- Home

- »

- Next Generation Technologies

- »

-

North America Manufacturing Automation Market, Industry Report, 2030GVR Report cover

![North America Manufacturing Automation Market Size, Share & Trends Report]()

North America Manufacturing Automation Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Technology (PLC, Robotics), By Deployment, By End-use, By Industry Vertical, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-282-6

- Number of Report Pages: 213

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

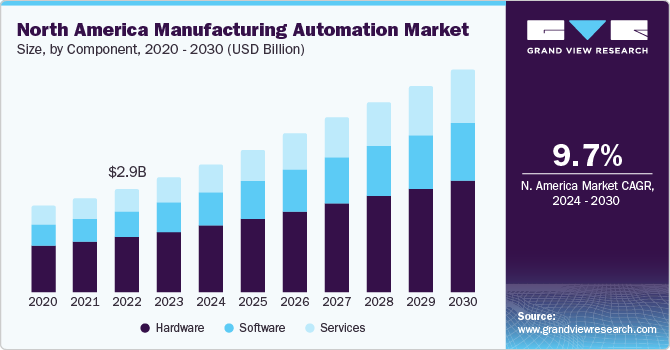

The North America manufacturing automation market size was estimated at USD 3.33 billion in 2023 and is projected to grow at a CAGR of 9.7% from 2024 to 2030. The market growth is attributed to the growing inclination of businesses to automate their operations to increase production capacity while reducing the manual labor and costs associated with it. Besides, stringent regulations pertaining to workplace safety have also instigated the adoption of automated technologies in manufacturing environments.

The ongoing technological developments, comprising robotics, Internet of Things (IoT), Artificial Intelligence (AI), machine learning, and 5G connectivity, are expected to create lucrative growth prospects for the market in the coming years.

The market expansion is being expedited with the rise of Industry 4.0 concepts, which involve the integration of digital technologies into manufacturing, thus urging the adoption of automation. Smart manufacturing relies on automation to create interconnected and intelligent production systems, which is encouraging governments to take profound initiatives for Industry 4.0 and the modernization of industries. Such initiatives are creating lucrative growth opportunities for the market growth in North America.

The favorable government initiatives are significantly influencing the market growth in the region. As a part of their initiatives, they are focusing on research and development (R&D) programs that enable industry, academia, and government to collaborate to develop innovative technologies. For instance, in February 2023, the government of Canada announced an allocation of USD 700 million for the Global Innovation Clusters program. As a part of this initiative, the government will provide USD 177 million for the Advanced Manufacturing Cluster, with an aim to support the commercialization of projects that develop, scale, and integrate advanced technology solutions in manufacturing, attracting investments and a skilled workforce from within the country and across the globe.

Robotics is playing a crucial role in the manufacturing sector, offering a wide range of benefits that enhance productivity, efficiency, safety, and overall operational performance. Several manufacturing companies have identified these advantages and are increasing investments both in robotics and automation. For instance, in May 2023, Rockwell Automation, Inc. entered a strategic partnership with Autonox Robotics to offer new manufacturing possibilities to companies across North America, Europe, Middle East & Africa through unified robot control solutions. This initiative is aimed at bringing together the robot mechanics of Autonox Robotics and the former’s Kinetix motors and drives. The robot solutions are programmed and controlled in a single environment using Logix-based controllers and the Studio 5000 automation system design software.

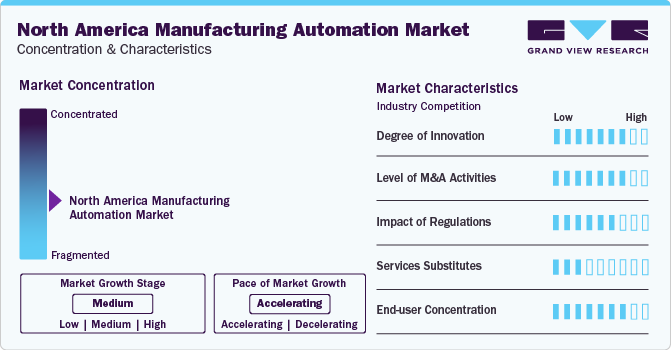

Market Concentration & Characteristics

The market growth stage is moderate, and the pace is accelerating. Businesses are increasingly inclined to automate their operations to increase production capacity while reducing the manual labor and costs associated with it. The market growth is substantiated by the increased demand for automated technologies in manufacturing environments driven by favorable government initiatives and regulations pertaining to workplace safety.

