- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Post-consumer Recycled Plastics In Food Packaging Market, Industry Report 2030GVR Report cover

![North America Post-consumer Recycled Plastics In Food Packaging Market Size, Share & Trends Report]()

North America Post-consumer Recycled Plastics In Food Packaging Market Size, Share & Trends Analysis Report By Raw Material, By Recycling Method (Chemical, Mechanical), By Plastic Type (PP, PET), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-298-3

- Number of Report Pages: 104

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

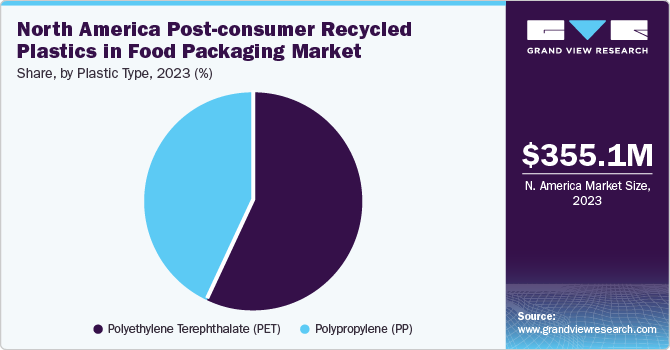

The North America post-consumer recycled plastics in food packaging market size was estimated at USD 355.13 million in 2023 and is expected to grow at a CAGR of 11.5% from 2024 to 2030. The growth of the market can be attributed to increasing consumer demand for sustainable packaging solutions, stringent regulatory measures promoting recycling and waste reduction, advancements in recycling technologies to improve the quality and availability of recycled plastics, and growing awareness among businesses about the environmental and economic benefits of utilizing post-consumer recycled plastics in food packaging applications.

As consumer awareness about environmental concerns grows, there is an increasing demand for eco-friendly packaging materials, particularly in North America. This trend is driving the adoption of post-consumer recycled plastics in food packaging applications, as manufacturers seek to align with sustainability goals and meet regulatory requirements. Moreover, the availability of post-consumer recycled plastics in North America provides an opportunity for companies to reduce their environmental footprint while catering to the preferences of environmentally conscious consumers.

Key market trends in include the growing emphasis on circular economy principles, technological advancements in recycling processes, and increasing collaborations across value chains to enhance the availability and quality of recycled materials. For instance, in March 2024, INEOS collaborated with GreenDot, Irplast, and Amcor to launch a packaging film containing 50% recycled plastic for the snack brand, Sunbites, which is owned by PepsiCo. Stringent regulations and initiatives promoting recycling and sustainability further drive market growth by incentivizing the use of post-consumer recycled plastics in food packaging. As companies prioritize sustainability and consumers continue to demand eco-friendly products, the North America post-consumer recycled plastics in food packaging market is expected to witness steady growth with environmental considerations playing a central role in shaping market dynamics and driving innovation.

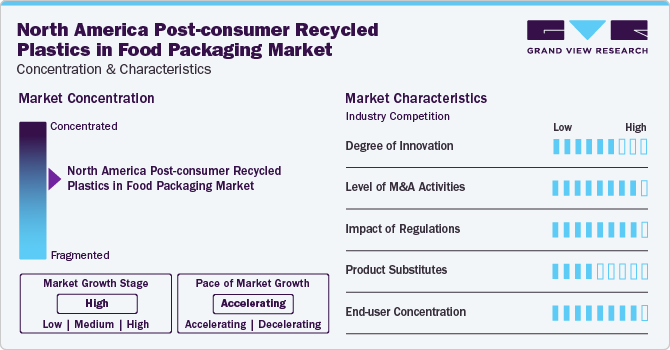

Market Concentration & Characteristics

The market growth stage is high and the pace is accelerating. The market exhibits a significant level of market concentration with key players dominating the industry landscape. Major companies such as Rubicon Global, Rumpke, Cascades Recovery+, Emterra Group Inc., GreenMantra Technologies, Method Products, PBC, Patagonia, Inc., Anchor Packaging,Re-Purpose Global, Plastic Bank, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Regulations in the plastic industry have a significant impact, driving industry players to invest in advanced recycling technologies and quality assurance measures for the production of sustainable plastic materials that can be recycled. Compliance with regulatory frameworks ensures patient safety, fosters innovation, and establishes trust among customers.

