- Home

- »

- Automotive & Transportation

- »

-

North America MUV Rental Market Size, Share Report, 2030GVR Report cover

![North America MUV Rental Market Size, Share & Trends Report]()

North America MUV Rental Market Size, Share & Trends Analysis Report By Application (On-airport, Off-airport), By MUV Type (Passenger Vehicles, Cargo Vehicles), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-666-0

- Number of Report Pages: 66

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

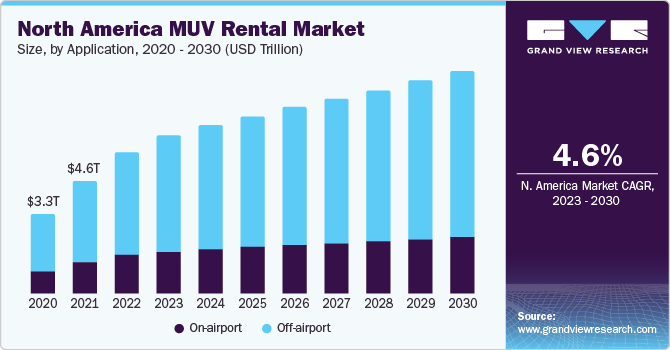

The North America MUV rental market size was valued at USD 6.8 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2030. The number of travelers in North America for business and leisure has recently increased. Although public transport is economical and frequently used in North America, renting a vehicle benefits travelers with additional requirements such as freedom of mobility and a preferred vehicle type. There has been a substantial increase in the number of recreational vehicle (RV) parks and campgrounds in North America, which has attracted travelers to rent an RV.

Business trips are gradually surpassing the number of leisure trips in North America, thus driving the need for MUV rental solutions. Business groups require vehicles on a rent basis throughout the year, whereas the demand for these vehicles from leisure groups is limited to peak periods. To capture a share of the untapped market, prominent players in North America have started providing premium services by offering discounts and packages to frequent travelers. Additionally, there has been a considerable increase in aggregator vehicle rental platforms globally. These platforms help customers compare several aspects of MUVs (provided by various brands), including features, vehicle models, rental plans, and others, to select a better vehicle.

In recent years, renting passenger vans has witnessed rapid growth. While several global companies have already established their footprint in North America, new entrants still have significant scope to enter the market. The market participants focus on providing better offers and services to attract customers and get more reservations. As a result, companies in North America have now started integrating advanced technologies into their business processes.

The service providers in North America are focusing on implementing various technologies for training, sales & marketing, and customer support, enabling better communication with their customers & gaining a competitive edge. The market participants' prime focus is maximizing their vehicles' utilization. In the case of reduced demand, the companies usually reduce the prices to stimulate the demand or reduce the size of their operating fleet of vehicles. A few companies in the market for North America MUV rental, especially those renting passenger vans, are renting out their vehicles on a long-term contract basis to maximize their profitability and reduce downtime of vehicles.

Van rental operators are increasingly tapping the opportunities generated by recent technological innovations in the mobility sector. Additionally, these operators are increasingly offering improvements in their services. They are now focused on providing various enhanced services to their customers, including online self-booking services, sophisticated in-vehicle amenities such as mobile phones, and express service for regular renters. Optimized customer information management enables the operators to deliver improved customer services.

Application Insights

Based on applications, the market is categorized into on-airport and off-airport. The off-airport application segment dominated the market with a share of 73.5% in 2022 and is expected to retain its dominance over the forecast period. The growing trend of renting recreational vehicles to commute to remote locations for camping and leisure purposes has significantly boosted segment growth. Another factor that promotes the demand for passenger van rentals in off-airport applications is increased business travelers. Travelers, in this case, require passenger vans on a rental basis and a regular basis throughout the year.

The on-airport segment is anticipated to witness a significant CAGR of 3.5% over the forecast period. The significant factors responsible for the growth of this segment are the increasing number of low-cost carriers and the improvement of the standard of living among the masses. Prominent market players in North America have established offices at major airports to serve air travelers better. Furthermore, they are increasingly seeking to benefit from the increase in air travelers by expanding their brand presence and vehicle fleet and promoting their services across all major airports.

