- Home

- »

- Pharmaceuticals

- »

-

North America Topical Skin Treatment Market, Report, 2030GVR Report cover

![North America Topical Skin Treatment Market Size, Share & Trends Report]()

North America Topical Skin Treatment Market Size, Share & Trends Analysis Report By Therapeutic Area (Skin Cancer, Eczema, Psoriasis), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-450-2

- Number of Report Pages: 121

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

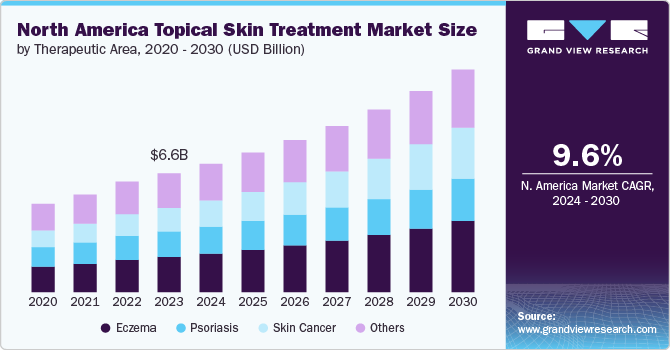

The North America topical skin treatment market size was estimated at USD 6.64 billion in 2023 and is projected to grow at a CAGR of 9.60% from 2024 to 2030. The market growth can be attributed to the increasing prevalence of skin conditions, advancements in treatment options, and strategic initiatives by key market players.

Skin cancer is the most common type of cancer across the U.S. and Canada, comprising about one-third of all new cancer cases. Its incidence is expected to continue to rise, primarily due to the Ultraviolet (UV) radiation exposure from the sun and tanning equipment. Most cases are preventable through various measures, such as wearing protective clothing, using sunscreen, and avoiding peak sun hours. Early detection is crucial for effective treatment, as melanoma, the deadliest form, can spread rapidly if not caught early. Government initiatives through Health Canada and the Public Health Agency of Canada focus on public awareness and prevention strategies to mitigate the growing prevalence of skin cancer.

According to the American Academy of Dermatology Association, skin cancer is the most common cancer across U.S., with one in five Americans expected to develop it during their lifetime. Each day, around 9,500 new cases are diagnosed, highlighting its significant impact. Over recent decades, the incidence of Basal Cell Carcinoma (BCC) has increased by 145%, and Squamous Cell Carcinoma (SCC) by 263%. These cancers primarily affect sun-exposed areas, such as the face and hands. Melanoma, the deadliest form, is projected to account for 200,340 new cases in 2024, with survival rates varying significantly based on early detection.

Topical therapies are becoming increasingly important for treatment of common skin conditions, such as skin cancer, eczema, and psoriasis. There is a pressing need to increase treatment options for skin cancer, as the rates continue to rise. While surgery, chemotherapy, and radiation therapy are common treatments, they can have significant drawbacks in terms of disfigurement, physical toll, and adverse effects. Novel topical treatments like Alpha DaRT are now in clinical trials to provide more options that can effectively treat skin cancer while minimizing the impact on patient quality of life. Hence, this factor is driving the growth of the market.

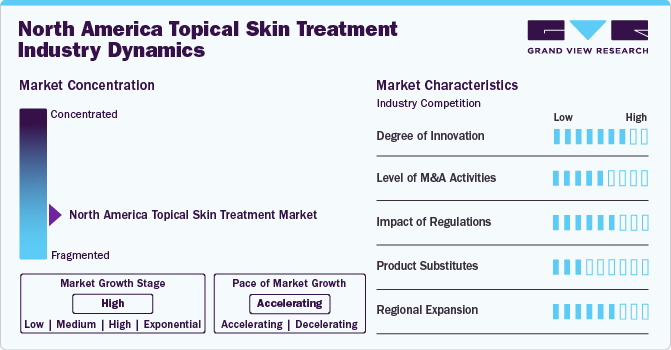

Market Concentration & Characteristics

The degree of innovation in this market is high. The market is experiencing significant advancements driven by technological trends, such as the development of nanoparticle-based drug delivery systems, which enhance drug penetration and efficacy. Innovations in topical patches, including microneedle and hydrogel patches, offer improved drug delivery and sustained release, increasing patient adherence. In addition, personalized medicine approaches and the integration of digital health technologies for remote monitoring and management are becoming more prevalent, further advancing the effectiveness and accessibility of skin treatments.

