- Home

- »

- Medical Devices

- »

-

North America Topical Drugs CDMO Market Report, 2030GVR Report cover

![North America Topical Drugs CDMO Market Size, Share & Trends Report]()

North America Topical Drugs CDMO Market Size, Share & Trends Analysis Report By Product Type (Semi-Solid, Liquid), By Service Type (Contract Development, Contract Manufacturing), By Sponsors, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-188-4

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

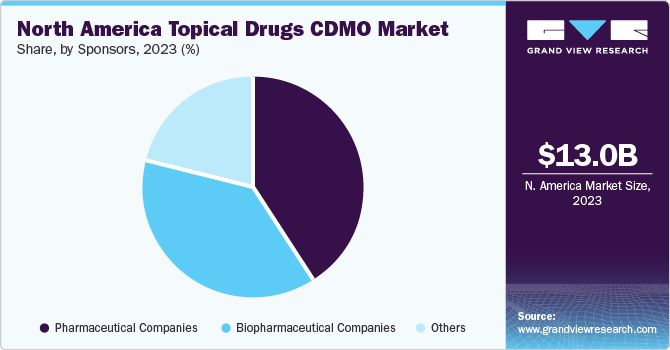

The North America topical drugs CDMO market size was estimated at USD 13.03 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 10.7% from 2024 to 2030. Rising healthcare outsourcing, improved patient care, R&D investments due to rising prevalence of various skin diseases, and expiration of existing patents are driving the topical drugs CDMO market in North America. Integration of advanced development and manufacturing technologies, cost-effectiveness, and heightened number of CDMOs are some major factors positively influencing market growth.

Contract Development and Manufacturing Organizations (CDMOs) have better expertise and resources pertaining to clinical trials and offer cost-effective manufacturing compared to pharmaceutical companies. Moreover, development of innovative drugs for a specific therapeutic application is effectively managed by CDMOs, which contributes to their demand.

Growing need for novel innovation and new product development are expected to improve demand in the market, and competitive pressure & pricing concerns are driving companies to outsource new drug development & manufacturing. This is expected to drive overall market growth. In addition, an emerging focus on developing advanced drug delivery technologies for enhanced drug stability and patient outcomes is expected to propel market growth.Moreover, technological advancements enable CDMOs to cater to diverse therapeutic needs in topical drugs. This includes treatment for various skin conditions, wound care, pain management, and dermatological disorders, accelerating market growth.

The demand for topical medications extends beyond traditional skin disorders. Topical formulations are increasingly utilized for pain relief, wound healing, scar reduction, and cosmetic applications. Such rising applications are expected to broaden pharmaceutical innovation and development opportunities in topical drug formulations. Moreover, affordability and accessibility are crucial factors driving the demand for topical drugs CDMO. The cost-effectiveness of topical drug development & manufacturing among CDMOs compared to in-house and technological advancements & development of innovative drug delivery systems to cater to increasing product demand contribute to the overall market growth.

The growing consumer concern about self-care is increasing the consumption of pharmaceutical products and cosmeceuticals. The growing need for topical drugs and the rising trend for outsourcing among topical drugs promote expanding manufacturing capabilities in various locations to meet the demand. For instance, in November 2023, SOHM, Inc. introduced a new Good Manufacturing Practice (GMP) manufacturing facility in Carlsbad, California, to manufacture topical products with a capacity of 1,892 liters per day. Similarly, in April 2022, BORA Pharmaceuticals invested USD 10 million to expand its oral solid dose capabilities at Taiwan, Zhunan, and Mississauga, Ontario facilities. The investment was planned for the next two years to meet the increasing client demand.

