- Home

- »

- Medical Imaging

- »

-

North America Medical Imaging Market, Industry Report, 2030GVR Report cover

![North America Medical Imaging Market Size, Share & Trends Report]()

North America Medical Imaging Market Size, Share & Trends Analysis Report By Product (X-ray Devices, Ultrasound, Computed Tomography, Magnetic Resonance Imaging), By End-use (Hospitals, Diagnostic Imaging Centers), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-208-2

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

North America Medical Imaging Market Trends

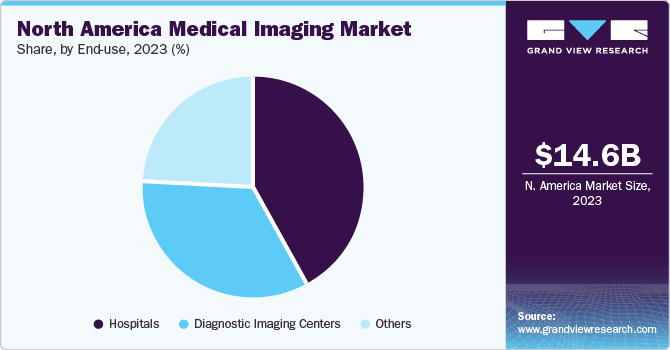

The North America medical imaging market size was valued at USD 14.6 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2030. Increasing prevalence of lifestyle-related diseases paired with rising demand for early detection tools is significantly driving the growth of the market. Furthermore, technological advancements to improve turnaround time, increased investment and reimbursement initiatives undertaken by the government is opportunistic for the North America market growth.

Increasing demand for state-of-the-art imaging modalities by teaching hospitals and universities to provide training for advanced technology is expected to have a significant impact on the medical imaging market growth during the upcoming years. Further, the adoption of AI to automate image quantification and identification process, is also expected to boost the market growth. For instance, Google’s Deepmind reads eye scans performed using optical CT scanner, to ensure early detection of age-related macular degeneration. Additionally, the introduction of 3D MRI and CT scans, enables the radiologists to quickly analyses scans, reducing analysis time and improving efficacy. Moreover, computer vision is being used to diagnose conditions that are not visible to the human eye.

The increasing incidence of chronic diseases in the North America region, including breast cancer, cardiovascular disorders, and neurological diseases, has created a high demand for imaging analysis. The U.S. National Center for Health Statistics estimated 1,958,310 new cancer cases and 609,820 cancer-related deaths in the country in 2023. The region is expected to maintain its dominance over the forecast period. Rapid increase in technological innovations and the growing incidence of chronic conditions are anticipated to further propel the market growth in the region. Advancements in imaging devices, including 3d and 4D image detailing, workflow automation, and prevalence of point-of-care technologies are reinforcing the technological ecosystem.

Increasing geriatric population, increase in the incidence of lifestyle-induced diseases, and rise in the awareness about early diagnosis of chronic diseases have fueled the demand for medical imaging devices. The U.S. has well-established medical codes, payment processes, and coverage policies for ultrasound services in hospitals, clinics, & imaging centers. This has contributed to the increasing number of ultrasound procedures in the U.S. Furthermore, the growing acceptance of pocket-sized medical imaging devices is expected to boost market growth.

