- Home

- »

- Medical Devices

- »

-

North America Product Design And Development Services Market, Report, 2030GVR Report cover

![North America Product Design And Development Services Market Size, Share & Trends Report]()

North America Product Design And Development Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Research, Strategy & Concept Generation, Concept & Requirements Development), By Application, By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68039-918-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

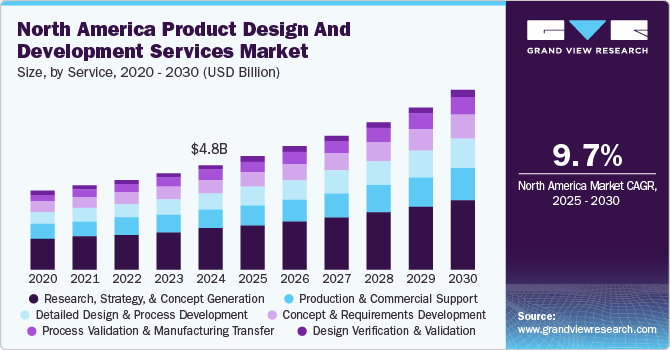

The North America product design and development services market size was estimated at USD 4.82 billion in 2024 and is projected to grow at a CAGR of 9.71% from 2025 to 2030. The market growth is primarily driven by the increasing demand for high-quality products and the growing complexity of product design and engineering. Rising regulatory requirements and advancements in medical technology add complexity to development processes, propelling demand for specialized services. Additionally, manufacturers face pressure to reduce operational costs while maintaining rigorous quality standards. Growth in the medical device sector, spurred by an aging population, escalating healthcare needs, and rising healthcare costs, further supports market expansion. These factors led to a surge in the need for efficient, compliant, cost-effective product design and development services, thereby accelerating market demand.

Continuous advancements in healthcare technology, particularly within the medical device industry, led to increasingly complex product designs that require sophisticated engineering methods. Navigating this complexity while ensuring compliance with stringent regulations drives healthcare companies to seek specialized product development services. The complex nature of designing complex devices requires precise methodologies and technical expertise, which proliferate the growth in design and development services.

The growing demand to manage and reducing operational costs without compromising product quality is a critical factor bolstering the market growth. Clinical trials are resource-intensive, involving significant expenses in data management, site selection, and patient recruitment. Thus, several companies are outsourcing design and development services to optimize product designs and streamline development processes to reduce costs to experienced service providers, boosting overall market growth. Moreover, cost-efficient strategies help maintain competitive pricing while meeting regulatory requirements, making cost management a significant driver in the adoption of product design and development services.

Furthermore, the growing demand for home healthcare and advanced, portable devices in North America led to the rapid development of next-generation diagnostic, therapeutic, and monitoring equipment designed for compactness, versatility, and precision. This customer-driven healthcare model drives innovation in customized wearables, electronic health records, and wireless, internet-connected systems that enable user-friendly, convenient home healthcare solutions.

Further, there is rising customer interest in tracking & recording information regarding their health habits. Initially, the personal informatics movement, also known as data journaling or health quantification, gained significant popularity owing to the introduction of mobile apps that made it easier for people to keep track of miles run & calories consumed per day, among others. As several companies launched advanced devices integrated with accelerometers & sensors to capture data automatically, users are freed from filling in information independently. Moreover, numerous companies are proactively involved in the innovative design, development, and launch of a wide range of wearable medical devices that cater to multiple tracking and analyzing tools such as heart & pulse rate, blood oxygen & respiration level, sleep monitoring, heat flux, galvanic skin response, etc. are likely to strengthen market demand.

Service Insights

The research, strategy, & concept generation segment dominated the market, accounted for over 39.64% revenue share in 2024. The segment is estimated to maintain its leading position over the forecast period. The segment growth is due to the comprehensive research required at this stage, which includes identifying user needs, evaluating the competitive landscape, and assessing relevant technologies. Increased investment in R&D activities is expected to enhance growth opportunities for this segment. Additionally, the rising demand for innovative diagnostic and therapeutic solutions continues to drive market demand in North America.

