- Home

- »

- Electronic & Electrical

- »

-

North America Smart Commercial Restroom Products Market Report 2030GVR Report cover

![North America Smart Commercial Restroom Products Market Size, Share & Trends Report]()

North America Smart Commercial Restroom Products Market Size, Share & Trends Analysis Report By Product (Touchless Faucets, Smart Consumables, Smart Hand Dryers), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-131-2

- Number of Report Pages: 96

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Market Size & Trends

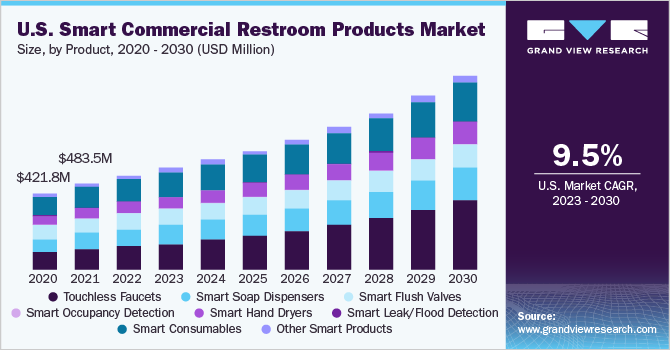

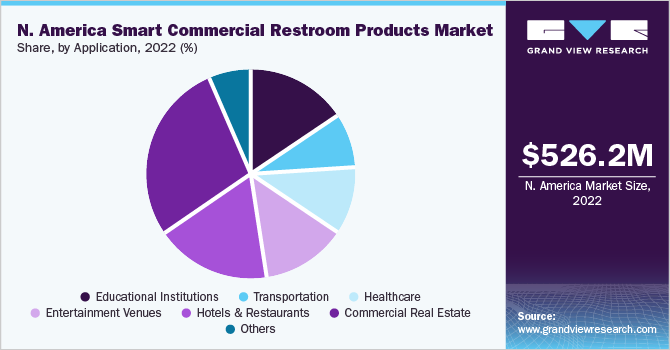

The North America smart commercial restroom products market size was estimated at USD 526.2 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030.The flourishing commercial construction, particularly in the hospitality sector, and home improvement activities enhance the need for smart bathroom accessories. The COVID-19 pandemic has accentuated the importance of hygiene and sanitation in public spaces, prompting businesses and facilities to invest in touchless, automated restroom solutions to minimize disease transmission. These smart products contribute to sustainability goals by promoting water and energy efficiency, aligning with growing environmental concerns. Cost savings through reduced utility bills and improved user experiences due to features like automatic flushes and self-cleaning toilets have made smart restroom products an attractive option.

Stricter regulations and building codes have further incentivized their adoption, ensuring compliance with accessibility and hygiene standards. Technological advancements, increased market competition, changing work environments, and consumer demand for smart technologies in public spaces have collectively fueled the growth of this market, making smart commercial restroom products increasingly prevalent and beneficial for businesses and users alike.

The North America smart commercial restroom products market is undergoing a transformative evolution marked by several noteworthy trends. The integration of IoT technology has emerged as a pivotal driver, enabling real-time monitoring and control through sensor-equipped restroom products.

The advent of app-based control allows users and facility managers to remotely manage various restroom functions, offering unprecedented convenience and control. The application of advanced data analytics and AI in analyzing restroom usage patterns enables businesses to optimize cleaning schedules, reduce resource consumption, and enhance overall restroom management. Customization features are becoming increasingly prevalent, allowing restroom products to be tailored to users' and businesses' specific needs and preferences. Sustainability certifications, like WaterSense and LEED, are gaining prominence as environmentally-conscious organizations opt for eco-friendly products to underscore their commitment to sustainability.

The expansion of touchless technologies from restrooms to other commercial spaces further fosters hygienic and seamless experiences, exemplifying the dynamic nature of the smart commercial restroom products market, driven by technology, health, and sustainability considerations.

Product Insights

In terms of revenue, touchless (motion) faucets held a market share of 25.8% in 2022. Touchless faucets eliminate the need for physical contact, reducing the risk of spreading germs and bacteria through commonly touched surfaces. With the rise in health and hygiene concerns, businesses and consumers seek touchless solutions to maintain cleaner and safer environments.

