- Home

- »

- Medical Devices

- »

-

North America Orthopedic Spine Devices Market, Report, 2030GVR Report cover

![North America Orthopedic Spine Devices Market Size, Share & Trends Report]()

North America Orthopedic Spine Devices Market Size, Share & Trends Analysis Report By Product (Spinal Fusion Devices, Vertebral Compression Fracture Treatment Devices, Non-fusion Devices), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-483-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

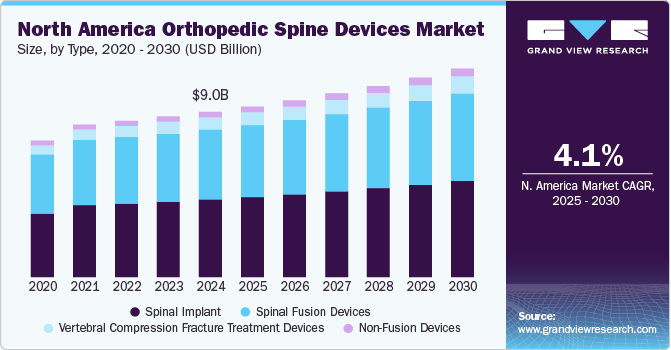

The North America orthopedic spine devices market size was estimated at USD 9.01 billion in 2024 and is projected to grow at a CAGR of 4.1% from 2025 to 2030. The rising incidence of road traffic crashes has significantly increased the number of Spinal Cord Injuries (SCIs). According to the National Spinal Cord Injury Statistical Center report published in 2023, approximately 18,000 new cases of SCIs occur annually in the U.S., which is about 54 incidents per 1 million people. The report also estimates that there are approximately 302,000 individuals living in the U.S. who have sustained an SCI.

Signs of aging such as weakening of bones due to excessive loss of bone mass, which is common between 25 and 54 years of age, and decreasing bone density, which becomes more prominent from 55 years & above, are expected to drive market demand. According to a 2019 publication from the National Library of Medicine, the 65-69 age bracket experienced the highest incidence of spinal cord fractures (69.2%), followed by a 50% rate in the 75-79 age group. The 70-74 age group most frequently received a diagnosis of central cord syndrome (43.8%, compared to 33.3% in the ≥80 years age group). Thus, the aging population is impelling the demand for orthopedic spine solutions. The Population Reference Bureau estimates that in 2022, the number of people in the U.S. aged 65 and older was 58 million, and it is expected to increase to 82 million by 2050.

The field of orthopedic surgery is constantly advancing with the continuous improvement of technologies. Enhanced versions of existing technologies are being developed to improve surgical outcomes and increase longevity. The tools, components, and instruments used in surgeries are consistently progressing. New titanium-based biocompatible or biomaterial-based screws and fixation systems have shown improved results with reduced chances of rejection over a longer period compared to previously used metal screws. Innovative technologies, including tissue grafting and the utilization of scaffolds and other tissue matrices for regenerating native tissue, have been effectively employed to enhance mobility and flexibility in recovered limbs. Matrices infused with growth factors are being utilized to promote better and faster healing of the tissue surrounding the injury.

Another driving force for the orthopedic spine devices market is increasing participation in sports & related events and the accompanying injuries. According to the report from Due North Consulting, Inc., approximately 242 million individuals in the U.S., which accounts for almost 80% of all Americans aged 6 and above, engaged in a sports or fitness activity in 2023. This marks a 2.2% rise from 2022, establishing it as the largest number of participants in a single year.

Increasing participation in sports leads to various injuries including cervical injuries. For instance, as per the National Library of Medicine report, the most common level of injury when a SCI occurs is cervical for four sports: hockey (81.5% cervical), skiing (81.1%), diving (98.2%), and American football (96.3%). In horseback riding, the largest proportion of injuries are cervical (46%), but thoracic (25.8%) and lumbo-sacral (24.4%) injuries are also prevalent. Snowboarding also has a significant risk for thoracic (27.6%) and thoraco-lumbar (28.9%) injuries.