The manufacturing automation market in North America is seeing an increasing number of merger and acquisition (M&A) activities by the leading players underlying a dynamic industry landscape. Strategic alliances and consolidations have become pivotal in fostering innovation and expanding market reach. Key players recognize the imperative need to integrate diverse technologies and enhance product portfolios to stay competitive.

As automation becomes mainstream and more sophisticated in the manufacturing sector, regulatory compliance and standards play a key role in the North American market. Regulatory frameworks ensure resilience, system stability, monitoring tools, comprehensive testing, risk controls, and exchange rules.

The market is not highly impacted by the substitutes due to exponentially increasing demand for automation to optimize operations, reduce costs, and reduce human errors. The only alternative to manufacturing automation is the traditional manual processes. However, the wide range of advantages associated with automation is only impelling its demand, which lowers the impact of substitutes.

End-user concentration is a significant factor in the North America market. Several industries, including automotive, consumer electronics, transportation, logistics, etc., are increasingly adopting automation to support their smart manufacturing initiatives, increase operational efficiency, reduce labor costs, and facilitate sustainable production.

Component Insights

Based on component, the hardware segment led the market with the largest revenue share of 52.6% in 2023. Hardware components in manufacturing automation solutions include sensors, actuators, controllers, and various other devices that enable the collection and analysis of data in real time. These components play a crucial role in the operation of smart factories, which rely on data-driven decision-making and automation to optimize production. The increasing adoption of smart technologies to improve manufacturing efficiency, reduce downtime, and enhance product quality is driving the demand for hardware components, thereby contributing to segmental growth.

The services segment is estimated to grow at a significant CAGR over the forecast period. Manufacturers frequently require custom solutions to meet their specific automation needs. Service providers offering customization and integration services play a significant role in ensuring seamless integration of automation into existing manufacturing processes. In addition, the region faces a shortage of skilled labor for manufacturing jobs, leading companies to adopt automation solutions to fill the gap. Services like system integration, training, and maintenance of automated systems are crucial for successful implementation, driving the demand for the services component.

Technology Insights

Based on technology, the PLC segment led the market with the largest revenue share of 69.3% in 2023, as this technology is extensively utilized in manufacturing units to control various operations and processes, including robotic devices and assembly lines. Designed for industrial environments, PLC systems are known for their ruggedness, high reliability, and ease of programming and fault diagnosis. In addition, advancements in PLC technology, such as faster processing speeds, improved communication capabilities, and integration with AI and the Internet of Things (IoT), are expected to drive the segment growth over the forecast period.

The robotics technology segment is estimated to witness at the fastest CAGR from 2024 to 2030, with the increasing adoption of this technology driven by continuous advancements in robotics, including improvements in precision, speed, and flexibility. These advancements make robots more capable and adaptable to diverse industrial applications. For instance, in July 2023, KUKA AG expanded its range of Autonomous Mobile Robots (AMR) with the KMP 1500P mobile platform and KMR in mobile cobots. These robots are optimally equipped for use in storage and production facilities, making them ideal smart partners for Industry 4.0 applications.

Deployment Insights

Based on deployment, the on-premises segment led the market with the largest revenue share of 53.2% in 2023, owing to the advantages associated with this mode of deployment. It offers manufacturers control over their automation systems and data. This is particularly significant in industries where data security and confidentiality are crucial parts of further operations. Furthermore, it reduces dependence on external networks and internet connectivity, which helps manufacturers prioritize operational continuity and minimize disruptions, which is expected to drive the segment growth.

The cloud-based deployment segment is projected to register at a significant CAGR over the forecast period. Cloud-based deployment is easily scalable, allowing manufacturers to adapt their automation infrastructure to changing production needs without significant investments. This is particularly beneficial for small and medium-sized enterprises (SMEs), which is augmenting the demand for cloud-based deployment. In addition, updates and upgrades can be delivered by the service provider, ensuring that manufacturers always have access to the latest features and improvements, thereby boosting segmental growth.

