North America Patient Support Technology Market Size, Share & Trends Analysis Report By Type (Standalone, Integrated), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-127-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

North America Patient Support Technology Market Size & Trends

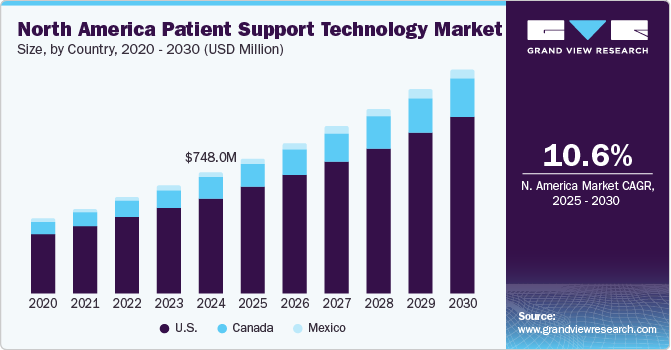

The North America patient support technology market size was estimated at USD 748.0 million in 2024 and is expected to grow at a CAGR of 10.6% from 2025 to 2030. The increasing demand for comprehensive patient-centric engagement solutions is expected to drive market growth. Moreover, the shift to value-based care and increasing investments in patient support programs are among the factors contributing to market growth. Furthermore, the increasing use of AI and chatbots to provide valuable support for medication adherence & patient inquiries is expected to boost the market growth over the forecast period.

Integration of AI into PSPs has revolutionized patient care by enhancing the efficiency and effectiveness of support services. AI-driven technologies facilitate personalized patient engagement, ensuring that support is tailored to individual needs, which is crucial for chronic disease management and medication adherence. These technologies enable real-time monitoring and data analysis, providing healthcare providers with actionable insights to intervene promptly when patients deviate from their treatment plans.

Key Success Stories Highlights AI Impact On PSPS:

OPALE Program: Concentrix’s OPALE program supports patients suffering from diffuse interstitial lung disease by combining digital tools with nursing support, achieving stable treatment compliance, and addressing emotional challenges since its inception in 2015.

aXess Program: Managed by Concentrix and Kyowa Kirin Pharma, this program enhances treatment adherence for XLH patients. It bridges home care and disease management, significantly improving patients' emotional and physical well-being.

Furthermore, a range of initiatives are being undertaken by both public and private entities in the industry to strengthen the market. There is a growing emphasis on fostering collaboration and partnerships to expand the utilization of advanced technologies in patient support programmers, thereby exerting a positive influence on market growth. For instance, Innovaccer Inc. formed a strategic partnership with P3 Health Partners, a physician-led organization. This collaboration represents a key advancement in value-based care, targeting improved patient outcomes, cost optimization, and enhanced experiences for both patients & clinicians.

"Our strategic partnership with Innovaccer accelerates our ability to empower providers with the necessary tools and data needed to better serve and support patients. Through the Innovaccer Healthcare AI Platform we will further reduce time spent on administrative tasks for our providers, enhance our data integration and analytics to better serve our payer partners, improve the quality of the care patients receive, and better manage costs across the continuum of care.”

-CEO of P3 Health Partners.

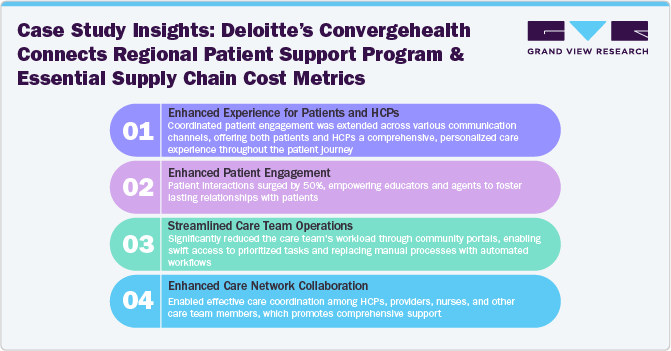

Case Study Insights: Deloitte’s Convergehealth Connects Regional Patient Support Program and Essential Supply Chain Cost Metrics

Converge HEALTH addresses healthcare challenges by delivering personalized experiences at scale. This flexible platform ensures ongoing patient engagement across diverse channels, enhancing partnerships between healthcare providers and patients. Furthermore, it educates, supports, and engages patients to enhance adherence & facilitates care coordination within their networks.

