- Home

- »

- Consumer F&B

- »

-

North America Olive Market Size And Share, Report, 2030GVR Report cover

![North America Olive Market Size, Share & Trends Report]()

North America Olive Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Olive Oil, Table Olive), By Application (Food & Beverage, Cosmetics & Personal Care, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-482-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Olive Market Size & Trends

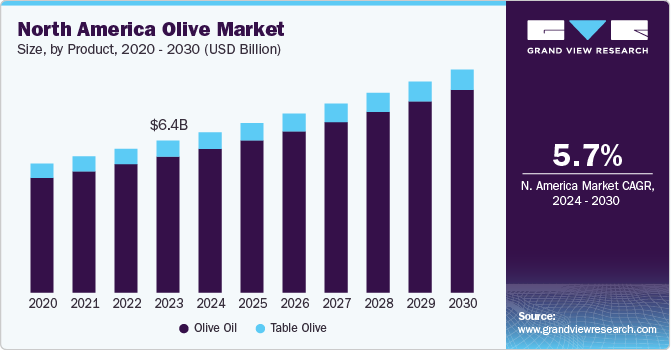

The North America olive market size was estimated USD 6.35 billion in 2023 and is expected to grow at a CAGR of 5.65% from 2024 to 2030. The market growth is significantly influenced by the rising popularity of Mediterranean cuisine, particularly in non-European countries such as the United States and Canada, where an increase in Mediterranean restaurants has led to higher demand for olives and olive-based dishes.

Another critical driver of the olive market is the growing awareness of health benefits associated with olive consumption. Olives are rich in healthy fats, particularly oleic acid, and contain antioxidants that contribute to various health benefits, including reduced inflammation and lower risks of heart disease. Olives are rich in monounsaturated fats, particularly oleic acid, which is known to improve heart health by lowering LDL (bad) cholesterol levels while raising HDL (good) cholesterol levels. This beneficial lipid profile helps reduce the risk of cardiovascular diseases, making olives a popular choice among health-focused individuals.

Moreover, olives are packed with antioxidants such as vitamin E and phenolic compounds, including hydroxytyrosol and oleuropein. These compounds not only combat oxidative stress but also exhibit anti-inflammatory properties that may help mitigate chronic conditions like diabetes, cancer, and arthritis. Research suggests that the consumption of olives can lower the risk of certain cancers and support cognitive health by reducing inflammation in the brain, which is linked to neurodegenerative diseases like Alzheimer's.

The versatility of olives in various culinary applications also contributes to their appeal. They enhance the flavor of dishes without adding excessive calories or unhealthy fats, making them an attractive option for those following low-carb or ketogenic diets. This adaptability has led to their integration into everyday diets across the globe, particularly in non-European countries where awareness of their health benefits is growing. This has led to an increase in demand for olives among health-conscious consumers.

Furthermore, the rise in veganism has shifted dietary preferences towards plant-based foods, with olives being a favored alternative due to their nutritional profile. There is also a marked trend towards organic products, with consumers increasingly seeking organic olives free from pesticides. This shift is particularly strong in the U.S., where specialized organic retailers are seeing increased sales of organic table olives. Additionally, the food service industry plays a significant role in driving demand, as restaurants and catering services incorporate olives into their menus, further boosting market growth.

Olive oil was the biggest market for olive products. The trend of minimally processed oils is significantly impacting the olive oil market by aligning with consumer preferences for healthier and more natural food options. As consumers become increasingly health-conscious, there is a growing demand for oils that are perceived as safer and more nutritious. Minimally processed oils, such as cold-pressed and virgin olive oils, retain their natural flavors and nutrients, making them highly desirable among those seeking to avoid harmful chemicals often found in heavily refined oils.

Minimally processed olive oils are rich in monounsaturated fats, antioxidants, and polyphenols, which are linked to various health benefits, including reduced risks of cardiovascular diseases and improved overall wellness. The popularity of extra virgin and virgin olive oils has surged as they are viewed as healthier alternatives compared to refined oils, thus driving demand in both retail and foodservice sectors. The clean flavor profile and unaltered organoleptic properties of cold-pressed olive oil further enhance its appeal, making it a preferred choice for culinary applications where taste is paramount.

