- Home

- »

- Electronic & Electrical

- »

-

North America Small Kitchen Appliances Market, Industry Report, 2030GVR Report cover

![North America Small Kitchen Appliances Market Size, Share & Trends Report]()

North America Small Kitchen Appliances Market Size, Share & Trends Analysis Report By Product Type (Coffeemakers, Juicers), By Distribution Channel (Specialty Stores, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-299-4

- Number of Report Pages: 103

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

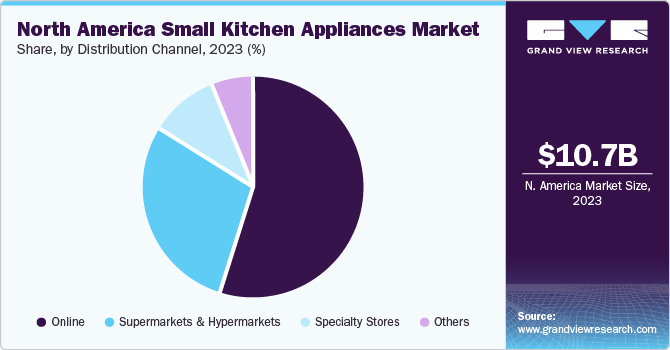

The North America small kitchen appliances market size was estimated at USD 10.66 billion in 2023 and is projected to grow at a CAGR of 3.7% from 2024 to 2030. Consumers are increasingly opting for appliances that can save time and effort in meal preparation, leading to a surge in the popularity of multi-functional and automated appliances in the region. Moreover, the growing number of single-person households and smaller living spaces are also contributing to the demand for compact and space-efficient appliances that can fit into limited kitchen areas.

The preference for home-cooked meals among Americans has experienced a notable surge, marking a significant lifestyle shift following lockdown periods. This change in behavior has spurred considerable market growth for small kitchen appliances. With more individuals opting to cook at home, there is an increased demand for appliances that facilitate convenient and efficient meal preparation. From air fryers to slow cookers, these small kitchen appliances have become essential tools for individuals looking to create homemade meals that are both convenient and nutritious.

A survey conducted by the National Frozen and Refrigerated Foods Association (NFRA) in 2023 revealed significant shifts in Americans' grocery shopping habits, particularly in their cooking behaviors. While there has been a slight decrease since its peak in 2020 and 2021, a substantial 81% of consumers are still cooking more than half of their meals at home. This trend is largely driven by the desire to save money and maintain control over their budgets, with 64% of Americans citing these reasons.

Many individuals have gained confidence in their cooking skills during lockdowns and are now seeking inspiration to prepare healthier meals at home. To aid in this endeavor, more people are turning to online grocery shopping and social media platforms for recipe ideas and ingredient usage tips. In addition, the survey found that 45% of consumers rely on air fryers, while 43% utilize slow cookers for cooking and meal preparation.

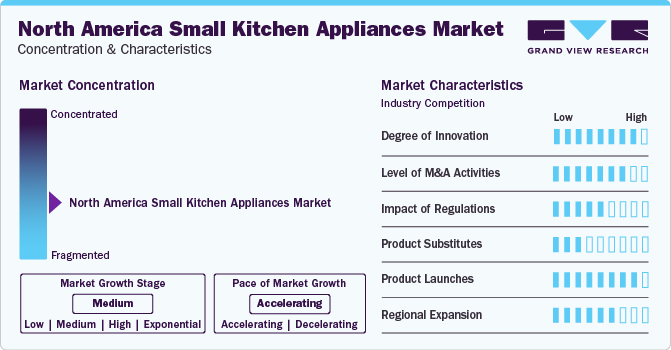

Market Concentration & Characteristics

The North America market is characterized by a high degree of innovation and a significant level of merger and acquisitions (M&A) activities. Companies within this market are continually pushing the boundaries with new and improved products that cater to evolving consumer demands for convenience, efficiency, and multifunctionality. Innovations such as smart kitchen appliances, which can be controlled via mobile apps and integrated with home automation systems, are particularly popular.

