North America PET Laminated Sheet For Thermoforming Market Size, Share & Trends Analysis Report By Type (Clear, Colored), By Application (Food Packaging, Medical, Electrical & Electronics, Industrial/Manufacturing), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-429-2

- Number of Report Pages: 172

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

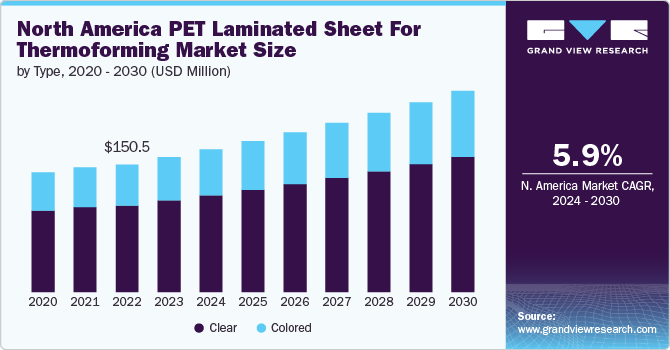

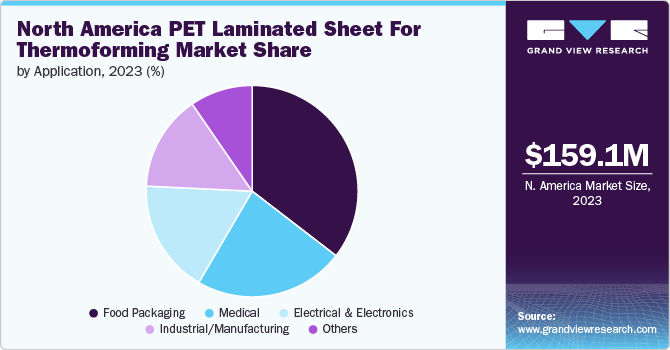

The North America PET laminated sheet for thermoforming market size was valued at USD 159.12 million in 2023 and expected to grow at a CAGR of 5.9% from 2024 to 2030. Growing adoption of thermoformed packaging solutions to pack food, medical, industrial, and other consumer goods products in North America is expected to significantly contribute to the growth of PET laminated sheet for thermoforming market.

One of the prominent trend in the North America PET Laminated Sheet for Thermoforming Market is the increasing adoption of thermoform packaging within North America's food industry. This trend is fueled by several key advantages that thermoform packaging products offer food producers, retailers, and consumers. Thermoform packaging products used in the food industry include trays, clamshells, containers, lids, cups, and bowls.

Drivers, Opportunities & Restraints

The market has witnessed significant growth in recent years, driven by rising demand for PET laminated sheet products and advancements in industries.PET laminated sheets used in thermoforming provide excellent barrier properties against oxygen and moisture, maintaining food freshness and preventing contamination. This is particularly important for perishable items such as fresh produce and meat products.

The growth in the food & beverage sector presents a huge opportunity for the PET laminated sheet for thermoforming market in North America. Moreover, innovations in thermoforming technology, such as improved methods for sorting and processing PET thermoforms, consistent with the growing emphasis on sustainability and circular economy practices in North America are expected to create opportunities for the market.

The market is growing at a rapid rate, however the market faced various challenges. Volatility in raw material supply and prices hinders the market growth.This volatility poses a significant challenge for the manufacturers of PET laminated sheets as it leads to unpredictability in production costs. Companies often face difficulties in planning and budgeting, when the prices of their primary raw materials fluctuate widely within short periods.

Type Insights

The clear segment dominated the market with the revenue share of 67.82% in 2023. The demand for clear PET laminated sheets in North America is driven by several factors, including the growing emphasis on product visibility and the material's recyclability. These clear PET laminated sheets offer excellent visibility, allowing consumers to easily view the contents of packaged products.

The colored type is expected to grow significantly over the forecast period. The colored type segment refers to PET sheets that have been tinted or pigmented to achieve various colors of the sheets. The demand for colored PET laminated sheets in North America is driven by several factors, including the growing emphasis on product esthetics, brand differentiation, and consumer preferences for visually appealing items.

Application Insights

The food packaging segment led the market with a revenue share of 35.46% in 2023. The food segment is a significant application area in the North America PET laminated sheet for thermoforming market. PET laminated sheets are widely used in food packaging, due to their excellent barrier properties, transparency, and ability to be easily thermoformed into various shapes and sizes.

The Medical segment is expected to grow at a significant CAGR over the forecast period. The medical sector represents a crucial application segment for PET laminated sheets in the North American thermoforming market. In medical packaging, PET laminated sheets are used to create blister packs, trays, and containers for pharmaceuticals, surgical instruments, and medical devices.

