North America Point Of Entry Water Treatment Systems Market Size, Share & Trends Analysis Report By Technology (RO Systems, Disinfection Methods), By Application (Residential, Industrial), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-315-4

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

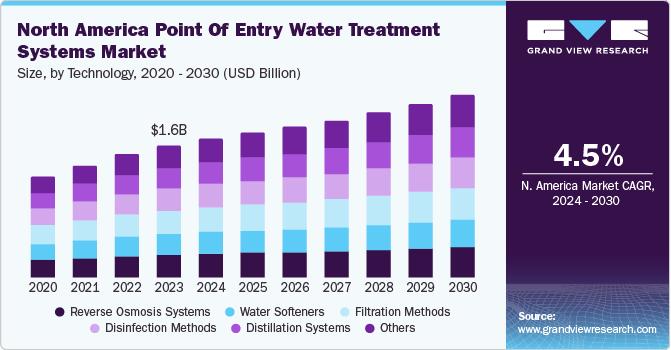

The North America point of entry water treatment systems market size was estimated at USD 1.57 billion in 2023 and is anticipated to grow at a CAGR of 4.5% from 2024 to 2030. With the increasing awareness of the harmful effects of contaminants in water, there has been a growing demand for point of entry water treatment systems in North America. These systems are designed to provide clean and safe water for entire households, removing harmful substances such as bacteria, viruses, and chemicals.

Through the Safe Drinking Water Act, of 1974, the Environment Protection Agency (EPA) has set standards for the quality of drinking water supply, and along with its partners, the agency implements numerous financial and technical programs to safeguard drinking water quality. Furthermore, The Clean Water Act establishes the fundamental framework for controlling the discharge of pollutants into waters and for regulating surface water quality standards. Thus, growing emphasis on the quality of water will drive the market for POE water treatment systems in the U.S.

According to estimates by the Centers for Disease Control and Prevention (CDC), American households are receiving the safest drinking water. Moreover, over 7.1 million Americans contract diseases caused by contaminated water each year. Additionally, with 6,630 deaths per year, the nation has consistently had some of the highest death rates among developed countries. The CDC has also calculated the costs that waterborne diseases have incurred for the American healthcare system, and they total approximately USD 3.3 billion. Such a high figure highlights the increasing demand for point of entry water treatment systems to be installed in hospitals, which are the primary source of most water disease cases seen in hospitals.

Furthermore, the U.S. government is undertaking several initiatives to improve its public infrastructure. For instance, in November 2023, the U.S. Department of Treasury announced a plant to invest USD 7.8 billion investment in airport infrastructure development projects, USD 34.1 billion for public transportation infrastructure, and USD 22.8 billion for water infrastructure in the country. Thus, growing commercial projects in the country are expected to drive the demand for point of entry water treatment systems.

Market Concentration & Characteristics

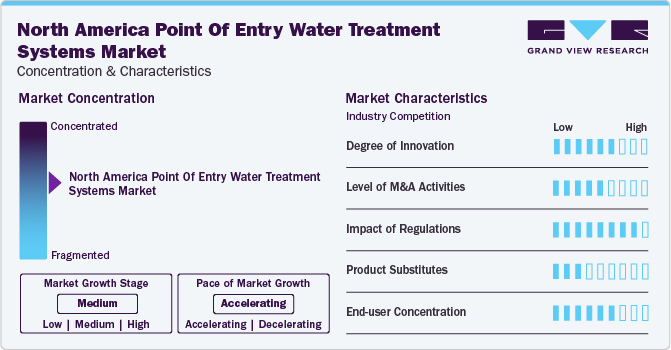

The market growth stage is medium, and the pace is accelerating. The market players are adopting organic and inorganic growth strategies, such as expansions, product launches, and partnerships/collaborations, and mergers & acquisitions, to strengthen their position in the North America market. For instance, Culligan and Waterlogic Inc. announced merger in November 2022, to provide clean and sustainable drinking water solutions and services. This merger will accelerate the delivery of sustainable consumer and commercial water solutions and services, providing clean, safe, and soft water.

Additionally, In March 2023, DuPont introduced PES ultrafiltration membranes. Customers who want to lower the distress of modules necessitated in water purification systems can utilize Multibore PRO as part of a multi-technology approach to municipal drinking water, desalination, or industrial water applications.

The regulatory impact on the market has been significant in North America. Regulations and standards set by organizations such as the Environmental Protection Agency (EPA) and the National Sanitation Foundation (NSF) have played a crucial role in shaping the market. These regulations ensure that the systems meet certain performance standards and are safe for use in homes. As a result, manufacturers have had to invest heavily in research and development to meet these regulations and stay competitive in the market.