The degree of innovation level is high in the market. Innovations such as advanced sorting technologies, chemical recycling methods, and robotic automation are driving improvements in the collection, sorting, and processing of post- consumer plastics. Additionally, developments in material science and additive manufacturing techniques enable the creation of food-safe packaging materials with higher levels of recycled content, meeting industry standards and consumer preferences for sustainability. Integration of digital technologies, such as blockchain and loT sensors, also facilitates traceability and transparency in the supply chain, ensuring the authenticity and quality of recycled plastic packaging materials.

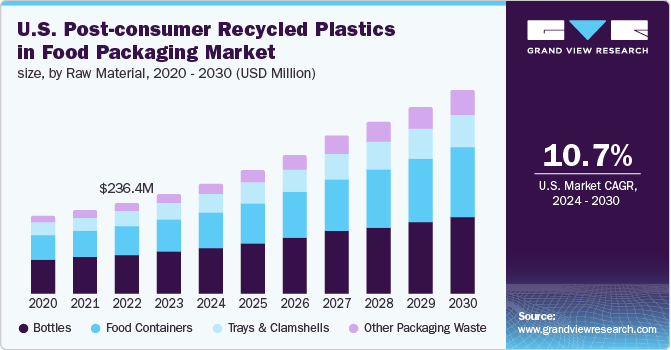

Raw Material Insights

The bottle segment led the market with a share of 42.4% in 2023. Bottles are among the leading raw materials for developing PCR plastics used for food packaging in North America. Increasing consumer awareness about environmental sustainability and surging demand for eco-friendly packaging options are fueling the growth of bottles segment of the market in the region. Consequently, food & beverage companies are increasingly incorporating PCR plastics into their packaging products. For instance, in April 2024, Amcor Plc launched a one-liter bottle made from polyethylene terephthalate (PET) for carbonated soft drinks (CSD). This bottle is manufactured with 100% PCR content.

The other packaging waste segment is expected to witness a substantial CAGR over the forecast period. Other packaging waste includes plastic bags, pouches, wrappers, and films. While these packaging materials serve essential functions in preserving and protecting food items, they also generate significant waste that contributes to environmental pollution. Consumer demand for sustainable packaging solutions continues to rise, leading to growing interest in incorporating PCR plastics into these packaging formats, thereby reducing reliance on virgin plastics and promoting a more circular economy.

Plastic Type Insights

The polyethylene terephthalate (PET) segment held the largest market share in 2023. Post-consumer recycled polyethylene terephthalate (PCR PET) is one of the major plastics with a high recyclability ratio. PCR PET resin offers mechanical, thermal, and chemical resistance and dimensional stability, similar to PET resin, making it ideal for manufacturing bottles and containers for packaging, films & sheets, straps, and fiber for textiles.

The polypropylene (PP) segment is expected to witness significant growth over the forecast period. Polypropylene (PP) plays a significant role in the North America post-consumer recycled (PCR) plastic food packaging market, due to its versatile properties and recyclability. PP is one of the popular choices for food packaging, as it offers excellent resistance to moisture, chemicals, and heat, making it suitable for a wide range of applications. With the growing emphasis on sustainability and the circular economy, the demand for PCR plastics is rising, including PP in food packaging, to reduce reliance on virgin materials and minimize environmental impact.

Recycling Method Insights

The mechanical segment led the market in 2023. Mechanical recycling plays a vital role in the North American market, serving as a key method for reusing plastic waste into new packaging materials. This process involves collecting used plastic containers, trays, and clamshells, sorting them based on polymer type, and then mechanically processing them into pellets or flakes. These recycled materials can then be used to manufacture new food packaging products, which reduces the need for virgin plastics and mitigates environmental impact.

The chemical segment is anticipated to experience rapid growth during the forecast period. Chemical recycling is emerging as a transformative solution in the North American post-consumer recycled (PCR) plastic food packaging market. This innovative approach offers a viable alternative to traditional mechanical recycling methods by breaking down plastic polymers into their molecular components, which can then be used to produce new plastic materials. Unlike mechanical recycling, which is limited by factors, such as contamination and polymer degradation, chemical recycling enables the recycling of a wider range of plastic types and formats, including multi-layered packaging films and heavily contaminated plastics.

