North America Smart Home Security Camera Market Size, Share & Trends Analysis Report By Product (Wired, Wireless), By Application (Doorbell Camera, Indoor Camera), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-583-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

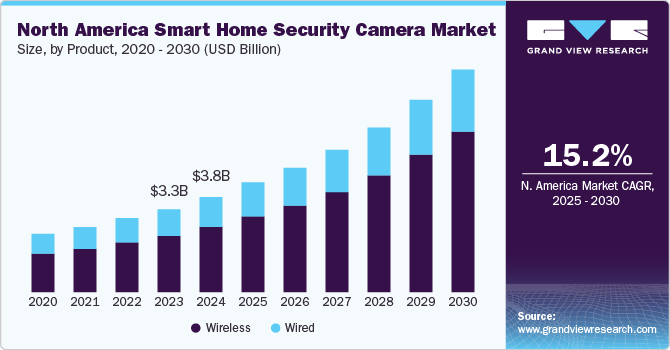

The North America smart home security camera market size was estimated at USD 3.78 billion in 2024 and is projected to grow at a CAGR of 15.2% from 2025 to 2030. The rapid adoption of IoT in smart homes is supporting industry growth. Consumers are shifting from traditionally mountable Wi-Fi cameras to the deployment of smart home security cameras to increase the security of their premises. These advanced smart home security cameras offer several benefits, which boost their installation in many households across the region. The ease of installation and easy availability of smart home security cameras drive the product demand.

Furthermore, increasing home remodeling activities, coupled with the growing need for smart home devices, are presenting lucrative growth opportunities for the market. In addition, the rising prominence of technologically advanced smart home security cameras boosts the demand for these products. The increasing prominence of energy conservation measures is also contributing to the greater penetration of innovative and smart home security cameras in the region. Technological advancements have been significantly driving the industry. Smart cameras that notify users of any movements when no one is at home are gaining traction.

An increasing number of younger consumers are buying homes, which is also driving the penetration of new technologically-advanced smart devices, such as smart plugs, smart locks, smart light bulbs, and smart home security. The rising construction of smart homes, a combination of luxury and convenience, is also boosting product demand. In addition, product features, such as motion sensors, door sensors, burglar alarms, spotlight cameras, and glass break sensors, are important to consumers. Companies offering such technologically-advanced features are likely to witness higher demand in the foreseeable future.

Furthermore, increased spending on renovating homes has driven the dominance of multifunctional and smart devices in residential settings. In addition, the rising preference for IoT, Artificial Intelligence (AI), and Virtual Reality (VR) has driven the application of these products. A growing number of smart home security camera manufacturers are integrating their products with smart assistant capabilities to enable them to be turned on or off using other connected devices. To complement the modern urban lifestyle, key industry participants such as Ring, Blink, Nest Labs, ADT, and Vivinit Inc. are coming up with smart, upgraded, and visually appealing products. Furthermore, the rising inclination for home security cameras with multiple features is anticipated to widen the scope of the North America market over the projected period.

Apart from these, growing concerns regarding energy and power will also drive the demand for smart home security cameras. These cameras help minimize energy consumption and offer high efficacy in terms of performance. Market players have been incorporating unique features such as solar-powered, remote control, digital control and interface, and multi-stage battery level display. Furthermore, with an increase in the number of customers purchasing a variety of products through online platforms, a rising number of companies have been selling their products online to reach a larger consumer base. E-commerce plays an important role in the distribution of smart home security cameras since it accounts for a large portion of the market revenue. Online sales channels allow consumers to explore millions of goods in one location without having to physically visit retail stores.

Product Insights

The wireless smart home security cameras accounted for a revenue share of 68.46% in the market. Wireless technology-enabled security systems are one of the most significant advancements in home security solutions and IoT, with many homeowners preferring them for effective protection. For those that already use smart home products such as Amazon Alexa, Google Assistant, and the like, smart cameras are a welcome addition to a broader smart home system. Furthermore, rapid innovations such as customizable surveillance zones, hybrid connection, better camera recording quality, and differentiation between pets, cars, or animals are increasing the demand for wireless security cameras.