The North America market has seen significant technological advancements in recent years. These advancements have enabled manufacturers to develop more efficient and effective systems that provide better water quality for households. One of the key technological advancements in this market is the use of advanced filtration media, such as activated carbon, ceramic filters, and reverse osmosis membranes. These media are designed to remove a wide range of contaminants, including bacteria, viruses, chemicals, and heavy metals.

Additionally, some systems now utilize ultraviolet (UV) and ozone technologies to kill bacteria and other microorganisms. Another significant development is the integration of smart technology into point of entry water treatment systems. Many systems now come equipped with sensors and monitoring systems, which allow homeowners to track their water quality and system performance in real time. Some systems can even be controlled remotely via a smartphone app, making it easier for homeowners to maintain and monitor their systems.

Technology Insights

The filtration methods technology segment held a revenue share of 17.7% in 2023. Point-of-entry water filtration systems eliminated the requirement of individual filter systems at each water dispenser at water usage. These point-of-entry water filtration systems utilize water filters that are either cartridge based or media-based. The most common contaminants removed by the water filtration systems are chlorine, pesticides, herbicides, heavy metals, and other emerging contaminants.

The distillation systems segment is projected to witness lucrative growth rate from 2024 to 2030. Distillation systems have the ability to effectively remove various protozoa, bacteria, and viruses along with chemical contaminants such as sulfate, sodium, nitrate, lead, chromium, cadmium, barium, arsenic, and other organic chemicals. The whole house water distillers are installed at the entry point of water in the home, and distilled water is used for various purposes such as drinking, cooking, cleaning, bathing, laundry, etc.

Application Insights

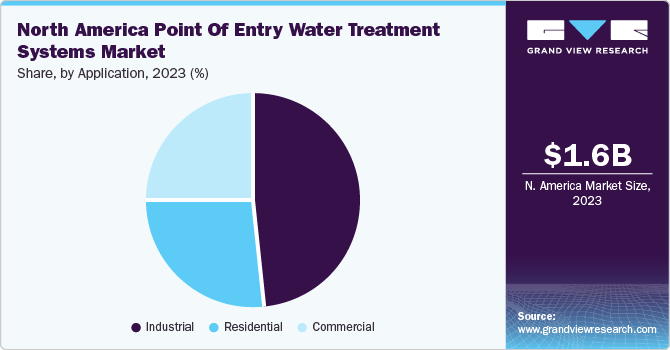

The industrial application segment dominated the market with the highest revenue share in 2023. The water used in various breweries, bottling plants, beverage manufacturing, and food processing facilities must be of high quality; hence, these industries use point of entry water treatment systems. Moreover, the penetration of these systems is increasing in the residential sector as well. The increasing preference for soft, odorless, and filtered water for purposes, such as showering, cleaning, bathing, and washing, is anticipated to contribute to segment growth.

The growing population, rising preference for eating out, and increasing demand for unique cuisines are likely to augment the restaurant industry’s growth, with a corresponding rise in the number of construction projects. Moreover, various global restaurant chains are entering the developing economies eyeing the increasing disposable income of consumers in these regions. For instance, in December 2023, McDonald’s announced a target of reaching 50,000 restaurants by 2027. This will include 1,000 new openings in the U.S. and international markets by 2027. Such strategic expansions by the big restaurant chains across the globe are likely to present increased opportunities for the manufacturers of point of entry water treatment systems. Point of entry water treatment systems are of vital importance for restaurants to maintain safety and comply with regulations related to water quality.

Country Insights

U.S. dominated the North America point of entry water treatment systems market and accounted for 74.0% in 2023. According to the Centers for Disease Control and Prevention (CDC), American households are receiving the safest drinking water. According to the U.S. Department of Health & Human Services 2023 report, there are about 7.2 million Americans who contract diseases caused by contaminated water each year.

According to World Bank, approximately 28,864 low-income households were provided with access to affordable urban housing units as of 2022. Sustainable point-of-entry water treatment systems are becoming increasingly necessary in Mexico due to the country's rapid growth in residential and commercial construction. Systems for treating water are regarded as long-lasting, simple to maintain, and capable of handling large volumes of water at once. Over the forecast period, these factors are anticipated to fuel the market demand for point of entry water treatment systems in Mexico.

Key North America Point Of Entry Water Treatment Systems Company Insights

Some key players operating in the market include 3M, DuPont Pentair plc, and Watts.

-

3M has over 75 years of experience in the field of water treatment. It provides filtration and separation solutions for food service, residential, science labs, marine, industrial, and other applications. The company provides reverse osmosis systems, water softeners, drinking water filters, and whole-house water filters. It has been operating through four business groups, namely safety & industrial, healthcare, consumer, and transportation & electronics.

