- Home

- »

- Electronic & Electrical

- »

-

North America Microwave Market Size, Industry Report 2030GVR Report cover

![North America Microwave Market Size, Share & Trends Report]()

North America Microwave Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Countertop, Over-the-Range, Built-In), By Technology (Convection, Traditional), By Price, By Capacity, By Power, By Distribution Channel, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-304-2

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

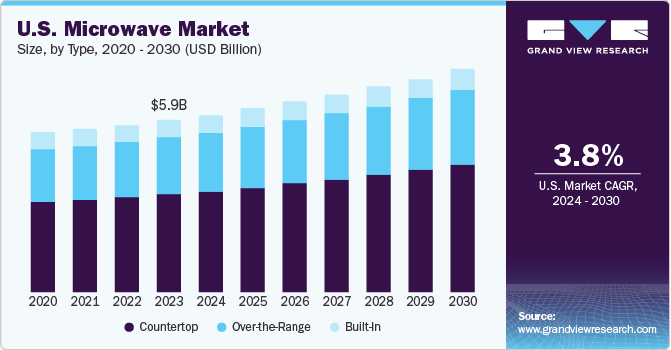

The North America microwave market size was estimated at USD 6.57 billion in 2023 and is expected to expand at a CAGR of 3.9% from 2024 to 2030. Continuous advancements in microwave technology, such as smart features, improved energy efficiency, and enhanced cooking capabilities, are driving consumer interest and adoption. Furthermore, the trend of urbanization in North America has led to a surge in demand for compact, multifunctional appliances like microwaves that efficiently utilize limited living spaces. This, coupled with the region's rising disposable income levels, has empowered consumers to invest in kitchen appliances that offer both convenience and time-saving benefits, further fueling the microwave market's growth.

Smart technology in microwave ovens, such as remote-control capabilities and automatic cooking programs, has enhanced user convenience and experience. In January 2022, Panasonic introduced its advanced smart microwave, the Panasonic Smart Inverter Countertop Microwave Oven (model NN-SV79MS), at the 2022 Consumer Electronics Show (CES) held in Las Vegas. This innovative appliance can be operated through any Alexa-enabled device or directly via the Alexa app. With 69.7 percent of smart speaker users in the U.S. preferring Alexa, the NN-SV79MS is designed to seamlessly integrate into the smart home ecosystems of these users. In addition, advancements in cooking sensors and precision cooking technologies have improved cooking outcomes by ensuring consistent results and optimal food quality.

The fast-paced lifestyle of many North American consumers is a significant factor contributing to the market growth. With more individuals leading busy lives, there is a growing demand for appliances that can reduce cooking time significantly. Microwave ovens offer a convenient solution for quick meal preparation without compromising on quality, making them essential for modern households.

The increasing demand for ready-to-eat meals, busy lifestyles, and technological advancements in microwave oven designs have contributed to the growth of the microwave market in the region. As more individuals rely on microwaves for quick meal preparation and reheating, the market continues to expand. According to a survey published in February 2024, conducted by OnePoll for Whirlpool on 2,000 U.S. adults, 25% of the respondents preferred using microwave to heat food..

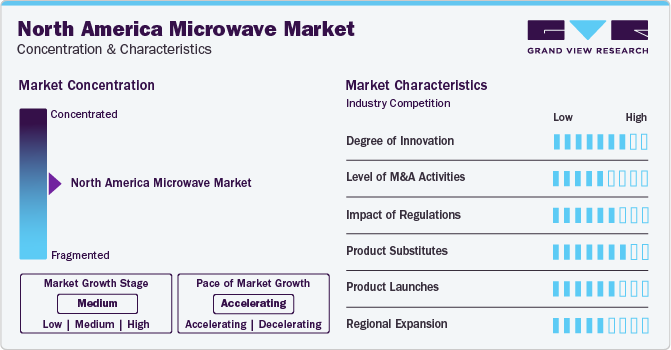

Market Concentration & Characteristics

The degree of innovation in the North America Microwave Industry is notably high, underpinned by a surge in technological advancements that have facilitated the integration of smart connectivity and energy-efficient features. Manufacturers are continually engaged in launching new microwave technology, such as introducing innovative features that streamline cooking processes and enhance efficiency. Inverter technology offers several advantages. It offers uniform heat distribution across food, eliminating any uneven hot or cold areas

In the North America region, the regulation of microwave is overseen by various governmental and international regulatory bodies. For example, in the United States, the Federal Communications Commission (FCC) regulates devices that emit radiofrequency (RF) energy to ensure that microwave ovens comply with specific standards related to electromagnetic interference. Similarly, the Environmental Protection Agency (EPA) sets energy efficiency standards for household appliances, including microwave ovens..

