North America Oral Health Probiotics Market Size, Share & Trends Analysis Report By Type (Probiotics, Prebiotics, Postbiotics), By Form, By End-user (Human, Animal), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-131-7

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Market Size & Trends

The North America oral health probiotics market size was estimated at USD 101.4 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.5% from 2023 to 2030.The market has grown substantially in recent years, driven by various factors. Firstly, there has been a surge in public awareness regarding the significance of maintaining optimal oral hygiene. People now recognize that oral health is not just about preventing cavities but also plays a pivotal role in overall well-being, encompassing gum disease prevention and combatting bad breath. This increased awareness has ignited a growing interest in products supporting and enhancing oral health, with oral probiotics emerging as a promising option.

Secondly, there has been a perceptible shift in consumer attitudes toward preventive healthcare. Rather than adopting a reactive approach to oral health issues, individuals are increasingly inclined to safeguard their oral well-being proactively. Oral probiotics are a natural and proactive method to sustain a healthy oral environment, helping prevent oral problems before they arise.

Additionally, the contemporary emphasis on holistic health and wellness contributes to this market's growth. Consumers are increasingly recognizing the interconnectedness of various facets of health, with oral health being an integral component. Maintaining a healthy mouth is now perceived as a contributory factor to overall well-being.

The availability of a diverse range of oral probiotic products and robust marketing efforts by manufacturers have also played a pivotal role in piquing consumer interest and driving sales. Dental professionals actively endorse these products, recognizing their potential in maintaining oral health and advising their patients to incorporate them into their daily oral care routines.

One of the most prominent trends is the increasing consumer preference for natural and organic oral care solutions. North American consumers are becoming more conscientious about the ingredients used in their oral care products, leading to a growing demand for products devoid of artificial additives and chemicals. This shift in consumer preferences underscores the market's trajectory toward natural and organic options.

Environmental sustainability is emerging as another key trend in the market. Consumers are increasingly concerned about the environmental impact of their purchases, including oral care products. Brands that adhere to eco-friendly practices, such as recyclable packaging and sustainable sourcing of ingredients, are gaining popularity.

Regulatory support and certifications endorsing natural and organic products are significant drivers. These endorsements provide credibility and assurance to consumers, encouraging the adoption of such products. Regulatory bodies are crucial in assuring consumers that their chosen products meet specific standards and criteria.

Apart from this, the broader health and wellness trend sweeping across North America is influencing consumers' oral care choices. People seek oral care products that align with their overall wellness goals, reflecting the interconnectedness of oral health and general well-being. This alignment drives the demand for natural and organic oral care options that promote holistic health.

Many of the millennial and Gen Z demographic are increasingly endorsing organic, plant-based, and sustainable oral care products. This shift in consumer preferences has not gone unnoticed by dentists, who are adapting their practices to be more environmentally friendly. Dentists actively reduce aerosols, incorporate organic scrubs into their treatments, and encourage patients to opt for all-natural oral care products.

In response to these trends, brands are intensifying their efforts to introduce products that align with the prevailing sustainability movement. For instance, Colgate-Palmolive Company, a U.S.-based corporation, offers a range of organic, gluten-free, and vegan oral care products under the Colgate Zero line of products. These products, which include mouthwashes, toothpaste, and toothbrushes, are targeted toward a younger, health-conscious, and eco-friendly consumer base and contain no preservatives, artificial flavors, sweeteners, or color.

Type Insights

In terms of revenue, probiotics held a market share of 81.1% in 2022.Oral health probiotics typically contain strains of bacteria that are beneficial for oral health. These include the species Lactobacillus and Bifidobacterium, among others. These bacteria help balance the oral microbiome, which can lead to improvements in various oral health issues. The oral cavity already contains a diverse range of beneficial as well as harmful microorganisms. Oral health probiotics enhance the natural oral microbiome with more beneficial strains. Probiotics help maintain a healthy balance of oral bacteria, reducing the presence of odor-causing bacteria that lead to bad breath.

The prebiotics market is expected to grow at a CAGR of 11.0% from 2023 to 2030. Oral health prebiotics selectively nourishes the beneficial bacteria while discouraging the growth of harmful bacteria. This helps maintain a balanced and healthy oral microbiome. These prebiotics reduce tooth decay, improve gum health, and ensure fresh breath. Prebiotics usually inhibit the growth of harmful bacteria in the oral microbiome by supplementing the probiotics with dietary sources like fibers and sugars that benefit the good bacteria in their growth.

