- Home

- »

- Distribution & Utilities

- »

-

North America Wires And Cables Market Size Report, 2030GVR Report cover

![North America Wires And Cables Market Size, Share & Trends Report]()

North America Wires And Cables Market (2023 - 2030) Size, Share & Trends Analysis Report By Voltage (Low Voltage, Medium Voltage, High Voltage), By Installation (Overhead, Underground), By End-use (Aerospace And Defense, Energy And Power), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-036-1

- Number of Report Pages: 84

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

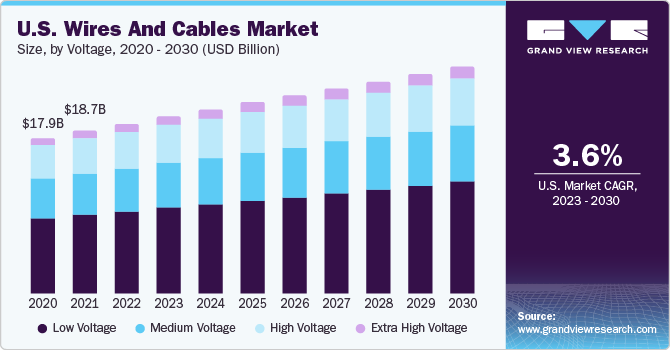

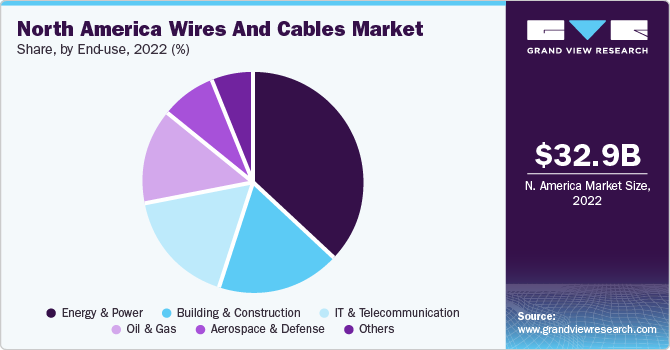

The North America wires and cables market size was valued at USD 32.96 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.4% from 2023 to 2030. Over the past years, several developments have occurred in the wires and cables industry. The increase in renewable energy generation is expected to influence the electricity trade. Thus, resulting in significant investments in the construction of high-capacity transmission lines. This, in turn, is expected to drive the market over the forecast period significantly. Several sub-national governments are gaining a significant position in renewable energy and energy efficiency ingenuities. Various emerging states within the U.S. and Canada are increasing their deployment and investment in renewable energy technologies. This strategy has helped them in their emergence as renewable energy leaders.

Moreover, there has been a rapid increase in economic activity and urbanization which is expected to drive growth in the infrastructure and construction industry. The demand from various sectors such as commercial, residential, telecom, energy and power, and automotive is leading to the expansion and upgradation of the infrastructure. Hence, it is anticipated to drive the market for wires and cables. Refurbishing aging infrastructure and constructing new commercial and residential buildings are expected to drive the overall market growth.

Smart grids reduce the cost incurred in traditional grids, including operational costs due to loss of power, hence, improving the profit margins of the electricity distribution companies. Moreover, there are various steps taken by the government in the U.S. to encourage the implementation of the smart grid. For instance, the New York state government, through NYSERDA, invested significantly in the innovation of smart energy technologies. The region chases to expand clean energy technologies, keep energy bills low, reduce carbon emissions, and improve grid reliability. Thus, government initiatives to implement smart grids significantly drive the North American wires and cables market.

The fluctuation in raw material prices is anticipated to pose a significant challenge to the growth of the market in the forecast period. Aluminum is widely preferred for manufacturing lightweight wires and cables, while silver offers superior conductivity compared to copper and aluminum, albeit at a higher cost. The volatile raw materials prices can be attributed to escalating exploration expenses, labor costs, the dynamics between governments and mining companies, and transportation disruptions. These fluctuations directly impact the overall wires and cables manufacturing costs, creating pricing uncertainties for industry players.

Voltage Insights

Based on voltage, the market is segmented into low voltage, medium voltage, high voltage, and extra high voltage. The low voltage segment accounted for the largest revenue share of 44.7% in 2022,owing to high usage in LAN cables, appliance wires, building wires, distribution networks, and others. These wires and cables offer a better provision of electricity for the end-user and simultaneously support smart grids for good-quality transmission. The renovation of existing buildings across North America is expected to support market growth over the forecast period. Besides, the energy and power sector across the region is undergoing rapid changes. Hence, most countries are experiencing significant electricity demand and are moving towards integrating large-scale renewable resources. Thus, is attributed to the increased need for low-voltage wires and cables.

