- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Polyolefin & Engineering Plastic Compounding Market, Report 2030GVR Report cover

![North America Polyolefin And Engineering Plastic Compounding Market Size, Share & Trends Report]()

North America Polyolefin And Engineering Plastic Compounding Market Size, Share & Trends Analysis Report By Product (Polyolefin, Engineering Plastics), By Application (Consumer Appliances, Packaging), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-303-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

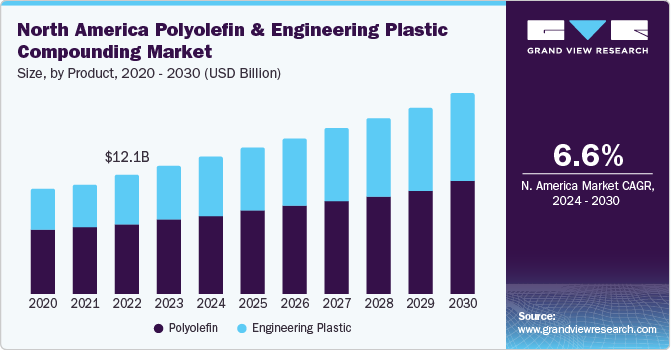

The North America polyolefin and engineering plastic compounding market size was estimated at USD 12.93 billion in 2023 and is expected to grow at a CAGR of6.6% from 2024 to 2030. The growth of the market is primarily driven by the escalating demand across diverse end-use sectors, such as packaging, automotive, and construction. This can be attributed to the remarkable attributes of polyolefins and engineering plastics such as lightweight, durability, and cost-effectiveness.

North America is a highly competitive market with significant demand for polyolefin and engineering plastic compounds across various end-use sectors such as automotive and electrical & electronics. The presence of prominent automobile manufacturers, such as Chrysler, Tesla, Ford, and Cadillac coupled with high disposable income are expected to drive the regional market growth. In addition, the market is characterized by the presence of several established suppliers and high domestic demand, particularly in the automotive end-use sector. Polyolefin and engineering plastics find many applications in various industries due to their versatile benefits, easy molding, and desired shape formation. Many automobile manufacturers prefer plastic vehicle components, which aid companies in achieving low-cost production.

The recent surge in production utilizing shale gas and increasing exploration activities have enabled North American consumers and producers to obtain an unprecedented level of cost-effectiveness, which, in turn, has bolstered the demand for polyolefin & engineering plastic compounding.

Rapid infrastructure expansion in the U.S. and Mexico is expected to increase product demand in the coming years. National measures to support the recovery of the housing sector are expected to have a positive impact on future construction development. Reconstruction activities in the U.S. coupled with infrastructure development in Canada and Mexico owing to rapid industrialization are expected to create huge market potential for polyolefin & engineering plastic compounds in North America over the forecast period.

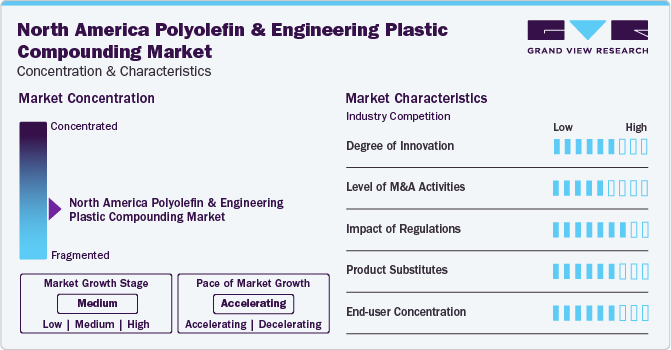

Market Concentration & Characteristics

The market is moderately consolidated, with key participants involved in R&D and technological innovations. Notable companies include BASF SE, LyondellBasell Industries Holdings B.V., Dow, Inc., DuPont, SABIC, RTP Company, and S&E Specialty Polymers, LLC (Aurora Plastics), among others. Several players are engaged in framework development to improve their market share.

Plastics are non-biodegradable and require concerted recycling using accepted techniques to avoid potential harm to the environment. Various federal and government regulations have been implemented to regulate and control plastic waste and reduce its negative impact on the environment.

Regulations in the plastic industry have a significant impact, driving industry players to invest in advanced technologies and quality assurance measures for the production of sustainable polyolefins and engineering plastic materials, which can be recycled. Compliance with regulatory frameworks ensures patient safety, fosters innovation, and establishes trust among customers.