The convenience and user experience of touchless faucets also drive their adoption. With touchless sensors detecting motion or proximity, users can activate the faucet effortlessly, making it ideal when hands are dirty or occupied. This touchless functionality caters to a wide range of users, including children, elderly individuals, and people with disabilities, ensuring accessibility and ease of use.

The smart hand dryers segment is expected to grow at a CAGR of 9.6% from 2023 to 2030. Smart hand dryers mainly focus on energy efficiency. Traditional hand dryers, particularly those with heating elements, can consume significant energy, leading to higher operational costs and environmental impact. On the other hand, smart hand dryers are designed with energy-saving features such as low-power motors and adjustable drying settings. By optimizing energy consumption, these dryers reduce utility expenses for businesses and contribute to overall sustainability efforts.

Conventional hand dryers with button-operated controls can be potential germ hotspots, as users need to touch them to activate the drying process. In contrast, smart hand dryers often come with touchless or sensor-based activation, minimizing the risk of cross-contamination. This touchless feature ensures a more hygienic hand-drying experience, particularly in high-traffic areas where maintaining sanitation is paramount. In September 2022, Stern Engineering Ltd. launched a touch-free, high-speed hand dryer for wall-mounted installations.

Application Insights

In terms of revenue, commercial real estate held a market share of 28.1% in 2022. Commercial real estate property owners and managers increasingly recognize that smart restroom products can be valuable in attracting and retaining tenants. Tenants are more likely to lease or renew leases in properties equipped with modern and convenient amenities, including smart restrooms. These high-tech facilities improve the overall tenant experience and contribute to tenant satisfaction and loyalty.

Additionally, smart restroom products help commercial real estate managers optimize operational efficiency. Features such as automated lighting, water conservation, and predictive maintenance reduce utility costs and the need for frequent manual inspections and maintenance. This translates to cost savings for property owners, making it a financially appealing investment.

The hotels & restaurants application is expected to grow at a CAGR of 9.7% from 2023 to 2030. In hotels, the guest experience is of paramount importance. Smart restroom products contribute to this experience by providing convenience, cleanliness, and luxury. Touchless fixtures, such as automated faucets, soap dispensers, and toilets, not only enhance hygiene but also offer guests a seamless and sophisticated experience. This convenience is particularly appreciated in high-end establishments, where every detail matters. Moreover, integrating smart occupancy sensors in restrooms allows hotels to manage cleaning schedules more efficiently, ensuring that restrooms are maintained and sanitized when needed without disrupting guest activities.

Conversely, restaurants benefit from smart restroom products that enhance customer satisfaction and operational effectiveness. Maintaining clean and well-stocked restrooms in high-traffic establishments can take time and effort. Smart products like occupancy sensors help restaurant staff monitor restroom traffic and respond promptly to cleanliness and supply needs.

Regional Insights

The U.S. dominated the market with a share of 90.4% in 2022. There has been a growing demand for clean and hygienic restrooms in commercial places across the U.S. due to a surge in footfall all year round. Although smart commercial restroom products may have higher upfront costs, they offer long-term savings through reduced water and energy consumption, lower maintenance requirements, and improved operational efficiency. These benefits have driven product adoption in the country's rising number of commercial and public places.

In August 2022, Sloan Valve Company announced the launch of ESD-360, a top-fill soap dispenser. The dispenser eliminates the need for reaching under the sink each time the soap reservoirs need to be refilled. The dispenser includes a top cover that can be opened via a tamper-resistant unlocking feature.

Canada is expected to grow at a CAGR of 7.2% from 2023 to 2030. Rapid urbanization and population growth in Canada have increased demand for commercial spaces like office buildings, shopping centers, airports, and other public facilities, which bodes well for installing smart restrooms and smart restroom products. Moreover, Canada has always strongly emphasized sustainability and energy efficiency, and smart commercial restroom products align with the country's eco-friendly initiatives.

