- Home

- »

- Homecare & Decor

- »

-

North America Tabletop Kitchen Products Market Report, 2033GVR Report cover

![North America Tabletop Kitchen Products Market Size, Share & Trends Report]()

North America Tabletop Kitchen Products Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Dinnerware, Flatware, Whitegoods, Buffet Products, Drinkware), By Application (Commercial, Residential), By Country, And Segment Forecasts

- Report ID: GVR-4-68039-442-8

- Number of Report Pages: 83

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Tabletop Kitchen Products Market Summary

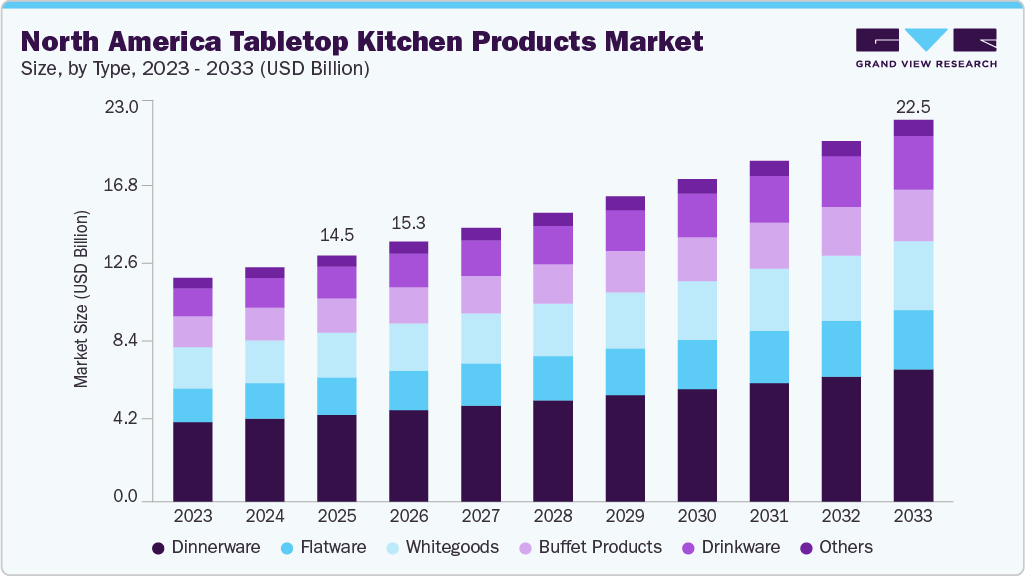

The North America tabletop kitchen products market size was estimated at USD 14.54 billion in 2025 and is expected to reach USD 22.51 billion by 2033, growing at a CAGR of 5.6% from 2026 to 2033. The market is rising as consumers are treating the home as a “primary venue” for hosting, self-expression, and everyday lifestyle upgrades, not just cooking.

Key Market Trends & Insights

- By country, the U.S. led the market with a share of 80.3% in 2025.

- By type, dinnerware led the market and accounted for a share of 35.1% in 2025.