These prebiotics are found in whole wheat, nutritional supplements, bananas, soybeans, and green leafy vegetables. The ability of oral prebiotics to remain in the oral cavity for an extended period, allowing for fermentation and the growth of beneficial bacteria, is a key factor in their effectiveness. For example, Xylitol is a well-studied oral prebiotic that reduces the risk of dental cavities. Chewing xylitol gum multiple times throughout the day can help create an environment in which harmful bacteria, particularly Streptococcus mutans, are less likely to thrive and thereby promote good oral health.

End-user Insights

In terms of revenue, human oral health probiotics held a market share of 70.2% in 2022. Oral health probiotics for human consumption are dietary supplements or oral care products that contain beneficial live microorganisms, typically bacteria, intended to support oral health and balance the oral microbiome. These products are designed for individuals to consume or use as part of their oral care routine. Oral health probiotics come in various forms, such as capsules, tablets, powders, lozenges, chewing gum, strips, toothpaste, and mouthwash. The effectiveness of oral health probiotics can vary among individuals and depend on factors like the specific strains used, the quality of the product, and individual oral health conditions.

There is a significant prevalence of oral health issues in North America, such as cavities, toothaches, and teeth sensitivity. This has driven the need for dental health products, including probiotics. The 2022 Delta Dental Oral Health and Wellness Survey, which involved a nationally representative sample of 1,000+ U.S. residents aged 18+, revealed that despite maintaining good oral hygiene, more adults experienced dental issues in 2022 than the previous year. Out of all these dental problems, 86% of the people suffered from cavities, marking a 6% increase. Moreover, 74% of the people suffered from pain and toothaches, and 67% had teeth sensitivity. This scenario is likely to boost the demand for human oral health probiotics.

The animal oral health probiotics market is expected to grow at a CAGR of 11.3% from 2023 to 2030. A rising prevalence of dental diseases among pets, including dogs and cats, has led to a greater emphasis on oral care among pet owners. Pet owners increasingly know the need to prevent painful dental conditions in their companion animals. This awareness has driven the demand for pet oral health probiotics.

The growing prominence and availability of personalized pet care and treatment have also facilitated the demand for oral health probiotics as a preventative measure. For instance, in May 2021, Basepaws, a Los Angeles-based pet care genetics company, introduced an in-home, preventive dental test that provides cat owners insights into their pets' dental health. This innovative screening test evaluates a cat's susceptibility to three prevalent dental conditions: periodontal disease, tooth resorption, and bad breath. Access to such information and insights will likely compel pet owners to invest in oral health products, including probiotics.

Distribution Channel Insights

In terms of revenue, sales through pharmacies & drug stores held a market share of 45.4% in 2022. Pharmacies and drug stores play a significant role in driving the demand for oral health probiotics as they are easily accessible to consumers across North America. They have a wide presence in urban and rural areas, making it convenient for individuals to purchase oral health probiotics when needed. Consumers often turn to pharmacies and drug stores for advice and recommendations related to their health, including oral care. Pharmacists and healthcare professionals provide valuable information and guidance regarding oral health probiotics.

Oral care brands have been actively collaborating with pharmacies across the U.S. as part of their strategic efforts to enhance product sales. By forging these partnerships, oral care brands can tap into pharmacies' extensive customer base and trusted reputation, thus reaching a broader audience of consumers prioritizing their oral health. For instance, in November 2021, Go Mouthwash unveiled a collaboration with United Pharmacy Network (UPN), a prominent provider of inventive pharmacy marketing solutions to enhance accessibility for travelers. This partnership aims to promote oral health globally by offering the widely popular single-use mouthwash for B2B procurement, enabling a broader audience to maintain good oral health.

Sales through online channel are expected to grow at a CAGR of 10.6% from 2023 to 2030. Many oral health probiotic brands sell their products to consumers through websites or online marketplaces. This allows them to reach a wider audience and control the pricing and marketing of their products. Oral health probiotic brands are increasingly using influencer marketing to reach potential customers. This involves partnering with social media influencers with a large following of people interested in oral health. Online retailers often offer discounts and promotions on oral health probiotics, which can make them more affordable for consumers.

