- Home

- »

- Pharmaceuticals

- »

-

North America Weight Loss Supplement Market, Industry Report 2030GVR Report cover

![North America Weight Loss Supplement Market Size, Share & Trends Report]()

North America Weight Loss Supplement Market Size, Share & Trends Analysis Report By Type (Liquid, Pills), By Ingredient (Vitamins & Minerals, Amino Acids), By Distribution Channel, By End-user, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-279-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

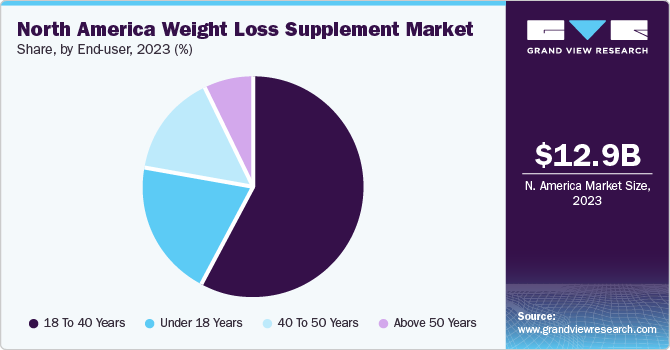

The North America weight loss supplement market size was estimated at USD 12.97 billion in 2023 and is expected to grow at a CAGR of 7.6% from 2024 to 2030. The rising incidence of obesity and related health conditions, such as cardiovascular disease (CVD), diabetes, and hypertension, are predicted to boost product demand. The prevalence of obesity has been increasing, and this trend has contributed to the growth of the market. For instance, based on the Trust for America’s Health’s (TFAH) 2022 report, West Virginia, Kentucky, and Alabama exhibit the highest prevalence of adult obesity, with rates standing at 40.6%, 40.3%, and 39.9%, respectively. Conversely, the District of Columbia, Hawaii, and Colorado boast the lowest rates of adult obesity, recorded at 24.7%, 25%, and 25.1%, respectively. This data on regional variations in adult obesity rates provides valuable insights for the market.

Moreover, the rise of sedentary lifestyles, coupled with easy access to high-calorie foods, has contributed to a growing prevalence of overweight and obesity, particularly in urban areas. This trend has created a significant market opportunity for weight loss supplements, as consumers seek convenient and effective solutions to manage their weight and improve their overall health. According to a CDC report in 2022,25% of adults in the U.S. do not meet the recommended activity levels essential for maintaining their health. Across states and territories, estimates of inactivity show a range from 17.7% in Colorado to 49.4% in Puerto Rico. More than 30% of adults were found to be physically inactive in seven states and one territory.

The campaign's significance becomes evident when considering the broader context of modern health challenges. Factors such as increasing health awareness, sedentary lifestyles, and the pervasive influence of social media have contributed to a rise in obesity rates and related health concerns across the population. For instance, the Weight Matters Campaign, initiated and presented by the Obesity Action Coalition (OAC), serves as a national endeavor aimed at supporting individuals grappling with excess weight in taking proactive steps toward managing their health effectively. This campaign is multifaceted in its approach, encompassing various resources, tools, and educational initiatives designed to empower individuals affected by excess weight to make informed decisions about their well-being. Its influence on the global weight loss supplement market is profound and multifaceted.

In addition, advancements in research and development have led to the formulation of innovative weight loss supplements with enhanced efficacy and safety profiles. Manufacturers are leveraging scientific breakthroughs and incorporating natural ingredients, such as green tea extract, Garcinia Cambogia, and conjugated linoleic acid, to create products that resonate with health-conscious consumers.