End-use Insights

Based on end-use, the discrete manufacturing segment held the market with the largest revenue share of 55.02% in 2023. The increasing adoption of automation technologies in manufacturing processes is a significant driver for the growth of the discrete manufacturing segment. Automated systems enhance efficiency, reduce labor costs, and improve overall production capabilities. Furthermore, the ability of discrete manufacturing to accommodate customization in the production of individual items aligns with developing consumer demands for personalized products, which in turn is contributing to the market growth.

The process manufacturing segment is estimated to grow at the fastest CAGR over the forecast period. Process manufacturing involves batch processing in industries such as chemicals, pharmaceuticals, and food and beverage. Automation in batch processing enhances efficiency, reduces production times, and ensures consistency in product quality. Moreover, automation technologies enable continuous process improvement in areas, which includes refining production processes, optimizing resource utilization, and minimizing waste, which is expected to boost the process manufacturing segment growth over the coming years.

Industry Vertical Insights

Based on industry vertical, the automotive segment held the market with the largest revenue share of 24.2% in 2023, owing to rapid adoption of automation driven by the rising need to boost productivity, efficiency, and competitiveness in this sector. This strategic move enables the integration of advanced technologies such as IoT, robotics, AI, and data analytics into automotive manufacturing processes, thereby facilitating improvements and driving productivity. As a result, the automotive segment is expected to experience continued growth due to the implementation of these automation solutions over the forecast period.

The consumer electronics segment is expected to record at a significant CAGR from 2024 to 2030, with the implementation of manufacturing automation for higher productivity, real-time data analysis, better quality control, flexibility, sustainability, and analytics. Siemens, for example, makes use of manufacturing automation to increase the productivity of its semiconductor production facilities. In addition, automated Surface Mount Technology (SMT) processes are used to precisely position electronic components onto printed circuit boards (PCBs). This technology plays a crucial role in ensuring accurate component placement, thereby reducing the risk of errors and enhancing the overall quality of production, which is augmenting the growth of the consumer electronics segment further.

Application Insights

Based on application, the assembly line automation segment led the market with the largest revenue share of 24.7% in 2023. Automation involves the use of advanced technologies and systems, which are extensively applied in assembly lines to enhance efficiency, precision, and overall productivity. For instance, the deployment of industrial robots in diverse assembly tasks, such as handling and placing components, welding, fastening, and complex operations, acts as a significant growth driver. These robots are capable of collaborative work with human operators, leading to enhanced production speed and accuracy, which is contributing to the market growth of the assembly line automation segment.

The material handling automation segment is expected to expand at the fastest CAGR from 2024 to 2030. Material handling automation is essential for optimizing efficiency, minimizing manual labor, and boosting overall productivity within the manufacturing process. Furthermore, there are numerous ways in which manufacturing automation is used in material handling such as automatic guided vehicles (AGV), automated storage and retrieval (ASRS), pallet dispensers/stackers, and automated sorting systems, among others. Automated sorting systems in material handling automation utilize conveyor belts, sensors, and robotic arms to categorize and redirect items based on predefined criteria. This application is commonly used in distribution centers and warehouses, which is further contributing to the segment growth.

Solution Insights

Based on solution, the control systems solution segment led the market with the largest revenue share of 43.31% in 2023. Control system solutions, such as Distributed Control Systems (DCS) and Supervisory Control and Data Acquisition (SCADA), optimize and automate production processes. They enable manufacturers to achieve efficiency by monitoring and controlling various aspects of the manufacturing operations, which is augmenting the growth. Furthermore, control systems provide real-time monitoring of machinery, equipment, and production lines, which is contributing to the market growth of the control systems segment.

The robotics and autonomous systems solution segment is estimated to register at a significant CAGR over the forecast period, owing to increased product demand driven by their ability to facilitate increased efficiency and productivity through automation of routine tasks. The flexibility and adaptability of robotics solutions make them appropriate to handle several tasks and altering to changing production requirements, leading to a dynamic and responsive manufacturing environment. Moreover, robotics supports the trend towards customization and small-batch production, catering to the rising consumer demand for personalized and niche products, which is driving the segment growth.