The North American market has seen low-to-moderate mergers and acquisitions (M&A) activity as large companies seek to expand their product portfolios, enter new segments, or acquire innovative startups. M&A activities help consolidate fragmented market segments like dermatology-based treatments and cosmetic-focused products, leading to economies of scale.

Topical treatments, especially those that claim therapeutic benefits, must adhere to strict guidelines. The FDA regulates products under its purview as either cosmetics or over-the-counter (OTC) drugs, depending on the claims made.

There are several product substitutes that can impact the demand for topical treatments. For skin conditions like acne, psoriasis, and eczema, some consumers prefer systemic treatments (oral medications) over topical treatments, especially in severe cases.

While North America remains a mature market, there are opportunities for regional expansion, particularly in underserved areas or specialized niches. Companies are increasingly targeting less saturated markets, such as rural and smaller urban centers, with more affordable or accessible skin treatments.

Therapeutic Area Insights

The eczema segment dominated the market and accounted for 29.7% of the revenue in 2023. The use of topical corticosteroids and emollients has been widespread, and biologics have begun to significantly impact the market. This trend can be attributed to the rising number of atopic dermatitis cases, improved patient awareness, and the emergence of advanced biologic & targeted treatments. According to Allergy & Asthma Network in March 2023, eczema, affecting 31.6 million Americans, peaks during childhood with 15.1% prevalence among children and 7.3% among adults. State-specific rates range from 8.7% to 18.1%, with higher prevalence in urban areas. These statistics underscore the widespread nature of eczema in the U.S. and highlight the need for effective management strategies to alleviate its significant societal and personal implications.

The skin cancer segment is expected to grow at a rapid pace during the forecast period. This growth is anticipated to be driven by continuous advancements in topical immunotherapies and targeted therapies, as well as the rising incidence of skin cancer due to factors such as an aging population and increased UV exposure. The burden of skin cancer has been on the rise, with incidence rates increasing over the past few decades. According to the World Cancer Research Fund, skin cancer is the 17th most common cancer worldwide, with more than 331,722 new cases reported in 2022.

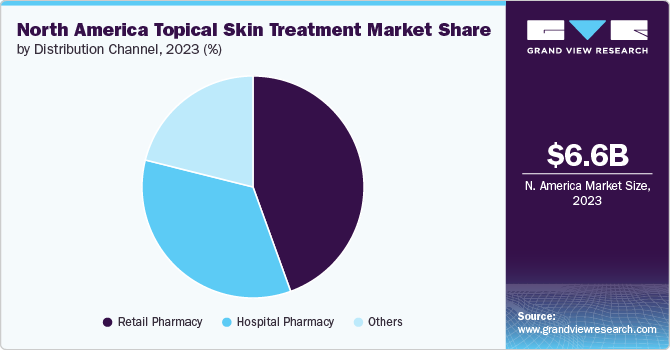

Distribution Channel Insights

Retail Pharmacy segment dominated the market with a market share of 44.49% in 2023. The dominance of retail pharmacies can be attributed to their accessibility and convenience for patients managing skin cancer with topical medications. The expansion of services offered by retail pharmacies and the wider availability of over-the-counter & prescription topical treatments are other factors likely to have contributed to the segment growth.

Other distribution channels, including online providers, are witnessing significant growth. The shift toward online pharmacies has been accelerated by the COVID-19 pandemic, which increased consumers' reliance on digital health solutions. The convenience of home delivery and the availability of a wide range of products online have made this channel increasingly popular. Online providers are expected to observe the highest CAGR during the coming years as more consumers turn to digital solutions for their healthcare needs

Country Insights

U.S Topical Skin Treatment Market Trends

The U.S. dominated the North America topical skin treatment market with a share of 89.3% in 2023. This growth can be attributed to the high prevalence of dermatological conditions, the advanced healthcare system, and substantial investments in R&D of innovative treatments. Major companies such as Pfizer Inc.; Novartis AG; AbbVie Inc.; and Johnson & Johnson dominate the market. These key players focus on continuous R&D to introduce innovative products, addressing various skin conditions like acne, psoriasis, and eczema.

