- Home

- »

- Advanced Interior Materials

- »

-

North America Metal Emblem And Logos Market, Report, 2030GVR Report cover

![North America Metal Emblem And Logos Market Size, Share & Trends Report]()

North America Metal Emblem And Logos Market Size, Share & Trends Analysis Report By Material (Aluminum, Stainless Steel, Brass, Zinc), By Application (Appliances, HVAC, Golf Carts, Off Road Vehicles), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-437-8

- Number of Report Pages: 72

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

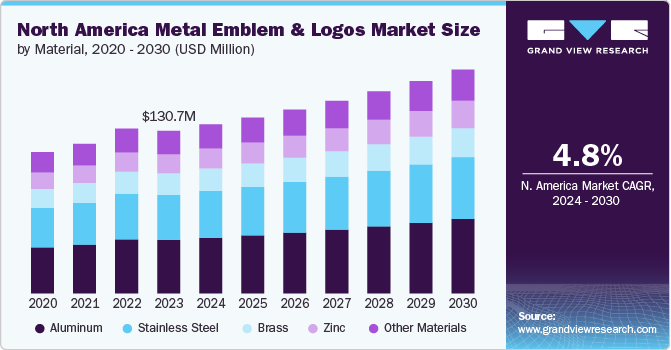

North America metal emblem and logos market size was estimated at USD 130.7 million in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2030. The growth can be attributed to the rising focus of companies on branding and marketing to differentiate their products in the market. Additionally, the ability of metal emblems and logos to offer durability and withstand harsh external environments while providing aesthetic appeal is increasing its use in various industries.

The growth of the automobile market in North America has been a major driver for the North America metal emblems and logos market. Strong demand exists in the automotive industry for metal emblems and logos, as they are an integral part of a vehicle's branding and identity. Automobile manufacturers use metal emblems and logos to showcase their brand names, logos, and distinctive designs on their vehicles.

Companies across various sectors, such as automotive, fashion, and consumer electronics, are adopting unique ways to differentiate their products and create a strong brand identity. Metal emblems and logos provide a visually appealing and durable option to achieve this goal. For instance, luxury car manufacturers such as BMW and Mercedes-Benz use metal logos on their vehicles to enhance the perception of quality and exclusivity.

Furthermore, metal emblems and logos play a significant role in the construction sector, serving various purposes such as branding, identification, and enhancing the visual appeal of construction projects. These emblems and logos are used by construction companies, contractors, and suppliers to showcase their brand identity and create a lasting impression on clients and stakeholders.

However, the rise of digital alternatives has emerged as a significant restraint for the North American metal emblems and logos market. With advancements in technology and the increasing popularity of digital marketing and branding strategies, companies now have alternative options to promote their brand identities without relying solely on physical metal emblems and logos.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The industry tends to have a consolidated market concentration, largely due to the presence of presence of many local and regional players with significant production capacity and low product differentiation. Metal emblem and logo manufacturers utilize various manufacturing techniques, such as stamping, etching, or casting, to create unique and visually appealing emblems.

The degree of innovation is moderate as technological advancements have led to a high emphasis on accuracy, efficiency, and innovation in the metal fabrication market across North America. Moreover, 3D printing has been utilized for localized on-demand production of tooling, such as jigs and fixtures. It offers flexibility in shapes and materials, speeding up production and reducing costs.

The regulatory landscape in North America's metal emblems and logos market is influenced by evolving standards and compliance requirements. Additionally, environmental regulations, such as those related to the use of eco-friendly materials and sustainable manufacturing practices, are shaping the market's approach to compliance and sustainability thereby leading to moderate impact of regulations.

Substitutes of metal emblems and logos can include non-metallic emblems, digital displays, or other forms of branding. The availability and acceptance of these substitutes by customers can impact the demand for metal emblems and logos.

Application in the industry include automotive manufacturers, heating, ventilation, and air conditioning (HVAC) manufacturers, construction firms, transportation companies, and other end users such as fashion brands that require metal emblems and logos for their products. End users value aesthetic appeal, brand representation, and product differentiation. Some of the major end-user firms in the region include Ford, General Motors, Whirlpool, West Coast Customs, and Chanel.

Material Insights

Aluminum accounted for the largest market share of 32.8% in 2023 as it is widely used in the creation of emblems and logos due to its remarkable combination of properties that make it an ideal material for such applications. Aluminum is lightweight, which implies that it adds minimal weight to the products it is attached to, be it vehicles, machinery, or apparel. This feature leads to its wide use in the automotive and aerospace industries, wherein weight reduction is paramount.

