- Home

- »

- Nutraceuticals & Functional Foods

- »

-

North America Protein Ingredients Market, Industry Report, 2030GVR Report cover

![North America Protein Ingredients Market Size, Share & Trends Report]()

North America Protein Ingredients Market Size, Share & Trends Analysis Report By Product (Plant Proteins, Animal/Dairy Proteins, Microbe-based Protein, Insect Protein), By Application (Foods & Beverages), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-215-4

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

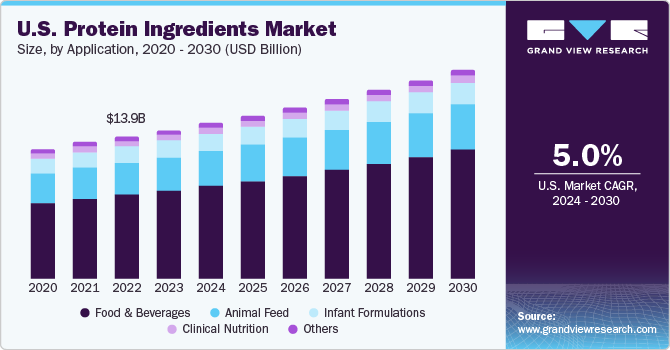

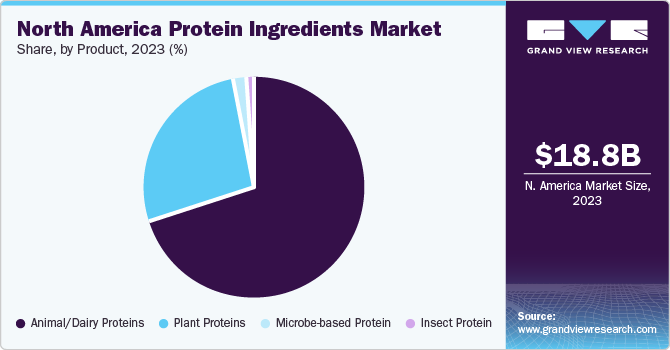

The North America protein ingredients market size was valued at USD 18.79 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2024 to 2030. Busy days at work, lifestyles revolving around such routines, and high disposable incomes accompanied by increasing awareness about the role of food in overall health enhancement are some of the major factors that are driving this market toward growth in the region. Health consciousness trends, growing consumption of products like sports drinks in young consumers, and preferences shifting toward diets that are rich in proteins, minerals, and vitamins have also been setting a great potential for the protein ingredients industry across North America. In addition, the response from buyers to novelty protein ingredients is encouraging new product development and boosting the R&D effort in the market, which has resulted in increased customer engagement and improved customer generation.

The North America market accounted for a share of over 37% of the global protein ingredients market in 2023. The use of protein ingredients in the production of food & beverages as well as in the development of animal feed is the main driver of this market in North America. Functional food and beverages have been generating high demand due to increased fitness awareness in the region, which in turn leads to a growing demand for protein ingredients by food & beverage manufacturers.

In addition, an upsurge in the consumption of products such as energy bars, cold cereals, and snacks infused with protein ingredients. The region has also identified the high consumption of high-protein, low-fat, and cholesterol-free beverages. The overall atmosphere filled with increased awareness is also accompanied by a higher rate of new cases and incidents related to cardinal health, especially in the age group 30-40, has fuelled the growing consumption of protein-rich food and beverages.

Increased activity related to research & development in the market has been one of the key reasons responsible for growing revenue. The local markets across the region are filled with a variety of alternative products that are rich in protein or have the presence of protein ingredients in one way or another. Growing trends of shifting diets to vegan from regular omnivore patterns have also been encouraging research and innovation like never before. Though, at a reduced level than earlier, animal-based protein ingredients are still popular with customers and are also been used in industries such as personal care, pharmaceuticals, and cosmetics.