In addition, there is a strong focus on developing eco-friendly and energy-efficient appliances to appeal to the growing segment of environmentally conscious consumers. Concurrently, the market is witnessing a high level of M&A activities as companies seek to expand their product portfolios, enhance technological capabilities, and increase market share. These strategic acquisitions and mergers are enabling firms to consolidate their positions in the market, leverage synergies, and accelerate growth. The dynamic nature of the North America market, driven by innovation and M&A, indicates a robust and competitive environment poised for continued expansion.

The North American small kitchen appliances industry is characterized by a high degree of innovation, driven by advancements in smart technology, connectivity, and user convenience. Manufacturers are increasingly incorporating IoT capabilities, enabling appliances to be controlled via smartphones and integrated with smart home ecosystems. Innovations in energy efficiency, multi-functionality, and compact design also reflect the growing consumer demand for appliances that save time and space while offering versatile performance. In addition, health-conscious consumers are driving innovation in appliances that facilitate healthier cooking methods, such as air fryers and steam ovens.

The small kitchen appliances market in North America has seen significant mergers and acquisitions as companies seek to expand their product portfolios, enhance technological capabilities, and increase market share. Major players are acquiring niche brands to diversify their offerings and cater to specific consumer needs. This trend is driven by the desire to leverage synergies, optimize supply chains, and achieve economies of scale. For instance, acquisitions of companies specializing in smart kitchen technology have been prevalent, reflecting the industry's push towards connected and intelligent appliances.

Regulations in the North American small kitchen appliances industry primarily focus on safety standards, energy efficiency, and environmental impact. Agencies like the U.S. Consumer Product Safety Commission (CPSC) and the Environmental Protection Agency (EPA) set stringent guidelines to ensure product safety and reduce energy consumption. Compliance with these regulations can be costly and time-consuming, impacting product development timelines and operational costs. However, these regulations also drive innovation as manufacturers strive to create more energy-efficient and eco-friendly appliances to meet regulatory standards and appeal to environmentally conscious consumers.

The market for small kitchen appliances faces competition from various substitutes that offer similar functionalities. For example, traditional cooking methods and manual kitchen tools can substitute for electric appliances like blenders and food processors. In addition, multifunctional appliances, such as smart ovens and all-in-one cookers, can replace several single-use devices, reducing the need for individual appliances. The rise of meal delivery services and pre-prepared food options also presents an indirect substitute, potentially reducing the demand for cooking appliances. However, the convenience and technological advancements in modern appliances continue to attract consumers seeking efficiency and enhanced culinary experiences.

Product Type Insights

The coffeemaker segment held the largest revenue share, 26.7%, in 2023. The demand for coffeemakers is expected to increase due to the rising popularity of specialty coffee consumption at home. Consumers in the U.S. and Canada are opting for high-end coffeemakers that offer advanced features such as programmable brewing, multi-temperature settings, and smart connectivity. Single-serve coffeemakers, particularly those compatible with popular capsule systems, are gaining traction due to their convenience and ease of use.

The air fryer segment is expected to grow at the fastest CAGR of 5.7% from 2024 to 2030. Air fryers have emerged as a popular alternative to traditional deep fryers, offering a healthier and more convenient way to prepare crispy, flavorful meals. In addition, the convenience of air fryers, which often come with multiple cooking functions and preset programs, appeals to busy households looking for quick and easy meal preparation solutions. As more people adopt healthier lifestyles and look for efficient kitchen appliances, the air fryer segment is set to expand, reflecting a broader trend toward health and wellness in food preparation.