Canada Topical Skin Treatment Market Trends

The market in Canada is expected to grow at a rapid driven by technological advancements, such as AI-driven diagnostics and telemedicine, which are being integrated into skincare practices. These innovations enhance accessibility to dermatological expertise and personalized treatment plans, catering to a consumer base that prioritizes effective and holistic skincare solutions.

Key North America Topical Skin Treatment Company Insights

Leading market players include Johnson & Johnson Services, Inc., GSK plc, Pfizer, Inc., and Novartis AG. These key players are adopting various strategic initiatives, such as product launches, collaborations, and partnerships, to sustain & build their market position. They are also expanding into emerging economies and fast-growing markets to maintain dominance.

LEO Pharma A/S, and Sun Pharmaceutical Industries Ltd are some of the emerging market players. These companies focus on partnerships between companies can strengthen their market position.

Key North America Topical Skin Treatment Companies:

- Johnson & Johnson Services, Inc.

- GSK Plc

- Pfizer, Inc.

- Novartis AG

- LEO Pharma A/S

- AbbVie, Inc.

- Bausch Health Companies, Inc.

- Galderma

- Sun Pharmaceutical Industries Ltd.

Recent Developments

-

In May 2024, LEO Pharma reported positive Phase 3 results for Enstilar (LEO 90100), an aerosol spray foam, in stable plaque psoriasis. Enstilar demonstrated superior efficacy over Daivobet ointment in reducing psoriasis severity and extent in a four-week trial involving over 600 patients in China. Both treatments were well-tolerated with consistent safety profiles.

-

In March 2024, Johnson & Johnson's JNJ-2113, an investigational oral peptide targeting IL-23 receptor, demonstrated sustained skin clearance in moderate-to-severe plaque psoriasis patients over 52 weeks in the FRONTIER 2 study. High response rates in PASI 75, PASI 90, and PASI 100 were maintained, with consistent safety profiles similar to earlier findings.

-

In January 2022, Pfizer's CIBINQO (abrocitinib), a once-daily oral JAK1 inhibitor, received FDA approval for adults with refractory, moderate-to-severe AD. Based on a large-scale program including over 1,600 patients across five trials, CIBINQO demonstrated significant efficacy in skin clearance and itch reduction, with a manageable safety profile.

North America Topical Skin Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.18 billion

Revenue forecast in 2030

USD 12.45 billion

Growth rate

CAGR of 9.60% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapeutic area, distribution channel, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Johnson & Johnson Services, Inc.; GSK Plc; Pfizer, Inc.; Novartis AG; LEO Pharma A/S; AbbVie, Inc.; Bausch Health Companies, Inc.; Galderma; Sun Pharmaceutical Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Topical Skin Treatment Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America topical skin treatment market report based on therapeutic area, distribution channel, and region:

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Cancer

-

Fluorouracil (5-FU)

-

Imiquimod

-

Ingenol Mebutate

-

Diclofenac Sodium Gel

-

Tirbanibulin Ointment

-

Other

-

-

Eczema

-

Corticosteroids

-

Calcineurin Inhibitors

-

Crisaborole (Eucrisa)

-

Topical Antimicrobials

-

Emollients and Moisturizers

-

Other

-

-

Psoriasis

-

Corticosteroids

-

Vitamin D Analogues

-

Coal Tar

-

Tazarotene

-

Topical Calcineurin Inhibitors

-

Combination Therapies

-

Other

-

-

Other therapeutic areas

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America topical skin treatment market size was estimated at USD 6.64 billion in 2023 and is expected to reach USD 7.18 billion in 2024.

b. The North America topical skin treatment market is expected to grow at a compound annual growth rate of 9.60% from 2024 to 2030 to reach USD 12.45 billion by 2030.

b. Based on therapeutic areas, the eczema held the largest market share of 29.7% in 2023. The use of topical corticosteroids and emollients has been widespread, and biologics have begun to significantly impact the market. This trend can be attributed to the rising number of atopic dermatitis cases, improved patient awareness, and the emergence of advanced biologic & targeted treatments.

b. Some of the key players in the North America topical skin treatment market are Johnson & Johnson Services, Inc., GSK Plc, Pfizer, Inc., Novartis AG, LEO Pharma A/S, AbbVie, Inc., Bausch Health Companies, Inc., Galderma, and Sun Pharmaceutical Industries Ltd.

b. Key factors that are driving the North America topical skin treatment market growth include increasing prevalence of skin conditions, advancements in treatment options, and strategic initiatives by key market players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."