- Home

- »

- Homecare & Decor

- »

-

North America Office Furniture Market, Industry Report, 2030GVR Report cover

![North America Office Furniture Market Size, Share & Trends Report]()

North America Office Furniture Market Size, Share & Trends Analysis Report By Product (Seating, Storage & Organization), By End-use, By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-332-6

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

North America Office Furniture Market Trends

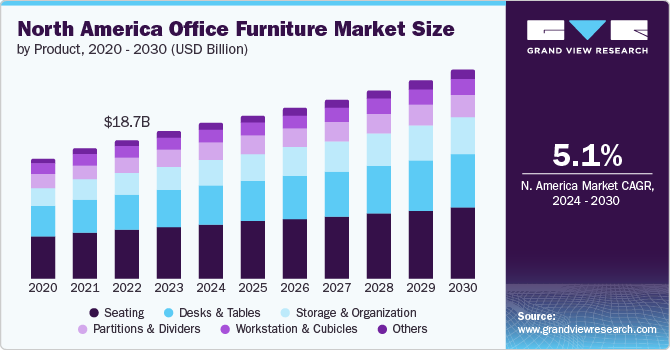

The North America office furniture market size was valued at USD 19.88 billion in 2023 and is expected to grow at a CAGR of 5.1% from 2024 to 2030. The renovations and expansions in commercial office spaces, coupled with rising corporate investments in employee well-being and workspace aesthetics, are expected to drive the demand for modern and customizable office furniture. Additionally, the increasing emphasis on ergonomic designs and sustainability is pushing demand for furniture that promotes wellness and environmental consciousness.

The robust growth of the IT sector in the U.S. is driving demand for specialized furniture to support technological advancements and collaborative work environments. Investments in office infrastructure, spurred by the establishment of corporate centers and remodeling activities, further drive the market. Consumer preferences are shifting towards modular and ergonomic office furniture solutions that are shaping product innovation and marketing strategies.

Businesses are increasingly shifting from traditional brick-and-mortar sales to online platforms. This has led to manufacturers leveraging company-owned portals and e-retailers to enhance product visibility and reach broader audiences. This shift is supported by investments in digital infrastructure, improving the accessibility and penetration of office furniture through online channels. Moreover, there's a trend towards direct sales methods to enhance brand visibility and engagement.

The U.S. market is experiencing robust growth driven by rapid urbanization and increasing office space demand, fueled by long working hours and a focus on employee productivity, that are driving significant investments in office infrastructure.

Manufacturers are responding by developing multifunctional furniture that enhances comfort and space utilization, catering to modern office layouts that prioritize collaboration and efficiency. According to the Energy Information Administration, the U.S. saw a 6% increase in commercial buildings and an 11% rise in square footage from 2012 to 2018, highlighting the expansion in office spaces that necessitate furniture solutions.

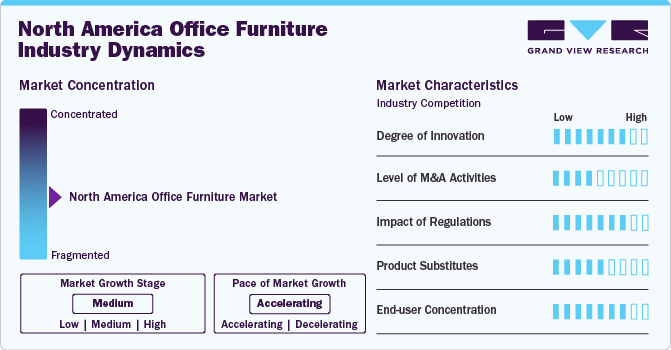

Industry Dynamics

The market growth stage is medium, and the pace is accelerating. The market is witnessing a high degree of innovation in terms of ergonomic designs in office furniture.

Companies are prioritizing optimal workspace layouts and ergonomic solutions, such as adjustable seating and workstation customization, as they aim to enhance employee comfort and reduce the risk of repetitive stress injuries (RSI). Innovations in office furniture that integrate ergonomic principles are expected to drive market growth in North America.

The market has experienced a significant level of M&A in recent years, driven by the need for companies to expand their market share, diversify product offerings, and enhance their competitive positioning. Major industry players are actively pursuing strategic acquisitions to leverage synergies, integrate advanced technologies, and capitalize on evolving workplace trends such as remote work and flexible office spaces. This consolidation trend is also fueled by the desire to streamline operations, reduce costs, and improve supply chain efficiencies, thereby strengthening the market presence and financial performance of the acquiring companies.