Various companies and research institutions across North America are investing in the development of chemical recycling technologies to address the challenges associated with plastic waste in the food packaging industry. For instance, in October 2023, revalyu Resources, one of the leading chemical PET recycling companies, announced the construction of a PET chemical recycling plant in Georgia, U.S., at an investment worth USD 200 million. The plant is expected to have a capacity of 200 million pounds per year (90,000 tons/year). The commissioning of this facility is expected by the Q3 of 2025.

Country Insights

U.S. Post-consumer Recycled Plastics In Food Packaging Market Trends

The U.S. market is expected to grow at a CAGR of 10.7% from 2024 to 2030, owing to the rise in plastic waste generation by consumers, leading to its recyclability. The presence of several food packaging companies, such as ReVital Polymers, Emerald Packaging, Inc., and revalyu. Resources in the country, is significantly driving the demand for PCR plastics in food packaging in the U.S.

The Canada post-consumer recycled plastics food packaging market held a significant share of revenue in 2023. Increasing concerns over landfills and plastic waste in Canada are creating awareness about sustainable solutions, such as PCR plastics, in the country and fueling their demand. Moreover, the regulations proposed by the federal government in the country, including the Minimum Recycled Content Act that includes a specific percentage of PCR by 2030, are pushing manufacturers to adopt PCR plastic solutions.

The post-consumer recycled plastics food packaging market in Mexico is growing at a substantial rate and is expected to maintain it through the forecast period. The manufacturing industry is growing in Mexico, owing to low labor costs and free trade agreements of the country with the U.S. and Canada. This is anticipated to fuel the demand for food-grade PCR plastics in Mexico over the forecast period.

Key North America Post-consumer Recycled Plastics In Food Packaging Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, new product launches, capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In April 2024, Amcor plc launched one-liter bottles made of polyethylene terephthalate (PET) for carbonated soft drinks (CSD). The product is manufactured using 100% post-consumer recycled (PCR) content.

-

In April 2024, ForeFront Supply Chain Solutions, a packaging and supply chain solution provider, launched polyethylene (PE) bags in the U.S. with 30% PCR content.

Key North America Post-consumer Recycled Plastics In Food Packaging Companies:

- Celanese Corporation

- BASF SE

- SABIC

- Eastman Chemical Company

- Exxon Mobil Corporation

- Novolex

- DOW, Inc.

- Veolia Group

- Plastic Recycling, Inc.

- ReVital Polymers

- KW Plastics

- NaturaPCR (Waste Management)

- PetStar

- Revolution Company

- PureCycle Technologies, Inc.

North America Post-consumer Recycled Plastics In Food Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 395.22 million

Revenue forecast in 2030

USD 759.22 million

Growth rate

CAGR of 11.5% from 2024 to 2030

Base Year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Raw material, recycling method, plastic type, country

Country scope

U.S., Canada, Mexico

Key companies profiled

Celanese Corporation; BASF SE; SABIC; Eastman Chemical Company; Exxon Mobil Corporation; Novolex; DOW, Inc.; Veolia Group; Plastic Recycling, Inc.; ReVital Polymers; KW Plastics; NaturaPCR (Waste Management); PetStar; Revolution Company; PureCycle Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Post-consumer Recycled Plastics In Food Packaging Market Report Segmentation

This report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America post-consumer recycled plastics in food packaging market report based on raw material, recycling method, plastic type, and country:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Food containers

-

Trays and clamshells

-

Other Packaging Waste

-

-

Recycling Method Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Mechanical

-

-

Plastic Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Polyethylene Terephthalate (PET)

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America post-consumer recycled plastics in food packaging market size was estimated at USD 355.13 million in 2023 and is expected to reach USD 395.22 million in 2024.

b. The North America post-consumer recycled plastics in food packaging market is expected to grow at a compound annual growth rate of 11.5% from 2024 to 2030 to reach USD 759.22 million by 2030.

b. The U.S. emerged as the largest regional segment and accounted for 73.11% of the market in 2023, owing to the rise in plastic waste generation by consumers, leading to its recyclability.

b. Some of the key players operating in this industry include Celanese Corporation; BASF SE; SABIC; Eastman Chemical Company; Exxon Mobil Corporation; Novolex; DOW, Inc.; and Veolia Group, among others

b. The expanding demand for post-consumer recycled plastics in food packaging is being driven by the increasing consumer demand for sustainable packaging solutions, stringent regulatory measures promoting recycling and waste reduction, advancements in recycling technologies to improve the quality and availability of recycled plastics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."