North America Mosquito Repellent Market Size, Share & Trends Analysis Report By Product (Coils, Cream & Oils, Vaporizer), By Distribution Channel (E-Commerce, Supermarkets), By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-535-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

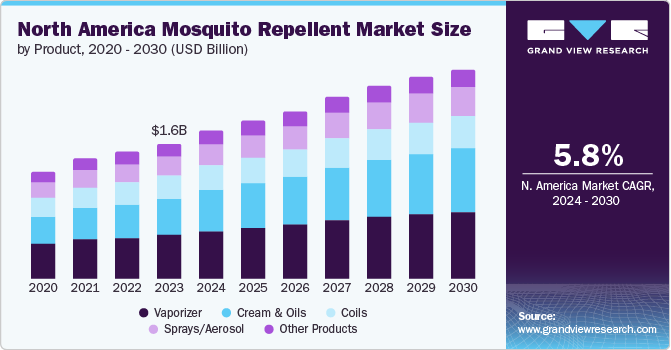

The North America mosquito repellent market size was valued at USD 1.6 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. Rising awareness of mosquito-borne diseases, surging demand for natural and organic alternatives, and growing participation in outdoor activities are prominent factors fueling market growth in the region. A notable trend is the increasing preference for DEET-free, natural, and organic repellents, driven by consumers seeking safer and more sustainable solutions for personal protection.

Market growth is driven by several key factors, including the rising incidence of mosquito-borne diseases such as Zika virus, West Nile virus, dengue, and chikungunya. This has prompted consumers to seek effective protection solutions, thereby boosting demand for mosquito repellents. Moreover, government initiatives for disease control and public health awareness campaigns have contributed to the growing demand for repellents, as consumers become more aware of the health risks associated with mosquitoes.

Product variety and innovation are also key drivers of the market. The availability of a wide range of products, including sprays, creams, and natural options, caters to diverse consumer preferences. Furthermore, innovations in formulations, such as long-lasting and eco-friendly products, have attracted consumers seeking effective yet sustainable solutions. The market offers a variety of active ingredients, including DEET, Picaridin, IR3535, and oil of eucalyptus, which provide different levels of protection against mosquitoes.

The increasing trend of outdoor leisure activities such as camping, hiking, and backyard parties is also driving the demand for mosquito repellents in North America. Consumers are seeking effective and easy-to-use products to protect themselves during these activities. As a result, repellents such as sprays, wipes, and gadgets that can be worn are gaining popularity. With the increasing awareness of the importance of mosquito repellents in preventing mosquito-borne diseases, the market is expected to continue growing at a significant pace in the coming years. Companies are responding by developing new products that cater to consumer needs and preferences, driving innovation and competition in the market.

Product Insights

Vaporizers accounted for the largest market revenue share of 32.2% in 2023, aided by its convenience and effectiveness. Unlike creams and sprays, vaporizers provide continuous protection over a larger area without requiring reapplication, making them ideal for patios, decks, and indoor spaces. The ease of use, area coverage, and variety of options are attractive features for families with young children and individuals who prefer non-invasive, mess-free solutions. This has led to increased demand for vaporizers as a preferred choice for mosquito repellent products.

The cream & oils segment is expected to register the fastest CAGR of 7.7% during the forecast period. Creams and oils offer a convenient, user-friendly way to apply insect repellent, providing instant protection from mosquito bites. With active ingredients like DEET and picaridin, they provide long-lasting protection. Meeting growing demand for natural and organic products, manufacturers have developed creams and oils with plant-derived ingredients. Their versatility in protecting against various outdoor and indoor activities makes them the top choice for a diverse range of consumers in the region.

Distribution Channel Insights

Supermarkets dominated the market and accounted for a share of 45.1% in 2023. Supermarkets in North America offer a comprehensive range of mosquito repellents, including sprays, creams, wipes, coils, and vaporizers, catering to diverse customer needs, preferences, and budget points. This variety provides a convenient and familiar shopping experience, making supermarkets a preferred channel for many mosquito repellent purchases, offering customers a one-stop-shop for their pest control needs.

