North America Tin Cannabis Packaging Market Size, Share & Trends Analysis Report By Application (Recreational Use, Medical Use), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-405-6

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

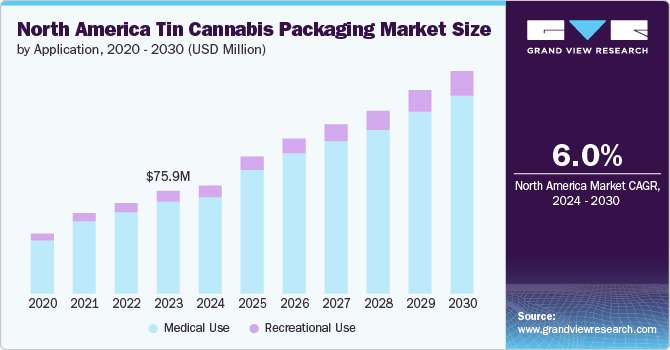

The North America tin cannabis packaging market size was estimated at USD 75.91 million in 2023 and is projected to grow at a CAGR of 12.8% from 2024 to 2030. Metal tins provide a sustainable option over plastic-based cannabis packaging since they are recyclable. Furthermore, tins are sturdier than plastic bags, glass jars, and plastic jars, protecting cannabis products from getting crushed or damaged during transportation or storage, thus contributing to their market growth.

The primary driver for the market growth is the stringent regulations governing the sale and distribution of cannabis products. Governments and regulatory bodies across the globe have implemented strict packaging guidelines to ensure product safety, prevent contamination, and restrict its access to minors. These regulations often mandate child-resistant packaging, tamper-evident features, and clear labeling, which has led to increased demand for specialized packaging solutions.

Sustainability is another crucial factor shaping market growth. Hence, growing environmental concerns and increasing consumer demand for eco-friendly products have led many cannabis packaging manufacturers to focus on developing sustainable packaging solutions. This includes the use of biodegradable materials, recyclable packaging, and minimalistic designs to reduce waste. In February 2021, PakTech, a U.S.-based designer and manufacturer of packaging handles, launched PakLock, its latest packaging innovation tailored for the CBD beverage market. The new product is manufactured from 100% recycled and 100% recyclable HDPE material. It features a child-resistant cap specifically designed for CBD-infused beverages. This new packaging solution is crafted to provide a secure and straightforward method for adults to consume CBD-infused beverages without concerns.

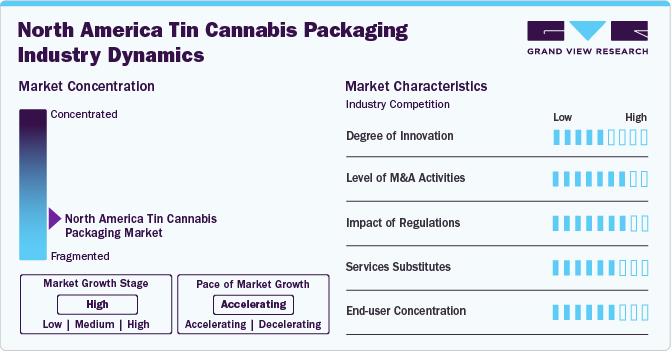

Market Concentration & Characteristics

Major North America tin cannabis packaging companies operating in industry include PakFactory, Marijuana Packaging, SKS Bottle & Packaging, Inc., Compliant Packaging, LLC, Tin King USA, Ztoda Packaging, Treeform Packaging Solutions, Tinwonder, DC Packaging, Marijuana Packaging Solution, O.Berk, Berlin Packaging, KYND Packaging Co., Inc., Brilliant Tin Box Manufacturing Co., Ltd., Pollen Gear, KacePack, Dymapak, and Stephen Gould.

