- Home

- »

- Next Generation Technologies

- »

-

North America Mixed Reality Headset Market, Report, 2030GVR Report cover

![North America Mixed Reality Headset Market Size, Share & Trends Report]()

North America Mixed Reality Headset Market Size, Share & Trends Analysis Report By Component, By Operating System, By Storage, By Charging, By End-user, By Industry, By Resolution, By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-321-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The North America mixed reality headset market size was estimated at USD 1.14 billion in 2023 and is expected to grow at a CAGR of 27.3% from 2024 to 2030. The emergence of the metaverse and the presence of major tech companies that are pioneers in mixed reality (MR) technology scattered across Silicon Valley and beyond fuels innovation and market expansion. These companies are investing in the hardware development of MR headsets and the software and content ecosystem, which is crucial for user adoption.

MR technology is the peak of advancements in several fields, including computer vision, graphics, display technology, and input systems. Devices such as Microsoft’s HoloLens 2 and Magic Leap 2 represent the cutting edge of MR, allowing users to see holographic images overlaid onto their physical environment, manipulated digital objects, and even experience spatial sound.

The rising interest in immersive and interactive gaming has sparked a rise in the appeal of mixed-reality headsets. These devices are gaining traction due to their seamless integration of virtual and augmented reality features, offering gamers a distinct and engaging experience. The surge in MR headset adoption is driven by technological progress, resulting in advanced features such as enhanced resolutions, faster refresh rates, superior tracking functions, and improved comfort designs, all aimed at delivering a genuinely immersive gaming experience.

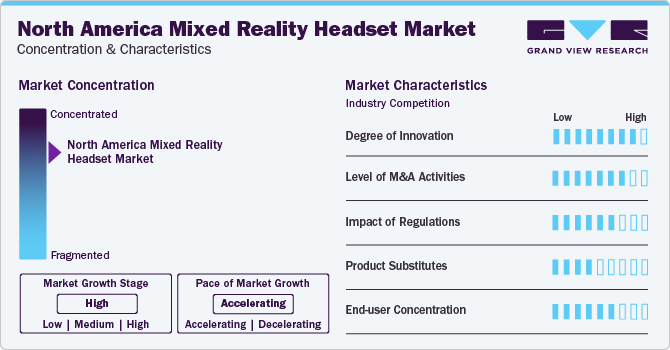

Market Concentration & Characteristics

The growth of the North America mixed reality headset market is high, and the growth is accelerating. The industry is characterized by high innovation due to rapid technological advancements and massive research and development investments. The development of sophisticated MR headsets uses advanced sensors, optics, and computing power to enable real-time interactions.

The industry landscape is evolving, with mergers and acquisitions playing a vital role. The companies strive to enhance their product offerings and capture the untapped market in the region. Acquiring firms with expertise in optics, display technology, tracking systems, or software development enables companies to speed up product innovation and maintain a competitive edge. For instance, in October 2022, Microsoft and Meta collaborated to bring Windows, MS Office, Teams, and Xbox Cloud Gaming to Meta Quest VR headsets.

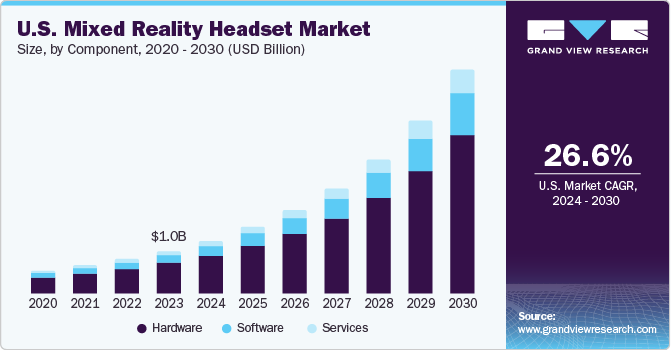

Component Insights

The hardware segment accounted for the largest market revenue share of 72.4% in 2023 due to consumers' increased demand and popularity of virtual and augmented reality experiences. Businesses across various sectors, such as healthcare, education, manufacturing, and retail, increasingly adopt MR headsets for training, design, maintenance, and customer engagement. According to American University, the use of MR headsets is diverse, and integrating technology in education creates interest and boosts students' creativity.