Aim -A leading global pharmaceutical firm’s digital health unit aimed to create an all-encompassing patient-centric engagement solution. This initiative aimed to establish an online platform for patients and Healthcare Professionals (HCPs) to independently manage access program services.

Resolution - Leveraging the PSP core, this approach formed the foundation for a multicounty deployment (across six nations). This ensured a versatile, scalable, and extensible solution, achieving swift and agile implementation within 7 months.

Outcome -The solution’s strategic implementation resulted in significant enhancements in patient-centric engagement, including:

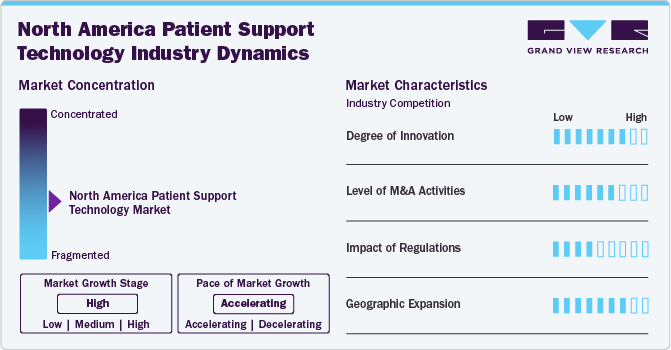

Market Concentration & Characteristics

The degree of innovation in the North America patient support technology industry is high. Technological innovation such as integration of AI and ML in patient support technology solutions. For instance, in November 2023, Accenture collaborated with Salesforce to assist life sciences companies in leveraging data and AI to achieve competitive differentiation. By utilizing Salesforce Data Cloud and Einstein AI, the collaboration aimed to enhance productivity and transform the experiences of healthcare professionals & patients.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in January 2024, Cardinal Health, Inc. entered into a definitive agreement to acquire Specialty Networks for USD 1.2 billion in cash. This acquisition aligns with Cardinal Health’s strategic focus on accelerating growth in its specialty business by integrating advanced technologies, capabilities, and talent to meet essential business & customer needs.

“Specialty Networks and Cardinal Health are united in their mission to deliver value for specialty physician practices and their patients and manufacturers with best-in-class offerings. This partnership is a strong cultural fit and a big win for physicians and patients.”

Shailendra Sharma, CEO of Specialty Networks

The regulatory framework for the North America patient support technology market is governed by multiple agencies, including the FDA and CMS. These agencies ensure compliance with healthcare standards and data privacy regulations, such as HIPAA. These regulations mandate the safe handling of patient information and the interoperability of health IT systems. In addition, the 21st Century Cures Act in the U.S. promotes the use of health IT to improve patient care and outcomes. This comprehensive regulatory landscape aims to enhance patient support technologies while maintaining high privacy and security standards.

Geographical expansion is contributing to the growth of the North America patient support technology market by enabling companies to reach underserved regions, increasing market penetration. Expanding into new areas also facilitates access to a broader patient base, driving demand for advanced support technologies. In addition, it encourages competition and innovation as companies adapt their offerings to meet diverse regional needs. This expansion is crucial for sustaining long-term market growth.

Type Insights

The integrated segment dominated the market in 2024. It is also expected to grow at the fastest CAGR of 10.9% during the forecast period. Integrated patient support technology solutions are leading the market because they offer a seamless, cohesive experience across the entire patient journey. These integrated solutions effectively combine various aspects of patient care into a single, unified platform. Thus, they enhance operational efficiency, improve patient outcomes, and facilitate better communication between patients & healthcare providers.

The standalone segment held a significant market share in 2024. Standalone patient support technology solutions are designed to function independently without integrating with other systems. These solutions concentrate on specific aspects of patient care, offering targeted support to enhance patient experience and adherence. While it provides specialized functionalities, their effectiveness depends on their ability to address particular needs, lacking the added benefits of a more comprehensive, integrated approach.

Country Insights

The North America patient support technology is driven by several factors, such as the growing recognition of the importance of enhancing patient care experiences, improving outcomes, and optimizing healthcare operations. Moreover, the shift toward patient-centered care strongly emphasizes involving patients in their own healthcare decisions. Patient support technologies enable patients to access information, engage with their health data, and actively participate in managing their conditions.

U.S. Patient Support Technology Market Trends

The U.S. accounted for the largest patient support technology market share of 79.2% in 2024. The growth is attributed to technological advancements and innovations in telehealth, AI, & data analytics. These enable effective patient monitoring, personalized care, & streamlined communication between patients and healthcare providers. The increasing use of patient engagement platforms also contributes to market growth.

