- Home

- »

- Next Generation Technologies

- »

-

North America Virtual Events Market, Industry Report, 2030GVR Report cover

![North America Virtual Events Market Size, Share & Trends Report]()

North America Virtual Events Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Internal, External), By Component, By Industry Vertical, By Application, By End-user, By Organization Size, By Use-Case, And Segment Forecasts

- Report ID: GVR-4-68040-298-0

- Number of Report Pages: 188

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Virtual Events Market Trends

The North America virtual events market size was valued at USD 34.39 billion in 2023 and is expected to grow at a CAGR of 17.6% from 2024 to 2030. The growth is attributed to the widespread adoption of collaboration and communication tools in various industries, including BFSI, IT & telecom, healthcare, manufacturing, education, media & entertainment, retail & e-commerce, etc. Moreover, the increasing adoption of Unified Communication as a Service (UCaaS)-based solutions across organizations, facilitating virtual engagement among employees and clients that ensure efficient and effective workflow, is accelerating the market growth. The rising demand for some of the popular UCaaS-based solutions, such as Google Workspace by Google LLC, Teams by Microsoft Corporation, and Zoom by Zoom Video Communications, Inc., is stimulating market growth.

Digital platforms allow users to participate in any event remotely, regardless of their location. The market outlook is further enhanced by the integration of new features and technologies, including Artificial Intelligence (AI), Augmented Reality (AR), and Virtual Reality (VR) in the virtual event tools. Furthermore, companies are rapidly adopting virtual simulated platforms to effectively manage time and resources, thereby driving the growth of the virtual events market. For instance, in February 2024, RingCentral, Inc. launched a new unified patient care solution that aims to simplify workflows and bridge gaps in the patient engagement journey for healthcare organizations globally.

The solution includes integrations with major Electronic Health Record (EHR) providers, such as Epic, Cerner, and AllScripts, as well as RingCentral’s AI-powered communications suite. These integrations are expected to help healthcare organizations improve patient engagement, streamline communications, and enhance patient care. Such developments will positively influence the market over the foreseeable future. Furthermore, changing work patterns across organizations comprising remote and hybrid work models, especially post-pandemic, have instigated the adoption of virtual event platforms in the region. These platforms help conduct various events, including product launches, annual meetings, sales meetings, job fairs, summits, audio/video conferences, exhibitions, trade shows, etc.

Moreover, the changing needs of end-users are prompting virtual events market players to introduce innovative solutions. The surge in dependence on Bring Your Own Device (BYOD) and Choose Your Own Device (CYOD) solutions is significantly driving the market growth in North America. The adoption of these solutions has reshaped the way businesses and individuals engage in virtual events, conferences, and meetings. As organizations continue to prioritize the benefits associated with the adoption of BYOD and CYOD solutions, their increased adoption is expected to play a pivotal role in driving the sustained growth of the regional market.

Market Concentration & Characteristics

The degree of innovation in the market is expected to be high as virtual events are becoming integral parts of organizational strategies, team collaboration, social interactions, and entertainment, which is widening the scope for innovation in these tools that meet evolving user expectations. The technological advancements in virtual event platforms are largely reflected in features, such as enhanced interactivity, immersive experiences, and integration with augmented reality (AR) and virtual reality (VR).

The level of merger and acquisition (M&A) activities in the market is expected to be moderate to high. With the rapid industry expansion, companies are focusing on forming strategic alliances and acquisitions to strengthen their market positions, access new technologies, and broaden their portfolio.

The impact of regulations on competition within the North America virtual events market is moderate to high. As virtual events involve aspects, such as data privacy, online security, and intellectual property, they are subject to regulatory frameworks. Stringent norms about data protection, content moderation requirements, and adherence to virtual accessibility standards may influence the competitive dynamics.

