- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Subfloor Adhesives Market, Report, 2030GVR Report cover

![North America Subfloor Adhesives Market Size, Share & Trends Report]()

North America Subfloor Adhesives Market Size, Share & Trends Analysis Report By Resins Type (Polyurethane, Acrylic, Vinyl), By Technology, (Water-borne, Solvent-Borne) By End Use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-331-5

- Number of Report Pages: 158

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

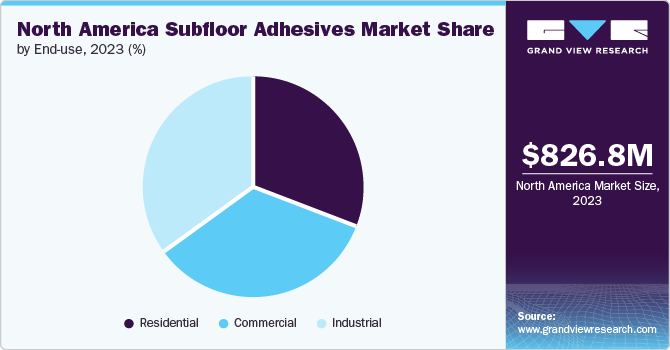

The North America subfloor adhesives market size was estimated at USD 826.8 million in 2023 and is projected to grow at a CAGR of 10.1% from 2024 to 2030. The demand for subfloor adhesives is a crucial component of the construction industry, serving both residential and commercial applications. In residential construction, subfloor adhesives play a vital role in ensuring the structural integrity and longevity of flooring installations.

Furthermore, increasing investments in the manufacturing of subfloor adhesives indicate its high demand in the market, which is expected to positively influence the growth of the subfloor adhesives market over the forecast period. Growing investments in the construction industry, especially in residential and commercial sectors, are projected to boost market growth over the forecast period.

Drivers, Opportunities & Restraints

Subfloor adhesives provide a durable and long-lasting bond between the subfloor and the flooring material, enhancing the overall stability and resilience of the flooring system. Similarly, in commercial applications such as office buildings, retail spaces, and industrial facilities, the use of subfloor adhesives is essential for maintaining the integrity of the flooring under heavy foot traffic and other stressors.

This demand is further amplified by the growing trend of do-it-yourself (DIY) home improvement projects, where homeowners and enthusiasts seek high-quality adhesives to ensure the longevity and stability of their flooring installations. The versatility and reliability of subfloor adhesives make them a sought-after product in the construction industry, catering to a wide range of applications and contributing to the overall quality and longevity of flooring systems.

Moreover, the growing popularity of DIY home improvement projects has significantly contributed to the demand for subfloor adhesives. DIY enthusiasts and homeowners embarking on renovation projects often seek adhesives that offer superior bonding strength, ease of application, and long-term durability.

As a result, the market for subfloor adhesives has experienced a notable upsurge, driven by the need for reliable adhesives that cater to the diverse requirements of DIY projects. This trend underscores the pivotal role of subfloor adhesives in empowering individuals to undertake their flooring installations with confidence, thereby enhancing the overall appeal and functionality of residential spaces. The accessibility and effectiveness of subfloor adhesives have positioned them as indispensable products in the construction industry, meeting the demands of both professionals and DIY enthusiasts alike.

Market Concentration & Characteristics

The North America subfloor adhesives market exhibits characteristics of a consolidated market, influenced by various factors such as the competitive landscape, regulatory scenario, and other market dynamics. Market structure, in economics, plays a crucial role in defining the nature of competition and the behavior of companies within a specific market.

Factors such as the number of buyers and sellers, degree of concentration, differentiation of products, and ease of market entry and exit contribute to shaping the market structure. In the case of subfloor adhesives, the market is influenced by the presence of a significant number of buyers and sellers, as well as the degree of differentiation of products, which impacts the competitive landscape.

The competitive landscape of the market is shaped by factors such as market concentration, which measures the concentration of top firms in the market and is closely associated with market competitiveness. Government regulations also play a pivotal role in shaping market structures, employing antitrust laws and policies to foster competition, prevent monopolistic dominance, and protect consumer interests. These regulations influence the competitive landscape by ensuring fair competition and preventing monopolistic practices, thereby contributing to the overall market dynamics.

