- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Plastic Pallets Market Size, Report, 2030GVR Report cover

![North America Plastic Pallets Market Size, Share & Trends Report]()

North America Plastic Pallets Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (HDPE, LDPE, PP), By Product (Nestable, Rackable, Stackable), By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-304-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Plastic Pallets Market Trends

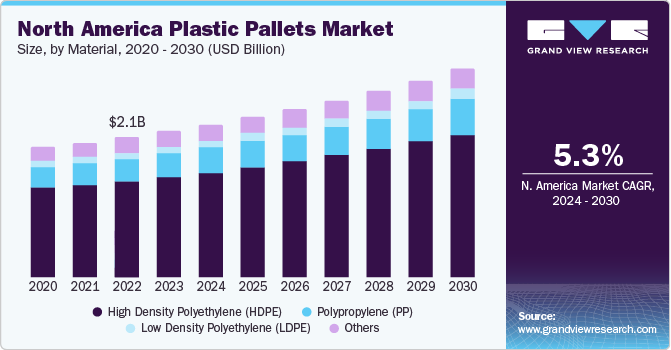

The North America plastic pallets market size was estimated at USD 2.06 billion in 2023 and is expected to grow at a CAGR of 5.3% from 2024 to 2030. Significant advantages exhibited by plastic pallets over traditional wooden pallets such as lightweight design, durability, complete solid structure, resistance to moisture, chemicals, and pests along are contributing to its market growth.

The U.S. stands out among key importing countries such as Mexico, Canada, Japan, China, and Germany. Logistics industry in U.S. is experiencing year-on-year growth due to increasing demand from exports and imports industry and coupled with growing foreign direct investment (FDI) in logistics businesses. Some key companies in U.S. logistics business include Expeditors International of Washington, C.H. Robinson Worldwide, DHL Supply Chain, UPS Supply Chain Solutions, and XPO Logistics, Inc. Increasing demand for logistics services from industries such as food & beverage, pharmaceutical and chemical has increased logistics spending, which reached USD 896 billion in 2022, a 6.1% rise from 2021 (USD 844.5 billion). Growing transportation and logistics industry spending pattern is expected to directly bolster the demand for plastic pallets over forecast period.

Key plastic pallet manufacturing companies in the U.S., such as GT+plastics, Rehrig Pacific Company, CABKA Group, and Allied Plastics, Inc., are updating their technologies to provide faster and better services to customers. For instance, in May 2023, Locus, one of the last-mile logistics technology companies, announced new industry-specific enhancements to its order-to-delivery last-mile logistics platform for its growing retail, CEP, and 3PL customer base.

Unprocessed raw wood-based wood packaging materials such as wooden pallets are a potential pathway for the introduction and spread of invasive pests. According to title 7, (Code of Federal Regulations, part 319.40-3(b)) of USDA’s Animal and Plant Health Inspection Service (APHIS), raw wood packaging materials used for importing products into the country should be treated and marked under an official program developed and overseen by the national plant protection organization in the exporting country. Also, importers are responsible for ensuring their wood packaging products are compliant with the International Plant Protection Convention’s (IPPCs) International Standards for Phytosanitary Measures (ISPM) 15 standards. Such stringent regulations can drive increased adoption of plastic pallets that do not require pest treatment.

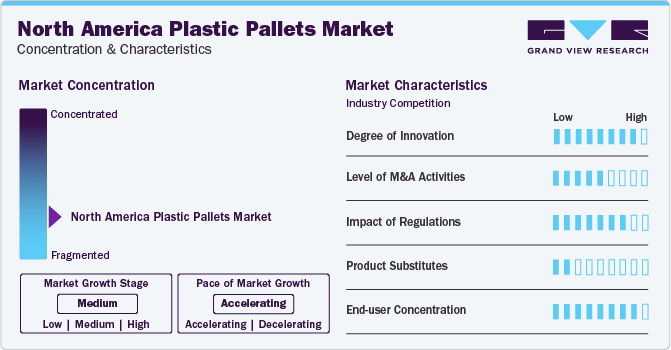

Market Concentration & Characteristics

The North America plastic pallets market is highly fragmented with the presence of a significant number of plastic pallets manufacturers. Mergers and acquisition strategic initiatives are seen to be undertaken by major plastic pallet manufacturers in North America to strengthen their market presence. For instance, in April 2023, Greystone Logistics Inc. announced its plans for the acquisition of Paradigm Plastic Pallets Inc., a Vanderburgh County-based recycled plastic pallets manufacturer. This acquisition is expected to provide Greystone Logistics Inc. access to the hollow profile extrusion process used by Paradigm Plastic Pallets Inc. at its Jasper facility.