Country Insights

The U.S. dominated the North America PET laminated sheet for thermoforming market with the highest revenue share of 61.27% in 2023. This market dominance is attributed to the presence of robust end-use industries and growing consumer demand in the country. In the food industry, which is one of the largest consumers of PET laminated sheets, the U.S. market has strong preference for convenient, portable, and visually appealing packaging.

Canada North America PET Laminated Sheet For Thermoforming Market Trends

The outlook for the Canadian automotive aftermarket is promising, with key growth opportunities in emerging trends such as Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS). All these factors are expected to drive the demand for automotive aftermarket parts, which in turn, is expected to propel the growth of Canadian automotive thermoformed plastics parts packaging.

Mexico North America PET Laminated Sheet For Thermoforming Market Trends

Mexico has become a significant manufacturing hub for electronics and consumer goods, with many multinational companies establishing production facilities in the country. These industries require high-quality, protective packaging for shipping and retail display. PET laminated sheets offer protective packaging and are ideal for creating custom thermoformed trays and blister packs for consumer goods such as smartphones, small appliances, and personal care products.

Key North America PET Laminated Sheet For Thermoforming Market Company Insights

The North America PET laminated sheet for thermoforming market is highly competitive, with several key players dominating the landscape. Major companies include Sealed Air; GOEX; Amcor plc; Tekni-Plex, Inc.; and Impact Consumer Products Group. The market is categorized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key North America PET Laminated Sheet For Thermoforming Companies:

- Sealed Air

- GOEX

- Amcor plc

- Tekni-Plex, Inc.

- Impact Consumer Products Group

- Cosmo Films

- Mylar Specialty Films Limited

- TORAY INDUSTRIES, INC.

- FILMQUEST GROUP INC.

Recent Developments

-

In February 2024, Mylar Specialty Films Limited, formerly known as DuPont Teijin Films, rebranded itself to reflect the heritage of the Mylar brand, which was introduced as the world's first biaxially oriented PET film in the 1950s. The company, a joint venture between Celanese Corporation and TEIJIN LIMITED, will continue to market the Melinex PET, Hongji PET, and Kaladex PEN range of products in addition to Mylar PET branded films. The rebranding signals the company’s commitment to innovation, leadership, and meeting the evolving industry needs.

-

In January 2024, Tekni-Plex, Inc. launched a new pharmaceutical-grade PET blister film made from Post-Consumer Recycled (PCR) plastic. This innovative product aims to enhance sustainability in the pharmaceutical packaging sector by incorporating recycled materials while maintaining the necessary performance standards for drug packaging. The introduction of this film also reflects the company’s commitment to developing eco-friendly practices in the industry and meeting the growing demand for sustainable packaging solutions.

-

In January 2024, Amcor plc significantly expanded its thermoforming production capacity at its healthcare manufacturing plant in Oshkosh, Wisconsin (U.S.). This move aims to meet the growing demand from customers in the medical, pharmaceutical, and consumer health sectors in North America.

North America PET Laminated Sheet For Thermoforming Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 168.28 million |

|

Revenue forecast in 2030 |

USD 237.13 million |

|

Growth rate |

CAGR of 5.9% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Base Year |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America |

|

Country Scope |

U.S.; Canada; Mexico |

|

Key companies profiled |

Sealed Air; GOEX; Amcor plc; Tekni-Plex, Inc.; Impact Consumer Products Group; Cosmo Films; Mylar Specialty Films Limited; TORAY INDUSTRIES, INC.; FILMQUEST GROUP INC. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America PET Laminated Sheet For Thermoforming Market Report Segmentation

This report forecasts revenue growth at, country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented North America PET Laminated Sheet for Thermoforming Market report on the basis of type, application, and country:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Clear

-

Colored

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food Packaging

-

Clamshells

-

Blister Packs

-

Fresh Food & Frozen Food Packaging

-

Others

-

-

Medical

-

Electrical & Electronics

-

Industrial/Manufacturing

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The global North America PET laminated sheet for thermoforming market size was valued at USD 159.12 million in 2023 and is expected to reach USD 168.28 million in 2024.

b. The global North America PET laminated sheet for thermoforming market is expected to grow at a CAGR of 4.8% from 2024 to 2030, reaching USD 237.13 million by 2030.

b. Based on type, the clear segment led the market with the largest revenue share of 67.82% in 2023. The demand for clear PET laminated sheets in North America is driven by several factors, including the growing emphasis on product visibility and the material's recyclability.

b. Key players operating in the North America PET laminated sheet for thermoforming market include Sealed Air; GOEX; Amcor plc; Tekni-Plex, Inc.; Impact Consumer Products Group; Cosmo Films; Mylar Specialty Films Limited; among others

b. Growing adoption of thermoformed packaging solutions to pack food, medical, industrial, and other consumer goods products in North America is expected to significantly contribute to the growth of PET laminated sheet for thermoforming market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."