- Home

- »

- Advanced Interior Materials

- »

-

North America Rental Air Compressor Market, Industry Report, 2030GVR Report cover

![North America Rental Air Compressor Market Size, Share & Trends Report]()

North America Rental Air Compressor Market Size, Share & Trends Analysis Report By Rental Type (Short Term Rental, Long Term Rental), By Country (U.S., Canada), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-487-8

- Number of Report Pages: 114

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

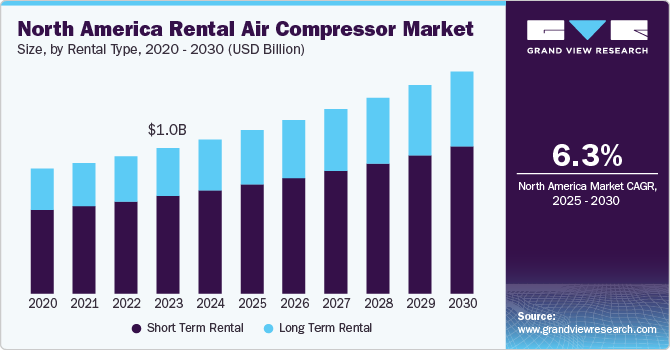

The North America rental air compressor market size was estimated at USD 1,068.2 million in 2024 and is projected to grow at a CAGR of 6.3% from 2025 to 2030, owing to a surge in construction and industrial activities. As infrastructure projects continue to expand and the demand for portable power solutions rises, rental air compressors have become essential for various applications. This trend is particularly evident in sectors such as construction, oil and gas, and manufacturing, where reliable and efficient equipment is crucial for operational success.

Companies are seeking flexibility and cost-efficiency, allowing them to allocate resources more effectively. Rental air compressors provide businesses with the ability to access high-quality equipment without the long-term commitments tied to ownership. Moreover, advancements in technology and the introduction of energy-efficient models have further enhanced the appeal of renting, as companies aim to reduce operational costs and minimize their environmental footprint.

The integration of smart technologies and IoT in air compressors is creating opportunities for improved monitoring and maintenance, thereby increasing reliability and performance. As industries become more focused on sustainability, providers that offer eco-friendly solutions and customizable rental packages will likely gain a competitive edge. This is expectedto further drive the demand for North America rental air compressors.

Market Concentration & Characteristics

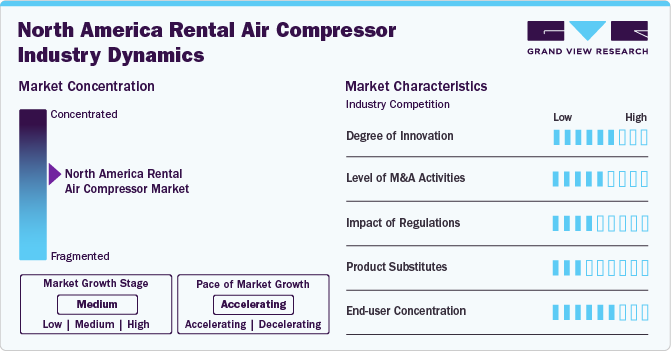

The North America rental air compressor industry exhibits a moderate level of concentration, characterized by a blend of established domestic companies and prominent global players. Leading brands dominate the landscape, leveraging their strong brand reputation, expansive distribution channels, and comprehensive service offerings. The involvement of international manufacturers has significantly enriched the market dynamics, introducing technological innovations and competitive pricing strategies. This competitive environment drives companies to consistently invest in research and development, aiming to provide reliable, energy-efficient, and advanced air compressor solutions to meet the diverse needs of both industrial and commercial clients.

Market characteristics in North America indicate a growing demand for rental air compressors, fueled by economic expansion, increased construction activities, and the rising need for portable and flexible equipment solutions across various industries. There is a noticeable trend towards energy-efficient and environmentally friendly compressor systems, supported by regulatory frameworks aimed at promoting sustainability and reducing operational costs. This shift not only enhances operational efficiency but also aligns with broader goals for environmental responsibility in the industry.

