- Home

- »

- Homecare & Decor

- »

-

North America Outdoor Furniture Market, Industry Report, 2030GVR Report cover

![North America Outdoor Furniture Market Size, Share & Trends Report]()

North America Outdoor Furniture Market Size, Share & Trends Analysis Report By Product (Seating Sets, Loungers, Dining Sets, Chairs, Tables, Others), Material Type (Wooden, Plastic, Metal), By End Use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-239-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

The North America outdoor furniture market size was valued at USD 16.57 billion in 2023 and is expected to grow at a CAGR of 5.8% from 2024 to 2030. With the rapid expansion of real estate as well as commercial construction, the demand for outdoor furniture in North America is expected to increase from this segment. According to the World Property Journal, the total value of every home in the U.S. was USD 33.6 trillion in January 2020. Increasing infrastructural developments as well as new building permits in the region are expected to present the outdoor furniture market with numerous opportunities.

North America outdoor furniture market accounted for 34.24% share of the global outdoor furniture market revenue in 2023. The market growth of outdoor as well as indoor furniture changed with the pandemic. People transformed their porch and the backyards into a gym, restaurants, and workplaces as they had to stay inside their homes for a long time. According to a blog published in Home News Now in March 2022, sales of American Furniture Warehouse peaked during the pandemic due to the transformation of the backyards made by people in order to experience outdoor comfort at their own place. The company usually buy products from 200 factories in 13 countries to keep the furniture in stock to meet the rising customer demand for outdoor furniture.

The rapid rise in commercial construction activities, especially in the hospitality sector, is also driving the demand for outdoor furniture. The hotel industry is a significant contributor to the hospitality market, fueling the development of new hotels. The thriving real estate industry, followed by numerous infrastructure improvements in the hospitality sector, will continue to drive the market growth.

According to Consumer Buying Trends Survey, Casual Living reported that there is an increase in outdoor furniture buying activity and millennials tend to purchase more than others. Millennial households accounted for 37 percent of purchases. Baby boomers followed close behind with 34 percent of sales, while generation X-ers accounted for 23 percent. Industry experts expect millennials’ buying power to continue in this sector, as Americans aged 19-35 years old begin to build careers, families, and homes.

Market Concentration & Characteristics

The North America outdoor furniture market is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Constant innovations and the growing trend of intense colors further support the demand for these products. According to the National Kitchen & Bath Association’s 2021 Design Trends Report, residential professionals seek innovation with hardware and accessories the most. About 17% of survey respondents, mainly designers and specifiers, specifically wished for more interesting hardware, such as new styles, colors, and designs.

Manufacturers are growing their promotion, advertising, and partnership to expand their customer base. Direct-to-customer is highly lucrative for companies that have market customer loyalty and have already invested in advertising campaigns to create a good brand presence and a committed consumer base. Manufacturers of outdoor products are estimated to have medium-to-high gross margins. Outdoor product manufacturers are expected to operate on medium-to-high profit margins. The hospitality sector accounts for the largest customer base of commercial tableware services across the region.

The end-user concentration is a significant factor in the North America outdoor furniture market. Customers buying outdoor furniture are looking for the right combination of luxury, elegance, and versatility. They tend to prefer items that are both elegant and trendy, as well as sturdy and easy to maintain. Furthermore, outdoor fire pit sets and conversation sets are gaining popularity, especially among millennials.

Product Insights

The outdoor seating furniture market in North America accounted for a revenue share of 28% in 2023. Growing demand for comfortable seating seat in commercial and residential sector is expected to boost segment growth over the forecast period.

The demand for outdoor tables in North America is projected to grow at a CAGR of 6.6% from 2024 to 2030. Consumers increasingly spent on home renovation by making their balconies or outdoor spaces more usable, thereby contributing to the increased demand for multipurpose and high quality tables. Tables are the important product in outdoor furniture, it helps to create aesthetic look and takes less space.

Material Type Insights

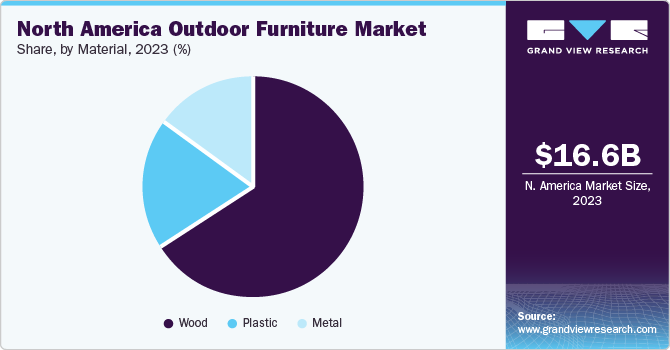

The North America wooden outdoor furniture market accounted for a revenue share of 65.88% in 2023. The capacity of wooden outdoor furniture to withstand harsh climatic conditions including rain, protection from insects, dust, and solid particles, and resistance to extreme temperatures have encouraged more people to buy outdoor furniture. Additionally, there is a considerable market need for outdoor furniture made of upholstery fabrics, teak wood, eucalyptus, and premium metals to adorn outdoor spaces.

