- Home

- »

- Organic Chemicals

- »

-

North America Phosphate Esters Market Size Report, 2030GVR Report cover

![North America Phosphate Esters Market Size, Share & Trends Report]()

North America Phosphate Esters Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Trialkyl Phosphate Esters, Triaryl Phosphate Esters), By Application (Fire Retardants, Lubricants), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-146-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

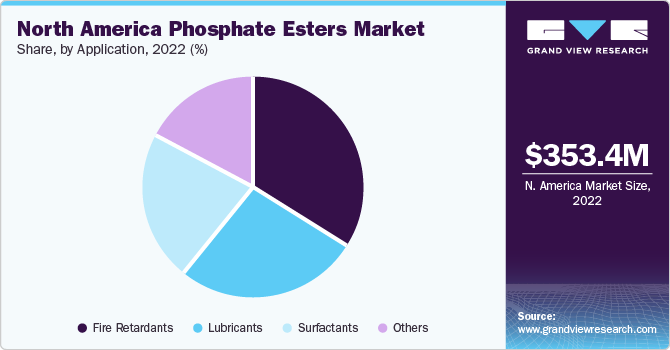

The North America phosphate esters market size was estimated at USD 353.4 million in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 9.2% from 2023 to 2030. This is attributed to its growing usage in widespread applications from lubricants, hydraulic fluids, and agrochemical products such as herbicides, fertilizers, and pesticides. Phosphate esters are produced by phosphoric acid material with polyols such as glycerol, followed by heating the mixture under reduced pressure in the presence of an organic base. The temperature at the time of heating is strictly regulated between 135° to 165° C. They are among the most versatile surfactants partially due to their solubility and stability in the alkali state. Phosphate esters act as effective coupling agents and display excellent emulsification and wetting properties along with low foaming properties.

Phosphate esters are widely used in fire retardant applications due to their oxidation stability and high ignition temperatures. They are added to industrial and consumer products to reduce flammability as well as in foams, hydraulic fluids, anti-foam agents, and plasticizers. In the electronics industry, they are used to provide coatings to electronic equipment to improve their fire-resistant properties.

Phosphate esters have a unique property of being mild which helps them become compatible with living tissue. This unique property makes them a natural alternative for personal care applications. Studies have found potassium lauryl to have the lowest skin irritation-causing effect along with low eye irritation effect. It also brought a fresh and long-lasting skin sensation. These qualities augur well for its usage in personal care applications especially in make-up removal, female hygiene, oral care, and baby products.

Complex structured esters have been developed to improve the toughness, adhesion, and durability of architectural and industrial coatings. These products are also usable for leave-on skin products and hair protection. They provide protective and durable films for hair, skin, and teeth, enabling delayed release of actives and enhanced deposition to extend the period of efficacy in skin care products.

The negative side effects of continuous exposure to phosphate esters on the environment and human health are one of the major restraints for its market. Humans can be exposed to them via oral, dermal, or inhalation routes. Most foods and drinking water have been found to contain traces of esters due to their wide application in plastics and industrial wastewater discharge respectively. Due to these possible ramifications, the Environmental Protection Agency has mandated a limit of 3 and 5 mg/m3 per 8-hour workday for triphenyl and tri-n-butyl phosphate respectively.

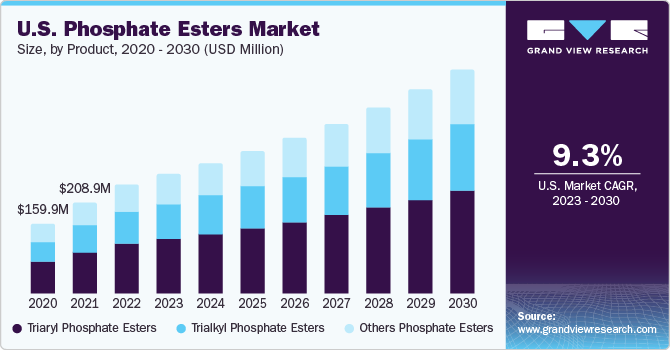

Product Insights

The triaryl phosphate esters dominated the market with the largest revenue share of 45.9% in 2022. This is attributed to their extensive applications in a variety of industries from oil & gas, cleaning, agriculture, pharmaceuticals, and others. Some of them such as tri-n-butyl are also prominently used as solvents as well as extraction agents in chemical processes undertaken in the nuclear industry. This extensive usage in varied industries contributes to it being the dominant segment among phosphate esters.

Trialkyl phosphate esters have widespread usage as flame retardants in textiles, plastics, and other materials. They are also used as plasticizers, enhancing the durability and flexibility of plastic products, especially in the production processes of PVC pipes, vinyl flooring, and cable insulation. The growth of the textiles market along with increasing usage of plastic are the major drivers of growth for the trialkyl phosphate esters segment.

