- Home

- »

- Advanced Interior Materials

- »

-

North America Mechanical Electrical & Plumbing Service Market, Report, 2030GVR Report cover

![North America Mechanical Electrical And Plumbing Service Market Size, Share & Trends Report]()

North America Mechanical Electrical And Plumbing Service Market Size, Share & Trends Analysis Report By Service Type, By End-use, By Type, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-334-6

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

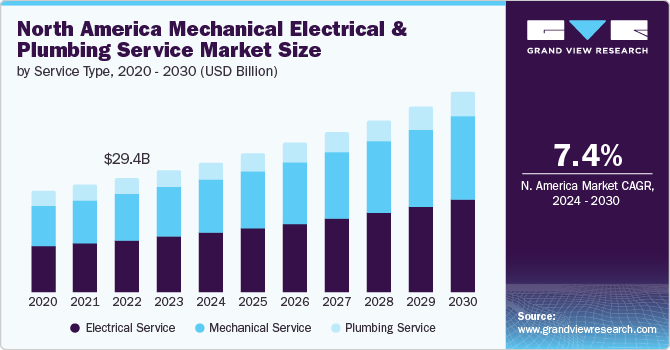

The North America mechanical electrical and plumbing service market size was estimated at USD 31,348.1 million in 2023 and is projected to grow at a CAGR of 7.4% from 2024 to 2030. The rising total construction projects across the U.S. are set to significantly boost the demand for MEP services in North America. This upsurge is primarily driven by the expanding urban infrastructure, commercial buildings, and residential complexes, which necessitate the installation and designing of mechanical, electrical, and plumbing equipment. In commercial buildings, these elements are often constructed by specialized MEP engineers.

The above factors will positively impact market growth over the forecast period. MEP services also help to improve building energy efficiency by integrating environmentally friendly methods such as renewable energy utilization, HVAC systems optimization, and smart lighting controls.

The mechanical, electrical, and plumbing (MEP) market is transforming due to the ongoing advancements in emerging technologies such as new BIM, MEP, etc. These advancements fundamentally alter how MEP systems are designed, managed, and implemented, ultimately leading to improved efficiency, enhanced intelligence in building systems, and increased sustainability. From integrating digital tools to using advanced analytics and automation, these emerging technologies are revolutionizing the entire MEP design process.

Drivers, Opportunities & Restraints

The growing new manufacturing facility in the U.S. is a significant market driver for market growth, reflecting the country's dynamic and expanding economy. This growth is largely attributed to various factors such as technological advancements, increased consumer spending, and government policies that encourage investment and innovation. According to the U.S. Census Bureau, construction spending on manufacturing facilities reached USD 196.44 billion in 2023, marking a significant increase of 71.3% compared to the USD 114.70 billion spent in 2022. This notable uptick in spending for manufacturing facilities can be attributed to evolving business demands, urbanization trends, rapid industrial expansion, and overall economic growth.

Increasing demand for energy-efficient buildings and adherence to stringent environmental regulations promote the adoption of green building practices. MEP services play a crucial role in designing and implementing energy-efficient HVAC, plumbing, and electrical systems. In addition, the integration of advanced technologies like building information modeling (BIM), the Internet of Things (IoT), and smart building systems is creating new opportunities. These technologies enhance the efficiency, accuracy, and sustainability of MEP systems.

However, budget limitations can serve as a significant constraint in several ways when dealing with commercial facility maintenance. First, it can restrict the extent to which ongoing maintenance tasks can be performed, potentially leading to the deferral of necessary repairs and upkeep. This deferral can result in escalated costs, as minor issues may develop into major problems requiring a more substantial financial outlay. Furthermore, budget constraints may limit a facility's ability to adopt innovative maintenance solutions or technologies that could improve efficiency and reduce long-term costs. For example, investing in energy-efficient systems or smart technology requires initial capital that may not be available within a tight budget.