The service segment is anticipated to register the fastest CAGR over the forecast period. The market is driven by the adoption of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML), which are crucial for creating personalized and adaptable mixed-reality solutions. Through the integration of AI and ML, mixed-reality headsets can analyze user information and choices to deliver customized experiences that cater to individual requirements. This personalized approach boosts user involvement and contentment, enhancing overall user experience.

Operating System Insights

The Android segment accounted for the largest market share in 2023. Android, as an operating system, offers a versatile platform for developing and deploying MR applications. This versatility stems from Android’s open-source nature, broad developer, and compatibility with various hardware devices. As the MR market evolves, the role of Android-based systems could become increasingly significant, especially in consumer and educational markets where accessibility and cost-effectiveness are vital considerations.

The windows segment is expected to grow significantly during the forecast period. Windows Mixed Reality (WMR), a platform developed by Microsoft Corporation, supports a range of MR headsets produced by various hardware partners such as HP, Lenovo, Dell, and Samsung. Windows-based mixed reality headsets provide seamless compatibility with Windows PCs, enabling users to connect and use headsets without additional software setups.

Storage Insights

The <128GB segment accounted for the largest market share in 2023. MR headsets with lower storage capacity are often priced competitively, which makes them more accessible to a broader range of consumers. Additionally, technological advancements in cloud computing, streaming services, and cloud-based applications fuel the demand for MR headsets with lower storage capacities.

The >128GB segment is anticipated to register the fastest CAGR over the forecast period. The segment caters to a specific user base that demands high performance, extensive content libraries, and the ability to store significant data locally. The preference for MR headsets with larger storage capacities reflects the growing sophistication of applications and the desire for more immersive experiences. Users who engage deeply with MR for professional, educational, or entertainment purposes find the higher storage capacity essential for a better experience.

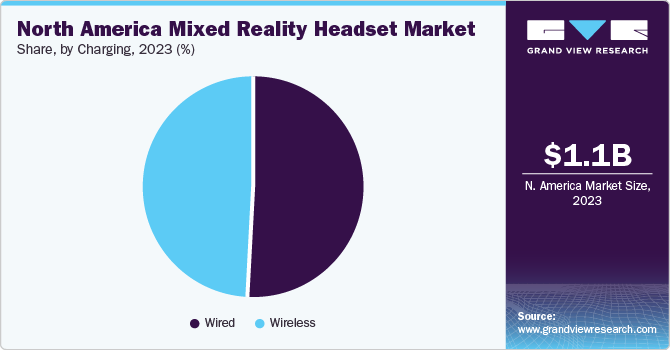

Charging Insights

The wired segment accounted for the largest market share in 2023. Wired charging for MR headsets provides a fast and reliable means of recharging, an essential feature for users who rely on MR technology for extended periods, such as in professional environments or during lengthy gaming sessions. The direct connection to a power source ensures a steady charge and often supports higher power delivery, enabling quicker recharge.

The wireless segment is expected to register the fastest CAGR over the forecast period. Wireless charging has emerged as a pivotal feature for MR headsets, driven by providing a futuristic and enhanced user charging experience. Advanced technology eliminates physical connectors and offers a more straightforward, streamlined way to recharge devices. For users, the ability to charge their MR headsets by simply placing them on a charging pad means less hassle with cables and ports, making the technology more accessible and appealing to a broader audience.

End-user Insights

Based on end-user insights, the market is segmented into commercial, consumer, and military & government. The consumer segment accounted for the largest market share in 2023 and is expected to retain its dominance over the forecast period. Consumer adoption of MR headsets is driven by technological advancements, content availability, and changing lifestyle patterns. Consumer demand is increasing as MR technology evolves and becomes more sophisticated by offering immersive and interactive experiences.

The military & government segment is anticipated to register the fastest CAGR over the forecast period. MR headsets are deployed for various applications, from combat training and simulation to mission planning and battlefield scenarios. These applications leverage the immersive and interactive nature of MR to create realistic scenarios and environments where soldiers can gain valuable experience without the risks associated with live training exercises. The U.S. Department of Defense mentions the vital role of MR headsets in improving the ability and training of warfighters in the Air Force.