Prominent industry leaders increasingly prioritize brand acquisitions to bolster their market reach and elevate their online sales presence. This strategy allows these major players to secure exclusive distributorships, effectively expanding their sales coverage. For example, In December 2021, Swedish-based probiotics products manufacturer BioGaia AB (publ), through its U.S. subsidiary, BioGaia Biologics Inc, agreed to acquire all shares of Nutraceutics Corporation, the parent company of Everidis Inc. Everidis Inc. serves as BioGaia's exclusive distributor for its branded products in the U.S. This investment in Everidis aligns with BioGaia's long-term strategy, focusing on direct-to-consumer digital sales, especially given Everidis's substantial online sales.

Form Insights

In terms of revenue, tablets held a market share of 48.2% in 2022. Probiotic tablets aid the treatment of certain oral conditions and risk factors such as dry mouth, recurrent cavities, and periodontal disease. Manufacturers are focusing on producing conventional probiotic products in the form of capsules, tablets, and sachets, which are likely to contribute to the growth of the market. Moreover, key market players are focusing on expanding their product portfolios by introducing a new range of products and investing heavily in the research & development of live microorganism strains.

The toothpaste segment is expected to grow at a CAGR of 11.6% from 2023 to 2030. Probiotic toothpaste contains beneficial live microorganisms, typically bacteria that can help balance the oral microbiome by introducing more good bacteria. This can create a more favorable environment for oral health. Probiotic toothpaste contains live bacteria from strains such as Lactobacillus and Streptococcus. These beneficial bacteria can promote oral health and positively influence the oral microbiome. Probiotic toothpaste is typically formulated without fluoride, which can benefit parents who prefer to avoid fluoride for their young children.

Manufacturers introduce unique products or formulations in specific regions to gain a competitive edge or differentiate themselves from competitors. For instance, in May 2021, Gallinée launched an oral care range that includes prebiotic toothpaste and prebiotic-probiotic tablet supplements designed to promote oral health by targeting the mouth's microbiome. The prebiotic toothpaste from Gallinée contains prebiotic ingredients that nourish beneficial bacteria in the oral cavity. By supporting the growth of these beneficial bacteria, it can help create a healthier oral microbiome, which may contribute to better oral health. The product range was available on Gallinée's own-brand website in the U.K., France, and the U.S.

Regional Insights

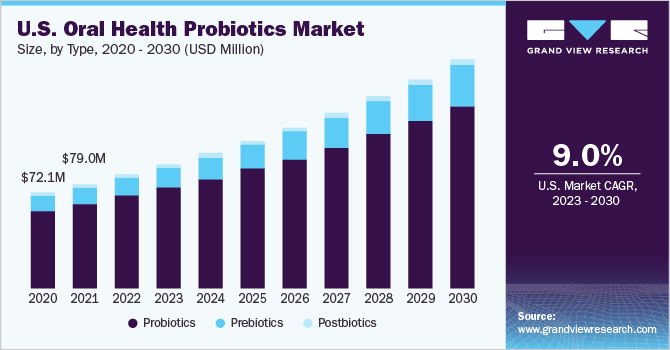

The U.S. was leading the market with a share of 84.7% in 2022. Consumers in the U.S. are becoming more conscious of the importance of oral health. They understand that good oral hygiene is about having a beautiful smile and plays a crucial role in overall health. People seek products like oral probiotics to maintain and improve their oral health as awareness grows. There's a notable shift in consumer behavior toward DS preventive healthcare. Rather than addressing oral health issues after they arise, consumers are proactively preventing problems like cavities, gum disease, and bad breath. Oral probiotics are a natural and proactive way to support oral health.

ProBioraKids, a pioneering probiotic designed specifically to enhance children's oral and overall health, was introduced in the U.S. in April 2022. ProBioraKids is available in a delicious orange creamsicle lozenge, ensuring a delightful taste. It is gluten-free and vegetarian and contains no artificial flavors, sweeteners, or colors. It is compatible with dental and orthodontic appliances, promoting convenience and ease of use.

Mexico is expected to grow at a CAGR of 13.7% from 2023 to 2030. People in Mexico, like other countries across the region, have been suffering from numerous dental problems such as cavities and gum disease. As consumers become busier and healthcare expenses continue to soar, people are looking for convenient and more proactive approaches to oral care. Oral health probiotics fit into this trend by offering easy-to-use preventive healthcare products.