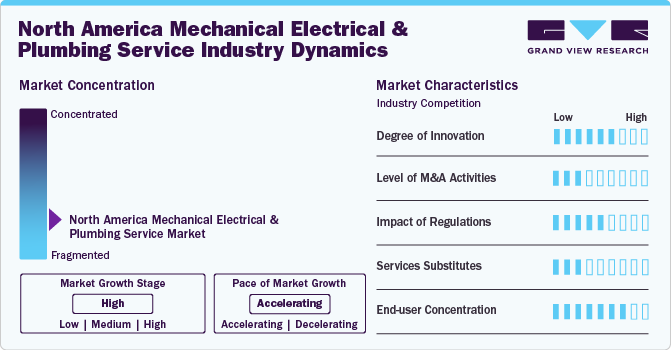

Industry Dynamics

The market growth stage is high, with an accelerating pace. The market is characterized by a high degree of innovation, which is attributable to the rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

Regulations play a significant role in shaping the North America market dynamics. Mechanical, electrical, and plumbing (MEP) codes and regulations govern the quality, safety, performance, and sustainability of MEP systems and services in buildings. These rules are crucial for ensuring that projects meet specific criteria, comply with expectations, and facilitate the acquisition of permits and certifications.

The North America mechanical, electrical & plumbing service among end-users is driven by the growing residential and commercial construction. The growth of this end-user segment of the market can be attributed to a steady demand for high-quality living spaces that cater to the diverse lifestyle preferences of customers and demographic profiles in the region. The vibrant real estate market of North America offers a wide range of residential options, including luxury villas, high-rise apartments, and townhouses.

The threat of substitutes in the North America market ranges from low to moderate. While direct substitutes for property and community management services are limited, alternative investment avenues exist. However, these alternatives do not entirely supplant the necessity for MEP service market. Yet, the emergence of innovative technologies and disruptive business models holds the potential to alter traditional practices, influencing market dynamics in the long term.

Service Type Insights

“The demand for mechanical service segment is expected to grow at a significant CAGR of 8.0% from 2024 to 2030 in terms of revenue.”

The electrical service segment held the largest revenue share in 2023. The electrical service segment plays a crucial role in the North America Mechanical Electrical & Plumbing (MEP) service market, catering to the ever-growing demand for reliable and efficient electrical systems in residential, commercial, and industrial settings. Power distribution, a significant component of this segment, involves installing, maintaining, and upgrading electrical systems that deliver electricity safely and efficiently throughout a building or facility. This includes the installation of transformers, switchgears, and distribution panels, ensuring reliable power supply and minimizing downtime.

The demand for the mechanical service segment is expected to grow at a significant CAGR from 2024 to 2030 in terms of revenue. The mechanical service segment encompasses three main service areas: HVACR system service, elevators and escalators service, and fire suppression & protection system service. The HVACR system service is a vital component of the mechanical service segment, catering to the installation, repair, and maintenance of heating, ventilation, air conditioning, and refrigeration (HVACR) systems.

End-use Insights

“The demand for residential end use segment is expected to grow at a significant CAGR of 8.0% from 2024 to 2030 in terms of revenue.”

The commercial end use segment held the largest share in 2023. The commercial end-use segment is a crucial component of the MEP service market in North America. It encompasses a wide range of buildings and structures, such as office complexes, retail spaces, educational institutions, healthcare facilities, and hospitality establishments. This segment is driven by the constant need for construction, renovation, and maintenance of these commercial spaces, ensuring optimal functionality, energy efficiency, and compliance with building codes & regulations.

The demand for residential end use segment is expected to grow at a significant CAGR from 2023 to 2030 in terms of revenue. The residential MEP service market in North America has witnessed significant growth in recent years, driven by several factors. First, the increasing urbanization and rising demand for new residential construction have fueled the need for MEP services. In addition, the aging infrastructure in many regions has necessitated renovating and retrofitting existing residential properties, further contributing to market growth.

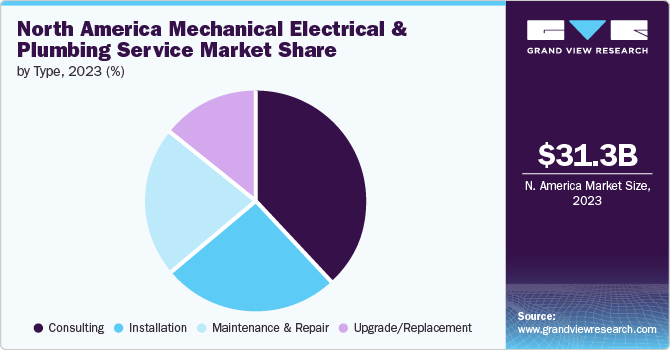

Type Insights

“The demand for upgrade/replacement type segment is expected to grow at a significant CAGR of 8.5% from 2024 to 2030 in terms of revenue.”

