- Home

- »

- Paints, Coatings & Printing Inks

- »

-

North America Powder Coatings Market, Industry Report, 2019-2025GVR Report cover

![North America Powder Coatings Market Size, Share & Trends Report]()

North America Powder Coatings Market Size, Share & Trends Analysis Report By Resin Type (Epoxy, Polyester, Hybrid, Acrylic), By Application (Consumer Goods, Automotive, Architectural), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-042-2

- Number of Report Pages: 270

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2015

- Forecast Period: 2017 - 2025

- Industry: Bulk Chemicals

Industry Insights

The North America powder coatings market size was valued at USD 1.91 billion in 2016 and is projected to expand at a CAGR of 6.8% over the forecast years. The industry is projected to witness significant gains over the next few years as a result of product’s ability to substitute conventional technologies including solvent borne products. Powder coatings are usually used in finished goods in several industries, such as automotive, industrial and construction equipment, and architecture. Major companies, such as Samsung, Mercedes Benz, Bosch, and Whirlpool, use in many of their products.

Rapidly expanding automotive manufacturing sector in the U.S. and Mexico is projected to augment the product demand in numerous applications including door handles, rims, and under hood components of vehicles. Increased use of the product can be attributed to the superior finish offered than liquid paints. In addition, demand for domestic appliances, such as washing machine, freezer cabinet, and microwave oven, is likely to augment the demand for powder coatings in these applications. The Clean Air Act of 1970 has resulted in restricting the use of liquid products in automotive and industrial manufacturing in the U.S. owing to their high VOC emission levels and adverse effects on the environment.

Traditionally, powder has been used to coat only certain parts of the automotive, such as chassis and engine parts. However, with several advancements it is now used for other parts including wheels, radiators, bumpers, shock absorbers, engine blocks, coil springs, and mirror frames, thereby boosting the product demand in the automobile industry. Major product manufacturers invest more in R&D to develop advanced products and solutions that are environmentally friendly and meet the set standards, such as the EU’s VOC Regulation 2004/42/EC. For example, The Dow Chemical Company launched an additive, ACRYSOL RM-725, which is solvent-free and forms a zero VOC paint formulation.

However, fluctuating prices of raw materials, such as titanium dioxide, resins, and pigments, may restrict market growth to some extent. On the other hand, increasing demand for cars and commercial vehicles in developing countries, such as Mexico, is projected to drive the powder coatings market over the next few years. Moreover, population growth, urbanization, and rising disposable income in Mexico have played an important role in increasing manufacturing in construction, energy and personal care industries. In addition, low manufacturing cost and vicinity to the U.S. have resulted in increasing the importance of Mexico as a manufacturing hub for automobile, oil & gas, electronics, personal care and pharmaceutical sectors.

Application Insights

In an architectural application, the product is applied to aluminum extrusions used in doorframes, windows, building facades, bathroom, kitchen, as well as electrical fixtures, as it provides protection from cold, heat, and corrosion. Infrastructural development in Mexico coupled with surging aluminum production is anticipated to augment the use of aluminum extrusion over the upcoming years. This is projected to augment the product demand in near future.

Furthermore, increasing demand for tractors in the U.S. and Canada on account of higher yields and economies of scale is expected to augment product demand. In addition, the general industrial application segment is also expected to witness substantial growth due to increased budgets on infrastructural developments as a result of increasing spending on sports. This is likely to spur the demand for soccer goals, golf courts, basketball backstops, cafeteria tables, and sports bicycles, thereby boosting market growth.

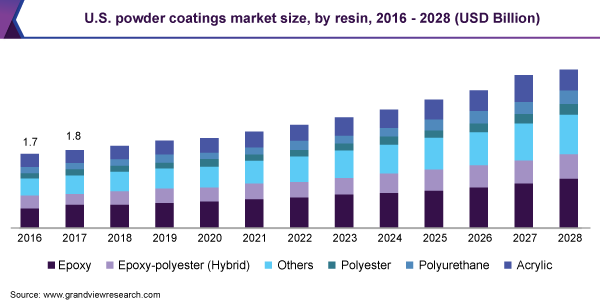

Resin Type Insights

Epoxy resin accounted for 29.0% of the overall market volume in 2016 and is projected to exhibit a significant growth owing to superior properties including resistance to stain, blistering, cracking, and extreme temperatures. Growing demand for these resins in the product is likely to stimulate the segment growth.

Epoxy resin is used in the product owing to high durability, which extends the life span of the paint. Polyurethane offers consistent finish and easy removal of dirt and dust by water. Increasing demand for polyurethanes owing to high abrasion, impact resistance along with excellent resistance to grease, oil, and water will augment the segment development.

Country Insights

Production capacity expansion by major automotive companies in the U.S. is projected to augment the demand for paints and coatings products. For instance, recently, BMW announced to expand its plant production capacity in Spartanburg, U.S., which will fuel the demand for architectural paints and coatings. Moreover, development and expansion of airports in New Orleans, Orlando, Los Angeles, and Tampa are anticipated to increase the product demand. Construction of new buildings will fuel the product demand in architectural applications over the forecast years. In addition, presence of various manufacturers in the country like Sherwin-Williams is likely to augment market growth over the next few years.

Continuing further, construction sector in Canada witnessed weak growth in the past due to low commodity prices, delicate economic conditions, high rate of unemployment, and poor capital investments. However, the industry is anticipated to foresee substantial growth with increasing government investments, development of public infrastructure, rising number of commercial projects. In addition, several government initiatives, such as the New Building Canada Plan (NBCP), Made in Canada, and Affordable Housing Initiative (AHI) will augment the product demand in construction sector over the coming years.

North America Powder Coatings Market Share Insights

Companies require significant capital investment owing to stringent specifications regarding testing and labeling of coatings before and after placing it in the market, thereby discouraging entry of new players in the market. Major market participants are investing heavily in R&D for manufacturing advanced products to meet set norms and regulations resulting in dynamic market conditions. AkzoNobel developed an improved technology intended towards reduction in cycle time of coating process. BASF SE developed a new anti-sticker powder coating called RELEST to prevent soiling and lower the cleaning costs.

Chemical companies, such as Bayer, have established strategic tie-ups with the companies in this market enabling an effective value chain. Some of the key companies in the market are BASF SE; Kansai Paint Co. Ltd.; PPG Industries, Inc.; Nippon Paint Holdings Co., Ltd.; Valspar Corporation; Sherwin-Williams Company; AkzoNobel N.V.; Eastman Chemical Company; Arkema S.A.; The Jotun Group; Koninklijke DSM N.V.; The Dow Chemical Company; Evonik Industries AG; and Ferro Arte de Mexico.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2015

Forecast period

2017 - 2025

Market representation

Volume in Kilotons, Revenue in USD Million, and CAGR from 2017 to 2025

Regional scope

North America

Country scope

U.S., Canada, and Mexico

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the North America powder coatings market report on the basis of resin type, application, and country:

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Epoxy

-

Polyester

-

Hybrid

-

Acrylic

-

Polyurethane

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

Consumer Goods

-

Architectural

-

Automotive

-

General Industries

-

Furniture

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

-

The U.S.

-

Canada

-

Mexico

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."