Industry Insights

The gaming segment accounted for the largest market share in 2023. MR headset has revolutionized the gaming experience by blending digital content with the physical environment, allowing players to interact with virtual elements as if they were in their immediate surroundings. Multiplayer gaming experiences also fuel the gaming segment’s expansion. MR technology enables new forms of social interaction within games, allowing players to share virtual spaces and experiences in real-time regardless of physical location. According to The Entertainment Software Association (ESA), around 60% of Americans play video games that further drives the market for MR headsets in the gaming segment.

The media and entertainment segment is anticipated to register the fastest CAGR over the forecast period. The segment is characterized by its innovative fusion of real and virtual worlds, interactive experiences, and audience engagement. It is gaining traction as a medium for storytelling, live events, TV shows, virtual concerts, and interactive entertainment.

Resolution Insights

The HD segment accounted for the largest market share in 2023. With consumers increasingly seeking enhanced visual upgrades in their immersive experiences, the HD segment has become a focal point for manufacturers and developers aiming to meet the expectations. HD resolution in MR headsets ensures that digital content is rendered with sufficient detail, making the virtual elements integrated into the real world appear more convincing and engaging.

The 4K and above market is expected to grow at the fastest CAGR over the forecast period. Manufacturers are enhancing mixed reality headsets with 4K and higher resolutions to meet users' demands for lifelike virtual environments. Advancements in display technology and graphics processing capabilities are driving the segment. The clarity offered by 4K and above resolutions can dramatically improve the effectiveness and user experience of MR applications.

Distribution Channel Insights

The offline segment accounted for the largest market share in 2023. Consumers demand a hands-on experience before purchasing the MR headset, which is vital for the offline segment’s growth. Tangible interaction is particularly crucial for MR technology, where the immersive experience is a key selling point that is difficult to convey through online descriptions or videos alone.

The online segment is expected to grow at the fastest CAGR over the forecast period. The convenience of online shopping, combined with the broad availability of detailed product information, reviews, and comparison tools, has propelled the online distribution channel to the forefront of MR headset sales. Consumers can search for and transact the preferred device from their homes. Manufacturers get direct consumer feedback through reviews and ratings that provide valuable insights about the product.

Country Insights

U.S. Mixed Reality Headset Market Trends

The U.S. mixed reality headset market accounted for the largest market revenue share of 89.7% in 2023. The U.S. is a hub of technological innovation and a key consumer market. The presence of big technological companies fuels innovation in MR technology. The country's ecosystem fosters rapid advancements in MR capabilities, including improvements in display technology and user interfaces. Additionally, the U.S. accounted for over 25% of the global mixed-reality headset market in 2023 and is expected to grow significantly over the forecast period.

Canada Mixed Reality Headset Market Trends

Canada's mixed reality headset market is anticipated to register the fastest CAGR over the forecast period. Canadian universities and research institutions are at the forefront of technological innovation, often collaborating with private enterprises. This synergy between academics and industry has fostered a favourable environment for developing and adopting MR technologies.

Key North America Mixed Reality Headset Company Insights

Some of the key players operating in the market include Meta, Apple, Microsoft, and Google.

-

Metaoffers MR headsets and is set to have profound implications for the future of digital interaction. The company envisions a future where MR technologies enable more immersive, interactive, and socially connected experiences. The Meta Quest Pro headset is a widely recognized augmented reality and virtual reality device offered globally.

-

Microsoft is recognized for its software products, such as Windows and Microsoft Office, and cloud services like Azure. The HoloLens and its successor, the HoloLens 2, stand out among the most advanced MR devices available, showcasing Microsoft’s commitment to pioneering.

Key North America Mixed Reality Headset Companies:

- Arvizio, Inc.

- Apple Inc.

- Dell Technologies, Inc.

- FYR Medical

- Google LLC

- Holo-Light GmbH

- Magic Leap, Inc.

- Meta Platforms, Inc.

- Microsoft

- Valve Corporation

- VRgineers, Inc.

