oncology

-

Neurology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Imaging Centers

-

R&D

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global nuclear imaging equipment market size was estimated at USD 6.58 billion in 2024 and is expected to reach USD 6.75 billion in 2025.

b. The global nuclear imaging equipment market is expected to grow at a compound annual growth rate of 3.23% from 2025 to 2030 to reach USD 7.91 billion by 2030.

b. The oncology segment dominated the nuclear imaging equipment market with a share of 48.9% in 2024. This is due to the growing prevalence of cancer worldwide and advanced nuclear imaging technology.

b. Some key players operating in the nuclear imaging equipment market include GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., Canon Medical Systems Corporation, Mediso, Cubresa Inc., Shimadzu Corporation, United Imaging Healthcare Co.

b. Key factors that are driving the nuclear imaging equipment market growth include increasing prevalence of cancer worldwide, technological advancements, clinical applications, and research, and increasing nuclear medicine imaging procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.