Drivers, Opportunities & Restraints

The North America rental air compressor industry is primarily driven by a booming construction industry, coupled with a growing emphasis on operational efficiency. As more construction projects emerge, the demand for portable and reliable equipment increases, making rental air compressors an attractive option for contractors. In addition, the flexibility offered by rental services allows businesses to scale their operations without the financial burden of purchasing equipment. This shift is further supported by advancements in technology, leading to more efficient and environmentally friendly air compressors, enhancing their appeal in various sectors.

The market presents numerous opportunities, particularly in the realm of technological innovation. The integration of smart technologies and IoT in rental air compressors opens avenues for improved performance monitoring, predictive maintenance, and enhanced energy efficiency. Furthermore, industries are becoming increasingly aware of sustainability practices, creating demand for eco-friendly compressor options. Companies that can offer customized rental packages tailored to specific industry needs can also capture market share, effectively addressing the diverse requirements of their clients and establishing a strong competitive advantage.

The North America rental air compressor industry faces several challenges. High competition among rental service providers can drive down prices, squeezing profit margins and complicating business sustainability. In addition, economic downturns can lead to reduced construction activities and lower demand for rental equipment, impacting revenue.

Rental Type Insights

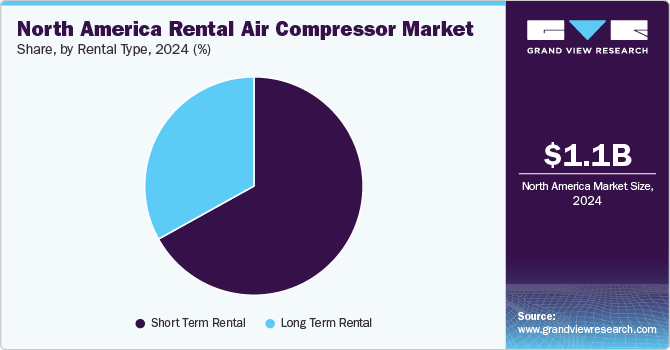

Based on rental type, the short-term rental segment led the market with the largest revenue share of 67.0% in 2024. The short-term rental segment of the North America market caters primarily to industries with temporary or seasonal needs. This segment is heavily driven by industries such as construction, events, and infrastructure projects, which often require air compressors for short durations. Short-term rentals, typically ranging from a few days to several weeks, offer flexibility to companies needing quick solutions without the long-term investment of purchasing equipment. The demand in this segment is often influenced by sudden project needs, emergency repairs, or seasonal surges in activities, making it a highly dynamic and fluctuating part of the market.

The long-term rental segment is anticipated to grow at the fastest CAGR of 6.6% during the forecast period, primarily serves industries with ongoing operational needs. Long-term rentals, typically lasting several months to multiple years, are commonly used by industries such as manufacturing, oil & gas, and energy. These industries often require continuous access to air compressors for regular operations or specific long-term projects but prefer renting over purchasing due to the financial flexibility and reduced responsibility for equipment maintenance. The long-term rental segment benefits companies by avoiding the high upfront costs of ownership and the expenses associated with depreciation, repairs, and storage.

Country Insights

U.S. Rental Air Compressor Market Trends

The rental air compressor market in the U.S. accounted for the largest revenue share of 80.5% in North America in 2024,primarily due to its robust construction and industrial sectors. With ongoing infrastructure developments, an upsurge in oil and gas exploration, and a continuous demand for temporary power solutions, the U.S. market is significantly larger than that of its neighbors. In addition, the presence of numerous rental companies and a growing preference for flexible rental agreements further solidify the U.S.'s dominant position. This strong economic activity, coupled with advancements in technology and equipment efficiency, positions the U.S. as a key player in meeting the diverse needs of various industries reliant on rental air compressors.