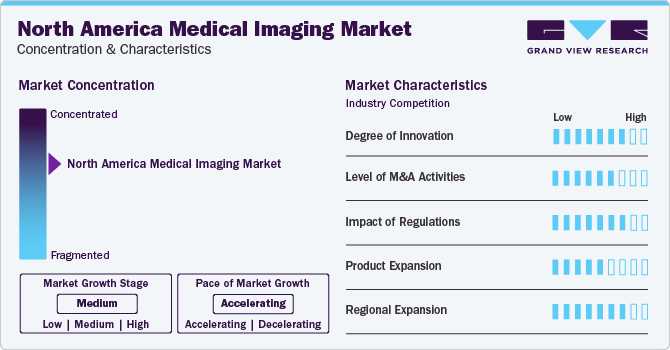

Market Characteristics

The market growth stage is medium and pace of the market growth is accelerating. Healthcare devices have made massive advancements in North America with several technological innovations. The government organization and non-government organization funding and support of digital health projects have accelerated medical imaging development & adoption in the region. Innovative medical imaging technologies help provide information about a specific disease and its genetic & biological data, contributing to the introduction of individualized diagnosis and therapy approaches. For instance, in May 2023, GE HealthCare announced U.S. FDA 510(k) approval of Precision DL, a deep learning-based image processing software included in GE HealthCare’s growing Effortless Recon DL portfolio.

The market is witnessing an increasing number of merger & acquisition (M&A) activities that are being undertaken by the prominent players. Several key companies are adopting these strategies to upgrade their portfolio in the region. For instance, in March 2023, Koninklijke Philips N.V. announced that it had entered a strategic partnership with the Champalimaud Foundation, a Portuguese translational biomedical research and clinical care provider. The partnership aimed to reduce the carbon footprint by almost 50% from Champalimaud's use of diagnostic & interventional imaging equipment by 2028.

North America witnesses strict government regulations and guidelines when it comes to the healthcare sector. The changing government regulations are affecting private companies by increasing the cost of compliance. The FDA is partnering with various organizations to promote awareness regarding radiation safety among medical professionals and patients. These partnerships will also highlight the effectiveness of medical imaging in disease screening and prevention.

In the healthcare industry, CT is the most preferred imaging modality in the pediatric and geriatric population. Organizations are devising innovative product development strategies and focusing on expanding their regional business footprints, which is driving the need to adopt advanced imaging solutions to understand the patient needs & predict the outcomes. For instance, in June 2022, Koninklijke Phillips N.V. collaborated with a medical imaging company, Polarean, to excel the hyperpolarized Xenon MRI for respiratory illness sufferers. Philips presented its 3T MR 7700 system at the 2023 International Society for Magnetic Resonance in Medicine Annual Meeting & Exhibition (ISMRM 2023, June 3-8, 2023, Toronto, Canada).

Prominent companies including GE Healthcare, Koninklijke Philips N.V., and Siemens have a significant presence in the major cities of North America. However, they are also focusing on their expansion in other countries in Europe and Asia Pacific. The market is projected to witness major expansion in the upcoming years.

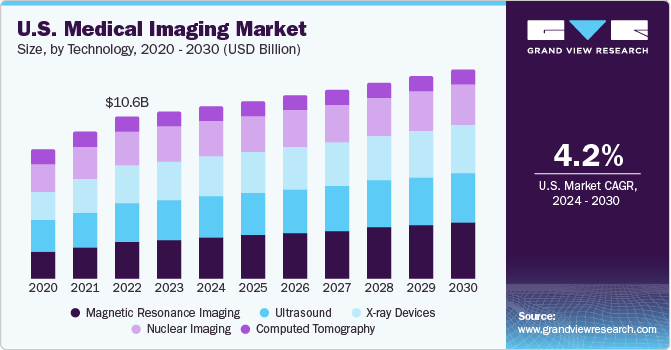

Product Insights

The magnetic resonance imaging segment held the largest share of 30.8% in 2023 and is expected to maintain its lead over the forecast period. MRI systems have applications in imaging of various organs, including the abdomen, pelvis, brain, spine, heart, and breast as well as musculoskeletal structure. MRI systems are expected to drive the market as scans produced are of superior quality because of an exceptional contrast resolution. Thus, MRI techniques can provide quantitative information about the biological and physical properties of tissue. As MRI is free from ionizing radiation, they are selected over CT, especially in patients and children requiring multiple imaging examinations.

