- Home

- »

- Advanced Interior Materials

- »

-

North America Stationary Air Compressor Market, Industry Report, 2030GVR Report cover

![North America Stationary Air Compressor Market Size, Share & Trends Report]()

North America Stationary Air Compressor Market Size, Share & Trends Analysis Report By Product, (Rotary/Screw, Centrifugal), By Lubrication (Oil Free, Oil Filled), By Power Range (51 To 250 kW, Over 500 kW), By Application, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-485-8

- Number of Report Pages: 114

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

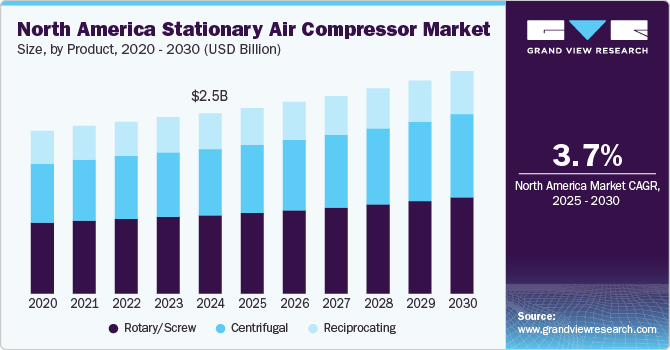

The North America stationary air compressor market size was estimated at USD 2.46 billion in 2024 and is anticipated to grow at a CAGR of 3.7% from 2025 to 2030. The demand for stationary air compressors in North America is witnessing significant growth, driven by the increasing applications across various industries such as manufacturing, construction, and automotive. The rise of automated processes and the need for efficient compressed air solutions have led to higher adoption rates of these systems. Moreover, the trend towards energy efficiency and sustainability is prompting businesses to invest in advanced compressor technologies that offer reduced energy consumption while maintaining optimal performance

In addition, government initiatives aimed at enhancing infrastructure and supporting industrial growth further bolster the market. As companies seek to modernize their equipment to comply with new regulations and improve productivity, the demand for stationary air compressors is expected to continue on an upward trajectory. The integration of smart technologies and IoT capabilities in newer compressor models is also appealing to industries looking to improve operational efficiency and reduce maintenance costs, thereby fostering a more robust market environment.

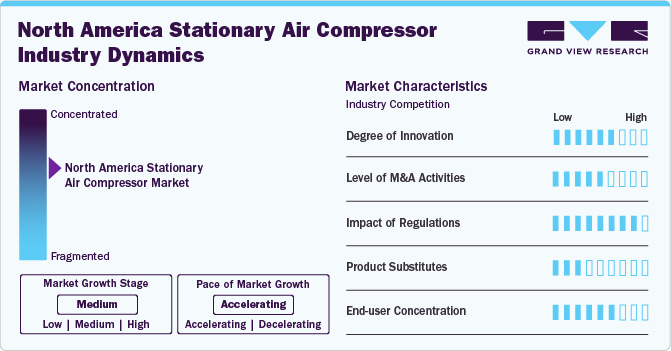

Market Concentration & Characteristics

The North America stationary air compressor market exhibits a moderate level of concentration, characterized by a mix of established domestic companies and prominent global players. Leading brands dominate the landscape, leveraging their strong brand reputation, expansive distribution channels, and comprehensive service offerings. The involvement of international manufacturers has significantly developed the market dynamics, introducing technological innovations and competitive pricing strategies. This competitive environment drives companies to consistently invest in research and development, aiming to provide reliable, energy-efficient, and advanced air compressor solutions to meet the diverse needs of both industrial and commercial clients.

Market characteristics in market indicate a growing demand for stationary air compressors, fueled by economic expansion, increased construction activities, and the rising need for portable and flexible equipment solutions across various industries.

There is a noticeable trend towards energy-efficient and environmentally friendly compressor systems, supported by regulatory frameworks aimed at promoting sustainability and reducing operational costs. This shift not only enhances operational efficiency but also aligns with broader goals for environmental responsibility in the industry.

Drivers, Opportunities & Restraints

One of the primary drivers for the market is the increasing industrial automation across various sectors. As companies strive to enhance productivity and efficiency, the demand for reliable compressed air solutions has surged. Additionally, advancements in technology, such as IoT and energy-efficient designs, are compelling industries to upgrade their equipment, further propelling market growth.