In Dece mber 2021, Bunzl Canada unveiled its exclusive IoT Cleaning Platform, known as WandaNEXT. The platform is set to take the spotlight this week at ISSA Canada, the nation's leading event for cleaning and hygiene products, services, and technology. This prestigious trade show and conference provide a platform for sharing insights into best practices, industry certifications, training, education, and current developments in Canadian facility management and commercial cleaning.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand share analysis indicates that key players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, and business expansions. Some of the initiatives include:

-

For instance, in June 2022, Kimberly-Clark Professional announced its collaboration with GOJO Industries to showcase its Onvation smart restroom technology at the Realcomm 2022 Expo held in Orlando, Florida. Onvation is a connected software solution that leverages IoT to help optimize restroom servicing in commercial settings. It not only improves facility management and operational efficiencies but also helps companies achieve their sustainability goals.

-

In June 2021, TOTO Ltd announced the launch of nine touchless faucets and two soap dispensers. The smart-sensor faucets and soap dispensers allow users to wash their hands in public restrooms without touching either, making sure that every trip to the restroom is convenient, comfortable, and clean.

-

In February 2021, Kraus USA Plumbing LLC expanded its Bolden Commercial Style Faucet collection with a new model equipped with touchless sensor activation. The new model has a hands-free activation with a built-in infrared sensor that enables consumers to turn the water on and off with just the wave of a hand.

Some prominent players in North America smart commercial restroom products market include:

-

Zurn Industries, LLC

-

Sloan Valve Company

-

Kimberly-Clark Worldwide, Inc

-

Moen Incorporated

-

TOTO Ltd

-

Georgia-Pacific Consumer Products LP

-

Delta Faucet Company

-

Pfister Faucets (Spectrum Brands)

-

Kraus USA Plumbing LLC

-

GROHE

-

American Standard (LIXIL Corporation)

-

Kohler Co.

-

Roca Sanitario, S.A

-

Delany Products

-

Chicago Faucets

North America Smart Commercial Restroom Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 566.1 million

Revenue forecast in 2030

USD 1.07 billion

Growth rate

CAGR of 9.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Zurn Industries, LLC; Sloan Valve Company; Kimberly-Clark Worldwide, Inc.; Moen Incorporated; TOTO Ltd; Georgia-Pacific Consumer Products LP; Delta Faucet Company; Pfister Faucets (Spectrum Brands); Kraus USA Plumbing LLC; GROHE, American Standard (LIXIL Corporation); Kohler Co.; Roca Sanitario, S.A; Delany Products; Chicago Faucets

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Smart Commercial Restroom Products Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the North America smart commercial restroom products market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Touchless Faucets

-

Smart Soap Dispensers

-

Smart Flush Valves

-

Smart Occupancy Detection

-

Smart Hand Dryers

-

Smart Leak/Flood Detection

-

Smart Consumables

-

Smart Toilet Paper Dispenser

-

Smart Paper Towel Dispensers

-

-

Other Smart Products

-

Smart Trash Bins

-

Smart Foot Traffic Sensors

-

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Educational Institutions

-

K-12 Educational Institutions

-

Higher Educational Institutions

-

-

Transportation

-

Airports

-

Other Transport Hubs

-

-

Healthcare

-

Entertainment Venues

-

Hotels and Restaurants

-

Commercial Real Estate

-

Office Buildings

-

Malls & Shopping Centers

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The global North America smart commercial restroom products market size was estimated at USD 526.2 million in 2022 and is expected to reach USD 566.1 million in 2023.

b. The global North America smart commercial restroom products market is expected to grow at a compounded growth rate of 9.3% from 2023 to 2030 to reach USD 1.07 billion by 2030.

b. Touchless (Motion) Faucets dominated the global North America smart commercial restroom products market with a share of 25.8% in 2022. Touchless faucets offer a convenient and modern user experience. Users can activate the water flow without having to touch potentially contaminated surfaces, and the automation adds an element of sophistication and innovation to restroom facilities.

b. Some key players operating in North America smart commercial restroom products market include Zurn Industries, LLC, Sloan Valve Company, Kimberly-Clark Worldwide, Inc, Moen Incorporated, TOTO Ltd, Georgia-Pacific Consumer Products LP, Delta Faucet Company, Pfister Faucets (Spectrum Brands), Kraus USA Plumbing LLC, GROHE, American Standard (LIXIL Corporation), Kohler Co., Roca Sanitario, S.A, Delany Products, Chicago Faucets.

b. Key factors that are driving the market growth include rising adoption of smart technology in commercial places across North America and growing inclination toward smart restrooms due to water and energy saving features.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."