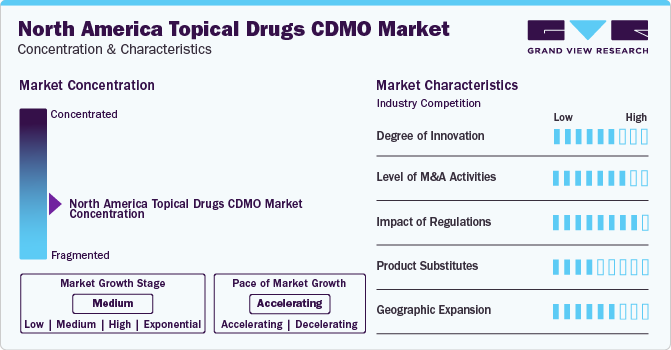

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The North America topical drugs CDMO market is characterized by evolving technologies and therapeutics, regulatory considerations, product innovations, increasing demand for cosmetic products, and increasing outsourcing of manufacturing processes to leverage cost advantages and specialized capabilities.

Degree of Innovation: advancements in drug delivery mechanisms, formulation technologies, and the development of novel compounds. CDMOs invest extensively in research and development (R&D) activities to enhance efficacy, safety, and patient outcomes. This includes exploring innovative delivery systems such as transdermal patches, microencapsulation techniques, or nanotechnology-based formulations that enable better skin penetration and controlled release of active pharmaceutical ingredients. Such advancements and innovations in CDMOs drive market growth in the region.

-

Impact of Regulations: Stringent quality protocols and regulatory norms by the U.S. FDA and Health Canada highly impact operational capabilities in the North America topical drugs CDMO industry. Market participants with robust compliance measures and a track record of fulfilling regulatory standards gain credibility and preference from biopharmaceutical sponsors.

-

Level of M&A Activities: Mergers and acquisition activities in the North America topical drugs CDMO industry are increasing and witness similar growth during the analysis timeframe. Several companies integrating advanced facilities and forming strategic alliances tend to achieve synergies in capabilities and resources, enhancing their competitiveness.

-

Market Fragmentation: The market comprises a large number of CDMOs and small players specialized in topical drug manufacturing. Specialization in specific technologies and materials has led to a fragmented market scenario.

-

Regional Expansion: CDMOs are implementing geographic expansion strategies to tap into new markets to establish a stronger presence in key countries within North America. Companies that effectively tailor their services to regional needs and regulatory nuances gain a competitive edge in the market.

Product Type Insights

Semi-solid formulations segment led the market and accounted for a revenue share of 66.2% in 2023. The segment growth is driven by increasing interest in semi-solid dosage forms, rising R&D activities, and a growing pipeline of semi-solid topical drugs, among others. Semi-solid dosage forms are usually present in various formulations, such as creams, ointments, and lotions. These dosage forms consist of active dissolved or uniformly dispersed ingredients in a suitable base and excipients. In addition, various advantages of semi-solid formulations include ease of use, rapid preparation, and local delivery capabilities. The interest in this segment has increased in recent years due to these benefits, fueling the demand for CDMOs with expertise in developing these products.

CDMOs play a major role in increasing product pipelines for several biopharmaceutical and pharmaceutical companies. This has led to a significant increase in strategic collaborations and expansion activities by industry players focusing on the development of semi-solid formulations for disease indications. This trend is expected to boost segment growth over the forecast period. For instance, in June 2023, Swiss-American CDMO, a manufacturer of topical solutions and a global company offering skin & personal care products, and BioNTX announced a partnership to launch the Biotechnology and Healthcare Industry Alliance of North Texas (BHIANT).

Service Type Insights

The contract manufacturing segment dominated the market in 2023. The growth of the segment can be attributed to a surge in the number of CDMOs entering the topical drugs CDMO industry. Several pharmaceutical companies are outsourcing topical formulations manufacturing to CDMOs owing to cost-effectiveness and less capital investment, which is one of the key factors contributing to segment growth. Furthermore, strong presence of small and midsized market players with advanced manufacturing capabilities in the region, leads to introduction of high-quality end products and ensures the effectiveness & safety of pharmaceutical products is expected to boost the market. Moreover, rising adoption of generic drugs and growing trend of Rx-to-OTC switches positively impact topical drug outsourcing to cater to a large customer base with an affordable price range, which is expected to support segment growth.