The market reflects a pronounced degree of acquisition activity, characterized by mergers, partnerships, and buyouts among key industry players. These strategic endeavors are pivotal in bolstering market presence, broadening product portfolios, and establishing comprehensive customer offerings. In January 2022, Blue Apron announced a strategic alliance with Panasonic Consumer Electronics Company, a renowned global leader in pioneering products and solutions. This partnership aims to provide customers with convenient cooking alternatives by combining handpicked recipes with quick and delicious techniques utilizing the Panasonic 4-in-1 Multi-Oven.

In the North America Microwave Industry, the presence of product substitutes plays a significant role in influencing consumer choices and market dynamics. Microwave substitutes include traditional ovens, toaster ovens, air fryers, and convection ovens, among others. Traditional ovens offer a different cooking experience with longer cooking times but provide a broader range of cooking capabilities.

Type Insights

Countertop microwave market accounted for a share of over 57% of the North America revenues in 2023. Countertop microwaves offer quick and easy cooking solutions, catering to busy lifestyles where people seek convenience in meal preparation. The ability to heat or cook food rapidly is a significant driver for consumers. Technological advancements and innovations are key factors driving the market for countertop microwaves. Innovations in microwave technology, such as sensor cooking, convection features, and smart connectivity, enhance the functionality and appeal of countertop microwaves.

In December 2020, Sharp Home Electronics Company of America (SHCA) introduced its first smart countertop microwave ovens, integrating Wi-Fi connectivity and certified Works with Alexa compatibility. This innovative feature allows for hands-free operation through voice commands. The launch includes two models based on size: a mid-sized 1.1 cubic feet oven and a larger, family-sized 1.4 cubic feet oven.

The North America over-the-range microwave market is projected to grow at a CAGR of 3.9% from 2024 to 2030. Over-the-range microwaves are designed to save space in the kitchen by combining the functions of a microwave oven and a range hood. With kitchen space often at a premium, especially in smaller homes and apartments, the space-saving design of over-the-range microwaves is a significant driver. Over-the-range microwaves also offer convenience by providing a centralized location for cooking and ventilation. They eliminate the need for separate countertop microwaves and range hoods, streamlining the cooking process and maximizing efficiency in the kitchen.

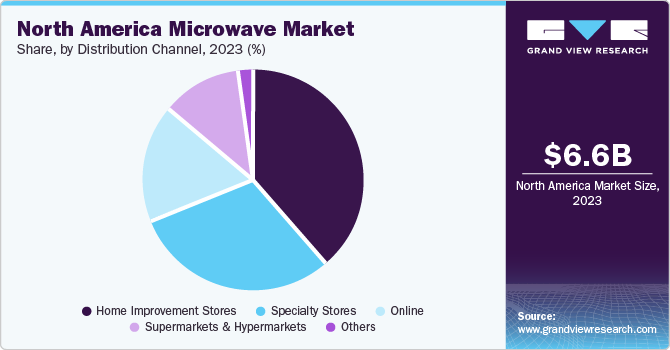

Distribution Channel Insights

The sales of microwave through home improvement stores accounted for a share of around 38% in 2023. The distribution of microwaves through home improvement stores is driven by several factors that align with the needs and preferences of consumers as well as the characteristics of these stores. Home improvement stores such as Lowe's attract customers who are already engaged in home renovation or improvement projects. Microwaves are often considered essential appliances for kitchen remodeling or upgrades, and home improvement stores offer a convenient one-stop shopping experience for consumers looking to purchase appliances alongside other home improvement materials..

The Home Depot, as a home improvement retailer, offers a variety of microwaves, including over-the-range and built-in models, along with countertop options. It offers products from well-known brands and often has a wide selection to choose from, based on the type, price, brand, and features.

The sales of microwave through online distribution channels are projected to grow at a CAGR of 4.2% from 2024 to 2030. A key driver of online channels of distribution is convenience. Online channels provide consumers with the convenience of browsing and purchasing microwaves from the comfort of their own homes at any time of day or night. This accessibility appeals to busy individuals and families who may not have the time or inclination to visit physical stores, allowing them to effortlessly compare products, read reviews, and make informed purchasing decisions with just a few clicks.