The wired smart home security camera is expected to grow at a CAGR of 12.9% from 2025 to 2030. Wired security cameras are more secure, less expensive, and highly reliable as they can run on battery power. Consistency in video production is more important than ever. There are no monthly charges for cloud storage. In addition, the recording devices are more complicated than the cameras in these systems, with cameras themselves being less expensive than their wireless counterparts. Thus, customers can save money by adding extra cameras to the system. To allow several devices to run simultaneously without overburdening the network, these cameras often use a single-cable Power Over Ethernet (PoE) connection.

Application Insights

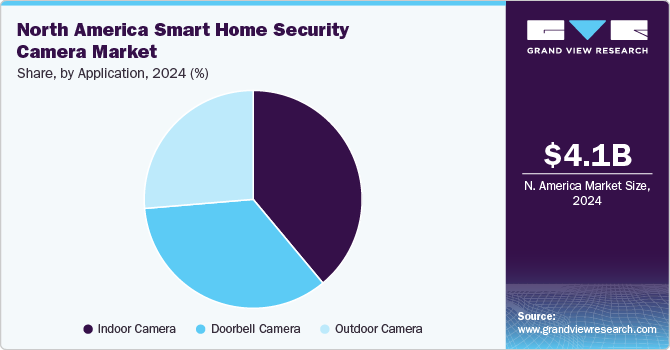

The application of a smart home security camera as an indoor camera accounted for a revenue share of over 42.23% in 2024. This is mostly due to an increase in the number of theft and burglary cases, which has raised public awareness regarding the importance of protecting one's house from criminal activity. Indoor smart cameras offer a variety of capabilities, including instant messaging in the event of a theft, alarm activation, and movement and behavior recognition, which has led to their widespread use in a variety of applications. Package theft is a common and frustrating problem for both homeowners and renters, and doorbell cameras can help prevent it. Doorbell cameras are one of the most popular types of smart home devices for safety as well as convenience.

The application of smart home security cameras as a doorbell camera is expected to grow at a CAGR of 16.5% from 2025 to 2030 in North America. Doorbell cameras are one of the most popular types of smart home devices, whether for safety or convenience. Ring, SkyBell, Google Nest, Vivint, and Remo+ are the top five video doorbell brands in the region. Furthermore, according to Security.org's survey on “porch pirates,” 40% of Americans have had items stolen; however, with a doorbell camera, consumers are notified as soon as the packages are delivered, and they can even instruct the deliverymen where to place them. Consumers are warned immediately if anyone passes by or attempts to steal the package and can call out to them through the doorbell camera speakers. All these factors are expected to augment market growth in the region during the forecast period.

Country Insights

U.S. Smart Home Security Camera Market Trends

The U.S. smart home security camera market accounted for a revenue share of 81.32% in 2024. The rising construction of smart homes, a combination of luxury and convenience, is boosting the demand for smart home security cameras. Consumers are more inclined to build homes that provide a sense of safety. Consumers are increasingly opting for smart devices. According to the Digital Market Outlook, the number of smart homes in the U.S. market is expected to be 77.1 million in 2025.

As artificial intelligence (AI) technology improves, consumers may expect significant advancements in smart home security authentication. Future security systems will move away from basic authentication practices, such as four-digit codes, to more secure alternatives. Facial recognition, voice recognition, and fingerprints will become the wave of the future, which will make it nearly impossible for an intruder to enter undetected. Security monitoring companies will also take advantage of smart home hubs and video cameras to identify emergency calls swiftly and detect the difference between an accidental alarm and a likely crime. This advancement will ultimately improve product penetration in the U.S. market, thus contributing to its growth.

Canada Smart Home Security Camera Market Trends

The smart home security camera market in Canada is expected to grow at a CAGR of 16.8% from 2025 to 2030. According to a cybersecurity solution provider, NordVPN, people in Canada take their security very seriously, as more than 92% of the people have some kind of IoT device in their households. Canadians as a community are known to be peace-loving, but they still experience criminal events across the country. Stats Canada reported more than 1.5 million incidents of property crime and more than 150,000 cases of breaking a year. All these factors are expected to support the growth of Canada's market during the forecast period.