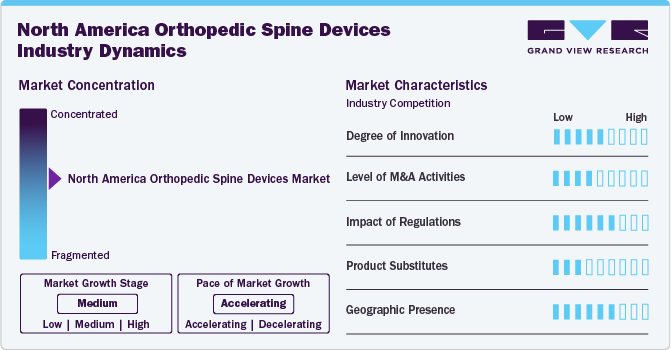

Market Concentration & Characteristics

The degree of innovation in the North America orthopedic spine devices market is significantly shaping the landscape of spinal care and treatment. Driven by advancements in technology, such as minimally invasive surgical techniques, 3D printing, and smart implants equipped with sensors, companies are introducing innovative products that enhance patient outcomes and reduce recovery times. The integration of robotics and artificial intelligence into surgical procedures is also revolutionizing spine surgeries.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for North America orthopedic spine devices. In January 2023, Orthofix Medical, Inc. and SeaSpine Holdings Corporation completed a merger to create a leading global spine & orthopedics company

Regulatory frameworks significantly impact the orthopedic spine devices market in North America, shaping product development, approval processes, and market entry strategies. In the U.S., the Food and Drug Administration (FDA) plays a crucial role in ensuring that spine devices meet safety and efficacy standards before they can be marketed. This rigorous regulatory environment fosters innovation by encouraging manufacturers to invest in research and development to meet compliance requirements.

The market faces competition from various product substitutes that influence both consumer choices and market dynamics. Traditional surgical interventions, such as spinal fusion, are often supplemented by alternative treatments such as chiropractic care, physical therapy, and non-invasive pain management techniques, which can reduce the demand for surgical devices. Additionally, emerging technologies such as regenerative medicine, including stem cell therapy and tissue engineering, present innovative alternatives to conventional spine surgeries, potentially offering less invasive options with shorter recovery times.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product approvals and funding create more opportunities for market players to enter new regions.

Product Insights

In 2024, the spinal implant segment dominated the North America orthopedic spine devices market and accounted for the largest revenue share of 42.41%. As per the Mayo Clinic report published in 2023, about 20% of U.S. adults have some degree of degeneration by age 65, increasing to about 35% by age 80. Furthermore, the growing adoption of spinal implants due to the advantages of minimally invasive devices, including fast recovery, less scarring, reduced bleeding risks, low infection, and short duration of hospital stay, is expected to drive segment growth. Moreover, increasing product launches and approvals for devices used in spine surgeries are driving market growth. In January 2023, Accelus, a medical technology company based in the U.S., introduced a modular-cortical system called linesider for use in spinal implant surgeries. This technology enables surgeons to implant screw shanks early in the procedure and personalize the construct using modular tulips and rods.

The vertebral compression fracture treatment devices segment in the North America market for orthopedic spine devices is anticipated to witness the fastest expansion over the forecast period. This can be attributed to the growing incidences of compressed bones of the spine due to cancer, trauma, and others. For instance, according to a report from the American Academy of Family Physicians, vertebral compression fractures (VCFs) are the primary complication of osteoporosis and impact over 700,000 Americans every year. The risk of fractures rises with age, and in the United States, 4 out of 10 women over 50 years old will suffer a spine, vertebral, or hip fracture in their lifetime. Thus, increasing cases of features will drive segmental growth.

End Use Insights

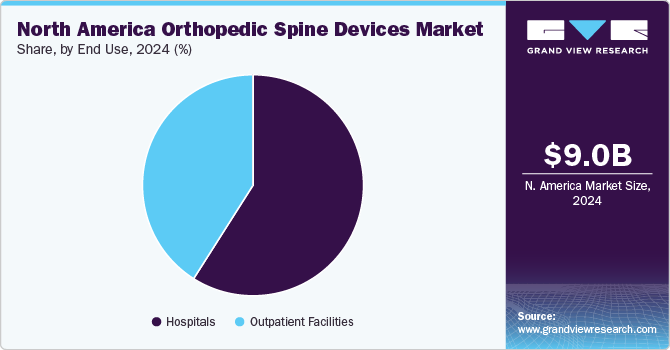

In 2024, the hospitals segment dominated the market and accounted for the largest revenue share of 59.0%. This can be attributed to the growing preference of the population for hospitals for surgical procedures. Furthermore, increasing cases of fractures are supplementing segmental growth. For instance, the American Academy of Family Physicians report states that 66,000 physician office visits are due to patients with vertebral compression fractures, and 45,000 to 70,000 hospitalizations occur each year, with half of them needing skilled nursing facility care. Such increasing hospitalization for fracture treatment is fostering segmental growth.