The competition from product or service substitutes in the market is moderate to high. While virtual events offer unique and immersive experiences, substitutes such as traditional in-person events, webinars, video conferences, and other online collaboration tools exist. The adaptability of these alternatives to specific user needs and preferences, coupled with the constant evolution of communication technologies, contributes to a dynamic landscape with a moderate to high level of substitute competition.

End-user concentration is high as several industry verticals are adopting virtual management solutions to collaborate within teams, host product launches, interact with clients, conduct training & development programs, etc. These platforms are witnessing heightened adoption across several industries, such as corporate, healthcare, education, manufacturing media & entertainment, telecom, etc.

Event Type Insights

The external event segment accounted for the largest revenue share of over 58% in 2023 on account of the increased adoption of virtual event tools by businesses to communicate with external entities. Several organizations are collaborating with tech companies to leverage the advances in technology and provide high-end services to their customers. The widespread adoption of digitally simulated tools by organizations to conduct or attend tradeshows, product launch events, press releases, client conferences, and other communication events is accelerating segment growth.

The internal event segment is anticipated to grow at the highest CAGR of over 18.0% from 2024 to 2030 with increasing digitization and internet connectivity, enabling more attendees to join virtual events easily. Many companies focus on digital transformation, which is fueling the adoption of virtual event platforms. Internal virtual events can be organized more frequently and enable participation from any location, which provides more flexibility and accessibility over in-person events restricted by travel budgets, venue availability, etc. As several organizations invest in digital infrastructure and employees effectively adapt to virtual collaboration tools, the internal event segment is expected to gain lucrative growth opportunities over the coming years.

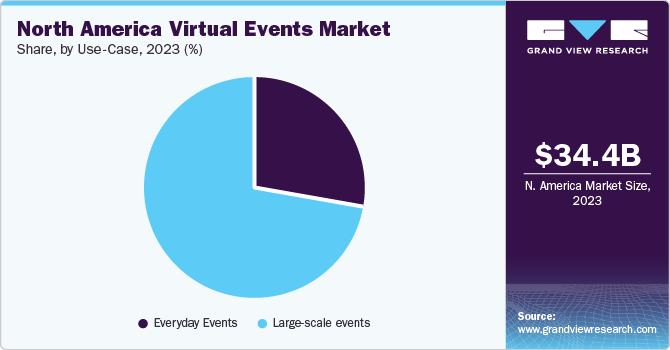

Use Case Insights

The large-scale events segment accounted for the largest revenue share in 2023 as several businesses are increasingly using online platforms to plan and host massive marketing events, new product introductions, reaching a wider audience with minimum cost involved. Solutions based on UCaaS, and SaaS are aggressively being adopted by the incumbents of manufacturing, healthcare, IT & telecommunications, and media & entertainment, among other industries and industry verticals for hosting large-scale virtual events.

The everyday events segment is estimated to witness a notable CAGR from 2024 to 2030. The growth is attributed to the increasing usage of virtual platforms for regular events, including recruitment, discussions, meetings, informal sessions, and target/sales meetings. The increased application of virtual platforms across various industries, including education, media & entertainment, healthcare, aerospace, logistics, automation, and manufacturing is creating lucrative growth opportunities for the segment.

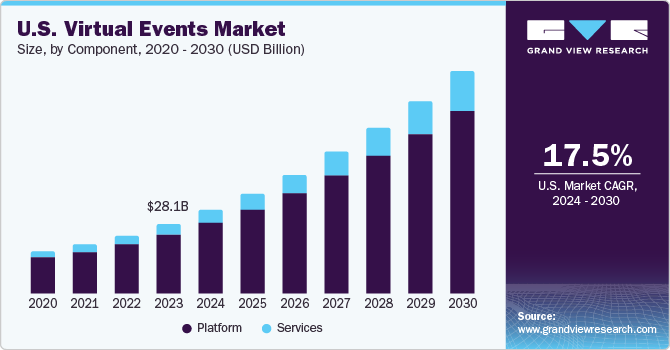

Component Insights

The platform segment accounted for the largest revenue share in 2023 due to increased product adoption driven by seamless integration capabilities that allow easy incorporation with existing systems and tools, such as customer relationship management (CRM) software and market automation tools. Moreover, the growing prominence of virtual events platforms offering an immersive and engaging user experience, featuring interactive booths, networking lounges, and gamification, is favoring their adoption, further contributing to segment growth.

