North America Packaged Salad Market Size, Share & Trends Analysis Report By Product (Vegetarian, Non-Vegetarian), By Processing, By Type, By Brand, By Distribution Channel, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-354-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

The North America packaged salad market size was valued at USD 7.41 billion in 2024 and is projected to grow at a CAGR of 7.9% from 2025 to 2030. The growth of this market is primarily driven by the increasing number of health-conscious customers worldwide, the rising number of individuals shifting their diets to healthy food choices, and the availability of customized and personalized products designed according to customer preferences.

The growing prevalence of chronic diseases linked with sedentary lifestyles, continuous exposure to work-life stress, growing cases of anxiety and depression, and significant rise in obesity and other health issues connected with dietary preferences have resulted in rising awareness. Individuals have shifted their diets from fast food or conventional food intakes characterized by high-calorie contents to less-calorie foods and healthy diets. This includes salads, soups, fruit smoothies, baked goods, seeds, nuts, and more.

Salads, prepared with freshly cut vegetables and animal-based proteins (in certain product categories), provide an attractive alternative to traditional meals. Young professionals and students, especially in urbanized areas worldwide, have been consuming packaged salads owing to multiple factors, such as ease of accessibility through online platforms, the convenience offered by the innovation-based packaging, and the presence of required nutritional content.

Individuals have shifted their diets from fast food or conventional food intakes characterized by high-calorie contents to less-calorie foods and healthy diets. This includes salads, soups, fruit smoothies, baked goods, seeds, nuts, and more. Salads, equipped with freshly cut vegetables and animal-based proteins if required, provide an attractive alternative to traditional meals. Young professionals and students, especially in urbanized areas worldwide, have been consuming packaged salads owing to multiple factors, such as ease of accessibility through online platforms, the convenience offered by the innovation-based packaging, and the required nutritional content provided by the product.

Demand for minimally processed products has been growing across regions, especially in the U.S. Salads, filled with handpicked blends of diverse greens, often topped with customers' choice of nuts, seeds, berries, salt, pepper, and tangy dressing in some cases, have been gaining significant customer attention. Changing lifestyles, extensive work hours, and growing inclination among customers towards convenient and healthy food options have resulted in increasing consumption of salads.

Availability of packaged salads in different flavors or bases, such as Caesar Salad, Chopped Sunflower Crunch Salad, Ultimate Caesar Salad, and others, plays a vital role in the growth experienced by this market. Salad kits offered by the key market participants in the packaged salad market are characterized by distinctive ingredients such as freshly cut veggies, leafy greens, and optional additions such as cheese, dried fruits, cooked grains, nuts, seeds, croutons, and separate packets of dressings.

To ensure desired shelf life and prevent contamination, the product developers adhere to determined standards associated with multiple processes. This includes diligent selection of materials, washing, drying, cutting, and packaging. Strict regulations regarding the packaging standards and detailed guidelines regarding steps including production, harvesting, postharvest handling, operations, distribution, and end-user handling (retail, food service, and consumer) have stimulated the adoption of technologies, automation systems, and a focus on quality assurance in this market.

Product Insights

The vegetarian salad segment dominated the North America packaged salad industry with a revenue share of 68.0% in 2024. This is attributed to the growing number of individuals inclined towards trends such as veganism, ease of availability, and customer preferences. Customers have been shifting their dietary preferences from fast food, menus served by popular quick service restaurants, and sugary beverages to leafy green, freshly cut vegetables, fruits, seeds, nuts, berries, and more. Significant changes in customer preferences are driven by growing awareness, effective marketing strategies adopted by the market participants, endorsements by popular celebrities, and benefits offered by the product contents, which are some of the key growth drivers for this segment.

The non-vegetarian salads segment is projected to experience the highest growth during the forecast period. Growth of this segment is mainly driven by increasing demand for the inclusion of animal-based proteins in packaged salad products such as boiled eggs, chicken, beef, turkey breast, fish such as Tuna, Shrimp, Salmon, Sardines, pork chops, bacon, seafood, and others. The availability of pre-ordered packaged salads, increased accessibility through online portals, and processed meat products are adding to the growth.