The impact of substitutes on the market is generally expected to be moderate to low. While alternatives like remote work setups, co-working spaces, and virtual collaboration tools offer flexibility and cost advantages, traditional office furniture remains essential for businesses requiring dedicated office spaces and ergonomic solutions that support productivity and employee well-being.

Product Insights

In 2023, seating furniture held around 35% revenue share of the market.The demand for seating furniture, including office chairs and sofas, continues to grow steadily. This trend is driven by increasing awareness of ergonomic benefits and the need to enhance workplace comfort and productivity. As organizations prioritize employee well-being and seek to create collaborative and inviting office environments, there is a rising preference for ergonomic office chairs that provide adequate support for long hours of sitting. Additionally, office sofas are gaining popularity for use in reception areas and informal meeting spaces, offering comfort and versatility while complementing the overall aesthetic of modern workplaces.

The demand for storage & organization office furniture is projected to grow at a CAGR of 6.4% from 2024 to 2030. The market is experiencing increasing demand for storage and organization furniture, driven by the need for efficient management of physical documents and resources in modern workplaces. Filing cabinets, shelving units, and storage solutions are crucial for maintaining a clean and organized office environment, which enhances productivity by enabling quick access to essential materials. Manufacturers like Herman Miller Inc. are responding to this demand with innovative product launches such as Ambit Workspace Solutions, offering versatile storage accessories designed to complement contemporary office setups.

End-use Insights

In 2023, corporate office segment accounted for the revenue share of around 46%. Factors driving the demand include the rise of startup culture, which emphasizes collaboration and flexibility in workspace design. As startups proliferate across the U.S. and Canada, there is a heightened need for versatile and modular furniture solutions that can adapt to evolving team dynamics and project requirements. This trend is driving demand for ergonomic desks, stylish chairs, and innovative storage solutions that cater to the aesthetic preferences and functional needs of modern workplaces.

The demand for office furniture for institutional segment is projected to grow at a CAGR of 6.0% from 2024 to 2030.The demand for office furniture in institutional settings across North America is experiencing significant growth, driven by expanding businesses and educational institutions seeking to create conducive work environments. Educational institutions, in particular, are evolving beyond traditional setups to incorporate collaborative and interactive learning environments, necessitating adaptable furniture configurations that foster engagement among students and staff alike.

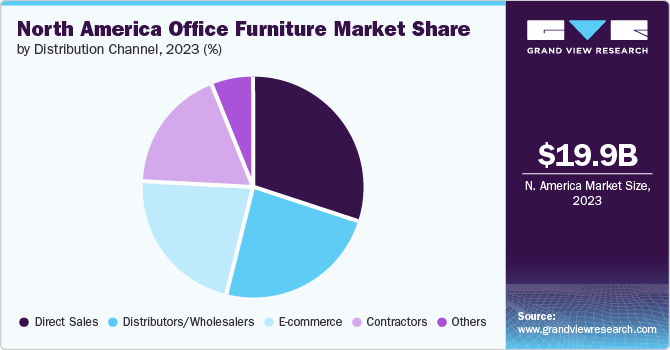

Distribution Channel Insights

In 2023, the direct sales channel accounted for a revenue share of around 30% share.In North America, the sales are expanding due to manufacturers' ability to offer customized solutions tailored to the specific needs of businesses, government agencies, and educational institutions. Companies like Virco Inc. highlight this trend by maintaining a robust direct sales team and dealer network, providing comprehensive support services from consultation to installation. This personalized approach not only strengthens relationships with clients but also enhances operational efficiency and customer satisfaction.

The e-commerce channels segment is expected to grow at a CAGR of 6.7% from 2024 to 2030. The increasing digitalization across industries is encouraging businesses to adopt online purchasing methods, including for office furniture. E-commerce platforms provide convenience, extensive product selection, and competitive pricing, appealing to businesses of all sizes seeking efficient procurement solutions. Moreover, advancements in technology, such as augmented reality (AR) for virtual product visualization and seamless integration of digital payment systems, enhance the online shopping experience, boosting confidence among buyers.