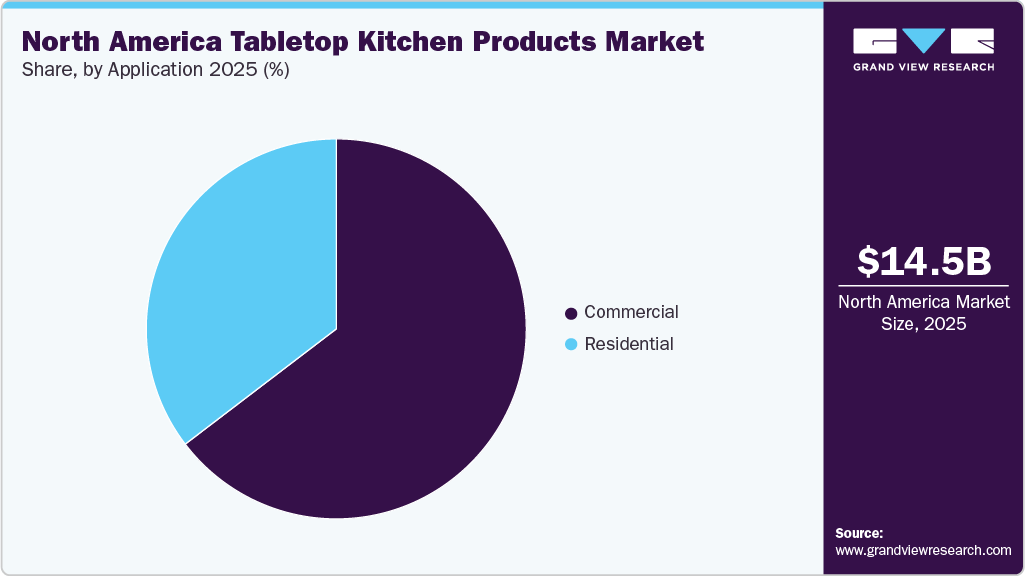

- By application, commercial led the market and accounted for a share of 64.5% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 14.54 Billion

- 2033 Projected Market Size: USD 22.51 Billion

- CAGR (2026-2033): 5.6%

Post-pandemic habits have structurally increased at-home meals, celebrations, and casual entertainment, which lifts repeat purchases across dinnerware, drinkware, serveware, flatware, storage, and countertop accessories. A key demand driver is the rise of home gatherings in North America small group dinners, weekend brunches, potlucks, game nights, and holiday hosting. Consumers want tablescapes that look curated without being overly formal, so they buy statement pieces (colored glassware, textured plates, serving boards, matching sets) that photograph well and elevate the experience.Design and color preferences are expanding because tabletop products have become part of home décor. Instead of neutral, one-style-for-everything sets, buyers prefer personalization mixing matte and glossy finishes, warm earthy tones, pastels, speckled ceramics, retro patterns, minimalist Scandinavian looks, or modern artisanal textures. This shift is also supported by more frequent home improvement plans (new dining setups, apartment moves, new kitchens) and the growth of online discovery, where niche aesthetics and limited collections are easier to find than in traditional retail.

In addition to household demand, commercial usage in the hospitality industry is significantly contributing to market growth. Hotels, restaurants, cafés, and catering services require tabletop kitchen products in large volumes and replace them frequently due to heavy daily use. Presentation has become a critical part of the dining experience in hospitality settings, pushing operators to invest in stylish, high-quality dinnerware and serveware that reinforce brand identity and ambiance. Boutique hotels and premium restaurants use distinctive tabletop designs to differentiate their guest experience.

Sustainability is becoming a differentiator because many North American consumers are more conscious of material choices and longevity. They increasingly look for durable, reusable, and responsibly positioned options such as recycled glass, responsibly sourced wood/bamboo, lead- and cadmium-safe claims where applicable, and packaging reduction while also valuing “buy better, keep longer” quality (chip resistance, dishwasher safety, stackability, and multi-use pieces).

Type Insights

Dinnerware dominated the North America tabletop kitchen product market with a share of 35.1% in 2025. The market for dinnerware, tabletop, and kitchen products is rising as consumers increasingly prioritize both functionality and aesthetics in their homes. Growing interest in home cooking and dining experiences, fueled by trends in entertaining guests, social media inspiration, and a desire for personal expression, has led shoppers to invest more in high-quality, stylish kitchenware. Moreover, rising disposable incomes and a focus on durable, sustainable materials are encouraging purchases of premium sets that enhance everyday meals and special occasions alike.

The drinkware tabletop kitchen products are predicted to have a CAGR of 7.0% from 2026 to 2033. Shifts in lifestyle preferences, such as more frequent home cooking, entertaining guests, and remote work routines, are driving demand for quality, stylish drinkware that enhances meal presentation and everyday use. Additionally, growing interest in sustainable, durable, and design-forward products has encouraged consumers to invest in items that reflect personal taste while offering long-term value. This trend is further supported by social media influences and an emphasis on home aesthetics, making drinkware and tabletop items essential components of modern kitchen living.