Distribution Channel Insights

Sales of small kitchen appliances through online stores accounted for a revenue share of 54.6% in 2023. The rising popularity of online channels for small kitchen appliance sales in the U.S. and Canada can be attributed to manufacturers' increased emphasis on adopting online sales methods. This shift is expected to enhance the supply chain and delivery speed of kitchen appliances through e-commerce platforms. In February 2024, Laura Ashley expanded its product offerings in the U.S. by partnering with VQ, a British home electronics manufacturer, and introduced a line of small kitchen appliances. The two companies have collaborated to create a range of tea kettles and toasters specifically designed for the U.S. market after the success of the Laura Ashley small appliance collection in Australia, New Zealand, and Europe.

Sales of small kitchen appliances through specialty stores are expected to grow at a CAGR of 3.6% from 2024 to 2030. Specialty stores often target niche consumer segments with tailored marketing campaigns that emphasize the unique features, benefits, and value propositions of their small kitchen appliances. This targeted approach resonates with consumers who prioritize quality, innovation, and craftsmanship in their purchasing decisions. For enthusiasts or collectors of specific small kitchen appliance brands, specialty stores offer an immersive brand experience that goes beyond mere product transactions. These stores may host brand events, product demonstrations, and educational workshops to engage customers and foster brand loyalty.

Many specialty stores offer customization options, allowing customers to tailor their appliances to their unique preferences. Many multi-channel kitchen appliance retailers are expanding their retail footprint across the U.S. to enhance their product offerings. Williams Sonoma opened a new store location at Hill Center Green Hills in early 2023. The new branded specialty store showcases an extensive range of cookware, cooks' tools, cutlery, electrics, bakeware, food, tabletop and bar accessories, cookbooks, and decorative accessories, providing customers with premium brands and the latest innovations for the kitchen and home.

Country Insights

U.S. Small Kitchen Appliances Market Trends

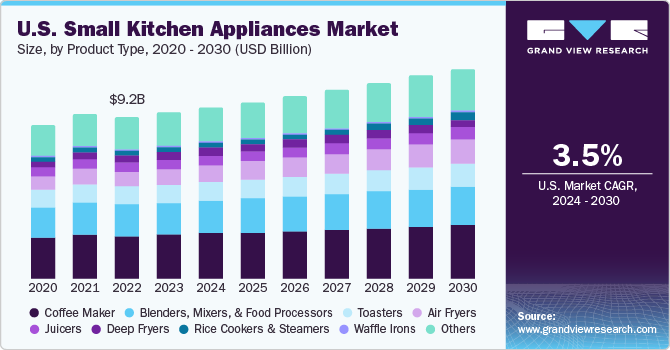

The small kitchen appliances market in the U.S. is expected to grow at a CAGR of 3.5% from 2024 to 2030. Technological advancements have significantly contributed to the popularity of small kitchen appliances. The miniaturization of components and the development of more energy-efficient designs have made it possible to create appliances that are both compact and powerful.

Smart appliances, which can be controlled remotely through smartphones or voice assistants, further enhance convenience and ease of use. Busy schedules and time constraints characterize modern lifestyles. Small kitchen appliances offer a solution to this time crunch by automating tasks and simplifying meal preparation. Slow cookers, for instance, allow users to prepare meals in advance and have them ready later.

Key North America Small Kitchen Appliances Company Insights

The North America small kitchen appliances industry is fragmented in nature, attributed to the presence of many small, regional companies that are introducing smart multi-functional appliances with attractive product designs and specifications to cater to diverse consumer preferences.

Key manufacturers are working toward increasing the availability of small kitchen appliances in retail and online stores. Moreover, these manufacturers are constantly striving to develop new and improved products that offer enhanced functionality, energy efficiency, and ease of use. This has led to the emergence of smart appliances, which can be controlled and monitored through smartphones or other connected devices, providing users with greater control and convenience.

Ninja (SharkNinja, LLC) and GE Appliances (Haier Company) are the dominant players operating in the North America dishwasher market.

-

Ninja (SharkNinja, LLC) sells its products through a variety of trade channels, with a significant portion dependent upon retail partnerships through both traditional brick-and-mortar retail channels and e-commerce channels. As of December 2023, the company partnered with 42 retailers across the United States and over 140 retailers globally. Their largest retailers include Walmart, Amazon, and Costco, each of which accounted for more than 10% of their net sales and together made up around 45% of their net sales for the year 2023.