Country Insights

The office furniture market in North America is expected to grow at a CAGR of 5.1% from 2024 to 2030.The shift towards remote and hybrid work models has driven the need for adaptable furniture solutions that support flexible work arrangements like hot-desking and collaborative spaces. This trend is complemented by a heightened focus on creating safe, comfortable, and ergonomic office environments that enhance employee productivity and well-being.The integration of technology into modern workplaces has also driven the demand for tech-friendly furniture that supports digital devices and connectivity solutions, catering to the evolving needs of a tech-driven workforce.

U.S. Office Furniture Market Trends

The U.S. office furniture market accounted for revenue share of around 75% in 2023 in the market. This is attributed to workplaces evolving with technological advancements and changing work cultures. There's a strong emphasis on ergonomic designs that enhance employee well-being and productivity, driving the adoption of features like adjustable seating and height-adjustable desks. Office furniture companies in the U.S. are expanding manufacturing capabilities and leveraging online platforms to meet growing demand, emphasizing sustainability and direct-to-consumer channels to cater to corporate offices and contract furniture providers.

Key North America Office Furniture Company Insights

The market is moderately fragmented. Key players in the office furniture market in North America are actively pursuing strategic initiatives such as mergers, acquisitions, and product launches. These efforts aim to strengthen market presence, expand consumer reach, and enhance product offerings. For instance, HNI Corporation's acquisition of Kimball International and Steelcase, Inc.'s acquisition of HALCON highlight strategic moves to capitalize on emerging market opportunities and broaden their portfolio capabilities. Furthermore, ongoing product innovation, such as new product launches like 9to5 Seating LLC's Ellie Chair, highlights a commitment to meet evolving consumer preferences with stylish, ergonomical, and functional designs.

Key North America Office Furniture Companies:

- Herman Miller Inc.

- Steelcase Inc.

- HNI Corporation

- Ashley Furniture Industries Inc.

- Haworth Inc.

- Teknion

- Global Furniture Group

- OKAMURA CORPORATION

- Virco Inc.

- 9to5 Seating LLC

Recent Developments

-

In June 2023, HNI Corporation finalized its acquisition of Kimball International, Inc., a provider of workplace, hospitality, and healthcare furnishings. This strategic move is aimed at strengthening the company's ability to seize post-pandemic opportunities, particularly in the fastest-growing regions, leveraging Kimball International’s extensive market presence and product expertise.

-

In June 2023, Steelcase Inc. was awarded a Gold rating from EcoVadis, a provider of business sustainability ratings. Steelcase Inc. received a perfect score of 100 on the EcoVadis environmental scorecard and continues to rank among the top 2% of businesses in the world's furniture manufacturing sector.

-

In February 2023, Herman Miller Inc. introduced the Passport work table. It comes in two sizes and has enough surface area for a laptop, a notebook, and a drink. It has a height-adjustable, untethered design that works without a plug or power source. These were made available in a variety of hues and finishes, and extra customization options are provided by add-ons like bag hooks and privacy screens.

North America Office Furniture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 20.95 billion

Revenue forecast in 2030

USD 28.27 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, distribution channel, region.

Regional scope

North America

Country scope

U.S, Canada, Mexico

Key companies profiled

Herman Miller Inc.; Steelcase Inc.; HNI Corporation; Ashley Furniture Industries Inc.; Haworth Inc.; Teknion; Global Furniture Group; OKAMURA CORPORATION; Virco Inc.; 9to5 Seating LLC

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Office Furniture Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America office furniture market report based on product, end-use, distribution channel, and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Seating

-

Desks & Tables

-

Storage & Organization

-

Partitions and Dividers

-

Workstation & Cubicles

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government

-

Corporate Offices

-

Institutional

-

Healthcare

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Sales

-

Distributors/Wholesalers

-

Contractors

-

E-commerce

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America office furniture market size was estimated at USD 19.88 billion in 2023 and is expected to reach USD 20.95 billion in 2024.

b. The North America office furniture market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 28.27 billion by 2030.

b. In 2023, the U.S. held a share of around 75% of the overall market revenue. The shift towards remote work and technological advancements has driven demand for flexible, ergonomic furniture solutions.

b. Some of the key players operating in the North America office furniture market include Herman Miller Inc., Steelcase Inc., HNI Corporation, Ashley Furniture Industries Inc., Haworth Inc., and Teknion.

b. Key factors that are driving the demand for office furniture in North America is driven by expanding business environments, rapid development of IT parks, and a surge in startups and corporate expansions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."