- Home

- »

- Clothing, Footwear & Accessories

- »

-

North America Ski Apparel Market Size & Share Report, 2030GVR Report cover

![North America Ski Apparel Market Size, Share & Trends Report]()

North America Ski Apparel Market Size, Share & Trends Analysis Report By Product (Outerwear, Mid Layers), By Price Range (Mass, Premium), By Distribution Channel, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-481-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

North America Ski Apparel Market Trends

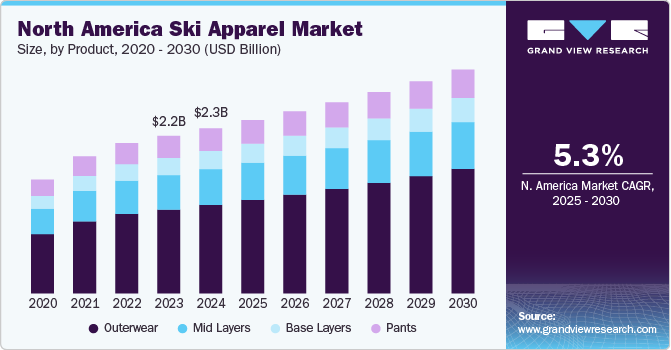

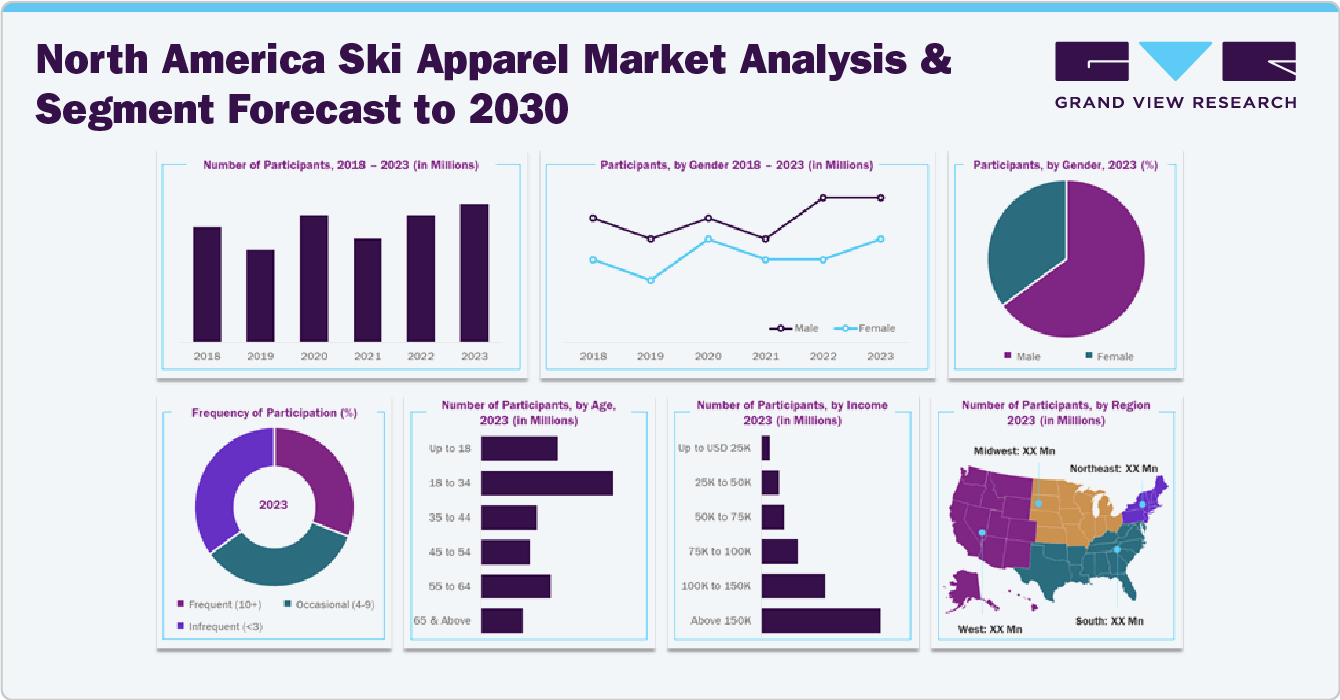

The North America ski apparel market size was estimated at USD 2.27 billion in 2024 and is expected to grow at a CAGR of 5.3% from 2025 to 2030. Skiing has become an increasingly popular activity in recent years in North America, especially among younger generations. As a result, skiing apparel, including jackets, pants, and gloves, has increased in demand. Moreover, the National Ski Areas Association (NSAA) reported record visitation at U.S. ski areas for the 2021-22 season, with a total of 61 million skier visits. This is an increase of 3.5% over last season’s national number.