Zinc segmental revenue is anticipated to grow at the fastest CAGR of 5.3% over the forecast period due to its durability that resists corrosion effectively, thereby ensuring that the components maintain their aesthetic appeal over a long period, even when exposed to harsh environmental conditions. Additionally, the versatility of zinc allows for a high degree of detail in casting. This makes it an ideal choice for intricate designs as it ensures that even the most complex logos and emblems can be accurately reproduced.

The brass emblem and logos market is expected to reach USD 23.5 million by 2030 owing to its superior properties and aesthetic value. As an alloy of copper and zinc, brass offers exceptional malleability which makes it incredibly easy to mold and carve brass into intricate designs and shapes. This characteristic is particularly beneficial in the development of emblems and logos wherein precision, and detail are paramount.

Stainless steel is also being widely utilized in the market primarily due to its superior durability and corrosion resistance properties. This ensures that emblems and logos developed from it retain their aesthetic appeal and structural integrity even in harsh environmental conditions. This longevity is crucial for maintaining brand image and recognition over time, thereby supporting the product demand.

Application Insights

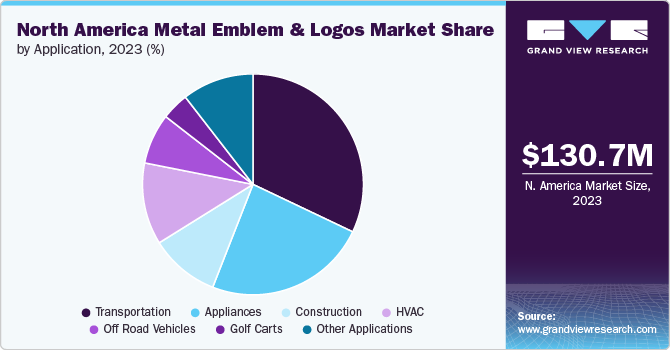

Transportation accounted for the fastest and largest market share of 32.1% in 2023 as the products help to distinguish a vehicle's make and model, giving it a unique identity. It also conveys the prestige, quality, and heritage of vehicles. Emblems are a powerful form of visual communication that, through design and material choice, pronounce brand values and appeal to consumers, influencing purchase decisions.

Metal emblems and logos on appliances play a crucial role in building the brand and consumer trust. They serve as a seal of quality and credibility, assuring consumers that they are investing in a product from a reputable manufacturer known for reliability and excellence. By using durable materials like metal, manufacturers communicate the longevity and robustness of their appliances, indirectly promising a long-term partnership with the user. In a fragmented consumer durables market with multiple brands, distinctive metal logos help products stand out, making them easily recognizable and improving their overall aesthetic appeal, which can significantly influence purchasing decisions.

The off-road vehicle segment is expected to reach USD 13.0 million by 2030 owing to its rising demand. Such demand for off-road vehicles is growing in North America due to increasing interest in outdoor adventures, the ability to navigate rough terrain, and enhanced vehicle technology, making off-roading more accessible and enjoyable. Off-road vehicle manufacturers use metal emblems and logos to differentiate their products from others. With the growth in off-road vehicles, the demand for the metal emblems and logos market is anticipated to witness growth over the forecast period.

Metal emblems and logos in the construction industry are commonly affixed to residential and commercial buildings, such as offices, hospitals, and industries. These symbols represent the identity of the companies responsible for construction, highlighting their work and associating it with specific standards of quality and safety. Moreover, they help in distinguishing products and services in a competitive market, ultimately fostering brand loyalty among consumers and stakeholders.

Country Insights

U.S. Metal Emblem And Logos Market Trends

U.S. metal emblem and logos market was the fastest and largest market with a revenue share of 74.8% in 2023, driven by the growth of the construction industry. As the construction sector expands, the need for branding and identity markers on commercial and residential buildings, equipment, and signage increases.Metal emblems and logos are highly sought after for their durability and aesthetic appeal, fitting perfectly for permanent, high-quality representations of brands in various construction projects. These items are pivotal in branding strategies, helping companies stand out in a competitive market by ensuring their logos are visible in high-value projects.

Metal emblem and logos market in Canada is growing at a CAGR of 3.8% over the forecast period. The automotive industry in Canada has witnessed significant growth, which in turn, is propelling the product demand. As consumer preferences shift toward vehicles that offer a combination of performance, aesthetics, and brand identity, automakers are increasingly incorporating customized, high-quality metal emblems and logos.

Mexico metal emblem and logos market accounted for USD 14.5 million in the region for 2023 owing to a significant rise in the sales of appliances and consumer durables within the country. As more people invest in high-quality appliances and electronics, manufacturers are focusing on differentiating their products in the market. Metal emblems and logos play a crucial role in brand recognition, conveying a sense of durability and quality to consumers. Consequently, manufacturers of appliances and consumer durables are increasingly sourcing these components to enhance their products' aesthetic appeal and brand value. This is expected to boost the metal emblems and logos market in Mexico.