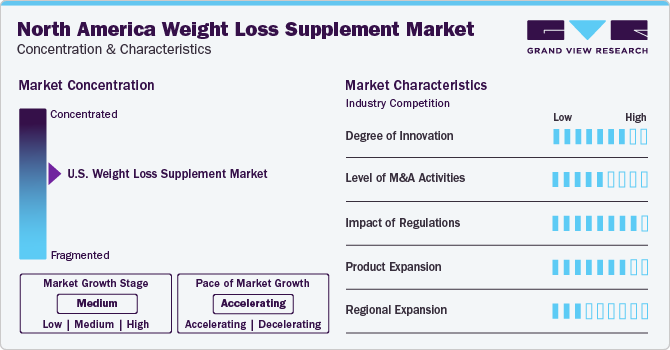

Market Concentration & Characteristics

The degree of innovation in the market is high, driven by advancements in ingredient formulations, delivery systems, and technology integration. Continuous research and development efforts aim to enhance efficacy, safety, and consumer appeal in this dynamic market. For instance, In July 2022, Herbalife Nutrition, a nutrition company, unveiled its newest scientifically supported offering, Fat Release, aimed at assisting consumers in maintaining healthy and active lifestyles. This product is designed to aid individuals who occasionally consume fatty foods as part of their meals if taken within two hours of eating. Fat Release contains Litramine, a patented cactus fiber ingredient derived from prickly pear, known for its ability to assist in reducing fat absorption from food.

The market's level of mergers and acquisitions remains moderate, with strategic alliances and acquisitions occurring to strengthen market positions and capitalize on emerging trends in health and wellness. For instance, in December 2023, Xponential Fitness, Inc., a prominent U.S.-based health and wellness brand, revealed its acquisition agreement with Lindora, a renowned metabolic health brand. As part of the deal, the 31 current Lindora clinics will transition into Xponential franchise establishments.

Regulation significantly impacts the market by ensuring product safety, efficacy, and accurate labeling. Stringent regulations, such as those from the FDA and FTC, shape product development, marketing strategies, and consumer trust, driving industry compliance and safeguarding public health.

Product expansion in the market is evident through the introduction of innovative formulations targeting diverse consumer needs, including fat reduction, metabolism support, and appetite control. For instance, in January 2024, GNC, a U.S.-based company, unveiled its latest product, GNC Total Lean GlucaTrim, a multi-action weight loss supplement. Engineered with an innovative formula, it aids in weight and inch reduction while preserving lean muscle mass and promoting healthy blood sugar and insulin levels.

The market demonstrates significant regional expansion. Companies strategically target diverse geographical areas to capitalize on varying consumer preferences, health trends, and regulatory environments, thereby driving market penetration and growth.

Type Insights

The powders segment dominated the market with the largest revenue share of 38.11% in 2023. The powdered formulation offers larger supplement quantities and extended shelf life, facilitating easily regulated dosages tailored to individual needs, which drives this segment. Its convenient administration and dosage enable rapid and efficient nutrient absorption, enhancing bioavailability compared to alternative formulations. Moreover, the key players bring innovative formulations and marketing strategies, expanding consumer awareness and driving demand for powdered supplements, thereby fueling market growth. For instance, In January 2024, Abbott revealed the introduction of its latest brand, PROTALITY, featuring a high-protein nutrition shake powder. This inaugural product within the line aims to cater to the increasing population of adults seeking to achieve weight loss goals while preserving muscle mass and ensuring optimal nutrition.

The pills segment is expected to grow at the fastest CAGR from 2024 to 2030. This growth is driven by the increasing preference for weight loss supplements in pill form, facilitated by their availability in various formats such as chewable tablets, sustained-release pills, and sublingual pills. Clinical trials also play a significant role in influencing the market growth. Positive outcomes from well-designed trials can enhance consumer confidence, drive product adoption, and stimulate market expansion by demonstrating the efficacy and safety of weight loss supplements. For instance, in June 2023, an experimental oral medication developed by Eli Lilly demonstrated a competitive advantage compared to pills manufactured by Novo Nordisk and Pfizer.

End-user Insights

The 18 to 40 years segment held the largest revenue market share of 57.89% in 2023. The increasing demand to uphold a healthy body weight and achieve an ideal physique is anticipated to propel the growth of this segment. The upward trend in disposable income and growing engagement in physical fitness pursuits are projected to have a favorable influence on segment expansion. In addition, knowledge on the advantages and mechanisms of weight loss supplements is forecasted to propel the segment forward. According to estimates from the National Institutes of Health in 2021, around 15% of U.S. adults have reported consuming weight-loss dietary supplements at some point in their lives, with a higher consumption rate observed among female adults compared to males. The rising desire for appetite suppressants, fat burners, and craving reducers is fueling growth within the segment.

The under 18 years segment is expected to grow at a significant CAGR during the forecast period. The increasing awareness among consumers within this age demographic regarding the benefits of the product is poised to propel the segment forward. In addition, the rise in disposable income within this segment is anticipated to contribute positively to its growth.