As with every other industry in the world, the protein ingredients market has also been experiencing environmental sustainability concerns. This has encouraged the industry to explore newer sources such as microbes and insects. However, to ensure the high quality, of these types of protein ingredients, the industry is regularised with stringent regulations developed by government bodies.

Market Concentration & Characteristics

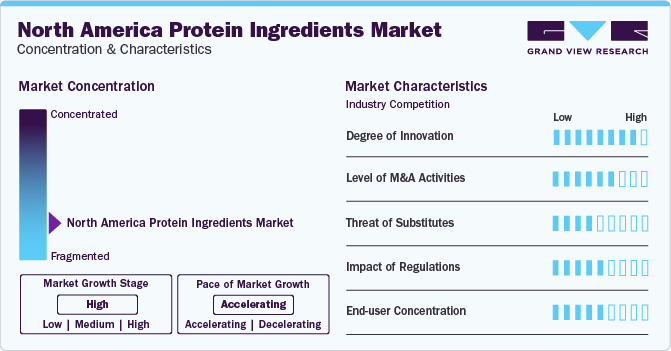

The protein ingredients industry in the region is growing at an accelerating pace and the growth stage is identified as high. The North America protein ingredients market is fragmented and primarily characterized by a high degree of innovation as consumer demands have been changing with increased market penetration of innovation protein ingredients market. The technological advancements have been fuelling innovation in the industry like never before. Companies have been discovering a variety of new sources for proteins. The emphasis on strategies aligned with sustainable sourcing techniques is also encouraging the industry participants to innovate constantly.

Mergers and acquisitions in the industry are primarily done to enhance operational capacities, bring in expertise from several functional areas, and expand the product portfolio to generate a presence in newer segments and markets. Established companies, equipped with extremely advanced technological know-how and decades of experience often acquire new entrants to engage in diversified product development.

Threat of substitute is quite at low level, as these protein ingredients provide unparalleled source of nutrition and products developed to include similar elements are generally similar and work as complementary products. The protein ingredients sourced from a variety of sources such as plants, animals, insects have found application in several industries including food & beverages, personal care and more. This scenario is backed with popularity of sources such as animal-based protein ingredients and cost-effectiveness in terms of insect-based protein ingredients.

The industry is moderately impacted by regulations. The prime regulations associated with this market are regarding the quality, environmental footprint, edible standards, shelf life of the offerings, and clear labeling. The industry consumers are from numerous groups such as vegans, omnivores, and vegetarians among others which makes it important for companies to provide detailed information about elements used by the manufacturers in the development of their products.

Products Insights

The animal/dairy protein ingredients market accounted for a revenue share of over 70% in 2023. Despite the changing trends and preferences of customers, animal/dairy proteins have been one of the most chosen alternatives by customers and application industries. This includes types such as egg protein, milk protein concentrates/isolates, whey protein concentrates, whey protein hydrolysates, whey protein isolates, gelatin, casein/caseinates, and collagen peptides. Industries such as food and beverage, animal feed, and personal care industries are highly dependent on the use of animal/dairy proteins in product development processes.

The existing high demand for animal/dairy proteins is backed by scientific evidence and recognition by government authorities, which has been helping the market to reach higher demands.

The North America insect protein market is expected to grow at a CAGR of 16.0% from 2024 to 2030. Protein derived from insects such as crickets is often used as one of the key ingredients in the production of a variety of foods, for instance, bars. One of the popular companies working on introducing snacks and other food products made out of edible insects and proteins, Jimini, has been in the industry since 2012. The company has launched various protein bars, granolas, and snacks where it has used insect proteins as one of the primary ingredients. These proteins derived from insects provide essential amino acids and are rich in vitamins B12, minerals, omega 3, and 6 as well.

