- Home

- »

- Nutraceuticals & Functional Foods

- »

-

North America Protein Supplements Market, Industry Report, 2030GVR Report cover

![North America Protein Supplements Market Size, Share & Trends Report]()

North America Protein Supplements Market Size, Share & Trends Analysis Report By Source (Animal-based, Plant-based), By Product, By Application, By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-212-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

The North America protein supplements market size was estimated at USD 2.64 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.6% from 2024 to 2030.The increasing obesity rate in the region has contributed to the growth of the protein supplements market. With the rising awareness of the importance of a healthy diet and regular exercise, the trend of fitness has become increasingly popular in recent years. Protein supplements have become a popular choice for individuals who are looking to supplement their diet with additional protein to support their fitness goals. As a result, the protein supplements market has experienced significant growth in the U.S.

North America Protein Supplements Market accounted for the share of 41.4% of the global protein supplements market in 2023.

Consumers are becoming more conscious of their health and are willing to invest in products that can help them maintain or improve their overall well-being. As a result, the protein supplements market is expected to continue growing in the U.S. in the years to come. The high prevalence of lifestyle diseases, such as diabetes and obesity, is driving demand for products that can help manage these conditions. Protein supplements are often recommended as part of a healthy diet for individuals with these conditions.

The protein supplement market has been experiencing significant growth in recent years, and the increasing demand for sports nutritional supplements is one of the major driving factors. Athletes and fitness enthusiasts require a higher protein intake to support their training and exercise routines, and protein supplements provide an easy and convenient way to meet this demand.

In addition to athletes and fitness enthusiasts, the general population is becoming increasingly health-conscious and aware of the importance of a balanced diet. As a result, many individuals are turning to protein supplements to supplement their daily nutritional intake and support their overall health and well-being.

The westernization of diets, the growing middle-class population with higher disposable incomes, and an increased focus on leading an active & healthy lifestyle are expected to drive the demand for protein supplements. Players in this market are looking to attract consumers with innovative and effective products. The high prevalence of lifestyle diseases is also driving product demand.

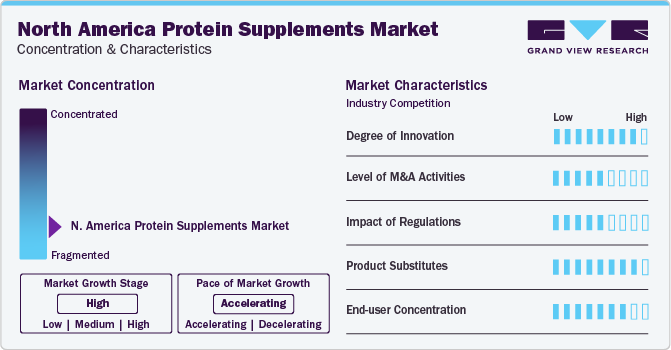

Market Concentration & Characteristics

The North America protein supplements industry is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Increasing number of health conscious population and huge product developments by major key players is anticipated to boost market growth. Furthermore, leading protein supplement producers in the U.S. are focusing on developing new products through investments in research and development and technological advancements. They aim to offer cost-effective and high-quality products. In addition, manufacturer are focusing on clean labels, high efficacy, and minimal side effects, which is expected to create growth opportunities in the market.

The industry is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. Increasing product awareness and robust branding by manufacturers propel market growth. Key players are also engaging in partnerships, agreements, joint ventures, and mergers & acquisitions to increase their market share and expand their geographic reach. Furthermore, they are making efforts to educate consumers about the benefits of protein ingredients while adhering to the regulatory standards set by the U.S. Food and Drug Administration (FDA).

Presence of stringent regulations regarding product quality and labeling requirements, protein supplements product manufacturers are expected to increase their expenditure on developing better-quality goods.

End-user concentration is a significant factor in the North America protein supplements industry.The rise of the fitness industry and the growing popularity of sports and fitness activities have fueled the demand for protein supplements. Wide availability of various forms of protein supplements such as powders, bars, and ready-to-drink beverages is gaining consumer’s attraction. Furthermore, the emergence of online platforms and e-commerce websites has made it easier for consumers to purchase protein supplements, which has further contributed to the growth of the market.

