North America Plumbing Fixtures Market Size, Share & Trends Analysis Report By Product, By Deployment (Residential, Commercial), By Distribution Channel, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-269-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

The North America plumbing fixtures market size was valued at USD 29.15 billion in 2024 and is projected to grow at a CAGR of 7.7% from 2025 to 2030. The increasing pace of development of residential and commercial projects in the region, coupled with the popularity of home redevelopment and refurbishing activities, has created substantial growth opportunities for companies manufacturing bathroom and kitchen fixtures. Furthermore, to cater to the dynamic consumer demands in the U.S. and Canada, brands are launching products that offer multifunctionality benefits and a strong aesthetic appeal. With water conservation becoming an important consideration for homeowners and business owners, products such as smart plumbing fixtures are expected to witness strong growth in demand in the coming years.

The U.S. and Canadian governments have significantly increased their investments in the construction sector, influencing the demand for bathroom and kitchen fixtures and accessories. According to a report published by Construction Coverage, the overall annual spending in the U.S. construction industry reached USD 2.0 trillion in 2023, with 1.5 million homes being built during the year. Homeowners are substantially investing in upgrading and remodeling existing bathrooms and kitchens, often choosing high-efficiency or luxury plumbing fixtures. The continuous migration of people from rural to urban areas creates a constant demand for plumbing fixtures across residential and commercial projects. Besides, the construction of commercial establishments, including offices, airports, railway stations, stadiums, shopping malls, and supermarkets, has also steadily grown in number. This has further boosted the demand for plumbing fixtures in the region. The growing trend toward energy-efficient and water-saving products, such as low-flow toilets and faucets, is also creating growth avenues for the North American plumbing fixtures industry.

Innovations in plumbing technology, including smart plumbing systems, touchless faucets, and sensor-based fixtures, are attracting consumer interest. These products often provide convenience, sustainability, and enhanced efficiency, which aligns with growing preferences for modern and eco-friendly solutions. For instance, in January 2022, Moen announced the launch of the smart Faucet with motion control, part of the company’s Moen Smart Water Network portfolio. The product is an upgraded version of the company’s smart faucet offering, featuring advanced touchless technology that enables users to control water flow and temperature using basic hand motions effectively. Consumers are becoming more conscious of the aesthetic appeal of plumbing fixtures, choosing products that align with modern design trends. This has increased demand for premium fixtures, such as designer faucets, showerheads, and bathtubs. Consequently, manufacturers are diversifying their product lines to offer both cost-efficient and premium offerings to address a range of requirements.

The rising focus on personalization and modernization has led consumers to purchase fixtures and accessories that complement home decor. Customizable options, such as finishes (brushed nickel, matte black, and gold), handle styles, and unique faucet designs, allow people to match their plumbing products with their bathroom or kitchen aesthetics. This drives demand for high-quality, custom-made fixtures. According to the 2024 U.S. Houzz Bathroom Trends Study, consumers increasingly prioritize personalization over resale value when renovating their bathrooms. The survey, conducted among over 1,200 consumers, found that the share of those preferring resale value dropped by five percentage points in 2024 (26%) over the previous year (31%).

On the other hand, the share of residents aiming to create a more accommodating space grew by 4 points, reaching 27%. The report also stated that investments in primary bathroom projects in 2023 increased by 11% from 2022, highlighting a growing consumer intent to use better quality fittings and accessories in these spaces. Such factors are expected to aid market growth during the forecast period.

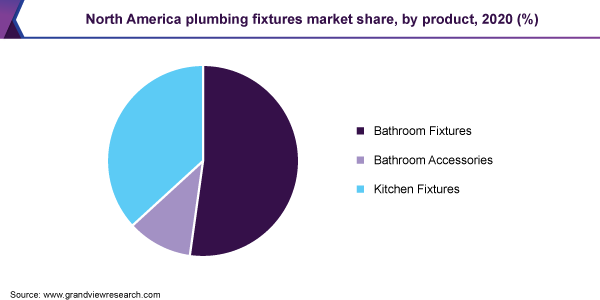

Product Insights

The bathroom fixtures segment accounted for a leading revenue share of 51.9% in the North America plumbing fixtures industry in 2024. Bathroom fixtures include a range of products such as bathtubs, sinks, showers, toilets, drains, faucets & taps, and others. As a necessity in bathrooms, these components have become essential purchases for new homeowners or those undertaking remodeling projects. Moreover, increasing environmental awareness among consumers in the U.S. and Canada has resulted in a strong demand for water-saving bathroom fixtures such as low-flow toilets, eco-friendly showerheads, and faucets with adjustable flow rates. Both consumers and governments are pushing for more sustainable solutions, influencing manufacturers to develop products that comply with water conservation standards.