The extra high-voltage is estimated to witness the fastest CAGR of 5.2% over the forecast period owing to increasing demand from the energy and power industries. Additionally, government initiatives taken for the implementation of smart grids are significantly driving the market. In November 2022, the U.S. Department of Energy (DOE) announced new financing opportunities worth USD 13 billion to enhance and upgrade the country's electric grid. These federal investments will serve as a catalyst, unlocking substantial capital from state and private sector sources. The funds will be utilized to construct projects that enhance the power grid's reliability and modernize it, ensuring that more American communities and businesses can access clean, affordable, and dependable electricity. This initiative aligns with the President's objective of achieving 100% clean electricity by 2035.

Installation Insights

Based on the installation segment, the market is sub-segmented into overhead and underground. The overhead segment accounted for the largest revenue share of 61.1% in 2022. It is an installation method where cables are laid overhead from poles to poles for electricity transmission and distribution. The overhead installation system is the utmost used approach in less polluted countries. The overhead approach is the easiest and cheapest form of installation. Moreover, countries with a high occurrence of natural disasters like earthquakes incline to have overhead cable installations.

The underground segment is expected to grow at the fastest CAGR of 3.8% during the forecast period. The underground installation is an installation method where wires and cables are laid beneath the ground at a certain distance from the surface level for transmission and distribution purposes. It lowers maintenance costs, incurs fewer transmission losses, and efficiently absorbs the power loads. The underground wires and cables installation release no electric fields; thus, several regional states are adopting underground installation. Besides, demand from several sectors such as telecom, automotive, commercial, energy and power, and residential sector is leading to upgradation and expansion of infrastructure.

End-use Insights

Based on end-use, the market is segmented into aerospace and defense, building & construction, oil and gas, energy and power, IT & telecommunication, and others. The energy and power segment held the largest revenue share of 37.2% in 2022. Government initiatives and regulations play a significant role in driving the growth of the energy and power segment in the wires and cables market. Governments in North America have implemented various policies to promote energy efficiency, grid modernization, and renewable energy integration. In April 2023, the U.S. Department of Energy (DOE) announced USD 52 billion for 19 selected initiatives as part of President Biden's Investing in America agenda, including USD 10 billion from the Bipartisan Infrastructure Law to bolster America's local solar supply network and USD 30 billion in financing for innovations that would assist with integrating solar power into the grid. This substantial investment is expected to foster the development of less costly, more effective solar power cells and the advancement of cadmium telluride (CdTe) and perovskite solar manufacturing.

The building & construction segment is expected to grow at the fastest CAGR of 4.3% over the forecast period. The growing population, along with the need for modernized infrastructure, has led to an increase in construction projects. It includes constructing residential buildings, commercial complexes, industrial facilities, and transportation infrastructure. The rising demand for wires and cables in the building and construction sector drives the market's growth.

IT and telecommunication sector is expected to grow significantly over the forecast period. In the IT and telecommunication sector, wires and cables are used for telecommunication lines, such as multiple phone lines, internet services, data and security services, and fax machines. Cables such as communication cables and power cables are widely used in the IT and telecommunication sectors. North America has seen a massive increase in data consumption, which has resulted in investments by companies such as Verizon and AT&T in fiber networks.

Oil and gas segment is expected to grow significantly over the forecast period. In the oil and gas sector, wires and cables ensure safety and operational integrity in the onshore, offshore, and subsea sectors. These products handle very harsh and severe drilling activities. Thus, these cables are needed to be replaced after a regular interval of time. Besides, the communication cables carry critical information to the stations, and variable frequency cable ensures smooth operation. Wires and cables are also used for several applications, such as pipeline management, process control, land-based drilling systems, offshore drilling, and pump equipment. Hence, demand for wires and cables across such oil & gas applications is anticipated to increase over the forecast period.

Country Insights

By country, the North America wires and cables market is segmented into the U.S. and Canada. The market in North America has reached a mature stage. However, refurbishing the aging infrastructure and constructing new buildings is expected to drive market growth. The value of construction measures private investments in non-residential and residential buildings, such as schools, hospitals, power plants, mining shafts, office towers, railroads, industrial facilities, apartment complexes, and single-family homes. These construction projects generate demand for wires and cables to provide power, internet, and other electrical and communication services.

U.S. held the largest revenue share of 59.2% in 2022 and is expected to grow at the fastest CAGR over the forecast period. Expanding internet access, lower broadband service costs, and the increasing use of smartphones have spurred more broadband connections in the country. These trends have encouraged higher demand for fiber-optic cable and other electrical cable products that deliver internet access, cable television programming, and other communication services to homes and businesses.