The demand for metal outdoor furniture market in North America is projected to grow at a CAGR of 6.0% from 2024 to 2030. There is increasing usage of cast aluminum in outdoor furniture by manufacturers due to its rising popularity among consumers. Cast aluminum is best for chairs as it is lightweight, and dining chairs must constantly be moved. Moreover, aluminum does not rust and is thinner than concrete, making it more appealing. Cast and hard tube aluminum have superior efficiency. Tubular metal is lightweight and hollowing, as well as less durable. However, because of its lightweight, it is suitable for poolside furniture and is often used for tables, folding chairs, and swing sets.

End-use Insights

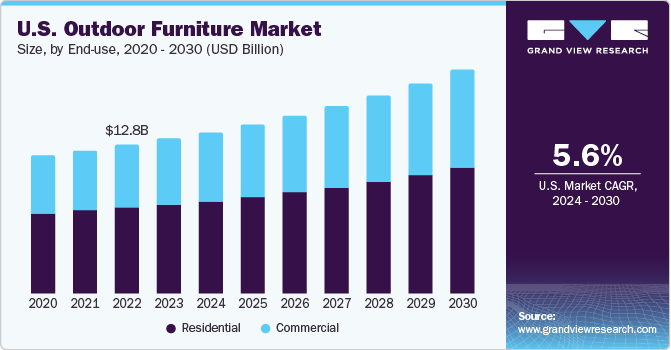

The residential outdoor furniture market in North America accounted for a revenue share of 41.48% in 2023.Consumers increasingly spent on home renovation by making their balconies or outdoor spaces more usable, thereby contributing to the increased demand for outdoor furniture. According to the survey conducted by Home Advisor, there has been a noticeable increase in spending for home improvement in the U.S., with USD 13,138 in 2020, which is USD 4,000 more than the previous year. Furthermore, in May 2019, Brown Jordan Inc. acquired Casttella Furniture Co., Inc. and its Costa Rican operations. Through this, Brown Jordan will be able to provide outdoor casual furniture to residential markets and expand its distribution network.

The North America commercial outdoor furniture market is projected to grow at CAGR of 5.8% over the forecast period of 2024-2030. The demand for outdoor furniture in North America has risen owing to the growing trend of family gatherings and dinners at home. This trend is further supported by the rising interest in creating and maintaining front yard and backyard gardens not only to enhance the aesthetics of the homes but also to entertain guests outdoor. This is likely to boost the demand for outdoor furniture in the residential segment.

Country Insights

The North America outdoor furniture market is projected to grow at a CAGR of 5.8% from 2024 to 2030. According to the latest Outdoor Furnishings Trend Report released by the International Casual Furnishings Association 71% of Americans have been spending much more time outside in 2022 compared to last year—as many as 7 hours. One of the main reasons for this is that more Americans are choosing to work from home and a lot of that time has been spent outdoors. The study also showed that 63% of Americans intend to upgrade their outdoor furniture this year, referring to purchases like outdoor chairs, dining tables, and sofas, among others.

U.S. Outdoor Furniture Market Trends

The outdoor furniture market held 80% of the North American sales revenue in 2023. The presence of companies such as Brown Jordan and Forever Patio, the availability of innovative and trendy furniture products in the market, and the willingness of consumers to spend on home furnishings, including outdoor furniture, are among the key factors fueling the U.S. market growth. With increased demand for outdoor furniture for various settings, direct retailers and furniture stores have been increasing their offerings to keep up with the demand.

For instance, in April 2022, stars of an HGTV home renovation show launched an outdoor décor line with retail giant Walmart. Dave and Jenny Marrs launched the Marrs Collection by Better Homes & Gardens, which features 30 outdoor furniture and décor items in an elevated and livable style to create the perfect backyard setup. The warm capsule collection includes a Teak Wood Outdoor Dining Table (at USD 997) and a Teak Wood Porch Swing with Cushions (at USD 897).

Canada Outdoor Furniture Market Trends

The outdoor furniture market in Canada is expected to grow at a CAGR of 7% from 2024 to 2030. The sales of outdoor furniture in Canada have seen an increase as the creation of outdoor living spaces such as decks, patios, balconies, porches, gardens, and poolside areas has risen in recent years. This can be attributed to positive economic growth. However, the Canadian climate can be rather unpredictable, with extreme temperature fluctuations ranging from rain to snow to sleet to hail. This has been known to take a toll on outdoor furniture, depending on the material used. This factor could limit the purchase of outdoor furniture in Canada.