Companies are increasingly focusing on the introduction of sustainable tins in the cannabis packaging industry. For instance, in December 2023, Compliant Packaging, LLC, a provider of child-resistant cannabis packaging, announced the launch of its latest innovation, the Smile Tin. This new product is designed to offer a sustainable and eco-friendly alternative to traditional cannabis packaging products. The Smile Tin is made from recyclable materials, thereby reducing the environmental impact of cannabis packaging. This new product launch demonstrates the commitment of the company to provide innovative solutions that prioritize both, environmental sustainability and consumer safety in the cannabis industry.

Application Insights

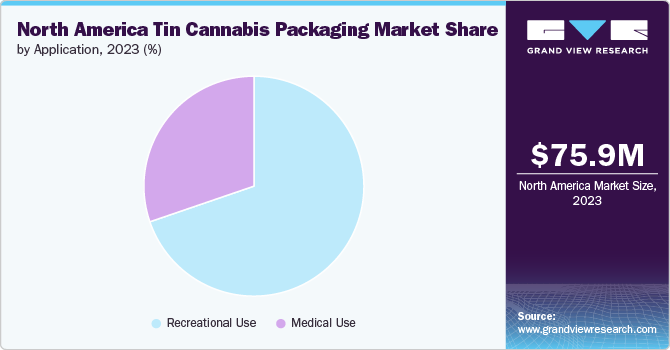

Based on application, the recreational use segment led the market with the largest revenue share of 69.75% in 2023. This segment has seen substantial growth following the legalization of recreational cannabis in various states and provinces across the U.S. and Canada. The recreational use segment is characterized by a diverse consumer base seeking cannabis products for personal enjoyment, relaxation, and social experiences.

The medical use segment is anticipated to grow at the fastest CAGR during the forecast period. It reflects the increasing recognition of cannabis as a therapeutic option for various medical conditions. The rapid growth of this segment can be attributed to the increasing awareness among patients regarding the medical applications of cannabis and cannabis-based products, specifically for treating severe medical conditions such as Dravet syndrome and cancer. With this surge in awareness, a large number of patients are turning to medical cannabis for therapeutic relief. This fuels the demand for specialized and compliant packaging products tailored to meet the unique medical use requirements. Medical conditions, such as Dravet syndrome and cancer, require precise dosage and secure storage of cannabis and cannabis-based products, thereby making regulatory-compliant packaging the most important in ensuring patient safety and treatment efficacy.

Country Insights

U.S. Tin Cannabis Packaging Market Trends

U.S. dominated the North America tin cannabis packaging market with the largest revenue share of over 89.77% in 2023. The U.S. market is experiencing growth, primarily due to the legalization of recreational cannabis and related products across Colorado, Washington, California, Oregon, and other states. However, the regulatory landscape remains complex with specific rules governing the sale and consumption of cannabis products. Manufacturers, suppliers, and consumers are required to adhere to these regulations, which further contributes to the demand for specialized packaging solutions that meet legal requirements.

Canada Tin Cannabis Packaging Market Trends

The tin cannabis packaging market in Canada operates within a regulatory framework that not only ensures the safety and security of cannabis products but also places a significant emphasis on environmental responsibility. The country's legalization of recreational cannabis at the federal level in 2018 marked a groundbreaking development that has since influenced the packaging landscape. Health Canada, the federal health department, has established strict regulations to govern the packaging of cannabis products with mandates such as child-resistant features, clear labeling, and tamper-evident measures, aiming to ensure public safety, prevent youth access, and deter illicit activities.

According to the Government of Canada, cannabis consumption in Canada has evolved significantly between 2018 and 2023. The prevalence of cannabis use in the country increased from 22% to 26% during this period. Notably, there has been a shift in consumption methods, with smoking declining from 89% to 63%, while edible and drinkable forms gaining popularity, from 43% to 55%. Hence, the evolving cannabis market may encourage producers to develop new cannabis-infused products, many of which could benefit from tin packaging for preservation and aesthetic appeal, thus driving the market growth in the country.

Key North America Tin Cannabis Packaging Company Insights

The market is fragmented, with the presence of numerous smaller regional and local players. The market has been witnessing a significant number of new product launches, merger & acquisitions, and expansions over the past few years.