The rise in winter tourism has significantly contributed to the increase in market growth. The U.S. and Canada are home to some of the world's most famous ski resorts. The tourism industry, recovering robustly from the pandemic, saw a surge in visitors, with Colorado alone attracting over 14 million tourists to its ski resorts in the 2022-2023 season. This influx of tourists often leads to increased purchases of ski apparel as travelers buy new gear for their trips.

Furthermore, according to a survey by Snowsports Industries America (SIA), 29.9 million people in the U.S. participated in snow sports during the 2022/2023 winter season, marking a notable rise compared to past years, when participation was approximately 25 million. This upward trend indicates a rising fascination with snow sports and their associated apparel.

Moreover, skiing apparel manufacturers are constantly leveraging new technologies to enhance the durability, breathability, and comfort of their products. For instance, some ski jackets now feature integrated heating systems to provide additional warmth on cold days. In December 2022, Helly Hansen introduced the Odin collection, which includes a range of jackets, pants, and other apparel, all designed with advanced materials and technologies to protect skiers in harsh weather conditions. The Men’s Odin 9 Worlds 2.0 Outdoor Shell Jacket features a waterproof and breathable Helly Tech Professional fabric, as well as a built-in RECCO avalanche rescue system transponder.

With rising environmental awareness, many consumers are now seeking sustainable options. A 2022 report by Textile Exchange found that 41% of consumers in North America are willing to pay a premium for sustainable apparel, including ski wear. This shift has prompted many brands to introduce eco-friendly products made from recycled materials and adopt greener manufacturing processes, further expanding the market growth.

Consumer Insights

In the U.S. ski apparel market, consumers prioritize high-performance, eco-friendly, and stylish gear. There’s a strong demand for functional features like breathability, insulation, and waterproofing, along with versatile layering options for different conditions. Sustainability drives preferences, with many choosing durable, eco-conscious materials. In addition, urban-inspired designs that blend slope and casual wear are popular, as are options for extended sizing and comfort. Tech-integrated apparel, such as heated jackets and GPS-enabled gear, appeals to safety-conscious, tech-savvy skiers. Direct-to-consumer and online shopping trends grow as buyers seek convenience, product variety, and competitive pricing through digital platforms.

Product Insights

Ski outerwear accounted for a revenue share of 53.62% in 2024. Technological advancements in ski apparel have also played a critical role in boosting demand. Today's ski outerwear is designed to provide superior protection against the elements while enhancing comfort and performance on the slopes. Modern fabrics and materials offer increased breathability, waterproofing, insulation, and durability, making skiing more enjoyable and safer for participants. Innovations such as Gore-Tex, Thinsulate, and other high-performance materials have set new standards in the industry, providing skiers with apparel that can withstand harsh weather conditions without sacrificing mobility or comfort. In addition, advancements in layering systems and ergonomic designs have made ski outerwear more versatile and functional, catering to a wide range of skiing styles and weather conditions.

Brands like The North Face and Patagonia have introduced ski apparel lines that incorporate advanced insulation technologies, thus driving the market demand and growth rate of ski outerwear in the region during the forecast period.

The ski base layers market is expected to grow at a CAGR of 5.1% from 2025 to 2030 in the region. As more people participate in winter sports and outdoor activities, there is a growing emphasis on performance and comfort in apparel choices. Skiers and snowboarders are looking for base layers that provide optimal moisture management, insulation, and comfort, allowing them to perform at their best in varying weather conditions. This focus on performance and comfort has led to an increased demand for high-quality base layers that offer the right balance of functionality and comfort.