The Canada rental air compressor market is expected to grow at a significant CAGR over the forecast period, driven by increasing investments in infrastructure projects and a rising demand for energy-efficient equipment. As the country focuses on upgrading transportation and energy facilities, the need for reliable and portable air compressors becomes crucial for contractors and industries. In addition, the growing trend of rental services as a cost-effective and flexible solution for businesses is further propelling market growth.

Key North America Rental Air Compressor Company Insights

Some of the key players operating in the North America market include OTC Industrial Technologies and United Rentals, Inc.

-

OTC Industrial Technologies is an industrial equipment, service, and supply company in the United States. Its product portfolio includes air compressors, pumps, bearings, motors, filtration systems, and other industrial machinery and tools. The company owns multiple companies, such as OTP Industrial Solutions, Advanced Industrial Products, and others. Its air supply group of companies includes DIRECTAIR, Air Technologies, IDG COMPRESSOR, CAS Compressed Air Systems, PK Controls, and LARON Air Supply.

-

United Rentals, Inc.provides a wide range of equipment, including heavy machinery, aerial work platforms, portable generators, general construction tools, and more. Their inventory of air compressors comprises stationary and portable air compressors from Atlas Copco, Hitachi Global Air Power, US LLC, Doosan Corporation, and Mi-T-M Corporation.

Key North America Rental Air Compressor Companies:

- CATERLPILLAR INC.

- Atlas Copco

- OTC Industrial Technologies

- United Rental Inc

- Sunbelt Rentals

- Texas First Rentals

- Empire Tool Rentals

- Pro Rental & Sales

- Mountain Air Compressor

- MacAllister Rentals

- Coast to Coast Equipment Rentals

- Harris Equipment Rental

Recent Developments

-

In July 2023, OTC Industrial Technologies announced the establishment of its new distribution center in Cincinnati, Ohio, U.S. This expansion enhances OTC's efficiency in operations, logistics, and customer service.

-

In December 2022, United Rentals, Inc. acquired Ahern Rentals, Inc. for about USD 2 billion in cash. This deal adds 2,100 employees, 60,000 rental assets, and 106 locations in the U.S. to the company. The acquisition positions United Rentals for strong demand and aligns with its long-term strategy to boost shareholder value.

North America Rental Air Compressor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,133.0 million

Revenue forecast in 2030

USD 1,539.5 million

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Rental type, region

Regional scope

North America

Country Scope

U.S.; Canada

Key companies profiled

CATERLPILLAR INC.; Atlas Copco; OTC Industrial Technologies; United Rental Inc.; Sunbelt Rentals; Texas First Rentals; Empire Tool Rentals; Pro Rental & Sales; Mountain Air Compressor; MacAllister Rentals; Coast to Coast Equipment Rentals; Harris Equipment Rental.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Rental Air Compressor Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America rental air compressor market report based on the rental type, and country:

-

Rental Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Short Term Rental

-

Long Term Rental

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

-

-

Canada

-

Ontario

-

Quebec

-

British Columbia

-

Alberta

-

Saskatchewan

-

Manitoba

-

New Brunswick

-

Nova Scotia

-

Newfoundland and Labrador

-

Prince Edward Island

-

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the North America rental air compressor Market include CATERLPILLAR INC., Atlas Copco, OTC Industrial Technologies , United Rental Inc, Sunbelt Rentals, Texas First Rentals, Empire Tool Rentals, Pro Rental & Sales, Mountain Air Compressor, MacAllister Rentals, Coast to Coast Equipment Rentals and Harris Equipment Rental.

b. The North America rental air compressor market is primarily driven by a booming construction industry, coupled with a growing emphasis on operational efficiency. As more construction projects emerge, the demand for portable and reliable equipment increases, making rental air compressors an attractive option for contractors.

b. The North America rental air compressor market size was estimated at USD 1,068.2 million in 2024 and is expected to be 1,133.0 million in 2025.

b. The North America rental air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2030 to reach USD 1,539.5 million by 2030.

b. U.S. dominated the North America rental air compressor market with a revenue share of 80.1% in 2024. The extensive industrial manufacturing, the strong establishment of commercial businesses, and growing awareness among the homeowners attributed to the position the market holds in the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."