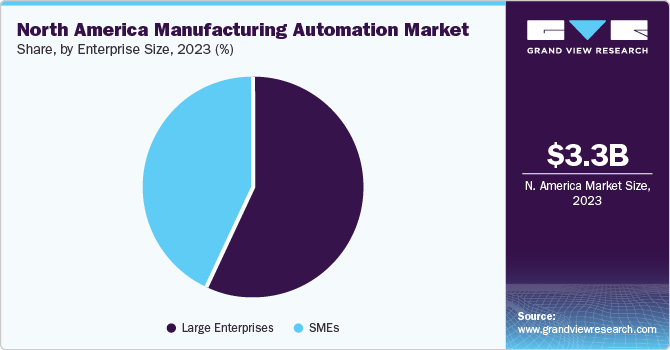

Enterprise-Size Insights

Based on enterprise size, the large enterprise size segment led the market with the largest revenue share of 57.49% in 2023. This is attributed to the rising demand for automation to handle large-scale operations, ensuring consistent and rapid production without compromising on quality. This leads to the adoption of manufacturing automation in large enterprises. For instance, in December 2023, ABB extended its partnership with Volvo Cars, providing over 1,300 robots and functional packages to facilitate the production of the upcoming generation of electric vehicles. The agreement includes diverse functional packages, addressing tasks such as spot-welding, riveting, dispensing, flow drilling, and ultrasonic weld inspection in the manufacturing process, which boosts segment’s growth.

The small and medium enterprises (SMEs) segment is expected to witness at a substantial CAGR from 2024 to 2030. The benefits of increased efficiency and productivity, along with cost savings from reduced manual labor, make automation the preferred option for SMEs to optimize their operations. Furthermore, automation systems contribute to improved quality control by ensuring consistency in manufacturing processes. This results in higher-quality products and reduces the probability of defects, which contributes to the growth of the segment.

Country Insights

U.S. Manufacturing Automation Market Trends

U.S. dominated the North America manufacturing automation market with the largest revenue share of 63.8% in 2023, owing to the increasing investments in automation technologies by domestic manufacturers. Moreover, the increasing inclination toward the development and integration of robots in manufacturing operations is accelerating the market growth. The supportive government initiatives are further driving market growth to encourage automation in manufacturing environments to ensure high productivity and workplace safety.

Canada Manufacturing Automation Market Trends

The manufacturing automation market in Canada is expected to witness at a substantial CAGR from 2024 to 2030, driven by technological advancements, particularly in areas like robotics, artificial intelligence, and the Internet of Things (IoT), which are increasingly being integrated into manufacturing processes, enhancing efficiency, productivity, and quality control. Furthermore, the rising need for cost reduction, coupled with the demand for faster production cycles and customized products, is driving manufacturers to adopt automation solutions.

Mexico Manufacturing Automation Market Trends

The Mexico manufacturing automation market is estimated to register at the fastest CAGR from 2024 to 2030. The growing proclivity for advanced manufacturing technologies is favoring market growth. According to the International Trade Administration, Mexico is among the five major importers of advanced manufacturing technology. The imports of this technology are increasing annually by 6.28% in the country. Besides, increasing investments in additive manufacturing across the automotive, medical devices, and aerospace sectors are also encouraging the adoption of automation solutions in the country. Such initiatives are expected to drive market growth in the coming years.

Key North America Manufacturing Automation Company Insights

Some of the key players operating in the market include ABB, Rockwell Automation Inc., Schneider Electric, and FANUC Corporation, among others.

-

ABB is one of the leading companies providing electrification and automation solutions, enabling safe, smart, and sustainable manufacturing practices. The company operates in business segments, including electrification products, robotics and motion, industrial automation, and power grids. The company’s industrial automation division provides products, services, and systems to enhance business processes

-

Rockwell Automation Inc. is a prominent market layer involved in the integration of control and information across enterprises to help them increase productivity and optimize operations. The company offers products, solutions, and services within the industrial automation domain

Eclipse Automation Inc., Mecademic, and Reko Automation Inc. are some of the emerging market participants in the North America market.