Key North America Smart Home Security Camera Company Insights

The market is characterized by the presence of numerous well-established players and is fragmented owing to the presence of a large number of smart home security camera manufacturers with strong customer networks. The increasing number of developments and innovations implemented by companies through various R&D activities and investments have significantly contributed to the region’s growth. To manufacture innovative smart home security cameras, companies are focusing on enhancing their production capacities through technological integration for production processes. Furthermore, several companies are making strategic appointments to enhance their capabilities and improve organizational leadership.

Key North America Smart Home Security Camera Companies:

- Vivint Smart Home, Inc.

- ADT Inc.

- SimpliSafe, Inc.

- Brinks Home Security

- Xiaomi Inc.

- Skylinkhome

- Protect America, Inc.

- Samsung Electronics Co, Ltd.

- Frontpoint Security Solution, LLC

- Arlo Technologies, Inc.

- Nest Labs

- Wyze Lab, Inc.

- blink

- eufy (Anker Innovations)

- Ring LLC

View a comprehensive list of companies in the North America Smart Home Security Camera Market

Recent Developments

-

In June 2024, Google Nest introduced a new AI-powered doorbell camera featuring advanced facial recognition technology. This innovation enhances home security by identifying familiar faces and delivering personalized notifications. The launch highlights Google’s commitment to integrating artificial intelligence (AI) into home security systems, offering smarter and more efficient monitoring capabilities.

-

In May 2024, Ring, an Amazon subsidiary, introduced an advanced battery-powered home security camera. With extended battery life and enhanced motion detection, the camera addresses the growing demand for flexible, easy-to-install home security solutions.

-

In September 2023, Eufy Security, the smart home security brand under Anker Innovations, introduced a series of dual-camera devices, establishing the world's first home surveillance mesh powered by local AI. The innovative lineup included cameras with wide-angle and telephoto lenses, elevating the surveillance capabilities of the devices.

North America Smart Home Security Camera Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 4.36 billion |

|

Revenue forecast in 2030 |

USD 8.83 billion |

|

Growth rate |

CAGR of 15.2% from 2025 to 2030 |

|

Actuals data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, country |

|

Country scope |

U.S, Canada, Mexico |

|

Key companies profiled |

Vivint Smart Home, Inc.; ADT LLC; Monitronics International, Inc.; SimpliSafe, Inc.; Brinks Home Security; iSmart Alarm, Inc.; LiveWatch Security LLC; Skylinkhome; Protect America, Inc.; Samsung Electronics Co., Ltd.; Frontpoint Security Solutions, LLC; Arlo Technologies, Inc.; Nest Labs; Wyze Labs, Inc.; blink; eufy; Ring LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Smart Home Security Camera Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America smart home security camera market report based on product, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Doorbell Camera

-

Indoor Camera

-

Outdoor Camera

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America smart home security camera market size was estimated at USD 3.78 billion in 2024 and is expected to reach USD 4.36 billion in 2025.

b. The North America smart home security camera market is expected to grow at a compound annual growth rate of 15.2% from 2025 to 2030 to reach USD 8.83 billion by 2030.

b. Indoor cameras dominated the North America smart home security camera market with a share of 38.95% in 2024. This is attributable due to an increase in the number of theft and burglary cases, which has raised public awareness about the importance of protecting one's house from criminal activity. Indoor smart cameras offer a variety of capabilities, including instant messaging in the event of a theft, alarm activation, and movement and behavior recognition, which has led to their widespread use in a variety of applications.

b. Some key players operating in the North America smart home security camera market are Vivint Smart Home, Inc., ADT LLC, SimpliSafe, Inc, Brinks Home Security, iSmart Alarm, Inc., LiveWatch Security LLC, Skylinkhome, Protect America, Inc., SAMSUNG ELECTRONICS CO., LTD, Frontpoint Security Solutions, LLC., Arlo Technologies, Inc., Nest Labs, Wyze Labs, Inc., blink, and eufy.

b. Key factors that are driving the North America smart home security camera market growth include increasing crime rates across the region, a rising number of consumers are focusing on safety and security systems, especially in residential areas. Smart home devices like smart alarms, smart cameras, and smart lockers are seeing rapid uptake by households to be safer and more secure. According to the burglary statistics released by the FBI, there are approximately one million burglaries in the U.S. every year.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."