Companies are pursuing regional expansion strategies through market entry into new geographic areas, forming partnerships with local distributors, and customizing products to align with rising needs for bio-based materials including polyolefin & engineering plastic in each region.

Product Insights

In terms of product revenue, the polyolefin segment accounted for the largest revenue share of 58.1% in 2023. Polyolefin is a polymer derived from a small set of simple olefins. It is nonporous, odorless, and nonpolar materials that finds applications in various industries including packaging, automotive, consumer goods, electrical & electronics, and building & construction, among others. Polyolefin finds applications in aforementioned industries owing to its lightweight nature, sealing capabilities, ease of processing, and stiffness. Player operating in the polyolefin market are focusing on innovation and new product development.

The engineering plastic segment is expected to grow at the fastest CAGR of 6.3% from 2024 to 2030. Engineering plastics refer to high-performance plastics with better mechanical and thermal properties than conventional plastics. Acrylonitrile butadiene styrene (ABS), acetal, polyamide (PA), polybutylene terephthalate, polyethylene terephthalate, and polyvinyl chloride are some of the major engineering plastics. Increasing applications of these plastics in industries, such as automotive, medical, packaging, and consumer electronics, among others, have increased their consumption in aforementioned industries in recent years. Players operating in the market are launching new products to meet the rising demand for engineering plastic products such as PET and PBT.

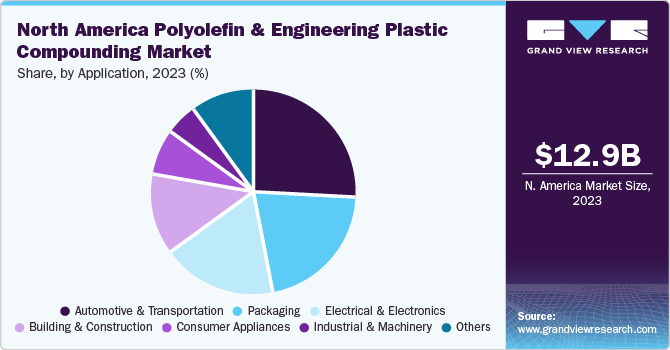

Application Insights

In terms of application, the automotive & transportation segment led the market in 2023 with share of 25.8%. The increasing production of automobiles in North America is driving the growth of polyolefin & engineering plastic compounding market in the region. Plastics compounds such as polypropylene (PP), polybutylene terephthalate (PBT), and polymethyl methacrylate (PMMA) are extensively used in various automotive applications such as exterior body parts, wiper arm casing & housings, bumpers, moldings, front grilles, cladding, and roof trims. The wide application scope of these materials can be attributed to their low thermal expansion, high stiffness, lightweight, good dimensional stability, resistance to moisture, good scratch resistance, and impact resistance in low temperatures.

The packaging segment is expected to witness the fastest CAGR of 7.5% during the forecast period. The demand for polyolefin & engineering plastic compounds in the packaging industry in North America is driven by mass consumption in the U.S. and Canada. Various regulatory agencies have established guidelines for packaging materials used in products that remain in contact with food. The use of polypropylene formulation results in the development of a cost-effective packaging solution with improved impact strength, flexibility, transparency, and process efficiency. The high demand for polyethylene in the packaging industry has contributed significantly to the growth of the regional plastic compound market.

Country Insights

U.S. Polyolefin & Engineering Plastic Compounding Market Trends

The polyolefin & engineering plastic compounding market in U.S. is expected to grow significantly over the forecast period. The U.S. has one of the world’s largest automotive markets with the presence of several large vehicles and auto parts manufacturers. The demand for engineered plastic compounds in the country is majorly generated by the expanding automotive industry coupled with rising construction activities. Engineer plastics such as PVC, PET, PBT, ABS, PMMA, and polyacetal are majorly used in the automotive industry. Capacity addition and plant expansion by automotive companies in the U.S. are further expected to augment the demand for polyolefin & engineering plastic compounds.

Canada Polyolefin & Engineering Plastic Compounding Market Trends

The polyolefin & engineering plastic compounding market in Canadais likely to account for a significant demand for plastic compounding owing to the rising demand in the automotive industry for new vehicles, mainly among the aging baby boom population in Canada. In addition, Canada holds favorable trade agreements with the Asian and European regions, which has bolstered the automotive industry’s growth, in turn, driving the polyolefin & engineering plastic compounding market.Moreover, the growth of the electronics sector in Canada is also a crucial factor for the polyolefin & engineering plastic compounding market growth. Polyolefin offers high heat resistance, which makes it ideal for use in various electronic devices such as cables and integrated circuit components.