Impact of regulations on the North America plastic pallets industry is significantly high. Since plastic pallets are designed to be a suitable alternative to traditional wooden pallets, the U.S. Food & Drug Administration (FDA) mandates testing of plastic pallet material used in food packaging. Plastic pallet manufacturers are required to maintain stringent quality control measures and ensure regular inspections of raw materials, production facilities, and finished products.

Material Insights

High-density Polyethylene (HDPE) dominated the material segment and accounted for the largest revenue share of over 68.0% in 2023. HDPE is extremely durable and offers strong impact resistance, and therefore sustains minimal or no damages due to rough handling by forklifts or any other material handling equipment. In addition, HDPE pallets have high weather and chemical resistance, which make them suitable for pharmaceutical and food applications, thereby contributing to its high market share.

The Polypropylene (PP) segment is expected to progress with a significant CAGR of 5.5% over the forecast period. PP offers stronger impact resistance and tensile strength as compared to HDPE, thus, making PP pallets ideal for heavy-duty applications. Growing demand for returnable pallet options primarily to reduce plastic waste and address sustainability concerns caused by expendable or one-way pallets, which in turn, is expected to contribute to PP pallet market growth.

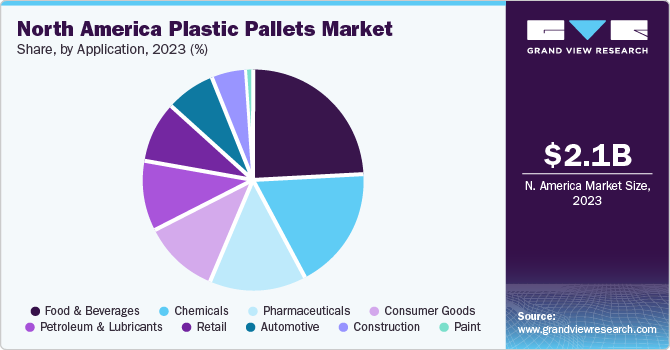

Application Insights

Food & beverages dominated the application segment and accounted for the largest revenue share of over 23.0% in 2023. Plastic pallets provide several advantages over traditional wooden pallets, including durability, resistance to moisture and pests, and ease of cleaning. Plastic pallets help ensure the integrity and safety of products throughout the supply chain in the food & beverages industry, where strict hygiene standards are important contributing to their high market share.

The pharmaceutical application segment is expected to progress at a CAGR of 6.4% over the forecast period. Plastic pallets offer distinct advantages over traditional wooden pallets, particularly in environments where cleanliness, hygiene, and regulatory compliance are important. Pharmaceutical companies in the U.S. and Mexico include Pfizer, Johnson & Johnson, Merck & Co., and Eli Lilly and Company, which rely on plastic pallets due to their resistance to moisture, pests, and contamination, ensuring the integrity and safety of pharmaceutical products throughout the supply chain.

Product Insights

Nestable plastic pallets dominated the North America plastic pallets market in 2023, accounting for a revenue share of over 44.0%. Nestable pallets are nested or stacked within each other, maximizing storage efficiency in warehouses or factory shop floor areas. Their design facilitates easy stacking, thus reducing storage space as compared with rackable and stackable pallets, thus, contributing to their high market dominance.

The rackable plastic pallets segment is expected to progress at a CAGR of 5.8% over the forecast period. These pallets are specifically engineered for use in racking systems and allow end-use companies to maximize their floor space, as the pallets can be placed equidistant in vertical order on the racks. Rackable pallets have a higher strength quotient as compared to stackable and nestable pallets, which makes rackable pallets a better choice for heavy-duty applications, thus contributing to their significant growth rate.

Country Insights

U.S. Plastic Pallets Market Trends

The U.S. dominated North America plastic pallets market, accounting for the largest revenue share of over 82.0% in 2023. Trade agreements like USMCA facilitate smoother trade flows within North America, potentially boosting demand for efficient transportation solutions like plastic pallets. The U.S. is a major trader in USMCA trade agreement. The USMCA has eliminated tariffs that were previously imposed during the NAFTA agreement which can result in increased exports from the U.S. to Canada and Mexico, thereby fueling demand for plastic pallets.