The consulting segment held the largest share in 2023. The demand for MEP consulting services is driven by the increasing complexity of building systems and the growing emphasis on energy efficiency and sustainability. As buildings become more sophisticated, integrating advanced HVAC systems, smart lighting, and automated controls, the role of MEP consultants becomes crucial in ensuring these systems are designed, implemented, and maintained effectively.

The demand for the upgrade/replacement segment is expected to grow at a significant CAGR from 2024 to 2030 in terms of revenue. The North American MEP service market, particularly in the upgrade and replacement segment, is witnessing significant growth driven by various factors. The aging infrastructure across the region is one of the major factors creating the need for frequent upgrades and replacements to ensure safety, efficiency, and compliance with modern standards. For example, many commercial buildings in major cities, such as New York, Toronto, and Los Angeles, require extensive MEP upgrades to meet current energy efficiency standards and to integrate modern technologies.

Country Insights

“In North America, the U.S. dominated the market in 2023, and it accounted for 77.5% market share in 2023.”

The U.S. mechanical, electrical & plumbing (MEP) service market dominated the North American region due to several factors, including its large economy, well-established infrastructure, and robust construction industry. The country has a massive construction industry driven by a growing population, urbanization, and continuous infrastructure development.

According to the Associated General Contractors (AGC) of America, the construction industry plays a vital role in driving the U.S. economy. In the first quarter of 2023, over 919,000 construction establishments were operating across the nation. The country's vast geographical expanse necessitates constant maintenance, repair, and replacement of existing MEP systems, creating a steady demand for MEP services. Moreover, the emphasis on energy efficiency and sustainability has led to the retrofitting of older buildings, further boosting the demand for MEP services in the country.

Key North America Mechanical Electrical And Plumbing Service Company Insights

Some of the key players operating in the market include EMCOR Group, Inc., WSP, Comfort Systems USA, Carrier, and KONE, Inc.

-

EMCOR Group operates through three business divisions, namely EMCOR Constructing Services, EMCOR Building Services, and EMCOR Industrial Services. The company offers critical infrastructure systems, including electrical, mechanical, lighting, air conditioning, heating, security, fire protection, and power generation systems.

-

WSP is a professional services consulting company primarily operating in a built environment. It offers a range of services, such as building services, acoustic and vibration services, electrical and mechanical engineering, and urban planning and design. Moreover, it has a significant presence in various sectors, including healthcare, aerospace, education, and infrastructure, and serves clients globally through its operations across regions, such as America, Europe, the Middle East, Africa, and Asia Pacific

Southland Industries, Pike Corporation, McKInstry, Rosendin Electric Inc., ArchKey Solutions, and Prime Electric are some of the emerging market participants in the North America market.

-

Southland Industries provides engineering, construction, service, and energy solutions. It helps in the areas of design, construction, and service of mechanical, plumbing, fire protection, process piping, automation, and control systems, as well as energy service needs. The company provides consulting, integrated project delivery, lean design and construction, design-build, design-assist, modular design and construction, building information modeling, mechanical construction, fire protection installation, computational fluid dynamics, and process engineering services.

-

Pike Corporation is a prominent company in the utilities industry, providing a wide array of services to support the construction and upkeep of infrastructure related to electricity, gas, and communication systems. The company offers comprehensive solutions encompassing facilities planning and site selection, obtaining necessary permits, engineering, design, installation, and maintenance services.

Key North America Mechanical Electrical And Plumbing Service Companies:

- EMCOR Group, Inc.

- WSP

- Comfort Systems USA

- Carrier

- Mitsubishi Electric Corporation

- Schindler

- KONE, Inc.

- Caravan Facilities Management LLC

- Choice Maintenance Group

- GALLOWAY & COMPANY, INC.

- Global Facility Solutions, LLC

- McGill Associates

- Mechanical Electrical & Plumbing Engineering, Inc.

- Kimley-Horn and Associates, Inc.

- Brandt Companies

- McKinstry

- Southland Industries

- Power Design, Inc.