Price Range Insights

The mass-priced ski apparel market accounted for a revenue share of over 70.59% in 2024. Many consumers prioritize affordability when purchasing ski apparel. Mass-priced ski apparel appeals to the broader segment of the market, including budget-conscious individuals and families. Furthermore, mass-priced ski apparel is often more prominently available in mainstream retail channels in the U.S., such as big-box stores, department stores, and online marketplaces. These channels attract a broader audience of consumers, leading to higher sales volume for mass-priced ski apparel. These factors are expected to contribute to the dominance of mass priced ski apparel in the region during the forecast period.

The premium-priced ski apparel is expected to grow at a CAGR of 6.2% from 2025 to 2030 in North America. In the region, there is an increasing trend among consumers prioritizing quality and durability over price, preferring premium-priced ski apparel that offers superior performance and longevity. Premium ski apparel often incorporates advanced materials, innovative technology, and meticulous craftsmanship, appealing to enthusiasts who value these factors. Furthermore, a strong brand preference among consumers is seen in the region. Premium ski apparel is often associated with reputable brands known for their quality, innovation, and heritage in the outdoor industry. Consumers in the region are willing to pay a premium for products from these brands due to their perceived value, reputation for excellence, and status symbol within the outdoor community, thereby augmenting the growth of the premium-priced segment during the forecast period.

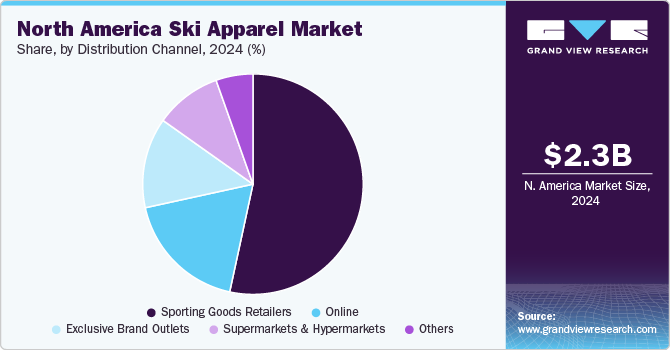

Distribution Channel Insights

The sales of ski apparel through sporting goods retailers accounted for a revenue share of over 53.39% in 2024. These retailers offer a wide range of ski apparel, including specialized apparel for skiing activities. The wide selection caters to the diverse needs and preferences of ski enthusiasts, driving sales through this channel. Furthermore, these stores offer specialized retail experiences tailored to outdoor enthusiasts, with knowledgeable staff who can provide expert advice and guidance on apparel selection. Moreover, many outdoor brands choose to partner with sporting/outdoor retail stores to make their products available and accessible to consumers, resulting in the availability of products from multiple prominent and emerging brands for consumers to choose from, further driving ski apparel sales through this channel in the region during the forecast period.

The sales of ski apparel through online channels are expected to grow at a CAGR of 6.5% from 2025 to 2030 in North America. Online channels offer convenience, allowing customers to browse, compare, and purchase ski apparel from the comfort of their homes. Furthermore, online platforms facilitate transparent pricing and easy comparison shopping, enabling consumers to quickly compare prices, features, and customer reviews across different brands and retailers.

Moreover, changing consumer preferences, particularly among younger demographics in the region, favor online shopping due to its convenience, flexibility, and seamless user experience. As digital natives become a larger share of the consumer market in the region, the preference for online channels is expected to drive high sales growth through this channel during the forecast period.

Country Insights

U.S. Ski Apparel Market Trends

The ski apparel market in the U.S. accounted for a revenue share of 78.85% in 2024 in the North American region. According to the National Ski Areas Association (NSAA), in the 2022-23 season, there were 480 ski areas in operation across 36 U.S. states. The alpine ski, telemark ski, and snowboard industries contribute over USD 55 billion in retail spending to the U.S. economy each year. These include expenditures made by skiers and snowboarders across all 50 states for equipment, travel expenses, and services. This scenario bodes well for the sale of snowboarding apparel across the U.S.

Furthermore, the rise in popularity of winter sports among younger generations, such as millennials and Gen Z, has contributed to the growing demand for ski apparel. This demographic is more likely to engage in outdoor activities and prioritize experiences over material possessions, leading to a surge in interest in skiing and snowboarding. As more people take up these activities, the need for appropriate ski apparel that offers protection, comfort, and performance on the slopes has increased significantly.