Canada held the second-largest share in 2022. The steady growth of the automotive industry in Canada drives the North American wires and cables market. The automotive sector requires various cables for vehicle wiring systems, battery electric vehicles (BEVs), hybrid electric vehicles (HEVs), and autonomous driving technologies. The increasing adoption of electric vehicles, vehicle connectivity, and automation advancements contribute to the demand for specialized automotive cables.

Key Companies & Market Share Insights

The key players are involved in new product developments, agreements, product launches, mergers and acquisitions, and expansion strategies to improve their market penetration. For instance, in May 2023, MaxLinear collaborated with JPC Connectivity to develop active electrical wires. This partnership will leverage MaxLinear's 5nm PAM4 DSP (Digital Signal Processor) technology to enhance data transmission speeds in hyperscale data centers. By incorporating MaxLinear's advanced DSP technology into JPC Connectivity's 800G current electrical wires, the companies aim to meet the critical demands of low-power, highly integrated, high-performance interconnect solutions for next-generation hyperscale cloud infrastructures. Additionally, in August 2019, Belden Inc. announced the launch of its new Digital Electricity Cables, designed in combination with VoltServer, the inventor of Digital Electricity. The cables are offered in hybrid copper/fiber and copper versions to transfer power and data over long distances.

Key North America Wires And Cables Companies:

- Belden, Inc.

- Encore Wire Corporation

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- LEONI

- LS Cable & System Ltd.

- Prysmian Group

- Hitachi, Ltd.

- Nexans

- Siemon

- Southwire Company, LLC

Recent Development

-

In May 2023, Airgain, Inc. launched the EZConnect platform, showcasing a flexible antenna design with 1-foot cables and standard connectors. These connectors effortlessly link to a customizable cable harness. The initial antenna to be exclusively launched with the EZConnect configuration is the MULTIMAX 5G fleet antenna, a groundbreaking product by Airgain. In conjunction with the EZConnect launch, Airgain has unveiled an online configurator tool that enables customers to personalize their cable lengths and connectors according to their specific requirements.

-

In September 2022, Omni Cable announced the acquisition of Bay Wire. Bay Wire provides value-added services and just-in-time delivery of copper building wire and various wire and cable products to the electrical distribution sector. With the acquisition, Bay Wire continues to function independently while receiving support from OmniCable whenever necessary.

-

In February 2022, Resideo Technologies, Inc. acquired Arrow Wire & Cable, enhancing ADI's Data Communications offerings. With a wide range of copper and fiber cabling and connectivity products, connectors, racking solutions, network equipment, and more, Arrow strengthens ADI's portfolio in this category. Moreover, the acquisition expands ADI's presence in terms of geographic coverage, owing to the inclusion of additional warehouse and distribution operations.

North America Wires And Cables Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 34.28 billion

Revenue forecast in 2030

USD 43.40 billion

Growth rate

CAGR of 3.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Voltage, installation, end-use

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Belden, Inc.; Encore Wire Corporation; Fujikura Ltd.; Furukawa Electric Co., Ltd.; LEONI; LS Cable & System Ltd.; Prysmian Group; Hitachi, Ltd.; Nexans; Siemon; Southwire Company, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Wires And Cables Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the North America wires and cables market report on the basis of voltage, installation, end-use, and country:

-

Voltage Outlook (Revenue in USD Billion, 2017 - 2030)

-

Low Voltage

-

Medium Voltage

-

High Voltage

-

Extra High Voltage

-

-

Installation Outlook (Revenue in USD Billion, 2017 - 2030)

-

Overhead

-

Underground

-

-

End-use Outlook (Revenue in USD Billion, 2017 - 2030)

-

Aerospace and Defense

-

Building & Construction

-

Oil and Gas

-

Energy and Power

-

IT & Telecommunication

-

Others

-

-

Regional Outlook (Revenue in USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The global North America wires and cables market size was estimated at USD 32.96 billion in 2022 and is expected to reach USD 34.28 billion in 2023.

b. The global North America wires and cables market is expected to grow at a compound annual growth rate of 3.4% from 2023 to 2030 to reach USD 43.40 billion by 2030.

b. Energy and Power dominated the North America wires and cables market with a share of 37.2% in 2022. This is attributable to rising need for power in U,S, and Canada.

b. Some key players operating in the North America wires and cables market include Belden Inc.; Encore Wire Corporation; Fujikura Ltd.; Furukawa Electric Co., Ltd.; Hitachi Metals, Ltd. (Hitachi Cable America Inc.); LEONI AG; LS Cable and System Ltd.; Nexans; Prysmian S.p.A.; and Siemon

b. Key factors that are driving the market growth include demand from various sectors, and refurbishment of aging infrastructure and the construction of new commercial and residential buildings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.