Application Insights

The food & beverages industry has been the highest-performing application area for protein ingredients in North America, having accounted for a revenue share of 59% in 2023. Different types of proteins are most commonly used in the development of various products; however, the food & beverage industry has been using them the most. A variety of food developed through protein ingredients have become part of the regular diets of customers. In addition, a high level of innovation and effort to reduce the environmental footprint has led to the introduction of numerous new products offered in the market. For instance, the protein ingredients sourced from plant-based sources are part of several fitness-friendly foods, protein bars, shakes, sports drinks, and other products from similar categories.

The animal feed application segment is projected to grow at a CAGR of 4.8% from 2024 to 2030. Plant & animal protein ingredients are utilized in the form of powders or liquid in animal feed additives to provide essential nutrition to animals to help in their overall growth. Animal & plant protein ingredients when added to feed mixtures aid in improving the rate of weight gaining in animals, preventing diseases and vitamin deficiencies, and improving feed digestion and conversion.

Country Insights

The protein ingredients market in North America is expected to grow at a significant rate over the forecast period on account of the increasing consumption of energy bars, cold cereals, and snacks infused with protein ingredients. New product introductions by companies including Nestlé and Danone are focused on consumer needs for high-protein, low-fat, and cholesterol-free beverages, thus augmenting the protein ingredients market growth.

U.S. Protein Ingredients Market Trends

The protein ingredients market in the U.S. accounted for a revenue share of 77.5% in 2023. The changing trends regarding dietary preferences, awareness about the role of protein ingredients in human health, and unprecedented growth in innovation are the factors responsible for the high demand of protein ingredients. The presence of emerging trends such as the use of flaxseed protein and sunflower seed protein are also driving market growth.

Mexico Protein Ingredients Market Trends

The Mexico protein ingredients market is expected to grow at a CAGR of 5.7% from 2024 to 2030. The innovative products that offer functional benefits to consumers primarily drive the Mexico-based market for protein ingredients. In the recent past, the increasing influence of media advertising in the country has encouraged a huge number of customers to buy protein-rich products.

Key North America Protein Ingredients Company Insights

The North America protein ingredients market consists some of established companies that hold greater market share, as well as a few new entrants who have been gaining customer attention. Some of the common strategies adopted by the companies operating in the market are product innovation, collaboration, the discovery of unexplored areas of the market, and acquisitions as well.

Key North America Protein Ingredients Companies:

- Cargill Incorporated

- ADM

- International Flavors & Fragrances Inc.

- Burcon

- The Scoular Company

- CHS Inc.

- Bunge Limited

- MGP

- Ingredion

- PURIS

Recent Developments

-

In January 2024, International Flavors & Fragrances Inc., one of the global leaders in the food & beverages industry, invested in high-moisture extrusion (HME) technologyfrom Coperion with the intent to develop novel plant-based recipes. This investment enhances the possibility of new product introduction for the North America protein ingredients market.

-

In May 2023, ADM, one of the market leaders operating in sustainably sourced solutions, announced that it is making a series of investments with the intent to expand its business in Brazil. Buckminster Química, a company founded in 1999, primarily manufacturing bi-distilled vegetable glycerine was acquired to further its strategy.

-

In July 2023, PURIS joined hands with Palmer Holland, Inc., which promised to support PURIS in activities such as distribution, marketing, and sales of pea protein, pea fiber, and upcycled pea starch. The strategic partnership is aimed at enhancing operations in food & beverage, sports nutrition, health, pet food, and nutraceuticals markets specifically in the US and Canada.

-

One of the global leaders in the development of plant-based proteins for food and beverages, Burcon NutraScience Corporation, announced in December 2023, that it entered into a partnership agreement with HPS Foods & Ingredients, to cater to overwhelming demand for its products. According to this agreement, Burcon will share existing infrastructure and manufacturing capabilities with its contract partner with the specific intention to commercially produce hempseed protein.

