- Home

- »

- Advanced Interior Materials

- »

-

North America Soft Alloy Aluminum Extrusion Market, Report, 2030GVR Report cover

![North America Soft Alloy Aluminum Extrusion Market Size, Share & Trends Report]()

North America Soft Alloy Aluminum Extrusion Market Size, Share & Trends Analysis Report By Product (Shapes, Rods & Bars), By End-use (Building & Construction, Automotive & Transportation), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-392-5

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

“2030 North America soft alloy aluminum extrusion market value to reach USD 10.99 billion.”

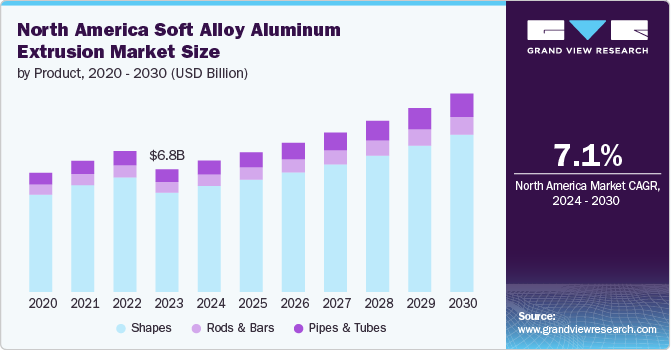

The North America soft alloy aluminum extrusion market size was estimated at USD 6.79 billion in 2023 and is projected to grow at a CAGR of 7.1% from 2024 to 2030. The 6xxx series aluminum alloys are majorly used in automotive industry and growing vehicle production owing to the emphasis on electric vehicles is augmenting the need for soft aluminum alloys for extruded products in North America.

Increasing demand for customized lightweight shapes owing to new design considerations and product miniaturization is contributing to the growth of the market in North America. Aluminum has excellent malleability, which makes it easy to produce different shapes using the extrusion process.

Drivers, Opportunities & Restraints

Growing distribution centers in North America is propelling demand for extrusions. Modern warehouses and transportation systems are imperative to the successful functioning of business functions. Productivity is achieved by optimizing warehouses, prudent inventory management, and maintaining robust logistics and transportation systems. Companies like Norsk Hydro ASA manufactures aluminum extrusion and profiles for automated distribution centers.

The U.S. is one of the leading markets that extensively utilizes warehouses, owing to the presence of e-commerce giants like Amazon, eBay, and Walmart. Amazon had 1,137 distribution centers in the U.S. and operated over 355 fulfillment centers in the country by the end of 2023. Most warehouses are held by the private sector while the remaining share is under local, state, and federal governments.

Fluctuation in aluminum prices is a key restraining factor for the market. The global aluminum market witnessed a decrease of 16.9% in 2023 as compared to 2022, owing to Chinese smelter capacity cuts, European smelter shutdowns, rising energy cost as a result of the Russia-Ukraine crisis, and the extremely high inflation levels faced by the U.S. economy. As of June 2024, there has been a decrease of 2.1% in average LME price compared to the previous month, with prices reaching USD 2,500 per ton.

Industry Dynamics

The North America soft alloy aluminum extrusion market has been exhibiting moderate growth and is characterized by rising demand for extrusions owing to the green energy transition and light weighting trends in key end user industries. The dynamic business environment has been a result of the market’s response to macroeconomic changes, the impact of geopolitical conflict, various trade barriers and countervailing investigations, and growth in end use industries.

The threat of substitutes is low. Materials including steel, carbon fiber, glass, and plastic can be used as substitutes for aluminum extrusions. However, aluminum itself is gaining prominence as an alternative to other products, owing to increasing demand for lightweight components.

Collaboration is one of the strategic initiatives that the market players adopt to increase their penetration in industry and enhance their brand value and recognition. For instance, in February 2023, LIFT announced a collaboration with the Aluminum Extruders Council to establish a pipeline of jobs in the U.S. for the aluminum extrusion industry.

Product Insights

“Shapes held the largest revenue share of over 81% in 2023.”