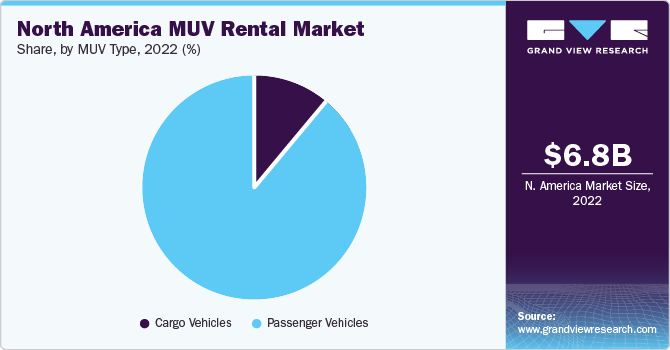

MUV Type Insights

Based on MUV type, the North America MUV rental market for has been segmented into passenger vehicles and cargo vehicles. The passenger vehicle segment accounted for the largest overall revenue share of 92.3% in 2022 and is expected to retain its dominance over the forecast period. The growing number of air travelers and internet-based bookings in North America are crucial factors boosting the growth of the market. Factors such as increased disposable income, consumer confidence, and stable regional economic conditions are also further driving the growth of this segment.

To enhance customer services, rental companies prioritize improvements such as self-service kiosks, online check-in, and loyalty programs to streamline and optimize the rental process. There is a noticeable trend in North America and among travelers from other countries, where online platforms are increasingly used to access vehicle rental services. Companies in this market typically offer comprehensive information about their vehicle fleet, including passenger and cargo capacity details. It enables customers to make informed decisions and select the most suitable multi-purpose utility vehicle (MUV) based on their specific requirements and convenience.

The cargo vehicles segment is anticipated to witness a significant CAGR of 3.6% over the forecast period. North America has a vast trade and distribution network requiring transporting goods between different locations, including warehouses, stores, and distribution centers. Cargo vehicles are essential for efficiently managing these logistics operations.

Regional Insights

The companies operating in the market are focusing on implementing various technologies in their business processes to maintain transparency and improve convenience for customers. A few MUV vehicle rental companies are introducing black box recorders in their fleet of vehicles. This technology incorporates GPS tracking to ascertain the location of the vehicle at any point in time. The companies are adopting this technology as a part of their strategy to limit the number of vehicles lost due to theft and to identify the customers violating speeding regulations during the journey.

The U.S. dominated the market with a market share of 84.9% in 2022. The upsurge in the number of tourists, coupled with the rise in cargo movement across the country, is expected to drive the country’s growth over the forecast period. Moreover, healthy economic conditions and rising disposable income, have also stimulated the growth of the MUV rental market in the country. The key players in the U.S. have started expanding their presence across all major metropolitan and micropolitan areas to address the increasing customer base.

Canada is anticipated to grow considerably, registering a CAGR of 3.5% over the forecast period. The country has witnessed an increase in the number of air travelers, the industry’s highest revenue-generating source, along with gains in per capita disposable income and a reduction in the rate of unemployment. The MUV rental market in Canada has been witnessing consolidation among the players over the last few years. The rising number of domestic travelers and the growth of the Canadian economy are expected to provide considerable opportunities for the country’s MUV rental market growth over the forecast period.

Key Companies & Market Share Insights

The companies are expanding their geographical presence and upgrading their vehicle fleet size to precisely address the demand for MUV on a rental basis across the region and to increase their profit margins. Moreover, the major players have also started launching their mobile applications for enhancing the convenience of customers. In March 2019, Sixt SE unveiled a mobile app that provided users with a plethora of services, including car renting, cab-hailing, and car-sharing.