The kitchen fixtures segment, meanwhile, is expected to grow at the fastest CAGR from 2025 to 2030 in the regional market. Kitchens, similar to bathrooms, are an essential part of every household, making them a major construction aspect for developers and remodeling companies. The remodeling of the kitchen, basement, and bathroom is emerging as the main focus area among regional consumers. This highlights the importance of upgrading kitchen features among homeowners to reflect modern trends and styles, leading to a constantly growing demand for products such as faucets, sink bowls, and pot filters, among other fixtures.

Deployment Insights

The commercial deployment segment accounted for a leading revenue share in the regional market in 2024. The rise in the construction of office buildings, hotels, multi-family residential complexes, shopping centers, and educational institutions has generated a corresponding need for quality plumbing fixtures in these spaces. New commercial construction projects drive a substantial portion of the demand for fixtures in regional economies. Several older commercial establishments also undertake renovations or upgrades regularly to meet current building codes, improve efficiency, or modernize design. This includes the replacement of outdated plumbing fixtures to enhance both functionality and aesthetics in kitchens and bathrooms. Additionally, the emergence and adoption of green building standards, such as LEED (Leadership in Energy and Environmental Design) and TRUE certification (Canada), encourage the demand for sustainable plumbing fixtures, aiding segment expansion.

The residential segment is expected to advance at a steady CAGR in the North America plumbing fixtures industry due to the increasing development of single-family homes and residential complexes in the region. Growing aging homes lead to plumbing fixture issues or inefficient performance. This has helped sustain a strong demand for replacing and upgrading existing plumbing fixtures. Homeowners often opt to remodel their kitchens and bathrooms, where plumbing fixtures are central to the functioning. A strong preference to modernize spaces with efficient, stylish, or luxurious fixtures is a major market driver. Smart faucets, touchless or motion-sensor faucets, and shower systems with temperature controls or app-based management are becoming popular in residential settings as they offer convenience, water savings, and an optimal user experience. Thus, the increasing incorporation of smart home technologies in bathrooms and kitchens has positively impacted the demand for plumbing fixtures.

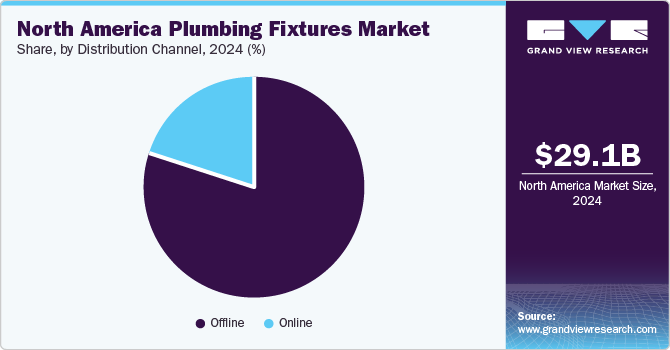

Distribution Channel Insights

The offline segment accounted for the largest revenue share in the global market in 2024. A majority of consumers prefer to comprehensively touch and see plumbing fixtures in person before making a purchase. Physical stores offer the opportunity for customers to test the functionality, durability, and design of products such as faucets, showerheads, and sinks, which can be crucial in their decision-making process. Moreover, in-store demonstrations of products, such as the operation of a faucet or the feel of a showerhead, are influential in encouraging purchase decisions. Retailers often showcase working models, allowing consumers to witness the product’s features directly. Physical stores often stock a broad range of products from multiple brands, addressing every consumer need for their project in a single location, which is important for large-scale home or commercial renovations.

The online segment is anticipated to expand at the highest CAGR from 2025 to 2030 in the North America plumbing fixtures industry. Online shopping platforms allow consumers to browse and purchase plumbing fixtures at their convenience, making it a time-saving operation, particularly for those with busy schedules who may not have the time to visit physical stores. Online platforms offer the convenience of home delivery, which appeals to consumers preferring to avoid the hassle of transporting large or bulky items such as faucets, showerheads, or sinks from stores to their homes. These platforms also enable consumers to quickly compare products, prices, and features across multiple retailers, helping them make more informed purchasing decisions. The ability to read reviews, view detailed product descriptions, and compare similar items has become a highly in-demand online shopping feature.

Country Insights

U.S. Plumbing Fixtures Market Trends

The U.S. plumbing fixtures market accounted for a dominant revenue share of 69.8% in the North American region in 2024. Improving infrastructure in the economy and rising disposable income levels of consumers have enabled homeowners to invest significantly in upgrading their homes. This has created major growth avenues for companies developing products such as fixtures and accessories for bathrooms and kitchens. According to the U.S. Census Bureau’s Survey of Construction (SOC) report for 2022, around 4.4% of newly constructed single-family homes in the country had at most one bathroom. Meanwhile, 62.3% of homes had two complete bathrooms, 25.8% had three full bathrooms, and 7.5% had four or more bathrooms. This showcases the popularity of a multiple-bathroom setup in American households, which generates a higher demand for items such as sinks, showers, taps, and bathtubs.