Recent Developments

-

In February 2024, AppleInc. launched Vision Pro, their revolutionary mixed reality headset in the U.S. The key features include spatial displays, eye tracking, hand tracking, and passthrough mode. The Apple Vision Pro is a powerful and versatile mixed reality headset with the potential to revolutionize the way consumers interact with computers.

-

In January 2024, Google LLC announced the collaboration with Qualcomm Technologies, Inc.for the purpose of using Qualcomm’s new Snapdragon XR2+ Gen 2 chip in their MR headsets.

-

In November 2023, Vrgineers, Inc. launched XTAL 3 CAVU MR Headset which is designed to offer an unparalleled immersive experience for professionals, especially in pilot training, by combining cutting-edge technology from AMD and NVIDIA to enhance performance and reduce latency to just 1 millisecond.

-

In October 2023, Meta launchedits mixed reality headset, Quest 3which is a significant upgrade over its predecessor, the Quest 2. The features include Snapdragon XR2 Gen 2, 4K+ infinite display, enhanced audio, and improved comfort.

-

In September 2022, Magic Leap, Inc. launched Magic Leap 2 MR headsetwhich is a smaller and lighter successor of Magic Leap 1, featuring a wider field of view and improved specifications. The headset features high-resolution displays that deliver sharper images and more vibrant colours, enhancing the overall visual experience.

North America Mixed Reality Headset Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,144.7 million

Revenue forecast in 2030

USD 6.04 billion

Growth rate

CAGR of 27.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, Operating System, Storage, Charging, End-user, Industry, Resolution, Distribution Channel

Country scope

U.S.; Canada

Key companies profiled

Arvizio, Inc.; Meta Platforms, Inc.; Microsoft; Apple Inc.; Magic Leap, Inc.; Google LLC; Holo-Light GmbH; Valve Corporation; Dell Technologies, Inc.; FYR Medical; VRgineers, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Mixed Reality Headset Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America mixed reality headset market report based on component, operating system, storage, charging, end-user, industry, resolution, and distribution channel.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Headset

-

Microphone

-

Sensors

-

Depth Sensor

-

G-Sensor

-

Gyroscope

-

Proximity Sensor

-

Others

-

-

Display

-

LED Technology

-

LCD Technology

-

-

Battery

-

Processor

-

Camera

-

Speakers

-

Others

-

-

Controller

-

Sensors

-

G-Sensor

-

Gyroscope

-

Others

-

-

Battery

-

Others

-

-

Accessories

-

Casing & Covers

-

Wrist Wearable

-

Cables

-

Power Adapter

-

External Battery

-

Gloves

-

Full Body Trackers

-

Lenses

-

Strap Belts

-

Others

-

-

-

Software

-

Services

-

-

Operating System Outlook (Revenue, USD Million, 2018 - 2030)

-

Android

-

Windows

-

Others

-

-

Storage Outlook (Revenue, USD Million, 2018 - 2030)

-

<128GB

-

>128GB

-

-

Charging Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Consumer

-

Military & Government

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Education

-

Gaming

-

Media and Entertainment

-

Healthcare

-

Retail and E-Commerce

-

IT & Telecom

-

Energy and Renewables

-

Oil and Gas

-

Automotive

-

Manufacturing

-

Sports

-

Others

-

-

Resolution Outlook (Revenue, USD Million, 2018 - 2030)

-

HD

-

4K and Above

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The North America mixed reality headset market size was estimated at USD 1.14 billion in 2023 and is expected to reach USD5 1.42 billion in 2024

b. The North America mixed reality headset market is expected to grow at a compound annual growth rate of 27.3% from 2024 to 2030 to reach USD 6.03 billion by 2030

b. Based on component, the hardware segment accounted for the largest market revenue share of 72.4% in 2023 owing to consumers' increased demand and popularity of virtual and augmented reality experiences

b. Some key players operating in the North America mixed reality headset market include Arvizio, Inc.; Meta Platforms, Inc.; Microsoft; Apple Inc.; Magic Leap, Inc.; Google LLC; Holo-Light GmbH; Valve Corporation; Dell Technologies, Inc.; FYR Medical; VRgineers, Inc.

b. The emergence of the metaverse and the presence of major tech companies that are pioneers in MR technology scattered across Silicon Valley and beyond fuels innovation and market expansion.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."