Sponsors Insights

Pharmaceutical companies accounted for the largest market revenue share in 2023. Increasing R&D investments by pharmaceutical companies to develop and commercialize topical drugs are propelling market demand. The large presence of small and middle-scale pharmaceutical companies with limited infrastructure & capital investment is expected to drive overall market demand. Moreover, the market demand for pharmaceutical companies can be attributed to the growing number of pharmaceutical companies ramping up their investments and product innovations in topical drugs. Moreover, most pharmaceutical companies are looking to outsource topical drug manufacturing due to rationalizing their own facilities. Furthermore, a significant increase in regulatory approvals for various topical products by pharmaceutical companies is boosting the demand for outsourced services. For instance, in July 2022, Incyte announced U.S. FDA approval for the topical cream Opzelura for the treatment of vitiligo. Hence, constant outsourcing of topical drugs and innovation of products in pharmaceutical companies have led market players to increase their product sales, which is expected to drive the market.

Biopharmaceutical companies are expected to register the fastest CAGR during the forecast period. This segment is driven by outsourcing end-to-end services, especially from small, midsized, and established biopharmaceutical companies that lack expertise in topical drug development. Moreover, a growing number of biopharmaceutical companies are investing in developing & producing topical drugs for several skin conditions, fueling segment growth.

Country Insights

The U.S. dominated the market and accounted for a revenue share of 88.3% in 2023. This can be attributed to top manufacturing hubs for highly reliable, complex, and high-end pharmaceuticals. Moreover, biopharmaceutical companies are focusing on the U.S. market due to the booming healthcare industry in the country, which is supporting the country’s considerable market revenue. Increased outsourcing practices by topical drug companies and support of CDMOs in reducing operational and capital expenses are among the key factors accelerating market growth. In addition, strong R&D practices in the country and promotion of new therapeutics have significantly contributed to the considerable market share held by the U.S. Furthermore, the need to maintain high client satisfaction amid intense competition is anticipated to fuel market expansion in the country.

Canada is projected to witness a stable growth rate over the forecast period. The pharmaceutical and biopharmaceutical sector in Canada is witnessing advancements due to an increase in investments, partnerships, and other strategic initiatives undertaken by CDMOs that initiate research in the area of skin diseases to address various skin-related and dermatological conditions. Moreover, research on topical & transdermal drug delivery systems is of great importance in the country.

Key North America Topical Drugs CDMO Company Insights

Some of the key players operating in the market include The Lubrizol Corporation, DPT Laboratories Ltd., Pierre Fabre Group, and Bora Pharmaceutical CDMO

-

The Lubrizol Corporation has innovative pharmaceutical & medical device products. It provides polymers, excipients, and product design, development, and manufacturing services. The company develops OTC products or prescription drug formulations in the topical drug delivery business. It offers Noveon, polycarbophil, Carbopol polymers, Pemulen polymers, and other topical IID-listed polymers, which can be used in developing effective & safe topical products. The qualities of products include aesthetic & sensory qualities, bio adhesion/mucoadhesion, & efficient rheology modification and thickening for topical semisolids.

-

DPT Laboratories Ltd. is a CDMO. DPT, a Mylan company, has expertise in semi-solid & liquid dosage forms, with a legacy of excellence. It develops pre-formulation, formulation, analytical, packaging, process development, stability testing, microbiology, and clinical trial supplies. The company also offers manufacturing for semi-solids & liquids, aerosol foams & sprays, and site & technology transfers.

-

Cambrex Corporation, Contract Pharmaceuticals Limited., and MedPharm Ltd. are some of the emerging market participants in the North America topical drugs CDMO market.

-

Cambrex Corporation is a prominent Contract Development and Manufacturing Organization (CDMO). The company provides the full range of services & support to create topical formulations, such as OTC products and prescription dermatological drugs. The technologies and equipment support a range of ointment, lotion, gel, and cream manufacturing services.