A notable restraint in the market is the high initial investment and maintenance costs associated with sophisticated systems. Many smaller companies may hesitate to adopt advanced compressor technologies due to budget constraints. Furthermore, fluctuations in raw material prices can impact manufacturing costs, leading to increased prices for end-users, which may hinder market expansion.

The growing focus on sustainability presents significant opportunities for the market. As industries look for greener solutions, there is a rising demand for energy-efficient and environmentally friendly air compressors. In addition, the integration of smart technologies that enable predictive maintenance and better energy management opens new avenues for innovation and growth, positioning manufacturers to meet the evolving needs of various sectors.

Product Insights

“The demand for the centrifugal product segment is expected to grow at a notable CAGR of 4.1% from 2025 to 2030 in terms of revenue”

The rotary/screw segment dominated the market and accounted for 43.3% of the global revenue share in 2024. The segment is replacing more traditional piston compressors where high volumes of compressed gas are required including refrigeration cycles such as chillers, or air-driven tools such as impact wrenches and jackhammers.

The centrifugal product segment is expected to expand at the fastest CAGR from 2025 to 2030. It has widespread industrial applications, including air separation, oil refining, and chemical processing. The high growth of the segment is also driven by its ability to operate without oil, range of rotational speeds, low maintenance, and high energy efficiency.

Lubrication Insights

“The demand for the oil free lubrication segment is expected to grow at a notable CAGR of 4.3% from 2025 to 2030 in terms of revenue”

The oil filled lubrication segment dominated the market and accounted for 62.4% of the global revenue share in 2024. An oil-filled air compressor, also known as an oil-lubricated air compressor, uses oil as a lubricant and coolant for its internal components, including the compressor pump. Oil-filled air compressors are commonly used in various industrial and commercial applications where clean, dry, and oil-free compressed air is not a strict requirement.

Oil-free segment is projected to expand at the fastest CAGR from 2025 to 2030. These compressors are more cost-efficient than their oil-filled counterparts, lightweight, and offer airflow (CFM) & pressure (PSI) equivalent to oil-lubricated variants. The segment’s growth is driven by its increasing adoption in the manufacturing sector. Furthermore, the oil-free compressors do not require a compressor oil separator component, thereby reducing operating costs and downstream filter replacement costs.

Application Insights

“The demand for the food & beverage application segment is expected to grow at a notable CAGR of 5.6% from 2025 to 2030 in terms of revenue”

The manufacturing application segment dominated the market and accounted for 44.3% of the global revenue share in 2024. The growth of the manufacturing sector has indeed played a significant role in the market expansion. Manufacturing processes often require compressed air for various applications, such as operating pneumatic tools, controlling valves, powering machinery, and more. As the manufacturing sector expands, the demand for compressed air also grows. Further, modern manufacturing facilities increasingly use automation and robotics to improve efficiency and productivity. These automated systems often rely on compressed air for their operation, which is driving the need for reliable and efficient air compressors.

The food & beverage segment is anticipated to witness significant growth from 2025 to 2030 due to increasing demands for higher operational efficiency, hygiene standards, and technological advancements in the sector. Air compressors play a critical role in various processes across food and beverage production, from packaging to processing and cleaning. This market is segmented primarily into two types of compressors: oil-free and oil-filled, with oil-free compressors being the preferred choice for food & beverage applications due to their ability to deliver contaminant-free air, which is crucial for maintaining food safety and quality standards.

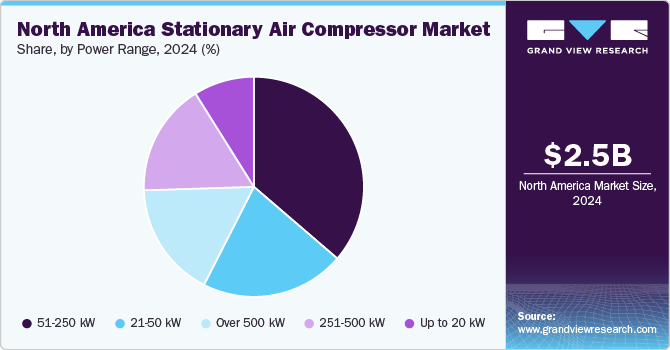

Power Range Insights

“The demand for the over 500 kW power range segment is expected to grow at a notable CAGR of 4.4% from 2025 to 2030 in terms of revenue”

The 51-250 kW segment dominated the market and accounted for 36.3% of the global revenue share in 2024. The segment has high use in industries including construction, manufacturing, and automotive. The above-mentioned applications require mid-range compressors for various tasks, such as assembly lines, pneumatic tools, and other production processes, thereby driving segment growth.