Source Insights

Animal based protein supplements accounted for a revenue share of 58.04% in 2023. Animal proteins are considered the highest quality protein sources. Protein plays an important role in improving and maintain health.Animal sources have a higher protein concentration and are, therefore, preferred for manufacturing supplements. Whey protein is the most popular animal based protein supplements. The growing demand for whey proteins is primarily attributed to its ability to enhance physical performance and reduce fats, driving its preference among fitness enthusiasts, sportspersons, and athletes. Whey protein isolates, concentrates, and hydrolysates are the most marketed forms of whey protein supplements among sports enthusiasts. Various studies have shown the importance of whey proteins in stimulating longitudinal bone growth and the development of bone mass in young children, which is expected to boost segment’ growth.

Plant-based protein supplements is expected to grow at a CAGR of 9.6% during the forecast period.Rising consumer awareness regarding a healthy lifestyle is driving a shift toward new protein sources. Despite the high demand for animal-based proteins, many consumers are switching to a vegan diet owing to concerns regarding animal welfare and the meat industry’s impact on the environment.Soy, wheat, rice, and spirulina are some key plant protein sources.Increasing consumer awareness regarding the nutritional benefits of plant-based proteins and the rising popularity of clean-label products are projected to fuel the market for plant protein supplements. Even though the global vegan population is still very small and represents a minority share of the target audience for plant-based protein supplements, the growth prospects of this demographic are high.Innovation in product development and technology has led to the development of novel plant protein sources such as seaweed, algae, sunflower, and amaranth. Technologies such as precision fermentation are accelerating product innovation in the market, with companies such as ICL Food Specialties, Protera Biosciences, and ADM investing in this technology.

Product Insights

The protein powder supplements accounted for a revenue share of 44% in 2023. Protein powder is derived from various raw materials, including egg, whey, soy, pea, and casein. Increasing consumer health consciousness has driven the trend of incorporating protein powders into daily diets for weight management, muscle gain, and overall health and wellness. In addition, there is growing product demand from elite athletes, bodybuilders, and casual exercisers. Plant-based protein powders are also gaining popularity, driven by the increasing number of consumers opting for vegan or vegetarian diets.

The Ready-to-Drink (RTD) supplements are projected to grow at a CAGR of 9.0% from 2024 to 2030. RTD supplements are pre-formulated protein drinks that require no additional mixing or preparation, making them easy to consume on the go. These drinks offer a high dose of protein and can be taken post-workout, pre-workout, or as a meal replacement. The proteins in RTD supplements are quickly absorbed by the body, promoting muscle recovery and aiding lean muscle growth. These factors are expected to increase segment’s growth over the forecast period.

Application Insights

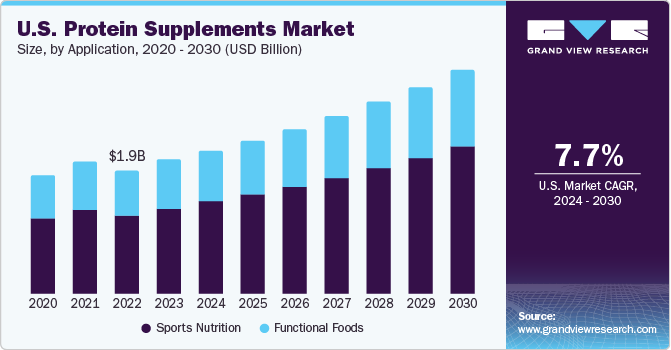

Application of supplements in functional food accounted for a share of 52.54% in 2023. Functional foods are primarily consumed to ensure the intake of nutritional constituents essential for the human body. Rising occurrences of cardiovascular diseases owing to inactive and slow lifestyles and fluctuating dietary patterns, especially between the ages of 30 and 40, have driven consumer awareness regarding the importance of omega 3-based nutraceutical products, boosting their adoption.