Technology Insights

Traditional microwave market accounted for a share of over 76% of the North America revenues in 2023. Traditional microwaves are gaining popularity due to their ability to provide quick and convenient cooking solutions. These appliances cater to the needs of individuals with busy lifestyles who seek ease in meal preparation. The primary advantage of microwaves lies in their capacity to heat or cook food rapidly, making them indispensable for many consumers. The convenience offered by microwaves is a significant factor driving their demand.

North America convection microwave market is projected to grow at a CAGR of 4.6% from 2024 to 2030. One of the key drivers of the convention microwave market is the efficiency and convenience these appliances offer. Conventional microwaves significantly reduce cooking time compared to traditional methods, making them essential for busy households and individuals looking for quick meal preparation options. In addition to household use, convention microwave ovens find significant demand in commercial settings such as cafes, restaurants, and hotels. Medium-duty commercial ovens with advanced features cater to businesses requiring quick and efficient cooking solutions during peak operations.

Price Insights

Microwaves priced between USD 301 to USD 500 accounted for a share of over 35.4% of the North America revenues in 2023. This price range of microwave thrives on a balance between affordability and functionality, appealing to a broad range of consumers. These microwaves offer essential cooking features such as reheating, defrosting, and basic cooking capabilities, making them suitable for everyday use in households of various sizes. The affordability of these microwaves makes them accessible to budget-conscious shoppers and those seeking value for money, providing an entry point into kitchen appliance ownership without breaking the bank..

The market for microwaves priced between USD 100 to USD 300 is projected to grow at a CAGR of 4.0% from 2024 to 2030. Many microwaves are priced between $100 to $300 and offer mid-range capacities, ranging from 0.7 to 1.2 cubic feet, suitable for small to medium-sized households. This size range accommodates most standard dinner plates and cooking containers, making them versatile for various cooking tasks and driving their demand.

Capacity Insights

Medium (1.5 to 2.5 cubic feet) capacity microwave accounted for a share of over 67% of the North America revenues in 2023. A key factor driving the segment is versatility. These microwaves offer a balance between compactness and spaciousness, making them suitable for a wide range of kitchen sizes and cooking needs. They provide enough room to accommodate larger dishes or multiple items simultaneously, such as family-sized casseroles or dinner plates, while still being compact enough to fit comfortably on most countertops. This versatility appeals to consumers who require a microwave that can handle various cooking tasks without taking up too much space in their kitchen, which is anticipated to fuel the segment growth.

Small (Less than 1.5 cubic feet) capacity microwave market is projected to grow at a CAGR of 3.7% from 2024 to 2030. The trend toward urbanization has led to an increase in smaller living spaces, such as apartments and condos, where traditional large appliances may not fit. This drives the demand for compact and space-saving appliances like small microwaves that can still offer functionality without taking up too much space. According to an article by the Center for Sustainable Systems, in 1950, 64% of the U.S. population resided in urban areas. This number has since increased to 83%. The projection for 2050 is that 89% of the U.S. population will live in urban areas.

Power Insights

Medium power (800 to 1,200 watts) microwave accounted for a share of over 78% of the North America revenues in 2023. Medium-power microwaves, ranging from 800 to 1,200 watts, are driven by a balance of efficiency, versatility, and convenience. Their power range allows for faster cooking times compared to lower-wattage models, catering to individuals and families with busy lifestyles who prioritize quick meal preparation.

These microwaves offer a significant improvement in cooking speed without consuming excessive amounts of energy, making them an attractive option for those seeking both efficiency and convenience in their kitchen appliances.According to a February 2024 Gitnux report, approximately 90% of households in the U.S. own a microwave.

High powered microwave market is projected to grow at a CAGR of 3.6% from 2024 to 2030. Microwaves with higher wattage significantly reduce the time needed to cook, making them a suitable choice for both individuals and families who value quick and convenient meal solutions. Whether it's warming up leftovers, thawing out frozen goods, or preparing meals from scratch, microwaves of higher power are capable of delivering meals that are ready to eat in considerably less time, suiting the needs of those with hectic schedules. This is anticipated to fuel the segment's growth.

Country Insights

U.S. microwave market Trends

The microwave market in the U.S. accounted for a share of more than 90% in 2023. Modern microwaves are not just limited to reheating food but come with advanced features such as smart connectivity, grill functions, convection cooking, and voice control. These innovations cater to the increasing consumer demand for smart home appliances, driving market growth. In April 2024, Samsung Electronics America, Inc. launched a new Bespoke Over-the-Range Microwave with edge-to-edge glass controls and a modern look. Available in several colors, it features Auto-Dimming Glass Touch Controls and a large 2.1 cu. ft. capacity to accommodate different cookware sizes.