-

Pentair plc operates through three business segments, namely Aquatic systems, Filtration solutions, and Flow Technologies. The aquatic systems business segment focused on manufacturing residential and commercial pool equipment and accessories including filters, pumps, heaters, lights, automatic cleaners, and automatic controls. Pentair, Sta-Rite, and Kreepy Krauly are the key brands in this segment. The filtration solutions business segment is engaged in the design, manufacture, and marketing of filtration and separation solutions for residential, commercial, food & beverage, and industrial applications. As of December 2023, it had 42 manufacturing facilities, 37 distribution facilities, 19 sales and corporate offices, and around 41 service centers globally.

BWT Holding GmbH, Culligan, and Watts are some emerging market participants in the market.

-

BWT Holding GmbH has five R&D sites including one in each Modsee, France, Germany, Russia, and Switzerland. Apart from these, BWT has 80 affiliated companies and subsidiaries along with an extremely well-curated distribution network that is instrumental in supplying its products to a large number of customers. It offers water treatment products and technologies to households, public facilities, swimming pools, industrial sites, hotels & hospitality sectors, and hospitals. As of December 2023, the company has 10 manufacturing facilities across the world..

-

Watts Water Technologies (WTS) is a leading provider of flow control and water management solutions for residential, commercial, and industrial applications worldwide. It was started as a small shop supplying machine parts to the New England textile mill, along with producing pressure reduction valves to safeguard the workings of boilers and water purification treatment systems and heaters. In 1985, Watts Water Technologies, Inc. was incorporated and is the parent company of Watts Regulator Co. Watts Water Technologies, Inc. operates through four business segments including residential & commercial flow control products, HVAC & gas products, drainage & water reuse products, and water quality products. The water quality products segment includes point-of-entry & point of use water filtration systems, monitoring & metering products, and conditioning & scale prevention systems for marine, commercial, and residential applications.

Key North America Point Of Entry Water Treatment Systems Companies:

- 3M

- DuPont

- Pentair plc

- BWT Holding GmbH

- Culligan

- Watts

- Aquasana, Inc.

- Calgon Carbon Corporation

- EcoWater Systems LLC

- GE Appliances

Recent Developments

-

In March 2023, DuPont introduced PES ultrafiltration membranes and DuPont Multibore PRO. Customers who want to lower the distress of modules necessitated in water purification systems can utilize Multibore PRO as part of a multi-technology approach to municipal drinking water, desalination, or industrial water applications.

-

In December 2023, Watts agreed to acquire Josam Company, a provider and manufacturer of drainage and plumbing products for over 100 years. This acquisition will expand sales networks and provide increased cross-selling opportunities.

North America Point Of Entry Water Treatment Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.65 billion |

|

Revenue forecast in 2030 |

USD 2.15 billion |

|

Growth rate |

CAGR of 4.5% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/ billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, application, country |

|

Country scope |

U.S.; Canada; Mexico |

|

Key companies profiled |

3M; DuPont; Pentair Plc; BWT Holding GmbH; Culligan; Watts; Aquasana, Inc.; Calgon Carbon Corp.; EcoWater Systems LLC; GE Appliances |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Point Of Entry Water Treatment Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America point of entry water treatment systems market based on technology, application, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Reverse osmosis systems

-

Water softeners

-

Disinfection methods

-

Filtration methods

-

Distillation Systems

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Offices

-

Hotels

-

Restaurants

-

Café

-

Hospitals

-

Schools

-

Others

-

-

Industrial

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America point of entry water treatment systems market size was estimated at USD 1.57 billion in 2023 and is expected to reach USD 1.65 billion in 2024.

b. The North America point of entry water treatment systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 2.15 billion by 2030.

b. The filtration methods technology segment held a revenue share of 17.7% in 2023. Point-of-entry water filtration systems eliminates the requirement of individual filter systems at each water dispenser at water usage. The most common contaminants removed by the water filtration systems are chlorine, pesticides, herbicides, heavy metals, and other emerging contaminants.

b. Some of the key players operating in the North America point of entry water treatment systems market include 3M; DuPont; Pentair Plc; BWT Holding GmbH; Culligan; Watts; Aquasana, Inc.; Calgon Carbon Corp.; EcoWater Systems LLC; GE Appliances

b. With the increasing awareness of the harmful effects of contaminants in water, there has been a growing demand for point of entry water treatment systems in North America. These systems are designed to provide clean and safe water for entire households, removing harmful substances such as bacteria, viruses, and chemicals.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."