Canada Plumbing Fixtures Market Trends

Canada is expected to advance at the fastest CAGR from 2025 to 2030 in the North America plumbing fixtures industry. The rising pace of development of housing projects in the economy and the growing hospitality sector has led to substantial sales of plumbing accessories for kitchens and bathrooms. There is an increasing trend toward upgrading bathrooms and kitchens with luxurious plumbing fixtures, especially in the country’s new construction or renovation projects. Premium materials, such as brushed gold and polished chrome, are in high demand for fixtures such as faucets, showerheads, and other products. A steadily growing demographic is considering luxury options as an effective way to enhance the overall home aesthetic and value. In the regions of Canada that experience extreme cold, there is a higher focus on plumbing products that can withstand freezing conditions. This includes insulated pipes, freeze-proof outdoor faucets, and other fixtures designed for harsh winter climates.

Key North America Plumbing Fixtures Company Insights

Some major companies involved in the North America plumbing fixtures industry include Delta Faucet Company, Moen Incorporated, and Brizo Kitchen & Bath Company, among others.

-

Delta Faucet Company is a U.S.-based manufacturer of plumbing fixtures, primarily known for its innovative faucets and bathroom accessories. The company specializes in commercial and residential faucets and other bathroom and kitchen products. For bathroom projects, the company offers sink faucets, shower heads, shower filters, bathing fixtures, and accessories for these segments. For kitchens, it manufactures sink faucets, specialty faucets, kitchen sinks, and accessories such as soap dispensers and glass rinsers. Delta Faucet Company operates through several notable brands, including DELTA, Kraus, and Peerless.

-

Moen Incorporated designs and manufactures kitchen and bathroom fixtures and smart home equipment related to these spaces. It develops kitchen products, including sink faucets, MotionSense Wave faucets, pulldown faucets, pullout faucets, workstation sinks, under-mount sinks, filtration faucets, and sink accessories. It manufactures single-handle faucets, widespread faucets, showerheads, spa systems, tubs, bidet seats, electronic toilets, and shower rods for the bathroom category.

Key North America Plumbing Fixtures Companies:

- Dornbracht GmbH & Co. KG

- House of Rohl

- Waterworks Operating Company LLC

- Kohler Co.

- Hansgrohe SE

- GROHE AG

- Lefroy Brooks Ltd

- Delta Faucet Company

- Masco Corporation

- Moen Incorporated

- Brizo Kitchen & Bath Company

Recent Developments

-

In October 2024, Moen announced an extension of its partnership with Meritage Homes, a major U.S. public homebuilder. This enables Moen to continue as Meritage’s exclusive supplier for faucets and bath accessories in the country. As per the multi-year agreement, Moen will provide a customized selection of bath and kitchen faucets, showerheads, and bath accessories, offering homeowners premium quality and durable designs in these spaces. The company’s bath faucets meet EPA WaterSense requirements, enabling environment-conscious customers to reduce their overall water usage.

-

In June 2024, Brizo Kitchen & Bath Company announced the inauguration of Brizo Chicago, the company’s new design studio, at the Merchandise Mart exhibition and trade center in Chicago. The space offers visitors a highly interactive and personalized experience, enabling them to access areas such as the customer lounge, shower experiences, bath and kitchen libraries, and learning stations. Product experts have been deployed to offer a curated product experience, while visitors can also avail themselves of training sessions to better understand Brizo’s products.

North America Plumbing Fixtures Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 31.60 billion |

|

Revenue forecast in 2030 |

USD 45.76 billion |

|

Growth rate |

CAGR of 7.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, deployment, distribution channel, country |

|

Country scope |

U.S., Canada |

|

Key companies profiled |

Dornbracht GmbH & Co. KG; House of Rohl; WATERWORKS Operating Company LLC; KOHLER Co.; Hansgrohe SE; Grohe AG; Lefroy Brooks Ltd; Delta Faucet Company; Masco Corporation; Moen Incorporated; Brizo Kitchen & Bath Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Plumbing Fixtures Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America plumbing fixtures market report based on product, deployment, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bathroom Fixtures

-

Bathtub

-

Sinks

-

Toilet

-

Showers

-

Faucets & Taps

-

Drains

-

Others

-

-

Bathroom Accessories

-

Storage Cabinets (With & Without Mirrors)

-

Towel Storage (Racks, Hangers)

-

Curtains

-

Mirrors

-

Others (Tissue Holders, Soap Dispensers, Curtain Rods, Hooks & Door Pulls)

-

-

Kitchen Fixtures

-

Faucet

-

Single/Double Sink Bowls

-

Others (Pot Filters, Sink Strainers)

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."