The services segment is estimated to record the highest CAGR from 2024 to 2030. The market has also seen significant growth in the services, which encompass communication, recruitment, sales & marketing, and training. These services have become essential for organizations hosting virtual events as they help to improve engagement, reach, and overall event success. Communication services, such as chatbots, live chat, and Q&A sessions, have become increasingly popular in virtual events. The increasing significance of these services across organizations is largely driving segment growth.

Organization Size Insights

The large enterprise segment accounted for the largest share in 2023 owing to increased adoption of digital platforms among large organizations. These corporations use virtual event management platforms to effectively collaborate with their employees, clients, and other stakeholders spread across different geographies. Moreover, these platforms ensure a smooth workflow across multiple geographical locations. Virtual platforms have allowed large corporations to work efficiently, especially during the pandemic when government-imposed restrictions on the movement of people were in place.

The small medium enterprises (SMEs) segment is expected to grow at the fastest CAGR from 2024 to 2030 as these organizations typically find virtual event solutions convenient for effective communication as they have limited resources for training, marketing, sales, and operations. Moreover, technological advancements coupled with the introduction of innovative, cloud-based solutions, are impelling the adoption of virtual event tools and solutions across SMEs, thereby expediting segment growth.

End-user Insights

The corporate segment dominated the market in 2023 due to the increased adoption of digitally simulated platforms by both private and public organizations. Several businesses are increasingly investing in online platforms to promote their products, facilitate collaboration among teams based in different locations, and increase their reach to their clients. For instance, in the healthcare sector, virtual events are being widely used by healthcare professionals to interact with allied professionals and patients as telemedicine is becoming a popular trend in this industry.

The educational institutes segment is estimated to record a notable CAGR from 2024 to 2030 owing to the widespread adoption of virtual platforms for academic purposes. The strong emphasis on online courses by students and professionals to develop skills is expected to drive the demand for digitally simulated platforms. The growing adoption of virtual event tools and solutions for training purposes is prompting market players to introduce dedicated training courses on digitally simulated platforms. For instance, Cisco Systems, Inc.’s Cisco Networking Academy offers a variety of courses focused on information automation, cybersecurity, programming, information technology, operating systems, and the Internet of Things (IoT).

Application Insights

The exhibitions & trade shows segment accounted for the highest revenue share in 2023 and is expected to continue dominating the market throughout the forecast years. The growing need for businesses to exhibit & market their products & services, evaluate the competition, and track the latest trends & prospects within the industry contributes to segment growth. Using digital spaces can potentially allow exhibitors to save money on travel, promotional items, accommodation, and other expenses associated with convening trade shows and exhibitions. Moreover, the quality leads and guests attracted by these events also help enterprises network, thereby favoring the overall segment outlook.

The other segment comprising events, such as concerts, keynotes, webinars, meetups, and job fairs, is expected to register the highest CAGR from 2024 to 2030. The segment growth is attributed to the widespread adoption of digital technology and high-speed internet connectivity that has made virtual events increasingly accessible and convenient for both organizers and attendees. This accessibility has significantly broadened the reach of events, allowing participants from around the globe to join without the constraints of travel or venue capacity limitations, which is expected to drive the segment growth in the coming years.

Industry Vertical Insights

The Information Technology (IT) segment accounted for the largest revenue share in 2023 owing to the rising significance of virtual events in this domain as they help increase the geographical reach and allow professionals to participate and share knowledge from anywhere in the world. Moreover, the strong presence of several major IT companies in the region is creating ample growth opportunities for the market amid the heightened reliance on virtual events as a means of communication, collaboration, and knowledge-sharing among them.