The over 500 kW segment is expected to grow at a significant CAGR from 2025 to 2030. Using an air compressor with a power output of over 500kW can offer several benefits, especially in largescale industrial applications. Compressors in this power range can deliver a significant volume of

compressed air at high pressures. This makes them suitable for demanding applications that require

substantial airflow, such as heavy manufacturing or mining. Moreover, large air compressors are often designed with advanced technology and energy-efficient featuresCountry Insights

The U.S. stationary air compressor market is expected to hold 76.1% of the North America stationary air compressor market in 2024. The U.S. stationary air compressor market is characterized by a robust demand driven by a diverse range of industries, including manufacturing, construction, and agriculture. The country's emphasis on technological advancement and automation has prompted many businesses to invest in high-performance compressors that improve efficiency and reduce operational costs.

The stationary air compressor market in Canada is experiencing steady growth, largely fueled by the expanding natural resources and mining sectors. The need for reliable compressed air systems in remote operations has heightened demand, as industries seek robust equipment capable of withstanding challenging environments. Furthermore, Canadian businesses are increasingly prioritizing energy efficiency and greener technologies, which have led to greater adoption of advanced compressor systems. The country’s commitment to sustainable development further encourages firms to upgrade their equipment, creating a favorable landscape for market expansion.

Key North America Stationary Air Compressor Company Insights

Some key market players include Atlas Copco AB, BAUER COMP Holding GmbH, Ingersoll Rand, and, Hitachi Global Air Power US, LLC.

-

Atlas Copco focuses on creating and producing technologies for oil-free compressors. The company ensures that its air compressors meet ISO standards. Beyond manufacturing, it offers rental, maintenance, and development services for assembly systems, construction equipment, and industrial tools. Its operations are segmented into four primary areas: industrial technology, power technology, vacuum technology, and compressor technology. Within its compressor technology segment, Atlas Copco produces a range of products, including gas and process compressors and expanders, air management systems, equipment for oil and gas treatment, vacuum solutions, and industrial compressors. These products find significant applications across the gas, oil, and manufacturing sectors. Atlas Copco's compressor systems are used in various settings, including hospitals, trains, and ships. The company faces stiff competition from key players in the market, such as Parker Hannifin Corp, Gardner Denver, Hitachi, Ltd., Kobe Steel, Ltd., Kaeser Kompressoren, and Ingersoll Rand.

-

Bauer Comp Holding GmbH serves as the umbrella organization for the worldwide Bauer Group and its related entities. The corporation's strategic operations, including business management, market and technology insights, and financial oversight, are centralized within the BAUER GROUP. The group encompasses 22 subsidiaries, collaborates with over 350 sales partners, and maintains 600 service points across the globe, making it a significant contender in the international market for high-pressure screw compressors. The company's product portfolio is extensive, including water cooled and air-cooled compressors, water and air-cooled boosters, treatments for air gas, storage solutions, systems for air and gas distribution, gas injection technologies, fuel gas systems, and both screw and lease compressors. The company serves a diverse array of industries, including but not limited to aerospace, chemical production, automotive, energy, food processing, oil and gas exploration, and mining.

KAESER KOMPRESSOREN, MAT Holding, Inc., FS-ELLIOT CO., LLC, Quincy Compressor LLC are some emerging players in market.

-

Kaeser Kompressoren specializes in the production of compressed air and vacuum solutions, offering an array of products, including systems for condensate management, filters, refrigerated and desiccant dryers, high-speed turbo blowers, lobe and rotary screw blowers, rotary screw compressors, oil-free reciprocating compressors, and various related accessories. Besides manufacturing, the company provides consulting, rental services, and maintenance support. Kaeser Compressors, Inc., a direct subsidiary, extends the brand's reach from its home base in Coburg, Germany. The company's European operations feature a key production site in Coburg, Germany, dedicated to crafting portable and reciprocating compressors and rotary screws, and a facility in Gera, Germany, focused on producing rotary blowers and refrigeration dryers. Kaeser also runs a sheet metal fabrication plant in Sonnefeld, located near Coburg.