Application Insights

Sales of North America tabletop kitchen products for commercial use accounted for a share of 64.5% in 2025. Compared with rigid e-cones, inflatable collars enable pets to move with fewer obstructions in homes and stores, which aligns with the commercial shopper mindset of try-before-buy and immediate need fulfillment. Pharmacies, veterinary clinics, and organized pet retailers are acting as key conversion points where recommendation by practitioners and physical product inspection influence purchase decisions. Retail formats such as large-footprint hypermarkets and pet specialty stores benefit from impulse accessory add-ons, while pharmacies deliver proximity-driven purchases for post-surgery, abrasion, or grooming-related protective use cases.

Sales of North America tabletop kitchen products for residential use are expected to grow at a CAGR of 5.4% from 2026 to 2033. Restaurants, cafés, catering services, and hospitality venues are investing in higher-quality, durable tabletop solutions to meet rising expectations for aesthetics, functionality, and hygiene. Growth in out-of-home dining, expansion of quick-service and experiential foodservice formats, and a greater focus on sustainability and premium materials are driving operators to upgrade their tabletop inventories. In addition, supply chain improvements and increased capital spending post-pandemic have further supported this uptick in commercial tabletop product purchases.

Country Insights

U.S. Tabletop Kitchen Products Market Trends

The U.S. tabletop kitchen products market accounted for a share of 80.3% in 2025. The market for tabletop kitchen products for consumers in the U.S. is expanding due to evolving lifestyle preferences, increased at-home dining experiences, and rising interest in home entertaining and culinary creativity. Consumers are seeking functional, durable, and aesthetically appealing items from dinnerware and serveware to utensils and small accessories that enhance everyday meals and special occasions. This growth is fueled by trends such as personalization, sustainable materials, and the influence of social media and cooking culture, which drive demand for premium and design-forward tabletop solutions that blend practicality with style.

Canada Tabletop Kitchen Products Market Trends

Tabletop kitchen products in the Canadian market are expected to grow at a significant CAGR from 2026 to 2033. Canadians increasingly value quality, design, and durability in items such as dinnerware, cutlery, glassware, and serving ware, driven by trends in healthier lifestyles, remote work, and social dining at home. In addition, the strong gift culture around weddings, holidays, and housewarmings supports steady demand. With rising interest in sustainable and locally made products, consumers are also willing to invest in premium, eco-friendly tabletop solutions that blend functionality with aesthetic appeal in everyday use.

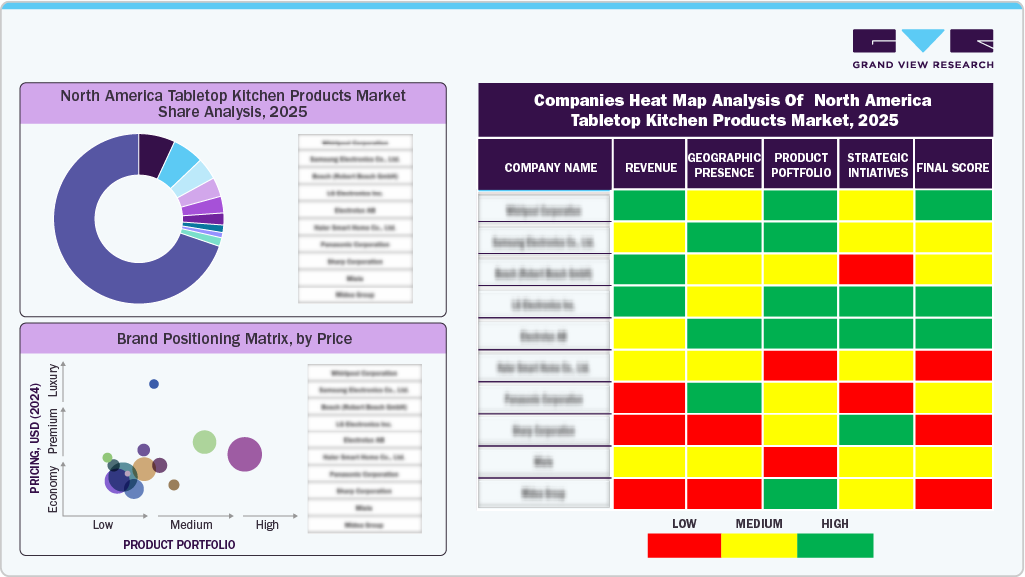

Key North America Tabletop Kitchen Products Company Insights

The presence of a few established players and new entrants characterizes the market. Many big players are increasing their focus on the growing trend of the North America tabletop kitchen products market. Players in the market are diversifying their service offerings in order to maintain market share.