The plastic pallets market in Canada is expected to progress at a CAGR of 6.5% from 2024 to 2030. In February 2024, the government of Canada and the Ontario provincial government announced an investment of USD 6.0 million to help agri-food industry organizations grow and expand their sales under the Grow Ontario Market Initiative. This additional funding brings the total funding for the Initiative through the Sustainable Canadian Agricultural Partnership to USD 12 million, which, in turn, can contribute to agricultural exports and drive demand for plastic pallets in Canada.

The Mexico plastic pallets market is expected to progress at a CAGR of 4.7% over the forecast period. This is attributed to the rapidly expanding industrial hub in Mexico. Mexico has 12 free-trade agreements with approximately 46 countries globally and has been witnessing continuous growth in the automotive and electronics industries. The electronics industry in Mexico is expected to experience a significant growth rate, as it has been exporting electronic goods to countries, such as China, Canada, Germany, and Japan which can drive the demand for plastic pallets.

Key North America Plastic Pallets Company Insights

The North America plastic pallets market is highly fragmented, with a significant presence of global as well as local companies offering various types of plastic pallets. Major market players undertake various strategies such as new product launches, joint ventures, mergers & acquisitions, and geographical expansions to strengthen their market presence.

-

In November 2023, ORBIS Corporation, one of the leading companies in reusable packaging, expanded its existing production facility in Urbana, Ohio in the U.S. The expansion added 30% more space to its tote (bag) and pallet production and allowed the company to increase its presses and tools to enhance its capacity and reduce lead times.

-

In March 2023, Schaefer Plastics North America introduced a new PALLET+ 910 under its Part of the PALLET+ product line. This new pallet enables function both as a nestable and stackable pallet.

Key North Plastic Pallets Companies:

- HEP

- Greystone Logistics

- ORBIS Corporation

- RPP Containers

- GT+plastics

- Rehrig Pacific Company

- Monoflo International

- Cabka Group GmbH

- INDUSTRIAL Pallets

- US Plastic Pallets & Handling

- Buckhorn Inc.

- Custom Built Plastic Pallets

- iGPS

- Decade Products, LLC

- Premier Handling Solutions

- Schoeller Allibert USA

- The Nelson Company

- Paxxal Inc

- Gorilla Pallets

- BearBoard

- TMF Corporation

- TriEnda Holdings, LLC

North America Plastic Pallets Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.25 billion

Revenue forecast in 2030

USD 3.07 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in million units; revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume Forecast, Revenue Forecast, Competitive Landscape, Growth Factors and Trends

Segments covered

Material, product, application, region

Regional scope

North America

Country Scope

U.S.; Canada; Mexico

Key companies profiled

CHEP; Greystone Logistics; ORBIS Corporation; RPP Containers; GT+plastics; Rehrig Pacific Company; Monoflo International; Cabka Group GmbH; US Plastic Pallets & Handling; Buckhorn Inc.; Custom Built Plastic Pallets; iGPS; Decade Products, LLC; Premier Handling Solutions, Schoeller Allibert USA, The Nelson Company; Paxxal Inc.; Gorilla Pallets; BearBoard; TMF Corporation; INDUSTRIAL Pallets; TriEnda Holdings, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Plastic Pallets Market Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of latest industry trends in each sub-segments from 2018 to 2030. For this study, Grand View Research has segmented North America plastic pallets market report based on material, product, application, and region:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

High Density Polyethylene (HDPE)

-

Low Density Polyethylene (LDPE)

-

Polypropylene (PP)

-

Others

-

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Nestable

-

Rackable

-

Stackable

-

Others

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Chemicals

-

Pharmaceuticals

-

Consumer Goods

-

Petroleum & Lubricants

-

Retail

-

Automotive

-

Construction

-

Paint

-

-

Country Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America plastic pallets market was estimated at USD 2.06 billion in the year 2023 and is expected to reach USD 2.25 billion in 2024.

b. The North Ameria plastic pallets market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 3.07 billion by 2030.

b. U.S. under regional segment accounted for largest share of North America plastic pallets market and accounted for a share of over 82.0% in 2023.Trade agreements like USMCA facilitate smoother trade flows within North America, potentially boosting demand for efficient transportation solutions like plastic pallets.

b. Some of the key players in North America plastic pallets market include CHEP, Greystone Logistics, ORBIS Corporation, RPP Containers, GT+plastics, Rehrig Pacific Company, Monoflo International, Cabka Group GmbH, and INDUSTRIAL Pallets among others.

b. Growing adoption of plastic pallets from wooden pallets by end-use industries such as food & beverage and pharmaceuticals and rising demand for lowering overall weight of bulk packaging are driving North America plastic pallets market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.