Key Metal Emblem And Logos Company Insights

Some of the key players operating in the market are LaFrance Corp., The Monterey Company, Inc., Medals of America, Impact Signs Inc., and Normic Industries, Inc.:

-

The Monterey Company, Inc. manufactures high-quality metal products and quality custom promotional items. It also manufactures custom products as per end-user requirements and sources promotional products from name-brand companies. The company manufactures metal emblems for pins & coins, patches, custom hats, charms & keychains, and promotional items, such as drinkware & design, coffee mugs, apparel, and others.

-

LaFrance Corp. operates through five divisions and houses business functions such as customer service, production planning, engineering, design, marketing, and accounting. The product mix of the company includes name plates/logos, decorative trims, and functional components. It caters to the needs of the appliance, automotive, HVAC, eyewear, golf, motorcycle, construction & agriculture, cosmetics & personal care, transportation, and other industries. The company has a global footprint with multiple manufacturing facilities across 50 countries. It has the capacity to ship 200 million pieces annually and has a presence in more than 20 countries. Currently, it operates 12 broad-based product lines to meet the expectations of the clients.

EmblemArt, Impact Signs Inc., Trailblazer Badges, and Elektroplateare some of the emerging market participants:

-

EmblemArt is an emblem production and full-service design firm. It has been designing and manufacturing custom emblems and custom graving products. In addition, it also offers services, including design consultation, product consultation, artwork conversion, production & manufacturing, and 3D printing. The company has the capability to design & manufacture emblem orders from small to full large scale based on the CAD design.

-

Impact Signs Inc. manufactures high-quality corporate signs, architectural sign letters, and plaques in its U.S. workshop. It offers a wide variety of materials, finishes, colors, and mounting options for designing & manufacturing plaques and letters. The company’s product mix includes custom-cast bronze plaques, metal letters for signs, custom office lobby signs, stainless steel letters, and backlit lobby signs. The company has completed over 21,000 structural sign projects since its inception and secured 1786 architectural signage orders in 2023. The company has a strong presence in 46 U.S. states.

Key North America Metal Emblem And Logos Companies:

- EmblemArt

- The Monterey Company, Inc.

- Medals of America

- Impact Signs Inc.

- Normic Industries, Inc.

- KEE Group Inc.

- LaFrance Corp.

- Trailblazer Badges

- Elektroplate

Recent Developments

-

In April 2024, the KEE Group Inc. passed the level 2 safety and product standardization certification. This certification is likely to help the company improve its product mix and operations by incorporating standard product designs.

-

In February 2023, Elektroplate announced the launch of its new personalization page. This interactive page allows customization of a variety of products, including license plate frames, hitch covers, and license plates, without having to purchase them in bulk. Such initiatives are likely to help the company strengthen its omnichannel presence and reach its customers more effectively.

North America Metal Emblem And Logos Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 135.8 million

Revenue forecast in 2030

USD 179.8 million

Growth rate

CAGR of 4.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

EmblemArt; The Monterey Company, Inc.; Medals of America; Impact Signs Inc.; Normic Industries, Inc.; KEE Group Inc.; LaFrance Corp.; Trailblazer Badges; Elektroplate

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Metal Emblem And Logos Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America metal emblem and logos market report based on material, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Aluminum

-

Stainless Steel

-

Brass

-

Zinc

-

Other Materials

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Appliances

-

HVAC

-

Golf Carts

-

Off Road Vehicles

-

Construction

-

Transportation

-

Other Applications

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America metal emblem and logos market size was estimated at USD 130.7 million in 2023 and is expected to reach USD 135.8 million in 2024.

b. The North America metal emblem and logos market is expected to grow at a compound annual growth rate of 4.8% from 2024 to 2030, reaching USD 179.8 million by 2030.

b. Aluminum dominated the North America metal emblem and logos market with a share of 32.8% in 2023, owing to its high lightweight, which implies that it adds minimal weight to the products it is attached to, be it vehicles, machinery, or apparel.

b. Some of the key players operating in the North America metal emblem and logos market are EmblemArt, The Monterey Company, Inc., Medals of America, Impact Signs Inc., Normic Industries, Inc., KEE Group Inc., LaFrance Corp., Trailblazer Badges, Elektroplate.

b. The key factors driving North America's metal Emblem and Logos include the surging growth of the automotive industry, along with the HVAC, golf carting, and construction industries in the region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."