The CT segment is expected to witness the fastest growth during the forecast period. High demand for point of care CT device and the development of a high-precision CT scanner by the integration of AI & ML and advanced visualization systems are the primary factors driving the segment. In March 2020, GE Healthcare increased their manufacturing capacity by opening new production facilities, to curb the growing demand for advanced imaging tools, especially during the Covid-19 pandemic.

End-use Insights

Hospitals captured the largest share of 41.6% in 2023. Rising demand for advanced imaging modalities and the integration of surgical suits with imaging technologies are some of the factors driving the segment growth. Over the years, there has been a sharp rise in demand for these modalities in teaching hospitals as compared to general or special hospitals. New hospitals generally provide dedicated space for imaging modalities. Rising competition and increasing demand for world-class healthcare services are the factors expected to fuel the segment growth in upcoming years.

The diagnostic imaging centers segment is expected to witness significant growth during the forecast period, owing to an increase in awareness about chronic diseases such as cancer, neurological diseases, and neurodegenerative disorders. This has accelerated the demand for CT and MRI procedures used for diagnosis, treatment planning, and prevention of chronic disorders. The increased adoption of advanced technology, improved infrastructure, and high funding for the development of these centers is supplementing the segmental growth.

Country Insights

North America medical imaging market share was estimated to be 36.6% of the global market in 2023. The presence of a large number of industry players and the high frequency of new product launches within the region are the factors contributing to the regional market growth. The region exhibits high adoption of advanced, high-end medical imaging equipment due to favorable reimbursement scenario and fundings from market players. The aforementioned factors, coupled with the increasing aging population, the rise of chronic diseases, and the growing trend of preventive diagnostic practices, are expected to drive the medical imaging industry in the region.

U.S. Medical Imaging Market Trends

Rapid technological advancements along with rising geriatric population in the country are increasing the need for faster and better access to healthcare. U.S. healthcare systems are constantly expanding and due to the country’s economic power, it has been witnessing high healthcare spending. The U.S. government and the non-government organizations are taking several initiatives that has led to an increase in the penetration of advanced medical imaging in the country. In the U.S., the number of ultrasound unit installations has significantly increased over the years. In October 2020, GE Healthcare collaborated with St. Luke's University Health Network to install 76 ultrasound systems as part of an AI-powered technology fleet, making it GE Healthcare's largest single-order ultrasound contract in the country worth USD 11 million. The growing awareness about the safety and diagnostic efficiency of medical imaging devices among healthcare providers has contributed to their rising adoption.

Canada Medical Imaging Market Trends

The increasing geriatric population, surge in lifestyle-induced diseases, and increase in the awareness about early diagnosis of chronic diseases have augmented the demand for medical imaging devices. According to the Canadian Institute for Health Information (CIHI), medical imaging is one of the essential parts of medical care and treatment in Canada. Moreover, recent product launches and ongoing partnerships between market players & governments to increase therapeutics supply are some of the other factors propelling the market growth. For instance, in May 2022, FUJIFILM VisualSonics, Inc. recently introduced Vevo F2, a groundbreaking imaging system designed for preclinical applications. The Vevo F2 stands out as the world's first ultrasound and photoacoustic imaging system capable of operating across an ultra-wide frequency range, from 71MHz to 1MHz. Its cutting-edge HD image processing technology and innovative signal pathway, from the transducer to the display screen, contribute to superior image clarity. The incorporation of multi-line processing further enhances frame rates, surpassing those of earlier generation platforms and elevating the capabilities of this state-of-the-art system

Key North America Medical Imaging Company Insights

Recent trends of collaborations of local and global companies are expected to have a synergistic effect on market growth. Such collaboration and exchange of technologies help in speeding up the development and boost the market competition, thus providing sophisticated yet affordable imaging systems. Such collaborations are not limited to diagnostic imaging players. The integration of imaging modalities with advanced surgical suits manufacturers is expected to have a boosting effect on the diagnostic imaging market growth as well as robot-assisted surgery systems.