- Rosendin Electric, Inc.

- Pike Corporation

- ArchKey Solutions

- M.C. Dean, Inc.

- ACCO Engineered Systems

- Think Construction Services

- Prime Electric

- MACDONALD-MILLER

Recent Developments

-

In June 2024, Essential Systems Engineering, a mechanical, electrical, and plumbing (MEP) engineering firm based in Asheville, North Carolina, joined forces with McGill Associates, a civil engineering firm with a strong presence in the Southeast region of the U.S. This partnership aimed to bring together two long-time Asheville-based businesses that share similar views on complete project delivery, client service, and innovative engineering solutions. Essential Systems Engineering brings a specific emphasis on sustainable and renewable energy technologies, including expertise in solar energy and geothermal heating.

-

In May 2024, Kimley-Horn and Associates, Inc., a major engineering, planning, and design consultancy, strengthened its presence in Southern California by expanding its services and capabilities in the region. The company added the team from LPDA, a leading landscape architecture and land planning firm, to enhance its offerings and better serve clients in the area.

North America Mechanical Electrical And Plumbing Service Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 33,475.3 million

Revenue forecast in 2030

USD 51,411.4 million

Growth rate

CAGR of 7.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, end-use, type, country

Region scope

U.S., Canada, Mexico

Key companies profiled

EMCOR Group, Inc., WSP, Comfort Systems USA, Carrier, Mitsubishi Electric Corporation, Schindler, KONE, Inc., Caravan Facilities Management LLC, Choice Maintenance Group, GALLOWAY & COMPANY, INC, Global Facility Solutions, LLC, McGill Associates, Mechanical Electrical & Plumbing Engineering, Inc., Kimley-Horn and Associates, Inc., Brandt Companies, Southland Industries, McKinstry, Power Design, Inc, Rosendin Electric, Inc., Pike Corporation, ArchKey Solutions, M.C. Dean, Inc., ACCO Engineered Systems, Think Construction Services, Prime Electric, MACDONALD-MILLER

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Mechanical Electrical And Plumbing Service Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America mechanical electrical and plumbing service market based on service type, end-use, type, and country:

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical Service

-

HVACR System Service

-

Elevators and Escalators Service

-

Fire Suppression & Protection System Services

-

Others

-

-

Electrical Service

-

Power Distribution

-

Lighting Systems

-

Electrical Panel Installation & Upgrades

-

Others

-

-

Plumbing Service

-

Drain Cleaning Services

-

Sewer Repair Services

-

Leak Detection and Repair

-

Fixture Installation and Repair

-

Piping Service

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Installation

-

Maintenance & Repair

-

Upgrade/Replacement

-

Consulting

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America mechanical electrical and plumbing service market size was estimated at USD 31,348.1 million in 2023 and is expected to reach USD 33,475.3 million in 2024.

b. The North America mechanical electrical and plumbing service market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030 to reach USD 51,411.4 million by 2030.

b. U.S. dominated the North America mechanical electrical and plumbing service market and accounted for a 77.5% share in revenue in 2023. The country has a massive construction industry, driven by a growing population, urbanization, and continuous infrastructure development. Further, country's vast geographical expanse necessitates constant maintenance, repair, and replacement of existing MEP systems, creating a steady demand for MEP services. Moreover, the emphasis on energy efficiency and sustainability has led to the retrofitting of older buildings, further boosting the demand for MEP services in the country.

b. Some of the key players operating in the North America mechanical electrical and plumbing service market include EMCOR Group, Inc, WSP, Comfort Systems USA, Carrier, Mitsubishi Electric Corporation, Schindler, KONE, Inc, Caravan Facilities Management LLC , Choice Maintenance Group, GALLOWAY & COMPANY, INC, Global Facility Solutions, LLC, McGill Associates, mechanical electrical & plumbing Engineering, Inc., Kimley-Horn and Associates, Inc., Brandt Companies, Southland Industries, McKinstry, Power Design, Inc, Rosendin Electric, Inc., Pike Corporation, ArchKey Solutions, M.C. Dean, Inc., ACCO Engineered Systems, Think Construction Services, Prime Electric, MACDONALD-MILLER

b. The growth of the new manufacturing facility in the U.S. and growing construction spending in the North America acts as an important market drivers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."