- Home

- »

- Advanced Interior Materials

- »

-

North America Personal Protective Equipment Market, Report 2030GVR Report cover

![North America Personal Protective Equipment Market Size, Share & Trends Report]()

North America Personal Protective Equipment Market Size, Share & Trends Analysis Report By Product (Hand Protection, Respiratory Protection), By End Use (Manufacturing, Healthcare), By Country And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-484-9

- Number of Report Pages: 114

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

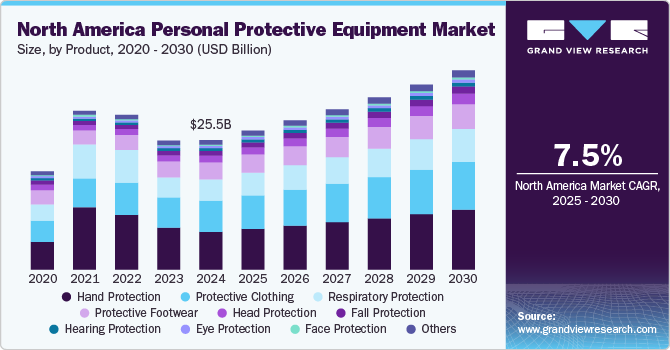

The North America personal protective equipment market size was estimated at USD 25.52 billion in 2024 and is anticipated to grow at a CAGR of 7.5% from 2025 to 2030 owing to a surge in construction and industrial activities. Growing awareness of worker safety on the workshop floor is anticipated to drive increased demand for personal protective equipment (PPE) during the forecast period. The demand for PPE surged significantly during the COVID-19 pandemic due to its effectiveness in protecting wearers from the virus.

The market is witnessing robust growth, owing to the increasing product demand in various end-use industries, such as food, pharmaceuticals, manufacturing, construction, and chemicals, to prevent hand injuries on the shop floor. Rising instances of hand injuries, including severe abrasions, punctures, chemical & thermal burns, and cuts at the workplace, are expected to fuel product demand soon. Additionally, import restrictions led to a rise in domestic personal protective equipment production. In the U.S., stringent regulations, such as the Families First Coronavirus Response Act, were enacted to safeguard public health workers and help curb the spread of COVID-19.

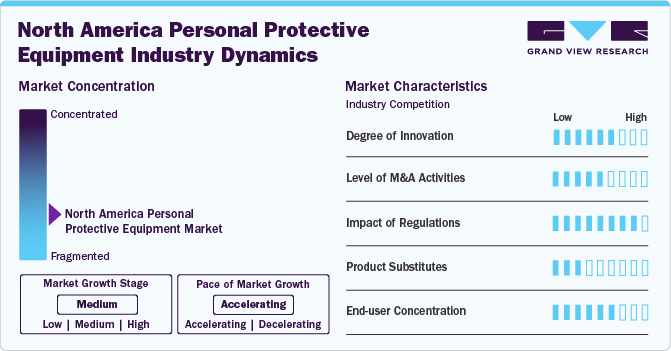

Market Concentration & Characteristics

The market is in a medium growth stage, with an accelerating pace. It is characterized by significant innovation driven by rapid technological advancements. In addition, companies are employing both organic and inorganic growth strategies—such as product launches, geographic expansion, mergers and acquisitions, and collaborations—to enhance their positions in the global market.

The North American market is marked by robust regulatory frameworks, a wide range of end-use industries, and a strong emphasis on worker safety. A major driver of this market is the rigorous enforcement of safety regulations across various sectors. Adhering to these regulations is essential in industries such as construction, manufacturing, oil and gas, and healthcare, which significantly boosts the adoption of PPE.

Technological innovation is also a key feature of the North American PPE market. There is an increasing emphasis on creating PPE from advanced materials that enhance durability, comfort, and breathability while maintaining safety standards. This focus has resulted in the development of lightweight, ergonomically designed PPE, which improves user compliance and minimizes discomfort during extended wear. In addition, the rise of smart PPE—equipped with sensors to monitor environmental hazards and worker health in real-time—is gaining popularity, further transforming the market landscape.

Drivers, Opportunities & Restraints

The COVID-19 pandemic significantly boosted the demand for PPE in North America, particularly in the healthcare and medical sectors, where items such as masks, gowns, and gloves became essential for crisis management. While demand surged during 2020-2021, the post-pandemic landscape has stabilized into a robust market for medical PPE. Furthermore, North America's emphasis on innovation in materials science has led to advancements in PPE technology. Modern PPE is increasingly crafted from lightweight, durable, and breathable materials that enhance user comfort while ensuring safety. This ongoing technological evolution is anticipated to continue driving market growth in the coming years.