Key North America Tin Cannabis Packaging Companies:

- PakFactory

- Marijuana Packaging

- Smoke Cones

- SKS Bottle & Packaging, Inc.

- Compliant Packaging, LLC

- Tin King USA

- Tin Canna

- Ztoda Packaging

- Treeform Packaging Solutions

- Tinwonder

- DC Packaging

- Marijuana Packaging Solution

- O.Berk

- Berlin Packaging

- The Bureau

- GPA Global

- KYND Packaging Co, Inc.

- Brilliant Tin Box Manufacturing Co., Ltd.

- Packagewea Cannabis Packaging Solutions

- Pollen Gear

- KacePack

- Dymapak

- N2 Packaging Systems LLC

- Stephen Gould

Recent Developments

-

In November 2023, Treeform Packaging Solutions, a provider of sustainable packaging solutions, opened a new warehouse facility in Concord, California in the U.S. The new warehouse aims to expand the operations of the company and serve its West Coast customers in the country in an improved manner. The facility features state-of-the-art equipment and storage capabilities, thereby enabling the company to efficiently manufacture and distribute its innovative packaging products

-

In October 2023, Dymapak, a manufacturer of child-resistant packaging solutions, launched the Squeeze and Turn Tin, a 100% curbside recyclable child-resistant packaging solution for consumer-packaged goods (CPG). The tin features an airtight seal, metal-on-metal construction, and a proprietary mechanism designed for ease of use while maintaining child resistance. The tin prioritizes sustainability by replacing plastic child-resistant closures that contribute to waste

North America Tin Cannabis Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 79.94 million |

|

Revenue forecast in 2030 |

USD 164.61 million |

|

Growth rate |

CAGR of 12.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Application, country |

|

Regional scope |

North America |

|

Country Scope |

U.S.; Canada |

|

Key companies profiled |

PakFactory; Marijuana Packaging; Smoke Cones; SKS Bottle & Packaging, Inc.; Compliant Packaging, LLC; Tin King USA; Tin Canna; Ztoda Packaging; Treeform Packaging Solutions; Tinwonder; DC Packaging; Marijuana Packaging Solution; O.Berk; Berlin Packaging; The Bureau; GPA Global; KYND Packaging Co, Inc.; Brilliant Tin Box Manufacturing Co., Ltd.; Packagewea Cannabis Packaging Solutions; Pollen Gear; KacePack; Dymapak; N2 Packaging Systems LLC; Stephen Gould |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Tin Cannabis Packaging Market Report Segmentation

This report forecasts revenue growth at region and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America tin cannabis packaging market report based on application, and country:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Recreational Use

-

Medical Use

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America tin cannabis packaging market was estimated at USD 75.91 million in 2023 and is expected to reach USD 79.94 million in 2024.

b. The North America tin cannabis packaging market is expected to grow at a compound annual growth rate of 12.8% from 2024 to 2030, reaching around USD 164.61 million by 2030.

b. The recreational use application segment accounted for the largest revenue share of 70.67% of the overall market in 2023. Recreational cannabis purchases often have fewer restrictions and regulations compared to medical cannabis. This makes it easier for people to obtain recreational cannabis products.

b. Key players in the market include PakFactory; Marijuana Packaging; Smoke Cones; SKS Bottle & Packaging, Inc.; Compliant Packaging, LLC; Tin King USA; Tin Canna; Ztoda Packaging; Treeform Packaging Solutions; Tinwonder; DC Packaging; Marijuana Packaging Solution; O.Berk; Berlin Packaging; The Bureau; GPA Global; KYND Packaging Co, Inc.; Brilliant Tin Box Manufacturing Co., Ltd.; Packagewea Cannabis Packaging Solutions; Pollen Gear; KacePack; Dymapak; N2 Packaging Systems LLC; and Stephen Gould.

b. The North America tin cannabis packaging market is rapidly growing, as tins provide a sustainable option over plastic-based cannabis packaging since they are recyclable.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."