Partnerships and collaborations are critical strategies that players adopt to gain a competitive edge. In February 2019, Budget Truck Rental, LLC, partnered with Fetch Truck Rental, a self-service truck startup, enabling the latter company’s customers to rent Budget’s box trucks, pickup trucks, and cargo vans with flexible terms and various rental options. Recently, Sixt SE commenced its business operations at San Antonio International Airport, Texas, U.S., to expand its geographic presence and enhance its market share. Similarly, in April 2019, Enterprise Holdings, Inc. announced a strategic partnership with a Japan-based company named Nippon Rent-A-Car Service, Inc. to expand its geographical footprint. Prominent players in the market are increasing the rental fleet size of electric & autonomous vehicles and vehicles featuring connected technologies. The following are some of the major participants in the North America MUV rental market:

-

Airport Van Rental

-

Enterprise Holdings, Inc.

-

Auto Europe

-

Budget Rent A Car System, Inc.

-

CarRentals.com.

-

DTG Operations, Inc.

-

Penske Corporation, Inc.

-

RVshare.com

-

SIXT

Recent Developments

-

In June 2023, Uber is expanding its Uber Carshare service to Boston, U.S., and Toronto, Canada. Initially launched in Australia, this product enables individuals to rent vehicles from private car owners for a specified duration. By introducing Uber Carshare to these cities, Uber aims to provide more flexible transportation options to its users.

-

In January 2023, National Car Rental unveiled a redesigned mobile app offering many new features and an enhanced user experience, elevating the seamless car rental process. With its improved aesthetics and user-friendly interface, the app enables customers to take full control of their rental experience, from making reservations to managing the return of the vehicle. The updated app provides a range of new features designed to empower customers and enhance their overall satisfaction with the rental process.

-

In June 2022, Hertz Company announced a significant deal worth USD 4.2 billion to acquire 100,000 Tesla fully electric vehicles (EVs) by the end of 2022, which has sparked competition among rental car agencies. Hertz has yet to disclose the total number of vehicles in its fleet, making it uncertain how many Teslas are currently available across the more than 30 markets where EVs are offered. It includes the introduction of the first batch of 65,000 Polestar 2s, an EV brand jointly owned by Chinese parent companies Geely and Volvo, which has plans to go public through a SPAC deal.

-

In September 2021, Enterprise Holdings partnered with Microsoft to introduce connected car technology to its car rental, commercial truck, and exotic vehicle rental fleets in the U.S., with plans to expand to Canada and the UK in the near future. This collaboration aims to enhance the rental experience by leveraging advanced technology, thus paving the way for a more efficient and streamlined rental process.

North America MUV Rental Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.59 billion

Revenue forecast in 2030

USD 11.59 billion

Growth rate

CAGR of 4.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, MUV type, region

Country scope

U.S., Canada, Mexico

Key companies profiled

Airport Van Rental, Enterprise Holdings, Inc., Auto Europe, Budget Rent A Car System, Inc., CarRentals.com., DTG Operations, Inc., Penske Corporation, Inc., RVshare.com, SIXT

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America MUV Rental Market Report Segmentation

This report forecasts revenue growth at regional and country levels and analyzes the latest industry trends in each sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the North America MUV rental market on the basis of, application, MUV type, and region:

-

Application Outlook (Revenue in USD Million, 2017 - 2030)

-

On-airport

-

Off-airport

-

-

MUV Type Outlook (Revenue in USD Million, 2017 - 2030)

-

Passenger Vehicles

-

Cargo Vehicles

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North america MUV rental market size was estimated at USD 6.8 billion in 2022 and is expected to reach USD 7.59 billion in 2023.

b. The global North america MUV rental market is expected to grow at a compound annual growth rate of 4.5% from 2023 to 2030 to reach USD 11.59 billion by 2030.

b. US dominated the North America MUV rental market with a share of 84.9% in 2020. This is attributable to the rising number of leisure and business trips across the region, both locally and internationally.

b. Some key players operating in the North America MUV rental market include Alamo, Airport Van Rental, Avis Budget Group, The Hertz Corporation, and Sixt SE

b. Key factors that are driving the car rental market growth include an upsurge in travel and tourism activities across the globe and improved road infrastructure, coupled with increased disposable incomes, especially in emerging economies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."