Key North America Tabletop Kitchen Products Companies:

- Villeroy & Boch AG

- Lenox Corp.

- Noritake Co.

- The Oneida Group, Inc.

- Fiskars Group

- Lifetime Brands, Inc.

- Corelle Brands LLC

- Steelite International

- Libbey, Inc.

- Hamilton Beach Brands Holding Company

Recent Developments

-

In May 2025, Starbucks and Brazilian fashion brand Farm Rio launched a limited-edition merchandise collaboration for summer 2025, featuring vibrant, tropical-inspired drinkware and accessories that reflect Farm Rio’s bold prints and Starbucks’ coffeehouse lifestyle. The limited-edition FARM Rio + Starbucks collection* is expected to be available in Starbucks stores in the U.S. and Canada.

-

In April 2024, over&back’s 2024 tabletop collection, now available via its Amazon storefront and at the New York Tabletop Show, offers coordinated tablescapes across modern, traditional, and coastal styles, expanding beyond dinnerware and serveware into linens, glassware, flatware, and decorative accessories, all designed to mix and match within an eight-color core palette and priced from $34.99 with easy-care, dishwasher- and machine-washable features for everyday home dining and entertaining.

North America Tabletop Kitchen Products Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 15.32 billion

Revenue forecast in 2033

USD 22.51 billion

Growth rate

CAGR of 5.6% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million/Billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Villeroy & Boch AG; Lenox Corp.; Noritake Co.; The Oneida Group, Inc.; Fiskars Group; Lifetime Brands, Inc.; Corelle Brands LLC; Steelite International; Libbey, Inc.; Hamilton Beach Brands Holding Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Tabletop Kitchen Products Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the North America tabletop kitchen products market based on type, applications, and country:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Dinnerware

-

Flatware

-

Whitegoods

-

Buffet Products

-

Drinkware

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Residential

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America tabletop kitchen products market size was estimated at USD 14.54 billion in 2025 and is expected to reach USD 15.32 billion in 2026.

b. The North America tabletop kitchen products market is expected to grow at a compound annual growth rate of 5.6% from 2026 to 2033 to reach USD 22.51 billion by 2033.

b. The tabletop kitchen products market in the U.S. is projected to expand at a CAGR of 4.7% over the forecast period.

b. Some key players operating in the North America tabletop kitchen products market include Fiskars Group, Lifetime Brands, Inc., Corelle Brands LLC, and Libbey Inc. in addition to several small and medium players such as Lenox Corporation, Noritake Co., The Oneida Group, Inc., ARC International, Villeroy & Boch AG, Steelite International, and Hamilton Beach Brands Holding Company.

b. The rising number of eateries and restaurants has driven the need for various tabletop kitchen products for the preparation, service, and delivery of various kinds of foods. With the rapid growth of the real estate industry and a rise in commercial construction in North America, the tabletop kitchen products market is likely to witness growth in the coming years.

b. Sales of North America tabletop kitchen products for commercial use accounted for a share of 64.5% in 2025. Compared with rigid e-cones, inflatable collars enable pets to move with fewer obstructions in homes and stores, which aligns with the commercial shopper mindset of try-before-buy and immediate need fulfillment.

b. Dinnerware dominated the North America tabletop kitchen product market with a share of 35.1% in 2025. The market for dinnerware, tabletop, and kitchen products is rising as consumers increasingly prioritize both functionality and aesthetics in their homes. Growing interest in home cooking and dining experiences, fueled by trends in entertaining guests, social media inspiration, and a desire for personal expression, has led shoppers to invest more in high-quality, stylish kitchenware.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.