- Home

- »

- Advanced Interior Materials

- »

-

North America Rental Chillers Market Size, Report, 2030GVR Report cover

![North America Rental Chillers Market Size, Share & Trends Report]()

North America Rental Chillers Market Size, Share & Trends Analysis Report By Equipment (Water-Cooled, Air-Cooled), By Product (Commercial, Industrial, Residential), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-998-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

North America Rental Chillers Market Trends

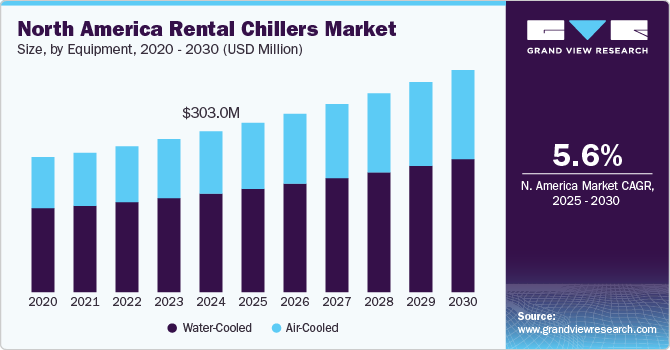

The North America rental chillers market size was estimated at USD 303.0 million in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2030. The increasing demand for temporary cooling solutions in various industries, including construction, events, and manufacturing, plays a significant role. For instance, during peak seasons or in response to unplanned equipment failures, companies often require additional cooling capacity to maintain operational efficiency.

Another contributing factor is the rise in industrial products, particularly in sectors like pharmaceuticals and food and beverage, where temperature control is crucial. The need for precise temperature management during production and storage processes leads to a higher demand for rental chillers that can provide reliable and scalable cooling solutions.

Drivers, Opportunities & Restraints

The flexibility and cost-effectiveness associated with rental solutions attract businesses that may not want to invest in permanent installations. Renting chillers allows companies to scale their cooling capacity based on current needs, avoiding significant capital expenditures while still maintaining operational performance.

While rental solutions can be cost-effective in the short term, the cumulative expenses over extended periods may deter some businesses from choosing this option. In addition, logistical challenges such as transportation and setup can lead to delays and increased operational complexity, particularly for large-scale events or projects.

The ongoing trend toward energy efficiency presents a significant opportunity, as companies increasingly seek rental chillers that use advanced technologies and environmentally friendly refrigerants. This shift not only aligns with sustainability goals but also helps businesses comply with regulatory requirements

Equipment Insights

Based on equipment, the water-cooled segment led the market with the largest revenue share of 61.46% in 2024. The high energy efficiency of water-cooled chillers makes them particularly appealing for large-scale operations where continuous cooling is essential. In addition, water-cooled chillers often have a smaller physical footprint compared to air-cooled units, allowing for more efficient use of space in industrial settings. As businesses increasingly focus on sustainability, the energy efficiency of water-cooled chillers helps reduce overall operational costs and aligns with corporate environmental goals.

The air cooled segment is anticipated to grow at a notable CAGR of 6.2% from 2025 to 2030. The demand for air-cooled chillers in the rental market is driven by their ease of installation and lower upfront costs. They require less maintenance compared to water-cooled options, making them a popular choice for businesses seeking quick deployment. Air-cooled chillers are also highly flexible, suitable for a wide range of applications, including temporary cooling solutions for events or seasonal needs. Their adaptability to different environments and applications is a significant advantage in the rental market.

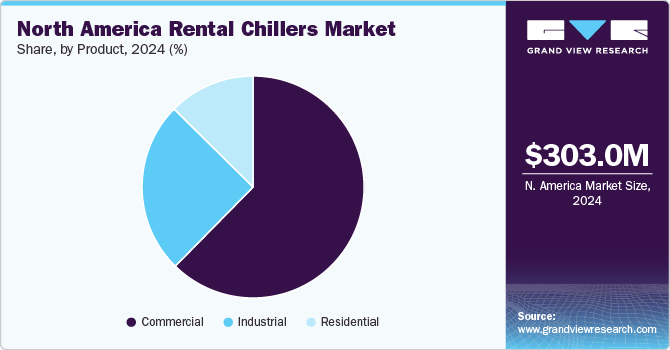

Product Insights

The industrial segment led the market with the largest revenue share of 25.03% in 2024. In the industrial sector, growth is driven by the need for robust cooling solutions in manufacturing processes, data centers, and other critical applications. As industries expand and modernize, the demand for effective temperature control to protect equipment and enhance productivity rises. In addition, the trend toward just-in-time manufacturing requires flexible cooling solutions that can be quickly deployed, making rental chillers an attractive option for industrial users.

The commercial segment is anticipated to grow at a considerable CAGR of 5.8% during the forecast period. In the commercial sector, growth is propelled by the rising demand for efficient climate control in spaces such as offices, retail stores, and event venues. The trend toward creating comfortable environments for customers and employees drives the need for reliable cooling solutions. Furthermore, seasonal fluctuations in temperature necessitate temporary cooling solutions, particularly during peak summer months, increasing the demand for rental chillers.