Key North America Medical Imaging Companies:

- GE Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers

- Canon Medical Systems Corporation

- Mindray Medical International

- Esaote

- Hologic, Inc.

- Samsung Medison Co., Ltd.

- Koning Corporation

- PerkinElmer Inc.

- FUJIFILM VisualSonics Inc.

- Cubresa Inc.

Recent Developments

-

In June 2023, GE HealthCare announced the FDA approval and product launch of Sonic DL, a deep learning-enabled technology developed to significantly augment image generation in MRI.

-

In May 2023, Koninklijke Philips N.V. announced the launch of the Philips CT 3500, a high-end CT system targeting the requirements of routine radiology and high-volume screening programs.

-

In February 2023, Boston Imaging (Samsung Medison Co., Ltd.) launched the Hera W10 Elite, the exclusive model of the Hera platform for obstetrics & gynecology, which provides clinicians a powerful Artificial Intelligence (AI) tools and clinical applications to enhance the diagnostic experience.

-

In January 2023, Pie Medical Imaging launched CAAS Qardia 2.0, a new version of its echocardiography software platform. The platform offers Artificial Intelligence (AI) driven workflows for clinical measurements. It also offers in-hospital deployment as zero-footprint solution, which can be accessed from a personal computer within the hospital network via the web browser.

-

In November 2022, Siemens Healthineers launched Magnetom Viato Mobile. It is a mobile MRI unit with 1.5 T, and its latest MRI scanner is optimized for mobile use and features a patient bore of 70 cm.

North America Medical Imaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.15 billion

Revenue forecast in 2030

USD 19.61 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, country

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Koninklijke Philips N.V., Canon Medical Systems Corporation, Mindray Medical International, Esaote, Hologic, Inc., Samsung Medison Co., Ltd., Koning Corporation, PerkinElmer Inc., FUJIFILM VisualSonics Inc., Cubresa Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Medical Imaging Market Report SegmentationThis report forecasts revenue growth in the North America market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America medical imaging market based on product, end-use, and country:

-

Product (Revenue in USD Million, 2018 - 2030)

-

X-ray Devices

-

By Modality

-

Radiography

-

Fluoroscopy

-

Mammography

-

-

-

Ultrasound

-

By Portability

-

Handheld

-

Cart/Trolley Based

-

-

-

Computed Tomography

-

By Technology

-

High end slice

-

Mid end slice

-

Low end slice

-

Cone beam

-

-

-

Magnetic Resonance Imaging

-

By Architecture

-

Closed System

-

Open System

-

-

-

Nuclear Imaging

-

By Product

-

SPECT

-

PET

-

-

-

-

End-use (Revenue in USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centres

-

Others

-

-

Country (Revenue in USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America medical imaging market size was estimated at USD 14.60 billion in 2023 and is expected to reach USD 15.15 billion in 2024.

b. The global North America medical imaging market is expected to grow at a compound annual growth rate of 4.40% from 2024 to 2030 to reach USD 19.61 billion by 2030.

b. Magnetic resonance imaging segment dominated the North America medical imaging market with a share of 30.79% in 2023. This is attributable to rising prevalence of chronic diseases in this region, including conditions, such as breast cancer, cardiovascular disorders, and neurological diseases, is driving the demand for advanced imaging analysis.

b. Some key players operating in the North America medical imaging market include GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Koninklijke Philips N.V., Canon Medical Systems Corporation, Mindray Medical International, Esaote, Hologic, Inc., Samsung Medison Co., Ltd., Koning Corporation, PerkinElmer Inc., FUJIFILM VisualSonics Inc., Cubresa Inc.

b. Key factors that are driving the market growth include presence of a large number of industry players and the high frequency of new product launches within the region are the factors contributing to the regional market growth. The region exhibits high adoption of advanced, high-end medical imaging equipment due to favorable reimbursement scenario and fundings from market players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."