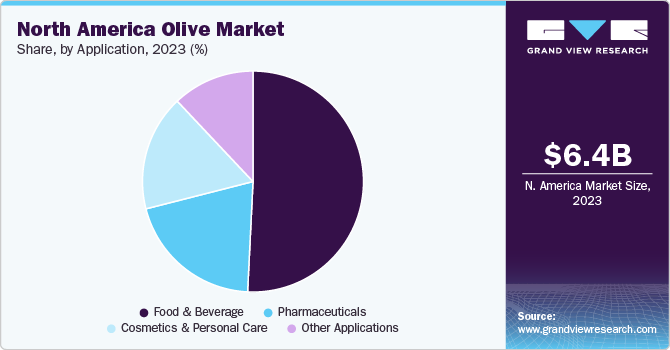

Olive oil is increasingly utilized in multiple sectors, including food, pharmaceuticals, cosmetics, and personal care. The food industry remains the dominant application segment, driven by consumer preferences for healthier cooking oils. Olive oil is favored for its health benefits, such as promoting heart health and providing essential fatty acids. Its use in salad dressings and as an ingredient in various food products enhances both flavor and nutritional value, making it a staple in many households.

In addition to food applications, olive oil is gaining traction in the pharmaceutical sector for its anti-inflammatory properties and potential health benefits. It is used in formulations for topical treatments and nutraceuticals. The cosmetic and personal care industries also leverage olive oil for its moisturizing and nourishing properties, leading to increased demand for skincare products that incorporate this natural ingredient.

One of the primary challenges is the highly seasonal nature of olive production, which leads to fluctuations in supply and pricing. Olives are predominantly harvested in the fall, from October to December, making the market vulnerable to variations in crop yields due to climatic conditions and disease outbreaks. Such unpredictability complicates supply chain management and can disrupt trade flows, affecting both producers and consumers alike.

Additionally, the limited geographical distribution of olive cultivation poses a major constraint. Olive trees thrive in specific Mediterranean climates characterized by mild winters and hot, dry summers. This geographical specificity means that olive production is concentrated in certain regions, making it susceptible to environmental challenges such as droughts and wildfires, which can severely impact yields. Consequently, any disruption in these key growing areas can lead to significant supply shortages and price volatility. Furthermore, competition in export markets presents another challenge. Many countries are entering the olive production space, aiming to replace imports with domestically produced goods. This increased competition can lead to oversupply in certain markets or a lack of confidence in the quality of domestic products compared to established producers from Mediterranean countries.

Lastly, there is a lack of awareness among farmers regarding market trends and demand characteristics, which can result in poor marketing performance and inadequate coordination between farmers and mills. These factors collectively hinder the ability of producers to adapt to changing market dynamics effectively.

Product Insights

The olive oil market was the largest and had a revenue of USD 5.68 billion in 2023. It is expected to grow at a CAGR of 5.9% over the forecast period. One of the primary reasons for this surge is the increasing health consciousness among consumers. Olive oil, particularly extra virgin olive oil, is recognized for its health benefits, including its high content of monounsaturated fats and antioxidants, which are associated with reduced risks of heart disease and other chronic conditions. As more people become aware of these benefits, they are incorporating olive oil into their diets as a healthier alternative to traditional cooking oils like soybean and sunflower oil.

The rising popularity of Mediterranean cuisine also plays a significant role in boosting olive oil demand. As consumers seek to explore diverse culinary experiences, olive oil has become a staple ingredient in many households. This trend is further supported by the growth of gourmet food stores and specialty retailers that offer a wide variety of high-quality olive oils, making it easier for consumers to access these products.

There is a notable shift towards organic and premium olive oil products, reflecting a broader trend in the food industry where consumers are willing to pay more for high-quality, traceable products. Sales of organic olive oil have seen significant growth, with consumers increasingly prioritizing natural and sustainably sourced ingredients. This trend aligns with the overall increase in organic product sales in the U.S., which reached record highs recently.

The expansion of e-commerce platforms has also contributed to the growing demand for olive oil. Online shopping provides consumers with convenient access to a diverse range of olive oil products, including artisanal and specialty options that may not be available in traditional retail settings. This accessibility encourages experimentation and increases overall consumption.