Resins Type Insights & Trends

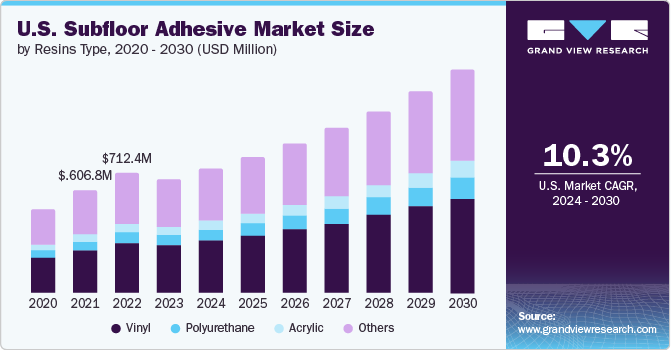

“Vinyl resins type segment is expected to witness growth at 10.3% CAGR.”

The vinyl resins type segment had an estimated revenue of USD 309.0 million in 2023 and is projected to reach USD 622.1 billion by 2030. Polyurethane resins are a type of synthetic resins widely used in various applications, including subfloor adhesives in the construction industry. They are known for providing a strong and durable bond between the subfloor and the flooring material, as well as their durability and high peel strength, thereby ensuring stability and longevity.

Acrylic resin is a thermoplastic or thermosetting plastic substance commonly used as a subfloor adhesive in North America. It is obtained from acrylic acid, methacrylic acid, or other related compounds. Acrylic resins have several properties that make them suitable for use as subflooring adhesives. They are transparent and have good tensile strength impact and UV resistance. These properties ensure that the adhesive can withstand stresses and strains placed on the subflooring materials.

Technology Insights & Trends

“Water-borne segment is expected to witness growth at 10.2% CAGR.”

Water-based adhesives are environment-friendly adhesives as they contain zero Volatile Organic Compounds (VOCs) and aid in reducing air pollution and improving indoor air quality. They have gained popularity in various industries, including subflooring adhesives, due to their environmental and safety benefits. In addition, waterborne adhesives are generally safe and have lower flammability risks than solvent-based alternatives.

Solvent-based adhesives are a class of adhesives known for their versatility and strong bonding capabilities. Unlike water-based adhesives, which use water as a solvent, solvent-based adhesives use organic solvents to dissolve and deliver adhesive components. Due to their unique characteristics and performance advantages, these adhesives find extensive applications in various industries.

End Use Insights & Trends

“Commercial segment is expected to witness growth at 10.4% CAGR.”

The commercial segment held the largest revenue share, 34.0% of the market in 2023. Subfloor adhesives are used in numerous commercial building applications, including offices, convenience stores, shopping malls, and the construction of other retail stores. The commercial subfloor adhesives market has witnessed advancements in adhesive technologies that meet specific requirements of commercial applications. These technologies aim to provide superior bonding, durability, and ease of installation.

The demand for subfloor adhesives in residential construction has grown in recent years. The use of a subfloor adhesive, also known as subfloor glue, is a standard practice in the construction industry to prevent floor squeaks and increase the overall stiffness of the floor. It is applied below the panels to secure them at the panel-to-joist connection, minimizing movement and ensuring the longevity and stability of the flooring.

Country Insights & Trends

“U.S. to witness market growth of CAGR 10.3%”

The U.S. is a prominent consumer of subfloor adhesives worldwide, with a revenue share of 81.4% in 2023. The market's growth in this region can be attributed to the increasing consumption of coconuts and coconut-based subfloor adhesives in key countries such as Indonesia, India, and Sri Lanka.

U.S. Subfloor Adhesives Market Trends

The public drinking water systems in the country that are regulated by the U.S. EPA supply drinking water to 90% of Americans. According to the Centers for Disease Control and Prevention, there are over 155,000 public water systems in the U.S. with approximately 82% of the population relying on these community water systems. The stringent government regulations intended for monitoring the disposal and production of wastewater in the country are predicted to fuel the demand for subfloor adhesives in water treatment applications in the U.S. over the coming years.

North America Subfloor Adhesives Company Share & Insights

Some of the key players operating in the market include RPM International Inc. (DAP Global Inc.), PPG Industries, Inc., and Henkel Corp.