-

MAT Holding, Inc. engineers, manufactures, and markets air compressors, pneumatic tools, pressure washers, generators, and accessories. The company has various subsidiaries, including MAT Industries LLC and MAT Foundry Group. It offers varied products categorized into compressors & tools, door power equipment, fencing, lawn & garden, pet containment, and logistics solutions. The company provides a wide range of air compressors that are sold under the Powermate, Proforce, Industrial Air, and Industrial Air Contractor brands. It also provides online tools for consumers and contractors to choose an appropriate compressor for a particular job. The company has distribution centers, manufacturing operations, and sourcing offices worldwide in the automotive, hardware, fencing, and power equipment sectors. With 40 factories globally, it has a geographical presence across the Americas, Europe, Asia Pacific, and the Middle East & Africa.

Key North America Stationary Air Compressor Companies:

- Atlas Copco AB

- BAUER COMP Holding GmbH

- Ingersoll Rand

- Hitachi Global Air Power US, LLC.

- KAESER KOMPRESSOREN

- MAT Holding, Inc.

- FS-ELLIOT CO., LLC

- Quincy Compressor LLC

- Chicago Pneumatic (Atlas Copco)

- Speedaire Air Compressor

- Kaishan USA

- PATTONS

Recent Developments

-

In August 2023, FS Elliot Co., LLC introduced the P400HPR Centrifugal Air Compressor. The P400HPR ensures energy efficiency and dependability while meeting any high-pressure application with improved features and exceptional performance. Some prominent players in the air compressor market include.

-

In October 2022, Atlas Copco announced the acquisition of the operating assets of Mesa Equipment & Supply Company, a compressor business based in Albuquerque, New Mexico. This acquisition will bring 19 employees from Mesa into Atlas Copco. Mesa sells oil-free and oil-injected compressors & compressor parts and offers related services across various customer segments. Vagner Rego, Business Area President of Compressor Technique, highlighted that this acquisition aligns with Atlas Copco's strategy to expand its geographic presence, enhance customer proximity, and increase regional service opportunities.

North America Stationary Air Compressor Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.03 billion

Growth rate

CAGR of 3.7% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, lubrication, power range, application, country

Country Scope

U.S.; Canada

Atlas Copco AB; BAUER COMP Holding GmbH; Ingersoll Rand; Hitachi Global Air Power US, LLC; KAESER KOMPRESSOREN; MAT Holding, Inc.; FS-ELLIOT CO., LLC; Quincy Compressor LLC; Chicago Pneumatic (Atlas Copco); Speedaire Air Compressor; Kaishan USA; PATTONS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Stationary Air Compressor Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America stationary air compressor market based on the product, lubrication, power range, application, and country:

-

Product Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Reciprocating

-

Rotary/Screw

-

Centrifugal

-

-

Lubrication Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Oil Free

-

Oil Filled

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Food & Beverage

-

Semiconductor & electronics

-

Healthcare/Medical

-

Oil & Gas

-

Home Appliances

-

Energy

-

Others

-

-

Power Range Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

up to 20 kW

-

21-50 kW

-

51-250 kW

-

251-500 kW

-

over 500 kW

-

-

Country Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

-

-

Canada

-

Ontario

-

Quebec

-

British Columbia

-

Alberta

-

Saskatchewan

-

Manitoba

-

New Brunswick

-

Nova Scotia

-

Newfoundland and Labrador

-

Prince Edward Island

-

Frequently Asked Questions About This Report

b. The North America stationary air compressor market size was estimated at USD 2.46 billion in 2024 and is expected to be 2,529.6 million in 2025.

b. The North America stationary air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.7% from 2025 to 2030 to reach USD 3.03 billion by 2030

b. U.S. dominated the North America stationary air compressor market with a revenue share of 76.1% in 2024. The U.S. stationary air compressor market is characterized by a robust demand driven by a diverse range of industries, including manufacturing, construction, and agriculture.

b. Some of the key players operating in the North America rental air compressor Market include Atlas Copco AB, BAUER COMP Holding GmbH, Ingersoll Rand, Hitachi Global Air Power US, LLC, KAESER KOMPRESSOREN, MAT Holding, Inc., FS-ELLIOT CO., LLC, Quincy Compressor LLC, Chicago Pneumatic (Atlas Copco), Speedaire Air Compressor, Kaishan USA, PATTONS.

b. The demand for stationary air compressors in North America is witnessing significant growth, driven by the increasing applications across various industries such as manufacturing, construction, and automotive. The rise of automated processes and the need for efficient compressed air solutions have led to higher adoption rates of these systems.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."