Among products, the shapes segment accounted for the largest share in 2023. This segment is anticipated to grow at a lucrative pace in the region over the forecast period. Aluminum has excellent malleability, which makes it easy to produce different shapes using the extrusion process. Under this process, aluminum billets are heated and forced with a hydraulic ram or press on steel dies using high pressure. The products formed from this process have the shape of the die.

The pipes & tubes segment is projected to witness significant growth over the forecast period. Pipes & tubes are used in support columns and handrails. These products are available in round, square, and rectangular shapes. Hollow aluminum extruded tubes are both strong and lightweight. As such, they are suitable for lightweight aerospace, automotive, and construction applications. The excellent heat conductivity of aluminum makes these tubes a top choice for use in heat-dissipating devices and heat shields.

End-use Insights

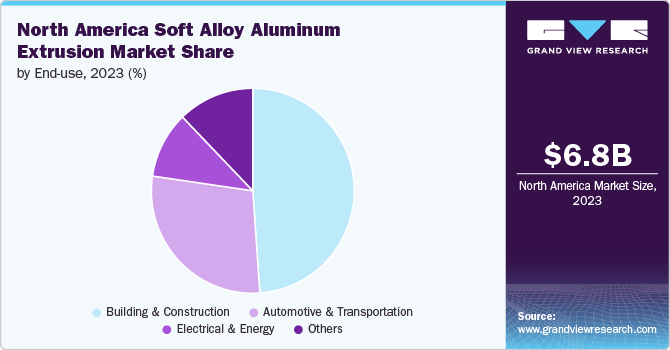

“Building & construction segment is anticipated to register a revenue CAGR of 7.2% over the forecast period.”

Considering the improvement in construction output in the U.S. with the inflation rates coming under control, demand for extruded products is rising in construction industry. Primary and secondary doors & windows, curtainwalls, storefronts, and entrance doors are among the key applications of aluminum extrusions in the building & construction industry. These products also find applications in awnings & canopies, housing units, bridges, and streets & highways.

The market for automotive & transportation applications is expected to grow at a significant rate during the forecast period. Aluminum extrusions have a wide range of applications in the automotive & construction sector. The establishment of new automotive manufacturing plants across the world is expected to fuel the demand for aluminum extruded products in the coming years.

Country Insights

“U.S. held over 83% revenue share of the overall North America soft alloy aluminum extrusion market.”

U.S. Soft Alloy Aluminum Extrusion Market Trends

The growth of the U.S. construction industry is a key factor contributing to the demand for soft alloys aluminum extrusions in the country. According to the U.S. Census Bureau, the total construction spending (residential and non-residential) in the country grew by 6.4% in 2023 on a y-o-y basis to touch USD 2,021.70 billion.

Canada Soft Alloy Aluminum Extrusion Market Trends

Canada’s GDP growth in 2023 was 1.5%. Growing investments in construction activities, automotive production, and industrial plants in Canada are projected to fuel the demand for soft alloys aluminum extrusions in the country.

Mexico Soft Alloy Aluminum Extrusion Market Trends

Growth in automotive industry of Mexico is propelling demand for the market in Mexico. In April 2024, EMAG, a manufacturer of auto and non-auto components inaugurated its new plant in the San Isidro Business Park, Querétaro. The new plant, part of its expansion strategy, will demonstrate the company’s continued commitment to the Mexico market.

Key North America Soft Alloy Aluminum Extrusion Company Insights

Some of the key players operating in the market include Hydro-Extrusion North America, Extrudex Aluminum Corp., Bonnell Aluminum, Western Extrusions, and Tubelite, Inc.

-

Hydro-Extrusion North America is headquartered in Illinois, U.S. It is a division of Norsk Hydro ASA that specializes in custom aluminum extrusions, offering comprehensive services from design to manufacturing. The company’s facilities are ISO 9001:2015 certified and include in-house die-making capabilities, utilizing advanced technology and CAD/CAM design. The company serves various industries including automotive, commercial transportation, mass transit, and solar energy, thus leveraging a nationwide network of production and supply facilities.