Another critical factor influencing the North American market is the rising awareness of workplace safety among both employees and employers. As the workforce becomes more educated about potential hazards in industrial settings, the demand for PPE that prevents injuries from slips, falls, and exposure to hazardous substances is on the rise. This increased awareness is fostering a culture of safety first, encouraging industries to prioritize investments in protective gear.

Sustainability is also becoming a vital aspect of North America's PPE industry. With a growing focus on greener manufacturing processes and reducing environmental impact, PPE manufacturers are increasingly exploring eco-friendly materials and recyclable products. This emphasis on sustainability aligns with broader environmental goals and consumer demand for responsible practices. Manufacturers are investing in research and development to produce PPE that is biodegradable or made from recycled materials, catering to environmentally conscious consumers and organizations.

Product Insights

“The demand for hand protection segment is expected to grow at a notable CAGR of 8.3% from 2025 to 2030 in terms of revenue”

The hand protection segment dominated with a revenue share of 29.3% in 2024. Hand protection is crucial in multiple industries, including construction, food processing, oil and gas, healthcare, and metal fabrication, to prevent common hand injuries. Hand protection equipment is employed in manufacturing to reduce the risk of injuries from cuts, abrasions, burns, and exposure to chemicals.

The head protection segment is expected to grow to the second-highest CAGR from 2025 to 2030. The expansion of the construction industry, particularly in regions like Africa and Southeast Asia, is a key driver behind the increasing demand for head-protection equipment. Initiatives, such as web conferences organized by organizations like The Philippine Green Building Council, to promote the adoption of green building construction practices further contribute to this trend. As construction activities surge, the need for head-protection equipment is expected to rise significantly, driving growth of the segment over the forecast period.

End Use Insights

“The demand for healthcare segment is expected to grow at a notable CAGR of 11.2% from 2025 to 2030 in terms of revenue”

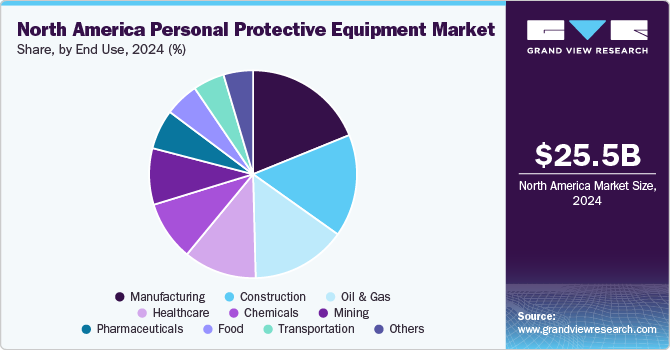

The manufacturing segment dominated the market with a revenue share of 18.9% in 2024. The manufacturing sector plays a vital role in driving the personal protective equipment (PPE) market in North America. This industry requires a wide array of PPE, including protective clothing, helmets, gloves, eyewear, and footwear, to protect workers from hazards such as chemical exposure, machinery accidents, and noise. The expansion of manufacturing in countries like the United States and Canada is anticipated to further increase PPE demand, bolstered by strict safety regulations and a strong emphasis on worker welfare.

The healthcare sector is a major contributor to the demand for personal protective equipment (PPE) in North America, driven by the necessity to protect medical professionals and patients from a variety of occupational hazards, including infections, chemical exposure, and bodily fluids. Essential PPE in this sector includes masks, gowns, gloves, face shields, and respirators. The ongoing need for high levels of safety in hospitals and clinics, combined with the increasing focus on infection control and patient safety, is significantly boosting the demand for PPE. Additionally, the expansion of healthcare facilities and services, along with the heightened awareness of health and safety protocols due to events like the COVID-19 pandemic, continues to drive the growth of the PPE market in North America.

Country Insights

U.S. Personal Protective Equipment Market

The U.S. PPE market is expected to hold around 80% of the North America market in 2024 primarily due to its robust construction and industrial sectors. Recent technological advancements in drilling and completion techniques have sparked a rapid escalation in oil and natural gas production within the U.S. According to the Energy Information Administration (EIA), the U.S. crude oil production surged to 13.3 million barrels per day (b/d) by late 2023, driven by enhanced drilling efficiency.

Canada Personal Protective Equipment Market

The PPE market in Canada is expected to grow at a significant rate with a CAGR of 6.6% over the forecast period. The Canadian market is experiencing notable growth, driven by several key factors. The increasing emphasis on workplace safety across various industries, particularly in construction, manufacturing, and healthcare, is fueling demand for PPE. Strict regulatory frameworks and compliance requirements related to occupational health and safety are prompting organizations to invest in protective gear to safeguard their workforce.

Key North America Personal Protective Equipment Company Insights

Some key players operating in the North America market include Honeywell International Inc. and 3M.

-

Honeywell International Inc. is a company renowned for its innovation, focusing on advanced technologies and products that enhance safety, efficiency, and sustainability. In the aerospace sector, Honeywell provides avionics, engines, and other systems for commercial and military aircraft. Its building technologies division offers solutions for building management, security, and energy efficiency.