Mexico Polyolefin & Engineering Plastic Compounding Market Trends

The Mexico polyolefin & engineering plastic compounding market is witnessing constant economic growth in the past few years. Rapid urbanization & industrialization, positive growth in the automotive, construction, and services sectors, and considerable investments in infrastructure are the key factors driving the market. The expanding automotive sector, on account of electric vehicles and the shift in consumer purchase behavior from considering cars as luxuries to now considering them as necessities, is anticipated to fuel the growth of the polyolefin & engineering plastic compounding market in the country.

Key North America Polyolefin And Engineering Plastic Compounding Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

Key North America Polyolefin And Engineering Plastic Compounding Companies:

- BASF SE

- LyondellBasell Industries Holdings B.V.

- Dow, Inc.

- DuPont

- SABIC

- RTP Company

- S&E Specialty Polymers, LLC (Aurora Plastics)

- Asahi Kasei Corporation

- Covestro AG

- Washington Penn

- Ascend Performance Materials

- KURARAY CO., LTD.

- TEIJIN LIMITED

- Evonik Industries AG

- 3M

Recent Developments

-

In January 2024, Sirmax introduced a recycled plastic door panel material with the presence of volatile organic compounds (VOCs) on interior finishes in automobile interiors. The application of this recycled PP compound extends beyond door panels, providing a versatile option for various automobile components such as glove compartments and center consoles.

-

In May 2023, Borealis AG announced the launch of a new class of engineering polymer known as Stelora. This new product can be used for various applications. However, high-heat-resistant capacitor film was its first commercially available application. This dielectric film made from Stelora offers benefits similar to a dielectric film made using PP resin, with notable enhancements such as superior electrical properties at high temperatures and exceptional heat resistance.

-

In February 2023, Polyplastics Co., Ltd., an engineering plastics manufacturer, announced the launch of a new polybutylene terephthalate (PBT), namely, DURANEX 201EB PBT Resin. This is an electrically conductive grade resin for millimeter wave radar applications in the automotive industry.

North America Polyolefin And Engineering Plastic Compounding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.86 billion

Revenue forecast in 2030

USD 20.37 billion

Growth rate

CAGR of 6.6% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

BASF SE; LyondellBasell Industries Holdings B.V.; Dow Inc.; DuPont; SABIC; RTP Company; S&E Specialty Polymers LLC (Aurora Plastics); Asahi Kasei Corporation; Covestro AG; Washington Penn; Ascend Performance Materials; Kuraray Co. Ltd.; Teijin Limited; Evonik Industries AG; 3M

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Polyolefin And Engineering Plastic Compounding Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America polyolefin and engineering plastic compounding market report based on product, application, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyolefin

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Ethylene-Vinyl Acetate (EVA)

-

Thermoplastic Polyolefins (TPOs)

-

Polymethyl Methacrylate (PMMA)

-

Other polyolefins

-

-

Engineering Plastic

-

Polycarbonate (PC)

-

Acrylonitrile Butadiene Styrene

-

Polyamide

-

Polyvinyl Chloride (PVC)

-

Thermoplastic Polyester

-

Polyacetal

-

Fluoropolymer

-

Other engineering plastics

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Consumer Appliances

-

Electrical & Electronics

-

Building & Construction

-

Industrial & Machinery

-

Packaging

-

Other applications

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America polyolefin and engineering plastic compounding market size was estimated at USD 12.93 billion in 2023 and is expected to reach USD 13.86 billion in 2024.

b. The North America polyolefin and engineering plastic compounding market is expected to grow at a compound annual growth rate of 6.6% from 2024 to 2030 and reach USD 20.37 million by 2030.

b. The U.S. dominated the North America Polyolefin & Engineering Plastic Compounding market with a share of over 82.8% in 2023. The demand for polyolefin and engineered plastic compounds in the country is majorly generated by the expanding automotive industry coupled with rising construction activities.

b. Some of the key players operating in the North America polyolefin and engineering plastic compounding market are BASF SE, LyondellBasell Industries Holdings B.V., Dow, Inc., DuPont, SABIC, RTP Company, S&E Specialty Polymers, LLC (Aurora Plastics), Asahi Kasei Corporation, and Covestro AG.

b. Key factors driving the North America Polyolefin & Engineering Plastic Compounding market growth include the escalating demand across diverse end-use sectors, such as packaging, automotive, and construction

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."