-

Extrudex Aluminum Corp. was established in 1980 and is headquartered in Ontario, Canada. It is a major player in the aluminum extrusion industry, serving large and small-scale industrial applications primarily in Central & Eastern Canada and the U.S. It has expanded its footprint across North America.

-

Bonnell Aluminum was established in 1955 and is headquartered in Georgia, U.S. It operates production facilities that deliver design solutions and advanced extrusion capabilities to major manufacturing clients across the U.S. It also maintains manufacturing operations in Carthage, Tennessee; Niles, Michigan; Clearfield, Utah; and Elkhart, Indiana. This extensive network supports the company’s focus on delivering high-quality aluminum solutions tailored to specific industry needs.

Key North America Soft Alloy Aluminum Extrusion Companies:

- ABC Aluminum Solutions

- Aluminum Canada, Inc.

- Astro Shapes, LLC

- Bonnell Aluminum

- BRT Extrusions Inc.

- Crystal Finishing Systems, Inc.

- Cuprum Aluminum Extrusion

- Extrudex Aluminum Corp Signature

- Extrusiones Metalicas S.A de C.V

- Hydro - Extrusion North America

- Indalum, S.A de C.V

- Spectra Aluminum Products

Recent Developments

-

In July 2023, ALMAG Aluminum announced revitalizing its aluminum extrusion plant in Pennsauken Township, New Jersey, U.S., by adding two new extrusion presses.

-

In June 2023, Mayville Engineering Company, Inc. signed a definitive agreement to acquire Mid-States Aluminum Corp., a Wisconsin-based established provider of aluminum extrusions, for around USD 96 million.

-

In April 2023, Rio Tinto announced the capacity expansion plan of its low-carbon, high-value aluminum billet production facility by 202,000 metric tons at its Alma, Quebec smelter. The commissioning is scheduled for the first half of 2025.

North America Soft Alloy Aluminum Extrusion Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.27 billion

Revenue forecast in 2030

USD 10.99 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD million/billion, volume in million pounds, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, country

Country scope

U.S., Canada, Mexico

Key companies profiled

Hydro - Extrusion North America; Extrudex Aluminum Corp Signature; Aluminum Canada, Inc.; Spectra Aluminum Products; ABC Aluminum Solutions; Cuprum Aluminum Extrusion; Extrusiones Metalicas S.A de C.V.; Indalum; S.A de C.V.; Bonnell Aluminum; Crystal Finishing Systems, Inc.; BRT Extrusions Inc.; Astro Shapes, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Soft Alloy Aluminum Extrusion Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America soft alloy aluminum extrusion market report based on product, end-use, and country.

-

Product Outlook (Revenue, USD Million; Volume, Million pounds, 2018 - 2030)

-

Shapes

-

Rods & Bars

-

Pipes & Tubes

-

-

End-use Outlook (Revenue, USD Million; Volume, Million pounds, 2018 - 2030)

-

Building & Construction

-

Residential

-

Non-Residential

-

Automotive & Transportation

-

Electrical & Energy

-

Others

-

-

Country Outlook (Revenue, USD Million; Volume, Million pounds, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America soft alloy aluminum extrusion market size was estimated at USD 6.79 billion in 2023 and is expected to reach USD 7.27 billion in 2024.

b. The North America soft alloy aluminum extrusion market is expected to grow at a compound annual growth rate of 7.1% from 2024 to 2030 to reach USD 10.99 billion by 2030.

b. Based on end-use segment, building & construction held the largest revenue share of more than 48.0% in 2023.

b. Some of the key vendors of the North America soft alloy aluminum extrusion market are Hydro – Extrusion North America, Extrudex Aluminum Corp Signature, Aluminum Canada, Inc., Spectra Aluminum Products, ABC Aluminum Solutions, Cuprum Aluminum Extrusion, Extrusiones Metalicas S.A de C.V., Indalum, S.A de C.V., Bonnell Aluminum.

b. Growing need for data centers coupled with rising production of electric vehicles are the major growth drivers for the North America soft alloy aluminum extrusion market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."