Application Insights

The fire retardants segment dominated the market with the largest revenue share of 33.4% in 2022. This is attributed to the effective ability of phosphate esters to form a protective char layer when exposed to heat. Different forms used in fire retardants include polyurethane forms, which are mainly used in automotive interiors, furniture, and building insulation. The construction industry has emerged as a major applicant of phosphate esters, where it can be used in adhesives and sealants as well as insulation materials in the building to make them fire-resistant.

Lubricants are also one of the major applicants of phosphate esters, where they are added as extreme pressure and anti-wear additives. They help reduce friction between moving parts by forming a lubricating film between surfaces and reducing metal-to-metal contact. These additives also possess anti-corrosion properties, which makes them viable for applications in marine and harsh environments. Some of the esters such as trimethylphenyl phosphate are specially used in high-temperature applications due to their ability to withstand extreme heat.

Regional Insights

The U.S. held the largest revenue share of approximately 70.7% in 2022. This is attributed to the large-scale manufacturing industry present in the country, spanning various end-user sectors of phosphate esters. The industrial sector in the U.S. heavily depends on these compounds in the construction, textile, agriculture, and oil & gas sectors. Phosphate esters are widely deployed in the oil & gas sector in the form of lubricants and additives. The country is a major global producer of oil & gas and is home to several distinguished industry names such as Chevron and Exxon Mobil, as well as international corporations such as BP and Shell. This ensures a constant and growing demand for phosphate esters in the country.

Canada holds a significant position in the market with a rising demand coming from the cleaning and cosmetics industry. Phosphate esters are extensively used in the cosmetics space due to the cleaning and brightening properties provided by them, as well as their non-reactive and non-toxic nature with regard to human skin. The increasing population in Canada, owing to immigration, has also been a leading factor for the increasing consumption of cleaning and personal care products in the country. The stringent environmental regulations set by the Canadian government augur well for the biodegradable variants in esters as they help lower the environmental impact from the end-user industries in the country.

Key Companies & Market Share Insights

Strategically investing in the development of cost-effective and environmentally sustainable products offers significant growth potential for major players within the industry. In addition, these companies are prioritizing the manufacturing of phosphate ester products that are characterized by lower toxicity levels. Notably, the North American market is currently dominated by key industry leaders such as CASTROL LIMITED, Solvay, Exxon Mobil Corporation, and Stepan Company.

Prominent market leaders exercise significant control, leveraging diverse strategic actions like product introductions, expansion endeavors, and mergers & acquisitions. For instance, in September 2022, LANXESS introduced Reolube, a phosphate ester-based lubricant designed to work in steam turbines, as well as turbo-compressors, reactor coolant pumps, and gas turbines.

Key North America Phosphate Esters Companies:

- ELEMENTIS PLC

- CASTROL LIMITED

- Chempri B.V.

- Croda International Plc

- Dow

- Eastman Chemical Company

- Ethox Chemicals, LLC

- Exxon Mobil Corporation

- Kao Corporation

- Lakeland Laboratories Limited

- LANXESS

- Solvay

- Stepan Company

North America Phosphate Esters Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 384.9 million

Revenue forecast in 2030

USD 717.1 million

Growth rate

CAGR of 9.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Kilotons in volume, revenue in USD million, and CAGR from 2023 to 2030

Report Coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

ELEMENTIS PLC; CASTROL LIMITED; Chempri B.V.; Croda International Plc; Dow; Eastman Chemical Company; Ethox Chemicals, LLC; Exxon Mobil Corporation; Kao Corporation; Lakeland Laboratories Limited; LANXESS; Solvay; Stepan Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options North America Phosphate Esters Market Report Segmentation

This report forecasts revenue & volume growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America phosphate esters market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Trialkyl Phosphate Esters

-

Triaryl Phosphate Esters

-

Others Phosphate Esters

-

-

Applications Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Lubricants

-

Fire Retardants

-

Surfactants

-

Others

-

- Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America phosphate esters market size was estimated at USD 353.4 million in 2022 and is expected to reach USD 384.9 million in 2023.

b. The North America phosphate esters market is expected to grow at a compound annual growth rate of 9.2% from 2023 to 2030 to reach USD 717.1 million by 2030.

b. U.S. dominated the North America phosphate esters market with a share of 70.7% in 2022. This is attributable to the large-scale end-use industry present in the country. The U.S. industrial sector relies heavily on them in the textile, construction, agriculture, and oil & gas sectors.

b. Some key players operating in the North America phosphate esters market include ELEMENTIS PLC, CASTROL LIMITED, Chempri B.V., Croda International Plc, Dow, Eastman Chemical Company, Ethox Chemicals, LLC, Exxon Mobil Corporation, Kao Corporation, Lakeland Laboratories Limited, LANXESS , Solvay, Stepan Company.

b. Key factors that are driving the market growth include growing usage in widespread applications from lubricants, hydraulic fluids, and agrochemical products such as weedicides, herbicides, fertilizers, and pesticides.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.