Application of supplements in sports nutrition is expected to grow at a CAGR of 8.9% during the forecast period.The increasing demand for sports nutritional supplements for core strength and endurance among athletes, weekend warriors, fitness enthusiasts, and professional athletes is expected to drive the segment. In addition, an increase in the number of gym-goers and rising demand for sports nutritional supplements to promote lean muscle growth, improve performance, assist in weight reduction, and boost stamina are expected to boost the segment growth.

Distribution Channel Insights

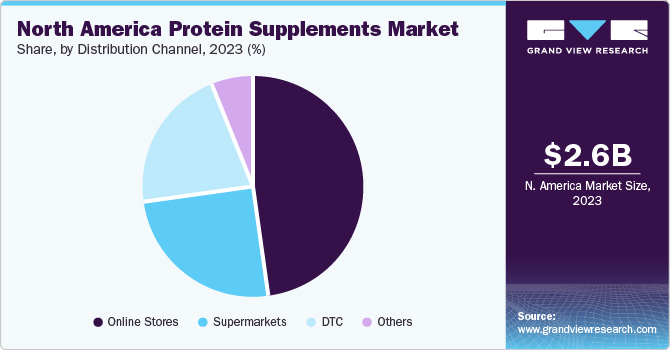

Sales of protein supplements through online stores accounted for a share of 47.5% in 2023. Increased number of internet users, ease of access to numerous brands, fast-paced consumer lifestyle, 24/7 availability of products, convenience of shopping, and a wide range of products offered are factors driving the sales of protein supplements through online distribution channels. The benefits to customers, including comparison in price range and the availability of numerous brands with customer reviews for the products, further drive the sales of supplements through this channel. Moreover, the presence of different discussion portals, discounts and offers, easy payment options, and various promotion strategies are projected to fuel the online sales of protein supplements over the forecast period.

Sales of protein supplements through supermarkets and hypermarkets is expected to grow at a CAGR of 9.3% from 2024 to 2030.Supermarkets and hypermarkets conduct detailed consumer sentiment analyses to understand customer preferences for products and brands. This allows them to offer products that are most likely to sell well, and they can charge premium prices if customers are willing to pay for them. The presence of established supermarkets & hypermarkets and departmental stores in the U.S. has been encouraging protein supplements manufacturers to distribute their products through these channels.

Country Insights

U.S. Protein Supplements Market Trends

U.S. protein supplements market accounted for a share of 87.4% in 2023. A survey conducted by CFANS Insights, affiliated with the University of Minnesota's College of Food, Agricultural, and Natural Resource Sciences, revealed that 80% of adults in the U.S. currently favor protein sources like pork, beef, poultry, and fish. However, 31% of respondents expressed their intention to consume more plant-based protein over the next five years, highlighting its growing trend. In the same survey, Gen Xers stood out with the highest current preference for plant protein at 26%, surpassing the 20% preference in other consumer segments. Meanwhile, 44% of Gen Z expressed their willingness to pay a premium for plant-based protein options. This data suggests evolving consumer preferences and a shift towards incorporating more plant-based protein sources into diets, especially among younger generations.

Canada Protein Supplements Market Trends

Canada protein supplements market is expected to grow at a CAGR of 7.0% over the forecast period. Canada has a well-established health and wellness culture. Consumers are increasingly conscious of their diet and nutrition. Furthermore, Canada has seen a significant increase in the number of vegetarians and vegans over the years. These trends, along with growing consumer preference for quick and convenient meal solutions, are expected to drive the growth of the protein supplements market in Canada during the forecast period.

Key North America Protein Supplements Company Insights

Some of the key players operating in the market include MusclePharm,Abbott, and CytoSport, Inc.

-

MusclePharm was incorporated in 2006 and is headquartered in Colorado, U.S. It is a performance lifestyle sports nutrition company, which focuses on developing and manufacturing nutritional supplements such as protein powders, protein gels, and protein bars. The company’s product segments include sport series, core series, black series and natural series.