Key North America Outdoor Furniture Company Insights

Some of the key players operating in the market include Ashley Furniture Industries, Inc., Brown Jordan Inc., and Agio International Company, LTD.

-

Ashley Furniture Industries, Inc. is a privately held firm founded in 1945 and is headquartered in Wisconsin, U.S. It is a manufacturer and retailer of home furniture and accessories. The company sells its products through independent furniture dealers, as well as 945+ Ashley Furniture Homestores.

-

Brown Jordan Inc. is a privately held firm incorporated in 1945 and headquartered in Florida, U.S. The company is a manufacturer, designer, and marketer of outdoor and indoor residential as well as hospitality furniture. The company sells its products under numerous brands, including Castella, Tropitone, Brown Jordan, Winston, Charter and Texacraft. The products are offered by type, collection, style, and designer. Catalogs are also present on sites to select the product; moreover, materials can be selected differently

Lloyd Flanders, Inc., Barbeques Galore, and Century Furniture LLC. are some of the other participants in the North America outdoor furniture market,

-

Lloyd Flanders, Inc. is a privately-held company incorporated in 1982 and headquartered in Michigan, U.S. The company has a full range of premium outdoor furniture, wicker, garden furniture, wood furniture, Lloyd Loom, exterior design, and outdoor rooms.

-

Barbeques Galore is privately-held company established in 1980 and headquartered in California, U.S. The company designs, manufactures, and retails BBQ grills and outdoor furniture products. Barbeques Galore has a wide variety of products in gas, charcoal, and electric grills, outdoor heaters, gas fireplace logs, and patio furniture and also provide customized BBQ. In outdoor furniture, the brand offers products such as chairs, sofa sets, bar stools, dining sets, tables, outdoor privacy screens, pergolas, and umbrellas. The company sells its products through various collections such as Weber, Big Green Egg, Twin Eagles, EVO, DCS, Alfresco, Firemagic, Heston, Blaze, and Green Mountain Grills.

Key North America Outdoor Furniture Companies:

- Ashley Furniture Industries, Inc.

- Brown Jordan Inc.

- Agio International Company, LTD.

- Lloyd Flanders, Inc.

- Barbeques Galore

- Century Furniture LLC.

- Kimball International Inc.

- Andreu World

- Homecrest Outdoor Living

- Gloster

Recent Developments

-

In June 2023, HNI Corporation announced the completion of the acquisition of Kimball International Inc. With pro forma revenue of almost $3 billion and combined EBITDA of about $305 million, the merger develops the market leader.

-

In January 2022, Ashley Furniture Industries, Inc. opened a concept store in Canton, Georgia. The new store places a strong emphasis on offering comfortable and high-quality goods for customers. The store features several furnishing products with the majority of them being “grab and go” to help consumers purchase the product the same day.

North America Outdoor Furniture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.35 billion

Revenue forecast in 2030

USD 24.34 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material type, end-use, and region

Regional scope

North America

Country scope

U.S. Canada, Mexico

Key companies profiled

Ashley Furniture Industries, Inc.; Brown Jordan Inc.; Agio International Company, LTD.; Lloyd Flanders, Inc.; Barbeques Galore; Century Furniture LLC.; Kimball International Inc.; Andreu World; Homecrest Outdoor Living; Gloster

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Outdoor Furniture Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America outdoor furniture market report based on product, material type, end-use and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Seating Sets

-

Loungers

-

Dining Sets

-

Chairs

-

Table

-

Others

-

-

Material Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wood

-

Plastic

-

Metal

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America outdoor furniture market was estimated at USD 16.57 billion in 2023 and is expected to reach USD 17.35 billion in 2024.

b. The North America outdoor furniture market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 24.34 billion by 2030.

b. The U.S. dominated the North America outdoor furniture market with a share of around 80% in 2023. The availability of innovative and trendy furniture products in the market, and the willingness of consumers to spend on home furnishings, including outdoor furniture, are among the key factors fueling the U.S. market growth.

b. Some of the key players operating in the North America outdoor furniture market include Ashley Furniture Industries, Inc.; Brown Jordan Inc.; Agio International Company, LTD.; Lloyd Flanders, Inc.; Barbeques Galore; Century Furniture LLC.; Kimball International Inc.; Andreu World; Homecrest Outdoor Living; Gloster

b. With the rapid expansion of real estate as well as commercial construction, the demand for outdoor furniture in North America is expected to witness a boost.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."