-

3M Company, headquartered in St. Paul, Minnesota, is a multinational conglomerate known for its diverse range of products and innovative technologies. The company is particularly renowned for its commitment to research and development, which drives the creation of a wide array of products. Some of its most recognized innovations include adhesive products, abrasives, medical supplies, and personal protective equipment (PPE) such as respirators and safety goggles. 3M's PPE offerings are vital in numerous industries, ensuring worker safety in environments such as healthcare, construction, and manufacturing.

Some emerging players operating in the North American market include Lakeland Industries, Inc. and Avon Protection plc.

-

Lakeland Industries, Inc. caters its products to various end-use industries such as biotechnology, chemical manufacturing, construction, metallurgy, healthcare, electric utilities, and pharmaceutical manufacturing. Its renowned brands include Arc X Rainwear, ChemMax, Interceptor Plus, Lakeland FR, MicroMax, Pyrolon, and SafeGard.

-

Avon Protection plc offers protective solutions in respiratory protection systems against chemical, biological, and radiological hazards through its two business segments, namely respiratory protection, and head protection. The respiratory protection unit caters to customers’ requirements for respirators, powered and supplied air systems, spares, accessories, and filters. The head protection unit is developing the next generation of bump protection and ballistic helmets.

Key North America Personal Protective Equipment Companies:

- Honeywell International Inc.

- Lakeland Industries Inc.

- DuPont

- 3M

- Ansell Ltd.

- Avon Rubber plc

- Alpha Pro Tech Limited

- Uvex Safety Group

- Mine Safety Appliances (MSA) Company

- Radians, Inc.

Recent Developments

-

In February 2023, The American Medical Manufacturers Association (AMMA), a newly established organization representing domestic personal protective equipment (PPE) manufacturers nationwide, has officially launched today. AMMA aims to emphasize the essential need for the United States to ensure consistent access to high-quality, American-made PPE, particularly during times of crisis.

-

In February 2022, LION, the largest family-owned manufacturer of personal protective equipment (PPE) for first responders in the United States, announced its acquisition of the Elbeco brand through an asset purchase. For many years, Elbeco has been a prominent designer, manufacturer, and distributor of high-performance uniforms for law enforcement, EMS, firefighters, and other public safety professionals.

North America Personal Protective Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.38 billion

Revenue forecast in 2030

USD 39.36 billion

Growth rate

CAGR of 7.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, end use, country

Country scope

U.S.; Canada; Mexico

Honeywell International Inc; Lakeland Industries, Inc; DuPont; 3M; Ansell Ltd.; Avon Rubber plc; Uvex Safety Group; Radians Inc.; Alpha Pro Tech Limited; Mine Safety Appliance (MSA) Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Personal Protective Equipment Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America PPE market based on the product, end use and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Head Protection

-

Hard Hats

-

Bump Caps

-

-

Eye Protection

-

Safety Glasses

-

Goggles

-

-

Face Protection

-

Full Face Shield

-

Half Face Shield

-

-

Hearing Protection

-

Earmuffs

-

Earplugs

-

-

Protective Clothing

-

Heat & flame protection

-

Chemical defending

-

Clean room clothing

-

Mechanical protective clothing

-

Limited general use

-

Others

-

-

Respiratory Protection

-

Air-purifying respirator

-

Supplied air respirators

-

-

Protective Footwear

-

Leather

-

Rubber

-

PVC

-

Polyurethane

-

Others

-

-

Fall Protection

-

Soft Goods

-

Hard Goods

-

-

Hand Protection

-

Disposable

-

General purpose

-

Chemical handling

-

Sterile gloves

-

Surgical

-

Others

-

-

Durable

-

Natural Rubber

-

Nitrile

-

Vinyl

-

Neoprene

-

Polyethylene

-

Others

-

-

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America personal protective equipment market size was estimated at USD 25.52 billion in 2024 and is expected to be USD 27.38 billion in 2025.

b. The North America personal protective equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2030 to reach USD 39.36 billion by 2030.

b. The U.S. dominated the North American PPE market with a revenue share of around 80% in 2024. The extensive industrial manufacturing, the strong establishment of commercial businesses, and growing awareness among the workers are attributed to the position the market holds in the country.

b. Some of the key players operating in the North America PPE Market include Honeywell International Inc., Lakeland Industries Inc., DuPont, 3M, Ansell Ltd., Avon Rubber plc, Alpha Pro Tech Limited, Uvex Safety Group, Mine Safety Appliances (MSA) Company, Radians, Inc., among others.

b. The North America personal protective equipment market is primarily driven by Key factors that include growing healthcare industry, rising awareness about the PPE products, and technological development in the production process.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."