In summary, the growing demand for olive oil in North America is fueled by heightened health awareness, culinary exploration, a preference for organic and premium products, and the convenience offered by online shopping. These factors collectively indicate a promising future for the olive oil market in the region.

Table olives were the other form of olive available in the market and are expected to grow at a CAGR of 3.5% from 2024 to 2030. Table olives are also gaining popularity due to their versatility in culinary applications. They are used in a wide range of dishes, from salads and pizzas to tapenades and antipasti platters. As more consumers explore Mediterranean cuisine, the incorporation of table olives into everyday meals has become more common. This trend is further supported by the growth of Mediterranean restaurants and gourmet food offerings across the country.

The availability of diverse varieties of table olives in grocery stores and online has also contributed to their growing popularity. Consumers now have access to a wider range of products, including organic and specialty olives, which encourages experimentation and boosts overall consumption.

Application Insights

Food and beverage was the largest application for olives and accounted for a market revenue of USD 2.73 billion in 2023. The growing demand for olive oil in the food and beverage industry, particularly in the U.S., is driven by a combination of health consciousness, culinary versatility, and evolving consumer preferences. As consumers increasingly prioritize healthier cooking options, olive oil-especially extra virgin olive oil-has gained recognition for its numerous health benefits, including improved heart health, anti-inflammatory properties, and rich antioxidant content. Studies have shown that regular consumption of olive oil can lower bad cholesterol (LDL) while raising good cholesterol (HDL), thereby reducing the risk of cardiovascular diseases.

Additionally, the Mediterranean diet, which prominently features olive oil, is associated with longer life expectancy and reduced incidence of chronic diseases, further boosting its appeal among health-conscious consumers. The versatility of olive oil also plays a crucial role in its rising popularity; it is not only used for cooking but also as a base for salad dressings, dips, and marinades, enhancing flavor without overpowering other ingredients. This adaptability has led many restaurants and food manufacturers to replace less healthy oils with olive oil in their offerings, aligning with the increasing demand for clean-label and minimally processed foods.

Furthermore, the rapid growth of the fast-casual dining segment focusing on healthy menus provides ample opportunities for olive oil suppliers to cater to this burgeoning market. As consumers continue to seek natural and nutritious food options, the demand for high-quality olive oil is expected to remain strong, supported by ongoing marketing efforts that highlight its health benefits and culinary applications.

Pharmaceuticals were the second largest application for olives and is expected to grow at a CAGR of 5.3% from 2024 to 2030. The growing demand for olive oil in the personal care and cosmetic industry in the U.S. is primarily driven by its recognized moisturizing and antioxidant properties, which make it an ideal ingredient for skincare and haircare products. Olive oil is rich in vitamins A, D, E, and K, along with essential fatty acids that nourish and hydrate the skin, promoting a healthy complexion and helping to combat signs of aging. This has led to an increasing incorporation of olive oil in various cosmetic formulations, such as lotions, creams, shampoos, and conditioners, appealing to consumers seeking natural and effective beauty solutions.

The trend towards organic and clean beauty products further fuels this demand, as consumers are increasingly inclined to choose products that are free from harmful chemicals and contain natural ingredients. According to market forecasts, the personal care segment of the olive oil market is projected to grow at a compound annual growth rate (CAGR) of 5.0% from 2024 to 2032, reflecting the rising consumer preference for healthier alternatives in personal care.

Additionally, the popularity of Mediterranean lifestyle products, which emphasize the use of olive oil for both culinary and cosmetic purposes, has contributed to its appeal in the personal care sector. As awareness of the benefits of olive oil continues to spread, its integration into beauty and wellness products is expected to expand further, solidifying its position as a favored ingredient in the U.S. personal care market.

Regional Insights

U.S. Olive Market Trends

The U.S. was the largest consumer for olive and accounted for a market share of over 80% in 2023. The U.S. olive market is expected to exceed USD 7 billion by 2030. The primary reason for the growth of olive oil in the U.S. is the increasing consumer awareness of its health benefits, which has significantly influenced dietary preferences. This growth is largely fueled by the rising recognition of olive oil as a healthier alternative to traditional cooking oils, attributed to its high content of monounsaturated fats and antioxidants. In fact, organic olive oil sales have seen a notable increase of 7.2% over the past year, highlighting a broader trend towards organic and natural food products.