The BFSI segment is estimated to grow at the highest CAGR from 2024 to 2030. The growing significance of internal communication for the incumbents of the banking and financial industry verticals is contributing to segment growth. Moreover, virtual events play a significant role in employee training and development within the BFSI industry. With dispersed workforces and the need for continuous upskilling, banks and financial companies utilize virtual training sessions, workshops, and conferences to deliver training programs to employees regardless of their geographical location, thereby fueling the segment's growth.

Country Insights

The North America virtual events market is estimated to witness a significant CAGR of 17.6% from 2024 to 2030 owing to a considerable rise in the number of virtual trade shows. With traditional in-person trade shows being canceled or postponed due to the pandemic, many organizations have turned to virtual trade shows as an alternative. These online events allow exhibitors to showcase their products and services, connect with potential customers, and generate leads from the comfort of their homes or offices. Virtual trade shows are trending as they empower attendees to engage with exhibitors, access educational sessions, and network with peers, eliminating the need for travel and associated expenses.

U.S. Virtual Events Market Trends

The virtual events market in the U.S. accounted for the largest revenue share in 2023 owing to the rising trend of virtual trade shows, allowing online events to allow exhibitors to showcase their products and services, connect with potential customers, and generate leads from the comfort of their homes or offices. Moreover, increasing adoption of virtual conferences that are more accessible to attendees as they eliminate the need for travel and lodging expenses, is also contributing to market growth.

Key North America Virtual Events Company Insights

Some of the key players operating in the market include Cisco Systems, Inc., Microsoft Corporation, Zoom Video Communications, Inc., and Avaya LLC among others.

-

Cisco Systems, Inc. specializes in collaboration, virtualization, unified communication, wireless, security, cloud, networking, unified computing systems, and data center products and services. Cisco Systems, Inc. provides its products and services, both directly through its channel partners as well as through its own sales channel to commercial businesses, large enterprises, consumers, and service providers

-

Microsoft Corporation’s major business segments include productivity and business processes, intelligent cloud, and personal computing. The company provides a comprehensive set of products for the market, including Skype for Business, Microsoft Teams, SharePoint, Yammer, and remote learning solutions

vFairs LLC, Gather Presence, Inc., and Whova Inc. are some of the emerging market participants in the North America virtual events market.

-

vFairs LLC offers a platform comprising features that allow users to host fully customizable and interactive virtual events, including job fairs, trade shows, conferences, and more

-

Gather Presence, Inc. offers numerous products and solutions, which include remote work, team, and use-case

Key North America Virtual Events Companies:

- 6Connex (Dura 6C, LLC)

- Accelevents

- Airmeet Inc.

- Avaya LLC

- BigMarker.com, LLC

- Bizzabo

- Cisco Systems, Inc.

- Community Brands

- Cvent, Inc.

- EventMobi

- Gather Presence, Inc.

- George P. Johnson Company

- Global Experience Specialists, Inc. (GES)

- HexaFair

- Hopin

- Hubilo Technologies Inc.

- Maritz Holdings Inc.

- Microsoft Corporation

- MootUp

- Notified (Digital Media Innovations, LLC)

- ON24, Inc.

- PheedLoop Inc.

- Remo USA, Inc.

- RingCentral, Inc.

- SpotMe Holding SA

- Swoogo LLC

- TouchCast, Inc.

- vFairs LLC

- Whova Inc.

- Zoom Video Communications, Inc.