-

DAP Products, Inc., a subsidiary of RPM International, is a provider of construction and home repair products. The company offers products such as adhesives, sealants, caulks, glazing, flooring coatings, roofing systems, spackling, general patches, insulating foams, and other related products for the building and construction industry. The company primarily operates in North America with manufacturing facilities located in Maryland, Ohio, Texas, and Dallas. It also has three distribution facilities, each in Maryland, Texas, and Missouri. The company sells its products to more than 60,000 retail stores in North America and South America.

-

Henkel Corp. is a manufacturer and marketer in the industrial and consumer sectors. The company produces and distributes a wide range of products, including hair care items, detergents, cleaning products, fabric softeners, adhesives, sealants, and functional coatings. Notable brands associated with Henkel include Technomelt, Dial, Syoss, got2b, Pattex, Pritt, Loctite, Schwarzkopf, and Persil. Henkel's products are used in various industries, such as automotive, electronics, industrial assembly, aircraft construction, and personal hygiene. The company operates globally, serving customers in Europe, IMEA (India, Middle East, Africa), North America, Latin America, and Asia-Pacific. Henkel is headquartered in Dusseldorf, Germany.

Franklin International, Grabber, and Akfix, among others, are some of the emerging market participants in the market.

-

Akfix operates in construction chemicals with a focus on eco-friendly products and technologies. Its product range includes adhesives and glues, sealants and silicones, PU foams, technical aerosols, waterproofing and heat insulation products, automotive after-care products, industrial products, and disinfectants. The company operates and distributes its products in 108 countries worldwide.

-

Grabber Construction Products Inc. is a manufacturer and distributor of fasteners & fastening systems for commercial and residential construction applications in the U.S. By offering a wide range of products for wood, metal, and drywall applications, the company has strengthened its position in the building materials manufacturing industry.

Key North America Subfloor Adhesives Companies:

- Selena Group (Tytan)

- RPM International Inc. (DAP Global Inc.)

- PPG Industries

- Akfix

- Grabber

- Franklin International

- Soudal Group

- Henkel Corp.

- HPS North America, Inc.

Recent Developments

-

In February 2023, Schnox HPS North America, Inc. and Ohio Valley Flooring announced a strategic partnership to provide Schnox subfloor product technologies in Ohio, Indiana, Kentucky, West Virginia, and Western Pennsylvania.

-

In January 2023, Palmetto Adhesives announced a strategic partnership with Sidereal Capital Group, which provides both companies with capital flexibility and strategic support for their growth initiatives.

-

In May 2022, H.B. Fuller acquired Beardow Adams, a UK-based adhesive manufacturing company. This acquisition expanded H.B. Fuller's portfolio of industrial adhesives.

North America Subfloor Adhesives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 900.8 million

Revenue forecast in 2030

USD 1,607 million

Growth rate

CAGR of 10.1% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resins type, technology, end use, region

Regional scope

North America

Country scope

U.S., Canada, Mexico

Key companies profiled

Selena Group (Tytan), RPM International Inc., (DAP Global Inc.), PPG Industries, Akfix, Grabber, Franklin International, Soudal Group, Henkel Corp., HPS North America, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Subfloor Adhesives Market Report Segmentation

This report forecasts revenue & volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America subfloor adhesives market report based on resins type, technology, end use, and region:

-

Resins Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyurethane

-

Acrylic

-

Vinyl

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Water-borne

-

Solvent-borne

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. North America subfloor adhesive market size was valued at USD 826.8 million in 2023 and is expected to reach USD 900.8 million in 2024.

b. The North America subfloor adhesive market is expected to grow at a compound annual growth rate of 10.1% from 2024 to 2030 to reach USD 1,607 million by 2030.

b. The U.S. dominated the subfloor adhesive market, with a share of 81.4% in 2030. This is attributable to the demand for subfloor adhesives in the construction industry, which serves both residential and commercial applications.

b. Some key players operating in the North American subfloor market include Selene Group (Tytan), RPM International Inc., (DAP Global Inc.), PPG Industries, Akfix, Grabber, Franklin International, Soudal Group, Henkel Corp., and HPS North America, Inc.

b. Key factors that are driving the market growth include the growing popularity of DIY home improvement projects has significantly contributed to the demand for subfloor adhesives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."