-

CytoSport, Inc. was incorporated in 1997 and is headquartered in California, U.S. The company is currently a subsidiary of Pepsico and is engaged in the development and manufacture of sports nutritional products and functional beverages. It offers protein powders under the brands including MUSCLE MILK, MONSTER MILK, and CYTOMAX, which cater to the needs of athletes, weekend warriors, and active lifestylists. The products offered by the company aimed at promoting workout recovery, sustained energy, and lean muscle growth.

Quest Nutrition, LLC., The Bountiful Company, and NOW Foods some of the other participants in the North America Protein Supplements Market

-

NOW Foods is a family-owned natural foods company, which has over 1,000 products including herbs, natural foods, vitamins, minerals, and natural personal care products marketed under its brands.The company operates through its six business segments, namely supplements, beauty & health, essential oils, sports nutrition, natural foods, and pet health. Moreover, sports nutrition segment manufactures protein powders.

-

Bountiful Company was founded in 1971 and is headquartered in New York, U.S. The company is currently owned by the Nestle Group. It is engaged in manufacturing, marketing, and distributing nutritional supplements in the U.S. as well as globally. The company operates through three main business segments including Consumer Products Group, Holland & Barrett International, and Direct to Customer (DTC).

Key North America Protein Supplements Companies:

- MusclePharm

- Abbott

- CytoSport, Inc.

- Quest Nutrition, LLC.

- The Bountiful Company

- NOW Foods

- Rousselot

- International Dehydrated Foods, Inc.

- Jym-Supplement-Science.

- Surthrival

Recent Developments

- In January 2023, Surthrival introduced the world's first plant-based protein powder that is sourced entirely from wild-foraged black walnuts in the U.S. Through an advanced CO₂ extraction process, the product yields a high concentration of plant-based protein, boasting 17 grams of protein per serving.

North America Protein Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,824.7 million

Revenue forecast in 2030

USD 4,392.3 million

Growth rate

CAGR of 7.6% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, application, distribution channel

Country scope

U.S., Canada

Key companies profiled

MusclePharm; Abbott; CytoSport, Inc.; Quest Nutrition, LLC.; The Bountiful Company; NOW Foods; Rousselot; International Dehydrated Foods, Inc.; Jym-Supplement-Science; Surthrival

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Protein Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America Protein Supplements Market report based on source, product, application, and distribution channel:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Animal-based

-

Whey

-

Casein

-

Egg

-

Fish

-

Others

-

-

Plant-based

-

Soy

-

Spirulina

-

Pumpkin Seeds

-

Wheat

-

Hemp

-

Rice

-

Pea

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Protein Powders

-

Protein Bars

-

RTD

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Nutrition

-

Functional Foods

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets

-

Online Stores

-

DTC

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America protein supplements market size was estimated at USD 2.64 billion in 2023 and is expected to reach USD 2,824.7 million in 2024.

b. The North America protein supplements market is expected to grow at a compounded growth rate of 7.6% from 2024 to 2030 to reach USD 4,392.3 million by 2030.

b. Animal based protein supplements accounted for a revenue share of 58.04% in 2023. Animal proteins are considered the highest quality protein sources. Protein plays an important role in improving and maintain health. Animal sources have a higher protein concentration and are, therefore, preferred for manufacturing supplements. Whey protein is the most popular animal based protein supplements. The growing demand for whey proteins is primarily attributed to its ability to enhance physical performance and reduce fats, driving its preference among fitness enthusiasts, sportspersons, and athletes.

b. Some key players operating in the North America protein supplements market include MusclePharm; Abbott; CytoSport, Inc.; Quest Nutrition, LLC.; The Bountiful Company; NOW Foods; Rousselot; International Dehydrated Foods, Inc.; Jym-Supplement-Science; Surthrival.

b. Key factors that are driving the North America protein supplements market growth include increasing obesity rate in the region has contributed to the growth of the protein supplements market. With the rising awareness of the importance of a healthy diet and regular exercise, the trend of fitness has become increasingly popular in recent years. Protein supplements have become a popular choice for individuals who are looking to supplement their diet with additional protein to support their fitness goals. As a result, the protein supplements market has experienced significant growth in the U.S.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."