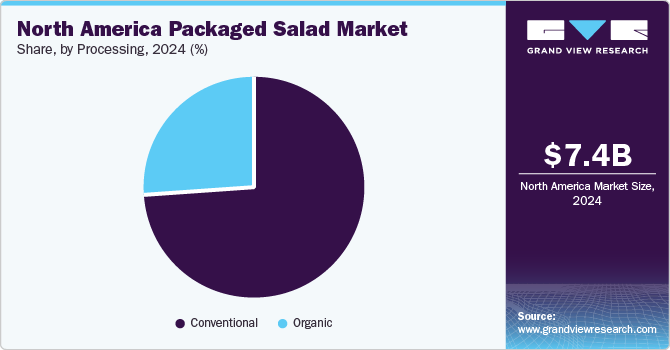

Processing Insights

The conventional salads segment held the largest revenue share of the North America packaged salad market in 2024. Conventional salads are well-liked by a large group of existing customers who prefer known tastes, flavors, ingredients, and palate-friendly products over trends such as organic offerings. New product launches and the entry of numerous food industry participants have also added to the growth of this market. For instance, in January 2025, Mann Packing, the vegetable division of Fresh Del Monte Produce Inc., launched Newman’s Own Salad Kits. The newly introduced line includes King of the Caesars, Parmesan Powerhouse, Italiano Magnifico, and Rodeo Remix.

The organic salad segment is expected to experience the fastest CAGR during the forecast period. This is attributed to the popularity of organically grown fresh produce, rising concerns regarding contaminations, and strict regulatory scenarios associated with including leafy greens such as lettuce in packaged salad products. Product launches by well-liked brands backed with vast distribution networks also contribute to the projected growth. For instance, in October 2024, Little Leaf Farms, one of the prominent brands that offer sustainably grown packaged lettuce, added a Sesame Ginger salad kit to its portfolio. Little Leaf Farms claims that greens provided by the brand are free from pesticides, fungicides, and herbicides while grown via controlled environment agriculture (CEA).

Distribution Channel Insights

The offline distribution segment held the largest revenue share of the North America packaged salad industry in 2024. Offline distribution channel growth is mainly backed by effective distribution accomplished by key brands through points of sale such as supermarkets, hypermarkets, convenience stores, local food vendor stores, and brand stores. Ease of accessibility and large offline distribution networks efficiently operated by the major market participants add to the growth.

The online distribution segment is anticipated to experience the fastest CAGR from 2025 to 2030. This is attributed to the growing inclination towards the use of smartphone-based applications, increasing growth experienced by online food delivery businesses, the convenience offered by the online shopping experience, and additional services offered by the segment, such as doorstep delivery, suggestions based on previous purchases, and others. The use of personalized marketing driven by consumer data also contributes to the growth of this segment.

Type Insights

The packaged greens segment dominated the North America packaged salad market in 2024. Growing demand for pre-washed, cut & bundled, packaged greens such as spinach, Swiss chard, lettuce, Bok choy, Romaine lettuce, cabbage, watercress, arugula, mustard greens, Collard greens, Okra, Broccoli, and others is contributing to the growth of this segment. Customers often buy packaged greens to make their salads by combining ingredients of their choice, dressing, and other additions. Expansions by key value chain participants also add growth opportunities.

For instance, in September 2024, BrightFarms, a company operating in the indoor farming industry, announced the launch of its new greenhouse facility in Yorkville, Illinois. BrightFarms offers products such as SUNNY CRUNCH lettuce, SPRING MIX, a combination of baby greens and lettuce, HARVEST CRUNCH, a combination of red and green leaf lettuces, BABY ROMAINE, BABY BUTTER butterhead lettuce, BABY SPINACH, and more.

The packaged kits segment is anticipated to experience the fastest growth during the forecast period. The development of this segment is primarily influenced by factors such as increasing inclination towards inclusion of healthy food options in daily diets, changing trends and shifts from fast food to low-calorie, high protein intake foods, and ease of availability facilitated by the effective offline distribution and availability through online platforms.

Product launches by the major industry participants and product innovation driven by consumer preferences have attracted new customer groups and are expected to bring novel growth opportunities. For instance, in September 2024, Fresh Express, a brand operating in the salad kits market, announced the launch of its Hot or Cold Salad and Noodle Meal Kits. A newly introduced product is a blend of freshly chopped, chilled vegetables, gourmet dressing sauce, toppings, and ready-to-eat pre-cooked noodles.

Brand Insights

The branded product segments held the largest revenue share of the North America packaged salad industry in 2024. This is mainly driven by aspects such as the quality of ingredients and products offered by the brands, adherence to compliance requirements and regulatory norms ensured by the companies, and packaging innovation strategies embraced by the key brands. Brand products feature labels that carry detailed information regarding ingredients included in the products, added substances, preservatives, if any, and more. The ease of availability through established retail brand stores and online portals also contributes to the growth experienced by the segment.