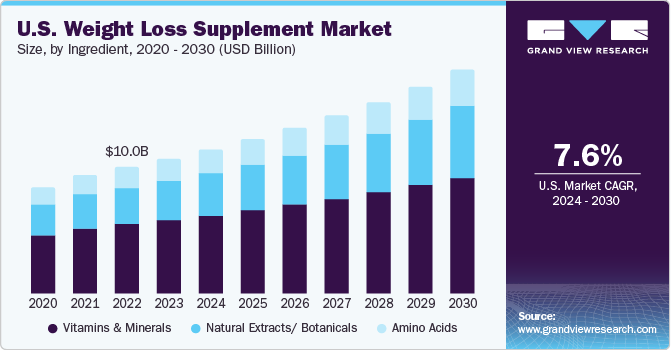

Ingredient Insights

Vitamins and minerals dominated the market and held the largest revenue share of 54.91% in 2023. Weight loss supplements, rich in vitamins and minerals, also contribute to overall nutrition and facilitate proper bodily function and metabolism. Many of these products contain antioxidants, which safeguard cells from structural alterations, improve overall health and performance, play a role in energy generation, and promote the maintenance of a healthy heart, brain, and other bodily functions. Moreover, the deficiency of Americans in essential vitamins contributes to the segment’s growth. As awareness of nutritional deficiencies rises, consumers increasingly seek supplements to address these gaps, driving demand for vitamin-enriched weight loss products and stimulating market expansion. For instance, according to CDC, half of Americans lack sufficient levels of vitamin A, vitamin C, and magnesium, while over 50 percent of the general population experiences vitamin D deficiency, irrespective of age.

The natural extracts/botanicals segment is expected to grow at a faster CAGR during the forecast period. The increasing global interest in organic and vegan supplements, driven by growing environmental awareness, is anticipated to bolster segment growth. Supplements derived from natural extracts and botanicals, including caffeine, green tea extract, Garcinia Cambogia, licorice root, ginseng, and green coffee bean extract, are popular. Furthermore, the demand for traditional remedies is opening avenues for innovative products from local players entering the market.

Distribution Channel Insights

In 2023, the offline segment dominated the market and held the largest revenue market share. The increasing accessibility of weight loss supplements in retail pharmacies, drug stores, health & beauty stores, and department stores is fueling growth in this segment. Furthermore, health & beauty stores and department stores are taking proactive measures to raise awareness about maintaining good health, which is anticipated to have a positive influence on segment expansion. In addition, offline stores are consistently enhancing overall customer engagement and shopping experiences. Many health stores and department stores have implemented point-of-sale terminals to expedite the checkout process.

The online distribution channel segment is expected to record the fastest CAGR over the forecast period. Online retailers are providing attractive discounts on product prices, thereby stimulating sales through digital channels. Moreover, these platforms are formulating and executing various strategies to rival offline competitors. The convenience offered by online distribution channels is favorably influencing segment expansion. In addition, with the increasing prevalence of e-commerce, there is a gradual transition towards online distribution channels for supplements. The increase in self-directed consumers is also a significant driver of segment growth.

Country Insights

The growth of weight loss supplements in North America continues to surge, driven by various factors, including increasing health consciousness, rising disposable incomes, and the prevalence of sedentary lifestyles. In addition, advancements in product formulations and marketing strategies have bolstered consumer engagement, while the convenience of online platforms has expanded accessibility. Alongside traditional supplements, emerging pharmaceutical interventions like the experimental drug retatrutide are generating significant interest. In a clinical trial presented at the American Diabetes Association's annual meeting in San Diego, retatrutide demonstrated promising results, with participants achieving an average weight loss of approximately 24% of their body weight, equivalent to around 58 pounds. Such breakthroughs underscore the growing momentum and potential for innovative approaches to combat obesity and promote healthier lifestyles across North America.