Canada Patient Support Technology Market Trends

Patient support technology market in Canada is driven by several factors, including government initiatives, strategic actions by market players, and the growing use of patient engagement platforms, which drive Canada's patient support technology market. Furthermore, expanding patient support programs for drugs significantly boosts awareness and drives the adoption of patient support technologies.

Mexico Patient Support Technology Market Trends

Patient support technology market in Mexico is driven by patient engagement platforms. These platforms help pharmaceutical companies address issues like poor adherence, a notable challenge in the region. Effective implementation requires collaboration with experts in behavior change and patient-focused communication. Therefore, pharmaceutical companies seek technologically advanced platforms developed by partners with expertise in creating compliant, engaging, and scientifically supported patient content. This contributes to the growth of patient support technology market in Mexico.

Key North America Patient Support Technology Company Insights

North America patient support technology market has a dynamic and rapidly growing nature. Major global entities, such as Deloitte, Accenture, McKesson Corporation, and Cardinal Health, Inc., are leading the charge. These companies are engaging in strategic initiatives, such as partnerships & product launches, to strengthen their market positions and cater to the growing demand for patient support technologies. The market is witnessing the emergence of several innovative players pushing the boundaries of patient engagement and care.

Companies such as AssistRx, Allazo Health, S3 Connected Health, Clinikly.ai, and Medisafe are leveraging advanced technologies—particularly AI—to enhance patient support & engagement, contributing to market growth.

Key North America Patient Support Technology Companies:

- Deloitte

- Accenture

- McKesson Corporation

- Cardinal Health, Inc.

- Engage (Inizio)

- DataRiver S.r.l.

- AssistRx

- Medisafe

Recent Developments

-

In July 2024, Engage (Inizio) collaborated with Nye Health to enhance patient support services. This integrated approach combines Engage’s comprehensive patient support solutions with Nye Health’s advanced analytics and data integration platform. The collaboration aims to create programs that effectively engage patients and their care partners, ultimately improving patient outcomes.

-

In April 2024, AssistRx introduced Advanced Access Anywhere (AAA), a solution aimed at enhancing therapy initiation and automating PSP enrollment at the pharmacy claim stage. This initiative addresses a critical market gap where patients often miss enrollment in support programs, interacting with the brand solely at the prescription and dispensing stages.

-

In September 2023, Medisafe launched Rapid Release, a service that deploys a customizable and scalable Digital Companion on its Connected Health Platform within 90 days.

-

“As a user-friendly and effective Digital Companion with swift implementation, Rapid Release streamlines pharmaceutical strategic planning and execution processes while enhancing efficiency and reducing costs. Medisafe’s proven platform delivers meaningful data insights and millions of patient engagements to our partners, on time and on budget.”-

Stacey Wasserman, Chief Business Officer of Medisafe

North America Patient Support Technology Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 835.0 million |

|

Revenue forecast in 2030 |

USD 1,384.8 million |

|

Growth rate |

CAGR of 10.6% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, country |

|

Regional scope |

North America |

|

Country scope |

U.S.; Canada; Mexico |

|

Key companies profiled |

Deloitte; Accenture; McKesson Corporation; Cardinal Health, Inc.; Engage (Inizio); DataRiver S.r.l.; AssistRx; Medisafe |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Patient Support Technology Market Segmentation

This report forecasts revenue growth and provides country level analysis of the latest trends in each sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the North America patient support technology market report based on type and country:

-

Type Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated

-

Standalone

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America patient support technology market size was estimated at USD 748.0 million in 2024 and is expected to reach USD 835.0 million in 2024.

b. The North America patient support technology market is expected to grow at a compound annual growth rate of 10.6% from 2025 to 2030 to reach USD 1,384.8 million by 2030.

b. In 2024, the U.S. dominates the North American market due to the increased presence of healthcare organizations seeking structured data and automation solutions.

b. Some key players operating in the North America patient support technology market include Deloitte; Accenture; McKesson Corporation; Cardinal Health, Inc.; Engage (Inizio); DataRiver S.r.l.; AssistRx; and Medisafe.

b. Key factors that are driving the market growth include increasing demand for comprehensive patient-centric engagement solutions in pharmaceutical firms, and advancements in AI-enabled technologies to enhance medication adherence. In addition, the increasing use of AI and chatbots to provide valuable support for medication adherence & patient inquiries is further boost the market growth over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."