The outpatient facilities segment in the North America orthopedic spine devices market is anticipated to witness significant growth over the forecast period. The increasing number of road accidents in North America is anticipated to boost market growth. According to statistics from the National Highway Traffic Safety Administration (NHTSA), around 19,515 individuals lost their lives in traffic accidents in the first half of 2023. According to a Forbes report on Car Accident Statistics, in 2023, around 35,766 fatal car accidents were registered in the U.S. in 2020. In addition, around 1,593,390 crashes resulted in injuries, while 3,621,681 caused property damage.

Country Insights

U.S. Orthopedic Spine Devices Market Trends

The U.S. orthopedic spine devices market in the held the largest share of 77.8% in 2024. Growing technological advancement in spine surgeries will escalate market growth. In August 2024, DePuy Synthes collaborated with eCential Robotics to introduce a navigation platform. The VELYS Active Robotic-Assisted System (VELYS SPINE) received510(k) clearance from U.S. FDA. It is specifically created for instrumenting and planning spinal fusion procedures in the thoracolumbar, cervical, and sacroiliac spine.

Canada Orthopedic Spine Devices Market Trends

Canada orthopedic spine devices market is anticipated to register the fastest growth during the forecast period owing to the aging population, increasing prevalence of spinal disorders, and advancements in medical technology. As per the Statistics Canada, number of persons aged 65 years and older were 7.8 million as of July 1, 2024

Key North America Orthopedic Spine Devices Company Insights

Key participants in the North America orthopedic spine devices market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key North America Orthopedic Spine Devices Companies:

- Medtronic

- Johnson & Johnson

- Stryker

- NuVasive

- Zimmer Biomet

- Globus Medical, Inc.

- Alphatec Spine, Inc

- Orthofix Holdings, Inc

- RTI Surgical Holdings

- B. Braun Melsungen AG

- Seaspine Holdings Corporation

Recent Developments

-

In October 2024, Stryker reported the finalization of its acquisition of Vertos Medical Inc., an industry leader in providing interventional pain management remedies for persistent lower back pain resulting from lumbar spinal stenosis.

-

In July 2024, Stryker obtained FDA 510(k) clearance for its Q Guidance System, which includes the Spine Guidance 5 software with Copilo.

-

In October 2023, NovApproach Spine launched the OneLIF interbody fusion device at the North American Spine Society’s Annual Meeting. The OneLIF device provides surgeons with one cage that supports numerous approaches to the individual’s lumbar spine.

-

In October 2021, Medtronic Canada ULC, a branch of Medtronic plc, a prominent company in healthcare technology, revealed the official introduction of the Mazor X System for robotic-assisted spine surgery.

North America Orthopedic Spine Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.30 billion

Revenue forecast in 2030

USD 11.35 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Medtronic; Johnson & Johnson; Stryker; NuVasive; Zimmer Biomet; Globus Medical, Inc.; Alphatec Spine, Inc.; Orthofix Holdings, Inc.; RTI Surgical Holdings; B. Braun Melsungen AG; Seaspine Holdings Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Orthopedic Spine Devices Market Report Segmentation

This report forecasts revenue and volume growth at regional and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the North America orthopedic spine devices market report based on product, end use, and region:

-

Product Outlook (Revenue USD Million, 2018 - 2030)

-

Spinal Fusion Devices

-

Thoracic & Lumbar Fusion Devices

-

Cervical Fusion Devices

-

-

Vertebral Compression Fracture Treatment Devices

-

Non-fusion Devices

-

Spinal Implant

-

Spinal Fusion Implants

-

Spinal Non-fusion Implants

-

-

-

End Use Outlook (Revenue USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America orthopedic spine devices market size was estimated at USD 9.01 billion in 2024 and is expected to reach USD 9.30 billion in 2025.

b. The North America orthopedic spine devices market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2030 to reach USD 11.35 billion by 2030.

b. In 2024, the spinal implant segment dominated the North America orthopedic spine devices market and accounted for the largest revenue share of 42.41%. The growing adoption of spinal implants due to the advantages of minimally invasive devices, including fast recovery, less scarring, reduced bleeding risks, low infection, and short duration of hospital stay, is expected to drive segment growth.

b. Medtronic, Johnson & Johnson, Stryker, NuVasive, Zimmer Biomet, Globus Medical, Inc., Alphatec Spine, Inc., Orthofix Holdings, Inc., RTI Surgical Holdings, B. Braun Melsungen AG, Seaspine Holdings Corporation

b. The rising incidence of road traffic crashes has significantly increased the number of Spinal Cord Injuries (SCIs). Another driving force for the orthopedic spine devices market is increasing participation in sports & related events and the accompanying injuries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."