-

MedPharm Ltd. offers dermal route formulation development services and supports early-phase discovery to process development. It mitigates risks & optimizes products prior to reaching costly clinical phases.

Key North America Topical Drugs CDMO Companies:

The following are the leading companies in the North America topical drugs CDMO market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these North America topical drugs CDMO companies are analyzed to map the supply network.

- The Lubrizol Corporation

- Cambrex Corporation

- Contract Pharmaceuticals Limited

- Bora Pharmaceutical CDMO

- Ascendia Pharmaceuticals

- Pierre Fabre S.A.

- Piramal Pharma Solutions

- DPT Laboratories, LTD.

- MedPharm Ltd.

- Zenvisionpharma

Recent Developments

-

In November 2023, SOHM, Inc. announced the establishment of a new manufacturing facility in Carlsbad. The new facility will manufacture SOHMbrand Rx topical and OTC products. It would handle all orders while its main facility in downtown San Diego is being renovated. In addition, 2,500 square feet have been allocated to store finished products. This will broaden the company’s service offerings and gain a competitive edge in the market.

-

In October 2023, Ascendia Pharmaceuticals, Inc. partnered with Ampio Pharmaceuticals, Inc. to provide services to support Ampio’s OA-201 clinical development for treating symptomatic osteoarthritis pain. This has enhanced the company’s revenue generation capabilities.

-

In December 2022, Formulated Solutions LLC announced an agreement to acquire a new 455,000 ft2 FDA-approved pharmaceutical semisolids, liquids, aerosol, BoV, and metered dose nasal spray production facility in Cleveland. The acquisition is anticipated to enhance Formulated Solutions LLC's service offering in topical products.

North America Topical Drugs CDMO Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.33 billion

Revenue forecast in 2030

USD 26.45 billion

Growth rate

CAGR of 10.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, capacity outlook, pricing analysis

Segments covered

Product type, service type, sponsors, country

Country scope

U.S.; Canada

Key companies profiled

The Lubrizol Corporation; Cambrex Corporation; Contract Pharmaceuticals Limited; Bora Pharmaceutical CDMO; Ascendia Pharmaceuticals; Pierre Fabre S.A.; Piramal Pharma Solutions; DPT Laboratories, LTD.; MedPharm Ltd.; Zenvisionpharma

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Topical Drugs CDMO Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America topical drugs CDMO market report based on product type, service type, sponsors, and country:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Semi-solid Formulations

-

Creams

-

Ointments

-

Lotions

-

Others

-

-

Liquid Formulations

-

Suspensions

-

Solutions

-

-

Solid Formulations

-

Transdermal Products

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Contract Development

-

Formulation Development

-

Analytical Testing

-

Stability Testing

-

Others

-

-

Contract Manufacturing

-

Clinical

-

Commercial

-

-

-

Sponsors Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biopharmaceutical Companies

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America topical drugs CDMO market size was estimated at USD 13.03 billion in 2023 and is expected to reach USD 14.33 billion in 2024.

b. The North America topical drugs CDMO market is expected to grow at a compound annual growth rate of 10.7% from 2024 to 2030 to reach USD 26.45 billion by 2030.

b. The U.S. dominated the North America topical drugs CDMO market with a share of 88.3% in 2023. This is attributable to the presence of top manufacturing hubs for highly reliable, complex, and high-end pharmaceuticals.

b. Some key players operating in the North America topical drugs CDMO market include The Lubrizol Corporation, Cambrex Corporation, Contract Pharmaceuticals Limited, Bora Pharmaceutical CDMO, Ascendia Pharmaceuticals, Pierre Fabre group, Piramal Pharma Solutions, DPT Laboratories, LTD., MedPharm Ltd., and Zenvision Pharma.

b. Key factors that are driving the market growth include increasing outsourcing R&D activities, patient inclination towards topical therapeutics, and advancements in manufacturing technologies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."