Growing Middle Eastern cuisine, which extensively incorporates olive oil, has further driven demand as consumers seek flavorful yet health-conscious options. The U.S. also benefits from favorable climatic conditions for olive cultivation, particularly in California, which accounts for over 95% of domestic production. As consumers continue to prioritize health and wellness in their food choices, the demand for high-quality olive oil is expected to remain strong, positioning it as a staple in both home kitchens and restaurants across the country.

Key North America Olive Company Insights

The competitive landscape of the olive market, particularly in the U.S., is characterized by a mix of established players and emerging brands, driven by increasing consumer demand for both olives and olive oil. Key competitors include major companies such as Deoleo, S.A., Sovena Group, Borges Agricultural & Industrial Edible Oils, S.A., California Olive Ranch, Inc., and Pompeian, Inc., among others. These companies dominate the market through extensive distribution networks and product diversification, offering a range of olive products from virgin and extra virgin oils to table olives. The competitive landscape is further influenced by marketing strategies that emphasize health benefits and culinary versatility, as manufacturers seek to raise awareness about olives' nutritional advantages and their incorporation into popular dishes like pizza and salads.

Key North America Olive Companies:

- California Olive Ranch, Inc.

- Pompeian, Inc.

- Deoleo, S.A.

- Sovena Group

- Borges Agricultural & Industrial Edible Oils, S.A.

- Del Monte Foods, Inc.

- Cargill, Incorporated

- GRUPPO SALOV

- Minerva Ltd.

- Unilever Plc

North America Olive Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.71 billion

Revenue forecast in 2030

USD 9.32 billion

Growth rate

CAGR of 5.65% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

California Olive Ranch, Inc.; Pompeian, Inc.; Deoleo, S.A.; Sovena Group; Borges Agricultural & Industrial Edible Oils, S.A.; Del Monte Foods, Inc.; Cargill, Incorporated; GRUPPO SALOV; Minerva Ltd.; Unilever Plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Olive Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America olive market report based on product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Olive Oil

-

Table Olive

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverage

-

Personal Care & Cosmetics

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America olive market size was USD 6.35 billion in 2023 and is expected to reach USD 6.71 billion in 2024.

b. The North America olive market is expected to grow at a compound annual growth rate (CAGR) of 5.65% from 2024 to 2030 to reach USD 9.32 billion by 2030.

b. The olive oil market was the largest and had a revenue of USD 5.68 billion in 2023. It is expected to grow at a CAGR of 5.9% over the forecast period. One of the primary reasons for this surge is the increasing health consciousness among consumers. Olive oil, particularly extra virgin olive oil, is recognized for its health benefits, including its high content of monounsaturated fats and antioxidants, which are associated with reduced risks of heart disease and other chronic conditions.

b. Some key players operating in the North America olive market include California Olive Ranch, Inc.; Pompeian, Inc.; Deoleo, S.A.; Sovena Group; Borges Agricultural & Industrial Edible Oils, S.A.; Del Monte Foods, Inc.; Cargill, Incorporated; GRUPPO SALOV; Minerva Ltd.; Unilever Plc

b. Market growth is significantly influenced by the rising popularity of Mediterranean cuisine, particularly in non-European countries such as the United States, UAE, and Singapore, where an increase in Mediterranean restaurants has led to higher demand for olives and olive-based dishes. Another critical driver of the olive market is the growing awareness of health benefits associated with olive consumption. Olives are rich in healthy fats, particularly oleic acid, and contain antioxidants that contribute to various health benefits, including reduced inflammation and lower risks of heart disease. Olives are rich in monounsaturated fats, particularly oleic acid, which is known to improve heart health by lowering LDL (bad) cholesterol levels while raising HDL (good) cholesterol levels. This beneficial lipid profile helps reduce the risk of cardiovascular diseases, making olives a popular choice among health-focused individuals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.