-

GE Appliances (Haier Company) has a significant presence both domestically in the U.S. and internationally. The company's workforce operates in nine manufacturing plants spanning five states, manufacturing a wide range of small kitchen appliances that find their way into half of all households across the U.S.

Key North America Small Kitchen Appliances Companies:

- Ninja (SharkNinja, LLC)

- Hamilton Beach

- GE Appliances (a Haier Company)

- Panasonic Corporation

- Cuisinart

- SMEG USA, Inc

- Tefal S.A.S. (T-fal)

- Bella Housewares (Gather)

- Russell Hobbs (Spectrum brands)

- Kenmore (Transform Holdco LLC)

Recent Developments

-

In March 2024, KitchenAid unveiled its latest appliance, the automatic grain and rice cooker, which introduces a convenient solution for cooking grains and beans. With 21 presets available, users can prepare a variety of grains effortlessly, eliminating the need for constant measuring or supervision. The appliance accurately dispenses the required amount of water based on the grains added, streamlining the cooking process.

-

In March 2024, HUROM introduced its latest innovation: the H320 Slow Juicer. Designed to meet the discerning needs of juicing enthusiasts worldwide, the H320 Slow Juicer embodies meticulous engineering to deliver ultra-low pulp juice. Despite its advanced features, loading and preparation remain exceptionally convenient, ensuring a seamless juicing experience for users.

-

In January 2024, Bosch Home Appliances, a renowned home appliances brand, introduced its latest innovation, a line of countertop Fully Automatic Espresso Machines. Recognized as a CES 2024 Innovation Award Honoree in the smart home category, these machines promise premium-quality coffee and a diverse array of beverage options, all easily accessible with a simple touch on the intuitive Active Select Display.

North America Small Kitchen Appliances Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.02 billion

Revenue forecast in 2030

USD 13.66 billion

Growth rate

CAGR of 3.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, distribution channel, region

Country scope

U.S.; Canada

Key companies profiled

Tefal S.A.S. (T-fal); Cuisinart; General Appliances (a Haier company); Hamilton Beach; Bella Housewares (Gather); Kenmore (Transform Holdco LLC); Russell Hobbs; SPECTRUM BRANDS, INC.; Panasonic Corporation; Ninja (SharkNinja, LLC); SMEG USA, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. North America Small Kitchen Appliances Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America small kitchen appliances market report based on product type, distribution channel, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Coffee Maker

-

Waffle Irons

-

Blenders, Mixers, & Food Processors

-

Juicers

-

Deep Fryers

-

Air Fryers

-

Toasters

-

Rice Cookers and Steamers

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America small kitchen appliances market is expected to grow at a compounded growth rate of 3.7% from 2024 to 2030 to reach USD 13.66 billion by 2030.

b. In 2023, the U.S. captured a revenue share of over 88.8% in the North America small kitchen appliances market. Technological advancements have significantly contributed to the popularity of small kitchen appliances. The miniaturization of components and the development of more energy-efficient designs have made it possible to create appliances that are both compact and powerful.

b. Some key players operating in the market include Tefal S.A.S. (T-fal), Cuisinart, GE Appliances (a Haier company), Hamilton Beach, Bella Housewares (Gather), Kenmore (Transform Holdco LLC), Russell Hobbs, SPECTRUM BRANDS, INC., Panasonic Corporation, Ninja (SharkNinja, LLC), and SMEG USA, Inc.

b. The North America small kitchen appliances market size was estimated at USD 10.66 billion in 2023 and is expected to reach USD 11.02 billion in 2024.

b. The preference for home-cooked meals among Americans has experienced a notable surge, marking a significant lifestyle shift following lockdown periods. This change in behavior has spurred considerable growth in the market for small kitchen appliances. With more individuals opting to cook at home, there is an increased demand for appliances that facilitate convenient and efficient meal preparation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."