-

Eclipse Automation Inc. produces custom automated engineering solutions for various sectors, including life sciences, energy, transportation, consumer goods, electronics, and industrial applications. The company is now a part of Accenture and is engaged in integrating its advanced automation capabilities with the latter’s deep digital expertise leveraging the cloud, data, and artificial intelligence (AI)

-

Mecademic supports the companies and institutions executing Industry 4.0 strategies by delivering robotic solutions that enhance productivity, boost quality of our customers’ products and operations, and reduce cost. It offers solutions for several applications, including dispensing, finishing, inspection & testing, machine tending, micro-assembly, among others

Key North America Manufacturing Automation Companies:

- ABB Ltd.

- Applied Manufacturing Technologies

- ATS Corporation

- Eclipse Automation Inc.

- Epson Robots

- Excelpro

- FANUC (FANUC Corporation)

- INTECH

- KUKA AG

- Mecademic

- Mitsubishi Electric Corporation

- Motoman (Yaskawa America, Inc.)

- Reko Automation Inc.

- Rockwell Automation Inc.

- Schneider Electric

- Teradyne, Inc.

Recent Developments

-

In December 2023, Applied Manufacturing Technologies expanded its engineering services to include Ignition by Inductive Automation, a tool for advanced SCADA and HMI solutions, addressing the rising need for digital transformation in manufacturing

-

In September 2023, ABB announced to invest USD 280 million for the expansion of its manufacturing presence in Europe. This initiative includes the establishment of an innovative facility known as the ABB Robotics European Campus, situated in Västerås, Sweden. The investment underscores ABB's commitment to enhancing its manufacturing capabilities and advancing robotics technologies in the European region

-

In October 2023, Mecademic launched its new product line, the MicroDASH series, with the initial shipments of its MCS500 SCARA. This innovative 4-axis robot is designed to provide precision, unparalleled space efficiency, and integration flexibility, facilitating the automation of inspection, small component design, and assembly applications

North America Manufacturing Automation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.72 billion

Revenue forecast in 2030

USD 6.49 billion

Growth rate

CAGR of 9.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, deployment, end-use, industry vertical, application, solution, enterprise size, regional

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

ABB Ltd.; Applied Manufacturing Technologies; ATS Corporation; Eclipse Automation Inc.; Epson Robots; Excelpro; FANUC (FANUC Corporation); NTECH; KUKA AG; Mecademic; Mitsubishi Electric Corporation; Motoman (Yaskawa America, Inc.); Reko Automation Inc.; Rockwell Automation Inc.; Schneider Electric; Teradyne, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Manufacturing Automation Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America manufacturing automation market report based on component, technology, deployment, end-use, industry vertical, application, solution, enterprise size, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

Professional Services

-

Managed Services

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

PLC

-

Robotics

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud-based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Discrete Manufacturing

-

Process Manufacturing

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Healthcare

-

Transportation and Logistics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Assembly Line Automation

-

Material Handling Automation

-

Welding and Fabrication Automation

-

Packaging Automation

-

Others

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Control Systems

-

Monitoring and Diagnostics

-

Robotics and Autonomous Systems

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

Frequently Asked Questions About This Report

b. Some key players operating in the North America manufacturing automation market include ABB, Applied Manufacturing Technologies, ATS Corporation, Eclipse Automation Inc., Epson Robots, Excelpro, FANUC (FANUC Corporation), INTECH, KUKA AG, Mecademic, Mitsubishi Electric Corporation, Motoman (Yaskawa America, Inc.), Reko Automation Inc., Rockwell Automation Inc., Schneider Electric, Teradyne, Inc.

b. The factors driving the North America manufacturing automation market include the growing inclination of businesses to automate their operations and the ongoing technological developments comprising robotics, Internet of Things (IoT), Artificial Intelligence (AI), machine learning, and 5G connectivity.

b. The North America manufacturing automation market was estimated at USD 3.33 billion in 2023 and is expected to reach USD 3.72 billion in 2024.

b. The North America manufacturing automation market is expected to grow at a compound annual growth rate of 9.7% from 2024 to 2030 to reach USD 6.49 billion by 2030.

b. The hardware segment accounted for the largest revenue share of 52.6% in 2023. The increasing adoption of smart technologies to improve manufacturing efficiency, reduce downtime, and enhance product quality is driving the demand for hardware components.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."