The e-commerce segment is projected to grow at the fastest CAGR of 5.2% over the forecast period. The rise of e-commerce has revolutionized the mosquito repellent market, enabling consumers to purchase products online with ease and convenience. Online platforms offer a vast array of products, facilitating price comparisons, product reviews, and informed purchasing decisions. The benefits of online shopping include doorstep delivery and multiple payment options, making it an attractive choice for customers. This has significantly enhanced the appeal of online purchasing, offering a seamless and hassle-free experience for consumers.

Regional Insights

North America mosquito repellent market dominated the global mosquito repellent market in 2023, driven by growing demand for natural and organic products. The region's dominance is attributed to its large population, well-developed retail infrastructure, and presence of leading players investing in marketing and innovation. Key growth drivers include product development, distribution networks, and consumer awareness campaigns, as well as rising incidence of mosquito-borne diseases and urbanization.

U.S. Mosquito Repellent Market Trends

Mosquito repellent market in the U.S. dominated the North America market with a share of 62.3% in 2023 due the large size of the population, high consumer awareness, and presence of mosquito-borne diseases. In addition, this is supported by a well-developed retail infrastructure in the U.S. that makes mosquito repellent products easily accessible to consumers. Several leading players reside in the country and are committed to investing heavily in marketing and product innovation to meet consumer demand.

Key North America Mosquito Repellent Company Insights

Some key companies in North America mosquito repellent market include The Coleman Company, Inc.; The Avon Company; Reckitt Benckiser Group PLC; Quantum Health; and S. C. Johnson & Son, Inc.; among others. Leading players in the region are propelling growth through strategic collaborations, mergers, and research and development initiatives focused on sustainable products, while consumer demand for natural repellents fuels competitive market dynamics.

-

Thermacell is a developer and manufacturer of chemical-free mosquito repellent solutions, providing outdoor patio shield repellers with rechargeable and fuel-powered refills for events, families, and friends, accompanied by online delivery services.

-

S. C. Johnson & Son, Inc. is a manufacturer and marketer of a diverse range of consumer goods, including home care, air care, pest control, home organization, and automotive products.

Key North America Mosquito Repellent Companies:

- The Coleman Company, Inc.

- The Avon Company

- Reckitt Benckiser Group PLC

- Quantum Health

- S. C. Johnson & Son, Inc.

- Dabur India Ltd.

- Godrej Consumer Products Limited

- Jyothy Laboratories Ltd.

- Thermacell

- Coghlan's

Recent Developments

-

In April 2024, SC Johnson Mexico donated 180,000 mosquito repellents to Cáritas Argentina, distributing them to disadvantaged communities affected by Dengue in Tucuman, Salta, Jujuy, Santa Fe, and Santiago del Estero through a collaborative effort.

-

In June 2023, Thermacelllaunched its EX90 and EX55 rechargeable mosquito repellents, designed specifically for outdoor enthusiasts and travelers, offering a 20-foot zone of advanced protection against mosquitoes.

North America Mosquito Repellent Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.8 billion |

|

Revenue forecast in 2030 |

USD 2.5 billion |

|

Growth rate |

CAGR of 5.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America |

|

Country scope |

U.S.; Canada; Mexico |

|

Key companies profiled |

The Coleman Company, Inc.; The Avon Company; Reckitt Benckiser Group PLC; Quantum Health; S. C. Johnson & Son, Inc.; Dabur India Ltd.; Godrej Consumer Products Limited; Jyothy Laboratories Ltd.; Thermacell; Coghlan's |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Mosquito Repellent Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America mosquito repellent market report based on product, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sprays/Aerosol

-

Coils

-

Cream & oils

-

Vaporizer

-

Other Products

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

E-commerce

-

Supermarkets

-

Other Distribution Channels

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."