On the other hand, the process validation and manufacturing transfer segment is predicted to witness the highest CAGR over the forecast period. With the increasing adoption of additive manufacturing and automation technologies, the need for rigorous process validation is vital to ensure reproducibility and consistency in product outcomes. This trend highlights the critical role of validation processes in meeting stringent regulatory and quality standards for the high reliability of healthcare products across clinical trials and commercial manufacturing.

Application Insights

The medical device segment dominated the market and accounted for the largest share in the overall revenue in 2024. The segment is expected to maintain its position over the forecast period. The medical device segment is further sub-segmented into therapeutic equipment, surgical instruments, clinical laboratory equipment, diagnostic equipment, biological storage, consumables, and others. The segment growth can be attributed to the rising demand for accurate diagnostic equipment, innovative therapeutic devices, and efficient clinical laboratory tools propels investment in specialized services. Additionally, the growth of minimally invasive surgical instruments and biological storage solutions requires rigorous trial processes to ensure safety and compliance. Consumables like syringes and catheters require rapid development cycles, further highlighting the need for reliable design services.

The pharmaceutical segment is expected to witness considerable growth potential over the forecast period. Further, the pharmaceutical segment is sub-segmented into oncology, cardiovascular diseases, CNS disorders, autoimmune diseases, ophthalmology, and others. Advances in technology and biotechnology and increased investment in research and development are driving innovation and the need for specialized design and development services. Additionally, evolving regulatory requirements and a shift toward patient-centric approaches are accelerating market growth. Collaborations between pharmaceutical companies and research organizations further enhance the demand for comprehensive product design and development services, ensuring effective trial methodologies and successful outcomes across therapeutic areas.

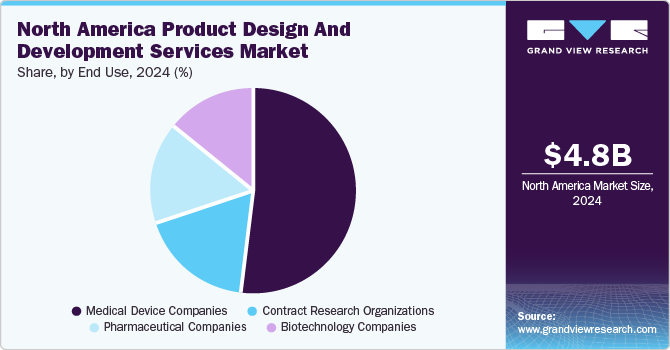

End Use Insights

The medical device companies segment dominated the market in 2024 and accounted for the largest share of the overall revenue and is anticipated to witness fastest growth over the analysis timeframe. This growth is primarily driven by the increasing demand for advanced and high-quality medical products. Additionally, a notable trend toward smaller, more portable devices necessitates the adoption of advanced manufacturing technologies, components, and automation techniques. The evolving economic landscape within the medical industry has intensified design and regulatory activities. Over the years, rapid advancements in medical research and surgical innovations have significantly influenced medical device design, represented by the emergence of minimally invasive surgical techniques that have given rise to new categories of laparoscopic instruments. These developments, which promise improved patient outcomes, are also propelling the growth of the medical device sector in North America.

The biotechnology companies segment is expected to witness a significant CAGR over the forecast period. The increasing focus on innovative therapies, personalized medicine, and advancements in genetic research drives segment growth. As biotechnology firms strive to develop innovative products, there is a growing demand for specialized design and development services that can navigate complex regulatory environments and optimize clinical trial processes.