North America Protein Ingredients Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.66 billion

Revenue forecast in 2030

USD 26.46 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast Period

2024 - 2030

Quantitative units

Revenue in USD billion/million, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecasts, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products, application, country

Key companies profiled

Cargill Incorporated; ADM; International Flavors & Fragrances Inc.; Burcon; The Scoular Company; CHS Inc.; Bunge Limited; MGP; Ingredion; PURIS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Protein Ingredients Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America protein ingredients market report on the basis of product, application, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion; 2018 - 2030)

-

Plant Proteins

-

Cereals

-

Wheat

-

Wheat Protein Concentrates

-

Wheat Protein Isolates

-

Textured Wheat Protein

-

Hydrolyzed Wheat Protein

-

HMEC/HMMA Wheat Protein

-

-

Rice

-

Rice Protein Isolates

-

Rice Protein Concentrates

-

Hydrolyzed Rice Protein

-

Others

-

-

Oats

-

Oat Protein Concentrates

-

Oat Protein Isolates

-

Hydrolyzed Oat Protein

-

Others

-

-

-

Legumes

-

Soy

-

Soy Protein Concentrates

-

Soy Protein Isolates

-

Textured Soy Protein

-

Hydrolyzed Soy Protein

-

HMEC/HMMA Soy Protein

-

-

Pea

-

Pea Protein Concentrates

-

Pea Protein Isolates

-

Textured Pea Protein

-

Hydrolyzed Pea Protein

-

HMEC/HMMA Pea Protein

-

-

Lupine

-

Chickpea

-

Others

-

-

Roots

-

Potato

-

Potato Protein Concentrate

-

Potato Protein Isolate

-

-

Maca

-

Others

-

Ancient Grains

-

Quinoa

-

Sorghum

-

Amaranth

-

Chia

-

Millet

-

Others

-

-

Nuts & Seeds

-

Canola

-

Canola Protein Isolates

-

Hydrolyzed Canola Protein

-

Others

-

Almond

-

Flaxseeds

-

Others

-

-

-

-

Animal/Dairy Proteins

-

Egg Protein

-

Milk Protein Concentrates/Isolates

-

Whey Protein Concentrates

-

Whey Protein Hydrolysates

-

Whey Protein Isolates

-

Gelatin

-

Casein/Caseinates

-

Collagen Peptides

-

-

Microbe-based Protein

-

Algae

-

Bacteria

-

Yeast

-

Fungi

-

-

Insect Protein

-

Coleoptera

-

Lepidoptera

-

Hymenoptera

-

Orthoptera

-

Hemiptera

-

Diptera

-

Others

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion; 2018 - 2030)

- Food & Beverages

-

Bakery & Confectionary

-

Beverages (Non-Dairy Alternatives)

-

Breakfast Cereals

-

Dairy Alternatives

-

Beverages

-

Cheese

-

Snacks

-

Others

-

-

Dietary Supplements/Weight Management

-

Meat Alternatives & Extenders

-

Poultry

-

Beef

-

Pork

-

Others

-

-

Snacks (Non-Dairy Alternatives)

-

Sports Nutrition

-

Others

-

-

Infant Formulations

-

Clinical Nutrition

-

Animal Feed

-

Others

- Food & Beverages

-

Country Outlook (Volume, Kilotons; Revenue, USD Billion; 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America protein ingredients market size was estimated at USD 18.79 billion in 2023 and is expected to reach USD 19.66 billion in 2024.

b. The North America protein ingredients market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 26.46 billion by 2030.

b. The U.S. dominated the North America protein ingredients market with a share of 77.5% in 2023. The changing trends regarding dietary preferences, awareness about the role of protein ingredients in human health, and unprecedented growth in innovation are the factors responsible for the high demand of protein ingredients in the country.

b. Some key players operating in the North America protein ingredients market include Cargill Incorporated, ADM, International Flavors & Fragrances Inc., Burcon, The Scoular Company, CHS Inc., Bunge Limited, MGP, Ingredion, and PURIS.

b. Key factors that are driving the market growth include the shift of consumer focus towards preventive healthcare and the consequent demand for nutrient-rich foods, including protein-enhanced products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."