Recent Developments

-

In January 2024, vFairs LLC hosted a four-day virtual event by Bionano Symposium 2024, an event of Bionano Genomics, Inc. Around 33 experts from around the world shared their valuable insights on the transformative use of OGM in different clinical research applications during the event

-

In January 2024, Cisco Systems, Inc. collaborated with Microsoft Corp. and Samsung Electronics Co. Ltd. and introduced new meeting room solutions named the Cisco Room Series. This new meeting room aims to provide an improved collaboration experience for hybrid meetings

-

In January 2024, Microsoft Corporation launched Microsoft Mesh, a virtual meeting platform on Teams. The solution provides a one-of-a-kind method for remote collaboration, enabling employees to gather in a shared virtual environment using their avatars. The platform is seamlessly integrated with Microsoft Teams, adding a new dimension to the remote work experience

-

In November 2023, Avaya LLC collaborated with KASCO Group, a leading conglomerate company that specializes in oil and gas shipping, trading, and marine services. This collaboration helped KASCO company to create a connected environment that enabled real-time communication between its global fleet

North America Virtual Events Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 41.34 billion

Revenue forecast in 2030

USD 109.22 billion

Growth rate

CAGR of 17.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Event type, component, organization size, end-user, application, industry vertical, use case, country

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

6Connex (Dura 6C, LLC); Accelevents; Airmeet Inc.; Avaya LLC; BigMarker.com, LLC; Bizzabo; Cisco Systems, Inc.; Community Brands; Cvent, Inc.; EventMobi; Gather Presence, Inc.; George P. Johnson Company; Global Experience Specialists, Inc. (GES); HexaFair; Hopin; Hubilo Technologies Inc.; Maritz Holdings Inc.; Microsoft Corp.; MootUp; Notified (Digital Media Innovations, LLC); ON24, Inc.; PheedLoop Inc.; Remo USA, Inc.; RingCentral, Inc.; SpotMe Holding SA; Swoogo LLC; TouchCast, Inc.; vFairs LLC; Whova Inc.; Zoom Video Communications, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Virtual Events Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America virtual events market report based on event type, component, organization size, end-user, application, industry vertical, use case, and country:

-

Event Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Internal Event

-

External Event

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Platform

-

Web-based

-

XR

-

-

Services

-

Communication

-

Recruitment

-

Sales & Marketing

-

Training

-

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Institutions

-

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Educational Institution

-

Corporate

-

Government

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Conferences & Conventions

-

Exhibitions & Trade Shows

-

Seminars & Workshops

-

Corporate Meetings & Training

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Consumer Electronics

-

Healthcare

-

Information Technology

-

Manufacturing

-

Media & Entertainment

-

Telecom

-

Others

-

-

Use Case Outlook (Revenue, USD Billion, 2018 - 2030)

-

Everyday Events

-

Large-scale events

-

-

Country Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the North America virtual events market include 6Connex (Dura 6C, LLC), Accelevents, Airmeet Inc., Avaya LLC, BigMarker.com, LLC, Bizzabo, Cisco Systems, Inc., Community Brands, Cvent, Inc., EventMobi, Gather Presence, Inc., George P. Johnson Company, Global Experience Specialists, Inc. (GES), HexaFair, Hopin, Hubilo Technologies Inc., Maritz Holdings Inc., Microsoft Corporation, MootUp, Notified (Digital Media Innovations, LLC), ON24, Inc., PheedLoop Inc., Remo USA, Inc., RingCentral, Inc., SpotMe Holding SA, Swoogo LLC, TouchCast, Inc., vFairs LLC, Whova Inc., and Zoom Video Communications, Inc.

b. Key factors that are driving North America virtual events market growth include the widespread adoption of collaboration and communication tools in various industries, increasing adoption of Unified Communication as a Service (UCaaS)-based solutions across organizations, facilitating virtual engagement among employees and clients, and changing work patterns across organizations comprising remote and hybrid working.

b. The North America virtual events market size was estimated at USD 34.39 billion in 2023 and is expected to reach USD 41.34 billion in 2024.

b. The North America virtual events market is expected to grow at a compound annual growth rate of 17.6% from 2024 to 2030 to reach USD 109.22 billion by 2030.

b. The external event segment accounted for the largest revenue share of 58.0% in 2023 on account of the increasing adoption of virtual event tools by businesses to communicate with external entities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.