Country Insights

The focus on energy efficiency and sustainability in North America is prompting businesses to adopt rental chillers that utilize advanced technologies. Regulatory frameworks supporting infrastructure development and the increasing prevalence of outdoor events also contribute to the growth of the rental chillers market across the region.

U.S. Rental Chillers Market Trends

The North America rental chillers market in the U.S. accounted for the largest market share of 82.8% in 2024. The demand for rental chillers in the country is significantly influenced by the booming construction sector, particularly in urban areas. Large-scale infrastructure projects and commercial developments require efficient cooling solutions during construction phases. Moreover, the increasing popularity of events and festivals drives the need for temporary cooling solutions in outdoor venues. The U.S. also has a strong emphasis on energy efficiency, encouraging businesses to seek rental options that minimize operational costs and align with sustainability goals.

The Canada rental chillers market is driven by several unique factors. The harsh climate in many regions creates a consistent demand for effective cooling solutions during the warmer months. In addition, Canada is experiencing growth in its industrial sector, particularly in oil and gas, mining, and manufacturing, which requires reliable temperature control. The emphasis on green technologies and energy-efficient solutions is also a strong driver as companies seek to reduce their environmental impact and comply with increasingly stringent regulations.

The rental chillers market in Mexico is expected to grow at the fastest CAGR of 5.9% over the forecast period. The market’s growth is driven by is primarily driven by rapid industrialization and urban development. The country is witnessing significant growth in manufacturing, particularly in automotive and electronics, which creates a demand for efficient cooling solutions in production processes. Furthermore, the rising popularity of events and festivals in urban areas increases the need for temporary cooling systems. Economic growth and investments in infrastructure also enhance the market as businesses look for flexible solutions to meet their cooling needs in a dynamic environment.

Key North America Rental Chillers Company Insights

Some of the key players operating in the market include ENTACT and WSP among Massaging & Marinating.

-

United Rentals, Inc. operates a comprehensive network of 1,520 rental sites across North America, with 38 locations in Europe, 23 in Australia, and 19 in New Zealand. In North America, the company is active in 49 states and all provinces of Canada. The company provides around 4,800 types of rental equipment, one of them being chillers.

-

Aggreko operates in 60 locations worldwide and is a provider of mobile modular power, temperature control, and energy services. The company specializes in delivering turnkey solutions. Their product range includes chillers, diesel generators, heat exchangers, and more. Aggreko serves various industries, including agriculture, building services and operations, construction and contracting, cryptocurrency energy and temperature control solutions, data centers, events, food and beverage, government, healthcare, manufacturing, mining, oil and gas, pharmaceuticals, petrochemical and refining, renewable energy, shipping, telecommunications, and utilities.

Key North America Rental Chillers Companies:

- United Rentals, Inc.

- Resolute Industrial

- Aggreko

- Carrier

- Sunbelt Rentals, Inc

- Trane

- Johnson Controls

- Daikin

- Power Mechanical

- Fluid Chillers, Inc.

View a comprehensive list of companies in the North America Rental Chillers Market.

Recent Developments

-

In February 2023,DAIKIN INDUSTRIES, Ltd. launched its second generation of air-cooled chillers featuring R32 scroll compressors, expanding the capacity range to 1010 kW from the previous 704 kW. This new range is designed for various applications, including process and comfort cooling, while offering improved efficiency and a more compact design, reducing size by 275 mm.

-

In September 2022, ENGIE announced the international launch of its SPECTRUM Water chiller on featuring an oil-free high-lift turbo compressor and utilizing the sustainable refrigerant R-1234ze. This innovative water-cooled brine cooler boasts a refrigeration capacity ranging from 170 to 1,100 kilowatts, with outlet temperatures as low as -10 degrees Celsius.

North America Rental Chillers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 319 million

Revenue forecast in 2030

USD 418.7 million

Growth rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, product, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

United Rentals, Inc.; Resolute Industrial; Aggreko; Carrier, Sunbelt Rentals, Inc; Trane; Johnson Controls, Daikin; Power Mechanical; Fluid Chillers, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Rental Chillers Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America rental chillers market report based on equipment, product, and region:

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Water-Cooled

-

Air-Cooled

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Industrial

-

Residential

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America rental chillers market size was estimated at USD 303.0 million in 2024 and is expected to reach USD 319.0 million in 2025

b. The North America rental chillers market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030 to reach USD 418.7 million by 2030

b. The water-cooled segment dominated the market in 2024 accounting for 61.2% of the overall revenue share. This growth is attributed to their adoption in large-scape operations due to their high energy efficiency. This efficiency translates to lower energy consumption, making water-cooled chillers particularly appealing for facilities that require continuous cooling, such as data centers, manufacturing plants, and large commercial buildings. By reducing energy costs, companies can significantly improve their overall operational efficiency and profitability

b. Some of the key players operating in the North America rental chillers market are United Rentals, Inc., Resolute Industrial, Aggreko, Carrier, Sunbelt Rentals, Inc, Trane, Johnson Controls, Daikin, Power Mechanical, and Fluid Chillers, Inc

b. The North America rental chillers market is primarily driven by the increasing demand for temporary cooling solutions across various sectors, including construction and events. Additionally, a strong focus on energy efficiency and sustainability encourages businesses to opt for rental chillers that reduce operational costs. The growth of industrial activities and infrastructure development also fuels market expansion

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."