Canada Ski Apparel Market Trends

The Canada ski apparel market is expected to grow at a CAGR of 6.1% from 2025 to 2030. Canada is known for its long and often harsh winter season, which typically lasts from November to April, depending on the region. The extensive winter conditions create an environment where winter sports, such as skiing and snowboarding, are not only popular but also a practical way to engage with the outdoors. The country’s geography includes many mountainous regions and vast areas of snow-covered terrain, making it a prime destination for winter sports enthusiasts.

Key North America Ski Apparel Company Insights

The North America regional market is characterized by the presence of numerous well-established players and is fragmented owing to the presence of a large number of ski apparel manufacturers with strong customer networks. The increasing number of developments and innovations implemented by companies through various R&D activities and investments have significantly contributed to the region’s growth. To manufacture innovative and technologically advanced ski apparels, companies are focusing on enhancing their production capacities through technological integration for production processes. Furthermore, a large number of companies are making strategic appointments to enhance their capabilities and improve organizational leadership.

Key North America Ski Apparel Companies:

- Columbia Sportswear Company

- Patagonia, Inc.

- The North Face, Inc.

- Burton Snowboards, Inc.

- Jones Snowboards

- Flylow Gear

- Spyder Active Sports, Inc.

- Arc'teryx Equipment Inc.

- Mountain Hardwear, Inc.

- Marmot Mountain, LLC

Recent Developments

-

In February 2024, Spyder Active Sports, Inc. revealed that starting in Fall 2024, Spyder skiwear made by the company will be free from Per and Polyfluorinated substances (PFAS). Alongside this move, Liberated will unveil new advancements in waterproof materials and Durable Water Repellent (DWR) technology, offering outdoor enthusiasts exceptional protection from the elements.

-

In October 2023, Alpine Canada Alpin (ACA) and Helly Hansen announced that they were renewing their partnership for another four years. Over the past eight years, Helly Hansen, a leading brand in technical outdoor clothing, has supplied ACA athletes, coaches, and support staff with professional-grade ski apparel and equipment. This collaboration has enabled Helly Hansen to gather valuable feedback and insights, which have been instrumental in refining and advancing its products to cater to the specific needs of professional ski teams, from training sessions to competitive events. The renewed partnership will continue through the winter 2026/2027 season, covering the 2026 Winter Olympic and Paralympic Games.

North America Ski Apparel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.38 billion

Revenue forecast in 2030

USD 3.06 billion

Growth rate

CAGR of 5.3% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price range, distribution channel, country

Country scope

U.S, Canada

Key companies profiled

Columbia Sportswear Company; Patagonia, Inc.; The North Face, Inc.; Burton Snowboards, Inc.; Jones Snowboards; Flylow Gear; Spyder Active Sports, Inc.; Arc'teryx Equipment Inc.; Mountain Hardwear, Inc.; and Marmot Mountain, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Ski Apparel Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America ski apparel market report based on product, price range, distribution channel, and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Outerwear

-

Mid Layers

-

Base Layers

-

Pants

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America ski apparel market size was estimated at USD 2.27 billion in 2024 and is expected to reach USD 2.38 billion in 2025.

b. The North America ski apparel market is expected to grow at a compounded growth rate of 5.3% from 2025 to 2030 to reach USD 3.06 billion by 2030.

b. Outerwear dominated the North America ski apparel market with a share of 53.62% in 2024. Technological advancements in ski outerwear have played a critical role in boosting demand. Today's ski outerwear is designed to provide superior protection against the elements while enhancing comfort and performance on the slopes driving its demand and growth during the forecast period.

b. Some key players operating in the North America ski apparel market include Columbia Sportswear Company; Patagonia, Inc.; The North Face, Inc.; Burton Snowboards, Inc.; Jones Snowboards; Flylow Gear; Spyder Active Sports, Inc.; Arc'teryx Equipment Inc.; Mountain Hardwear, Inc.; and Marmot Mountain, LLC.

b. The North America ski apparel market is driven by a rising interest in winter sports, fueled by a growing emphasis on active lifestyles and outdoor recreational activities. Additionally, expanding tourism at ski resorts, coupled with celebrity endorsements and social media influence, has boosted demand, making ski apparel both a functional necessity and a style statement.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."