Canada microwave market Trends

Canada microwave market is projected to grow at a CAGR of 4.5% from 2024 to 2030. The demand for technologically advanced microwave ovens with features such as smart connectivity and energy efficiency is growing in Canada. Consumers are increasingly looking for innovative and convenient cooking solutions, which is driving the adoption of advanced microwave oven models. In March 2023, SHARP Canada launched the SMD2443JSC Microwave Drawer Oven. The microwave has a sensor cook and has a classic stainless steel design.

Key North America Microwave Company Insights

The North America market is highly competitive, with a range of companies offering various products. Many big players are increasing their focus on new product launches, partnerships, and expansion into new markets to compete effectively.

Key North America Microwave Companies:

- Whirlpool Corporation

- Samsung Electronics Co. Ltd.

- Robert Bosch GmbH

- LG Electronics Inc.

- Frigidaire (Electrolux Inc.)

- Kenmore (Transform Holdco LLC)

- GE Appliances (a Haier company)

- Panasonic Corporation

- Breville

- Sharp Corporation

Recent Developments

-

In December 2023, Kenmore, a home solutions provider in America, unveiled an entirely new collection of major kitchen appliances. Among the highlights of the new range are advanced features like TurboBoil, which accelerates food preparation, Steam and Self Clean functions for simplified maintenance, and Air Fry capability (complete with a basket) to promote healthier cooking alternatives

-

In January 2022, Panasonic unveiled its first smart microwave, the Panasonic Smart Inverter Countertop Microwave Oven (NN-SV79MS), during the 2022 Consumer Electronics Show (CES) in Las Vegas. This innovative appliance is compatible with Alexa, allowing users to control it through any Alexa-enabled device or the Alexa app

-

In January 2022, Blue Apron announced a strategic alliance with Panasonic Consumer Electronics Company, a renowned global leader in pioneering products and solutions. This partnership aims to provide customers with convenient cooking alternatives by combining handpicked recipes with quick and delicious techniques utilizing the Panasonic 4-in-1 Multi-Oven

North America Microwave Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 8.54 Billion

Growth rate

CAGR of 3.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, price, capacity, power, distribution channel, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Whirlpool Corporation; Samsung Electronics Co. Ltd.; Robert Bosch GmbH; LG Electronics Inc.; Frigidaire (Electrolux Inc.); Kenmore (Transform Holdco LLC); GE Appliances (a Haier company); Panasonic Corporation; Breville; Sharp Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Microwave Market Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America microwave market report based on type, technology, price, capacity, power, distribution channel, and country.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Countertop

-

Over-the-Range

-

Built-In

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Convection

-

Traditional

-

-

Price Outlook (Revenue, USD Million, 2018 - 2030)

-

Below $100

-

$100 to $ 300

-

$301 to $500

-

$501 to $1,000

-

$1,001 to $2,000

-

Above $2,000

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Small (Less than 1.5 cubic feet)

-

Medium (1.5 to 2.5 cubic feet)

-

Large (More than 2.5 cubic feet)

-

-

Power Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Power (Less than 800 watts)

-

Medium Power (800 to 1,200 watts)

-

High Power (More than 1,200 watts)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets &; Hypermarkets

-

Specialty Stores

-

Home Improvement Stores

-

Online

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America microwave market size was estimated at USD 6.57 billion in 2023 and is expected to reach USD 6.79 billion in 2024.

b. The North America microwave market is expected to grow at a compounded growth rate of 3.9% from 2024 to 2030 to reach USD 8.54 billion by 2030.

b. Countertop microwave market accounted for a share of over 57% of the North America revenues in 2023. Countertop microwaves offer quick and easy cooking solutions, catering to busy lifestyles where people seek convenience in meal preparation.

b. Some key players operating in North America microwave market include Whirlpool Corporation, Samsung Electronics Co. Ltd., Robert Bosch GmbH, LG Electronics Inc., Frigidaire (Electrolux Inc.), Kenmore (Transform Holdco LLC), GE Appliances (a Haier company), Panasonic Corporation, Breville, Sharp Corporation

b. Key factors that are driving the market growth include continuous advancements in microwave technology, such as smart features, improved energy efficiency, and enhanced cooking capabilitieshas propelled the market for cultured meats and plant-based protein sources.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.