U.S. Weight Loss Supplement Market Trends

The weight loss supplements market in the U.S. held the largest market share in 2023, driven by factors such as increasing health consciousness, rising obesity rates, and a growing focus on wellness. In this evolving landscape, startups such as Noom are playing a pivotal role in shaping consumer behavior and preferences. Noom, known for its innovative approach to weight management through personalized coaching and behavior tracking, is expanding its offerings to include a new program called Noom Med. This program represents a significant development as it integrates the use of anti-obesity medications, such as Wegovy, into Noom's comprehensive weight loss solutions. This expansion not only diversifies Noom's service offerings but also underscores the growing integration of pharmaceutical interventions within the broader landscape of weight management solutions in the U.S. market.

Canada Weight Loss Supplement Market Trends

Canada weight loss supplements market held a significant share in 2023, influenced by several factors, including increasing awareness of health and wellness, rising rates of obesity, and a growing emphasis on personal fitness and appearance. Approximately 1 in 4 Canadian adults, accounting for 26.6% of the population, are currently living with obesity, highlighting the urgent need for effective weight management solutions. This prevalence of obesity underscores the demand for weight loss supplements as individuals seek ways to address their weight-related concerns and improve their overall health.

Key North America Weight Loss Supplement Company Insights

The market players operating in the market are adopting product approval to increase the reach of their products in the market and improve their availability, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key North America Weight Loss Supplement Companies:

- Glanbia PLC

- GlaxoSmithKline PLC

- Herbalife Nutrition Ltd.

- Abbott

- Nestle

- NutriSport Pharmacal, Inc.

- Amway Corp.

- Ajinomoto Co. Inc.

Recent Developments

-

In March 2024, Novo Nordisk disclosed that the U.S. FDA granted further approval for Wegovy. This approval extends its indication to include reducing major cardiovascular events, such as heart attack or stroke, in obese or overweight adults diagnosed with known heart disease. This recommendation is in conjunction with a reduced-calorie diet and increased physical activity.

-

In January 2024, Abbott, a U.S. introduced its latest offering, the PROTALITY brand. This new line features a high-protein nutrition shake designed to cater to the increasing demographic of adults seeking to manage weight loss while preserving muscle mass and ensuring optimal nutrition.

-

In January 2024, GNC, a U.S.-based company, unveiled its latest product, GNC Total Lean GlucaTrim, a multi-action weight loss supplement. Engineered with an innovative formula, it aids in weight and inch reduction while preserving lean muscle mass and promoting healthy blood sugar and insulin levels.

-

In February 2024, Herbalife unveiled its latest innovation, the Herbalife GLP-1 Nutrition Companion, introducing a new series of food and supplement product combinations. These offerings, available in both Classic and Vegan options, are now accessible in the U.S. and Puerto Rico, offering consumers a diverse array of flavors to choose from.

North America Weight Loss Supplement Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.83 billion

Revenue forecast in 2030

USD 21.42 billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, ingredient, distribution channel, end-user, country

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Glanbia PLC; GlaxoSmithKline PLC; Herbalife Nutrition Ltd.; Abbott; Nestle; NutriSport Pharmacal, Inc; Amway Corp.; Ajinomoto Co. Inc.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

North America Weight Loss Supplement Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the North America weight loss supplements market based on type, ingredient, end-user, distribution channel and country:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

Softgels

-

Pills

-

Others

-

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins & Minerals

-

Amino Acids

-

Natural Extracts/ Botanicals

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Under 18 years

-

18 to 40 years

-

40 to 50 years

-

Above 50 years

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline Channel

-

Online Channel

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. Some key players operating in the North America weight loss supplements market include Glanbia PLC; GlaxoSmithKline PLC; Herbalife Nutrition Ltd.; Abbott; Nestle; NutriSport Pharmacal, Inc; Amway Corp.; Ajinomoto Co. Inc.

b. The rising incidence of obesity and related health conditions, such as cardiovascular disease (CVD), diabetes, and hypertension, are predicted to boost product demand. The prevalence of obesity has been increasing globally, and this trend has contributed to the growth of the market.

b. The North America weight loss supplement market size was estimated at USD 12.97 billion in 2023 and is expected to reach USD 13.83 billion in 2024.

b. The North America weight loss supplement market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 21.42 billion by 2030.

b. The powders segment dominated the overall market with the larger revenue share of 38.11% in 2023. The powdered formulation offers larger supplement quantities and extended shelf life, facilitating easily regulated dosages tailored to individual needs, which drives this segment. Its convenient administration and dosage enable rapid and efficient nutrient absorption, enhancing bioavailability compared to alternative formulations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."