Moreover, consumers in Mexico are seeking oral health probiotics that are free from harsh chemicals, natural, and safe. In Mexico, there has been a notable surge in dental cavities and gum issues during the pandemic due to increased consumption of carbohydrates and sugary products and deteriorating personal hygiene habits.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand share analysis indicates that key players are focusing on strategies such as new type launches, partnerships, mergers & acquisitions, business expansions, and others. Some of the initiatives include:

-

In April 2022, ProBiora AB launched ProBioraKids, an oral care probiotic lozenge for children. Lozenges are developed to help protect against cavities and gum disease by boosting the levels of beneficial bacteria in the mouth. They contain a patented blend of three strains of good bacteria that are naturally found in the mouth: Streptococcus oralis KJ3, Streptococcus rattus JH145, and Streptococcus uberis KJ2.

-

In May 2021, the company expanded into oral care by launching a prebiotic toothpaste and probiotic supplement. The toothpaste is formulated with xylitol and prebiotics to cleanse the teeth while supporting the oral microbiome. It is also vegan and gluten-, lactose-, and sugar-free. It is formulated with live probiotics that are said to contribute to the maintenance of gums, teeth, and mucosa.

Some prominent players in North America Oral Health Probiotics market include:

-

BioGaia AB

-

NOW Foods

-

HYPERBIOTICS

-

ProBiora Health

-

OraTicx

-

Replenish The Good

-

Great Oral Health

-

Pure Research Restore

-

Church & Dwight Co., Inc. (Therabreath)

-

NatureWise

-

Swanson

-

Jarrow Formulas, Inc.

-

Revitin

-

Dessert Essence

-

Gallinee

-

BURST

-

Blis Probiotics

-

ProDentim

-

Luvbiotics

-

Riven

-

Designs For Health, Inc.

North America Oral Health Probiotics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 110.9 million |

|

Revenue forecast in 2030 |

USD 209.2 million |

|

Growth rate |

CAGR of 9.5% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, form, end-user, distribution channel, region |

|

Regional scope |

North America |

|

Country scope |

U.S.; Canada; Mexico |

|

Key companies profiled |

BioGaia AB; NOW Foods; HYPERBIOTICS; ProBiora Health; OraTicx; Replenish The Good; Great Oral Health; Pure Research Restore; Church & Dwight Co., Inc. (Therabreath); NatureWise; Swanson; Jarrow Formulas, Inc.; Revitin; Dessert Essence; Gallinee; BURST; Blis Probiotics’ ProDentim; Luvbiotics; Riven; Designs For Health, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Oral Health Probiotics Market Report Segmentation

This report forecasts revenue growth at regional & country levels and analyzes the latest trends and opportunities in each sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the North America oral health probiotics market report based on type, form, end-user, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Probiotics

-

Prebiotics

-

Postbiotics

-

-

Form Outlook (Revenue, USD Million, 2017 - 2030)

-

Tablets

-

Lozenges

-

Gummies

-

Toothpaste

-

Mouthwash

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Human

-

Animal

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Pharmacies & Drug Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America oral health probiotics market size was estimated at USD 101.4 million in 2022 and is expected to reach USD 110.9 million by 2023.

b. The North America oral health probiotics market is expected to grow at a compounded growth rate of 9.5% from 2023 to 2030 to reach USD 209.2 million by 2030.

b. Tablets dominated the North America oral health probiotics market with a share of 48.2% in 2022. Oral care tablets often come in minimal or recyclable packaging, reducing plastic waste. Additionally, they typically require less water for use, which aligns with conserving water resources. As sustainability becomes a more significant consumer consideration, tablets are seen as a greener option.

b. Some key players operating in North America oral health probiotics market include BioGaia AB, NOW Foods, HYPERBIOTICS, ProBiora Health, OraTicx, Replenish The Good, Great Oral Health, Pure Research Restore, Church & Dwight Co., Inc. (Therabreath), NatureWise, Swanson, Jarrow Formulas, Inc., Revitin, Dessert Essence, Gallinee, BURST, Blis Probiotics, ProDentim, Luvbiotics, Riven, Designs For Health, Inc.

b. Key factors that are driving the market growth include growing awareness of the benefits of probiotics for oral health and increasing prevelance for oral diseases.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."