Country Insights

U.S. Product Design And Development Services Market Trends

The product design and development services market in U.S. dominated in the North America and accounted for 82.26% revenue share in 2024. Rapid growth in the manufacturing of medical devices to meet the increasing demand for efficient healthcare in the U.S. is expected to be one of the key factors propelling the market growth. Moreover, growing inclination toward medical device product design and development outsourcing by medical device manufacturers due to the requirement of high maintenance and efficient systems for the management of raw materials that help in minimizing the overall setup costs and regulatory requirements.

Key North America Product Design And Development Services Company Insights

The key companies are implementing several market growth strategies, such as collaboration, merger & acquisition, expansion, service portfolio expansion, and competitive pricing, to gain competitive edge in the market. For instance, In May 2023, DeviceLab partnered with Nouslogic Telehealth, Inc. to develop and commercialize next generation remote patient monitoring systems and wireless medical devices. Such partnerships offered numerous growth opportunities to the company in a significant market.

Key North America Product Design And Development Services Companies:

- Ximedica (Veranex)

- DeviceLab, Inc.

- Jabil Inc.

- Flex Ltd.

- Plexus Corp.

- Celestica Inc.

- StarFish Medical

- Nordson Medical

- Planet Innovation

- Donatelle

- Cambridge Design Partnership Ltd.

- Integer Holdings Corporation

- Cirtec

Recent Developments

-

In November 2023, Arch Systems, the prominent provider of data, analytics, and insightful solutions for manufacturing operations collaborated with Plexus Corp. Through this partnership, Plexus Corp. gain access to ArchFX platform across its SMT lines within production facilities across the globe to enhance the company’s industry 4.0 journey. This integration enables Plexus to capture essential analytics at several levels as well as enhancing its operation capabilities.

-

In May 2023, StarFish Medical signed a license agreement with Cybeats Technologies Corp for SBOM Studio to enhance cyber security management and help to adhere with FDA guidelines related to SBOMs for market approval of new products. Such partnerships broadened the company’s service offering of the company.

North America Product Design And Development Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.22 billion

Revenue forecast in 2030

USD 8.29 billion

Growth rate

CAGR of 9.71% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, application, end use, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Ximedica (Veranex); DeviceLab, Inc.; Jabil Inc.; Flex Ltd.; Plexus Corp.; Celestica Inc.; StarFish Medical; Nordson Medical; Planet Innovation; Donatelle; Cambridge Design Partnership Ltd.; Integer Holdings Corporation; Cirtec

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

North America Product Design And Development Services Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America product design and development services market report on the basis of service, application, end use, and country:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Research, Strategy, & Concept Generation

-

Concept & Requirements Development

-

Detailed Design & Process Development

-

Design Verification & Validation

-

Process Validation & Manufacturing Transfer

-

Production & Commercial Support

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Device

-

Diagnostic Equipment

-

Therapeutic Equipment

-

Clinical Laboratory Equipment

-

Surgical Instruments

-

Biological Storage

-

Consumables

-

Others

-

-

Pharmaceuticals

-

Oncology

-

Cardiovascular Diseases

-

CNS Disorders

-

Autoimmune Diseases

-

Ophthalmology

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Device Companies

-

Pharmaceutical Companies

-

Biotechnology Companies

-

Contract Research Organizations

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America product design and development services market size was estimated at USD 4.82 billion in 2024 and is expected to reach USD 5.22 billion in 2025.

b. The North America product design and development services market is expected to grow at a compound annual growth rate of 9.71% from 2025 to 2030 to reach USD 8.29 billion by 2030.

b. The research, strategy, & concept generation services segment dominated the market with a share of 39.62% in 2024. This is attributable to extensive research, business, and design strategy that generates maximum revenue.

b. Some of the players operating in this market are Ximedica; Celestica Inc.; DeviceLab, Inc.; Jabil, Inc.; Plexus Corp.; Planet Innovation; Flex Ltd.; Starfish Medical; Nordson MEDICAL; and Donatelle

b. Key factors that are driving the North America product design & development services market growth include increasing demand for advanced and quality medical products, growing trend of small and more portable products, and increasing demand for health data tracking.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.