The private-label products segment is projected to experience the highest growth during the forecast period. The development of this segment is primarily influenced by the increasing demand for customized or personalized packaging and the growing focus on product differentiation to attract a greater customer base. Multiple retailers have shown interest in featuring diverse and unique salad products to ensure the availability of various products for different customer requirements.

Country Insights

U.S. Packaged Salad Market Trends

The U.S. packaged salad market dominated the North America market with a revenue share of 76.6% in 2024. Growing awareness regarding the role of leafy greens and salads in overall human health, availability of packaged products by key brands, accessibility to packaged salad products through online portals, and increasing inclination towards including healthy foods in the diet are some of the key growth driving factors. Ease of consumption, a large variety of products available in the market, and new product launches by the major brands are likely to add lucrative growth opportunities.

Canada Packaged Salad Market Trends

Canada packaged salad market is projected to experience the highest CAGR during the forecast period. This is attributed to factors such as increasing growth in product availability, rising awareness regarding benefits offered by the salad contents and leafy greens, and growth in customers shifting their dietary preferences to healthy foods from conventional meals or fast food items. Demand for freshly cut leafy greens such as lettuce, spinach, and others, availability through online platforms, and accessibility through a network of offline retail brand stores are likely to add growth to this market.

Key Packaged Salad Company Insights

Some of the key companies in the North America packaged salad market are BrightFarmsl, Dole, Earthbound Farm, Mann Packing Co., Inc, Fresh Express, and others. To address growing competition and increasing demand for innovation-based products, the key market participants have embraced strategies such as packaging innovation, collaborations, new product launches, and others.

-

BrightFarms is an indoor farming company that primarily supplies fresh salad greens to supermarkets and other points of sale. The company has advanced technology-assisted greenhouses across multiple locations, including New Hampshire, Virginia, Pennsylvania, Ohio, North Carolina, and Illinois. It offers fresh lettuce options, including classic greens, salad kits, and crunchy mixes.

-

Fresh Express, one of the market participants in the packaged salads market, provides an extensive range of products, including salad kit varieties such as Asian Apple, Twisted Caesar Creamy Truffle Caesar Chopped, French Blue Cheese, Twisted Caesar Enchilada Caesar Chopped, and Butter Supreme, Spinach & Bacon Gourmet Café Salads, Twisted Caesar Pesto Caesar Chopped, and more.

Key North America Packaged Salad Companies:

- BrightFarms

- Dole

- Earthbound Farm

- Eat Smart

- Missionero

- Gotham Greens

- Mann Packing Co., Inc

- BONDUELLE

- Fresh Express

- VEGPRO INTERNATIONAL

- organicgirl

View a comprehensive list of companies in the North America Packaged Salad Market

Recent Developments

-

In December 2024, Fresh Express, a salads and fresh produce company, announced the acquisition of McEntire Produce, Inc., a fresh-cut produce supplier. The acquisition aims to expand Fresh Express’ food service operations in the North America region.

-

In October 2024, Bonduelle, one of the major market participants in ready-to-eat, plant-based meals, launched Bistro Loaded Bowls. The newly introduced product contains fresh greens, nearly 12 grams of protein, crunchy toppings, and dips. The range is available in three varieties: Avocado Crunch Chicken Grilled, Lemon Mediterranean Grilled Chicken, and Grilled Chicken and Guacamole.

North America Packaged Salad Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.99 billion |

|

Revenue forecast in 2030 |

USD 11.68 billion |

|

Growth Rate |

CAGR of 7.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, processing, type, brand, distribution channel, country |

|

Country scope |

U.S., Canada, Mexico |

|

Key companies profiled |

BrightFarms; Dole; Earthbound Farm; Eat Smart; Missionero; Gotham Greens; Mann Packing Co., Inc; BONDUELLE; Fresh Express; VEGPRO INTERNATIONAL; organicgirl |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global North America Packaged Salad Market Report Segmentation

This report forecasts revenue growth at North America, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the North America packaged salad industry report based on product, processing, type, brand, distribution channel, and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vegetarian

-

Non-vegetarian

-

-

Processing Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Packaged Greens

-

Packaged Kits

-

-

Brand Outlook (Revenue, USD Million, 2018 - 2030)

-

Private Label Products

-

Branded Products

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."