- Home

- »

- Homecare & Decor

- »

-

North America Laboratory Workstation & Storage Furniture Market, Report, 2030GVR Report cover

![North America Laboratory Workstation & Storage Furniture Market Size, Share & Trends Report]()

North America Laboratory Workstation & Storage Furniture Market Size, Share & Trends Analysis Report By Product (Workstation, Work Bench Cabinets), By End-use, By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-320-1

- Number of Report Pages: 88

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

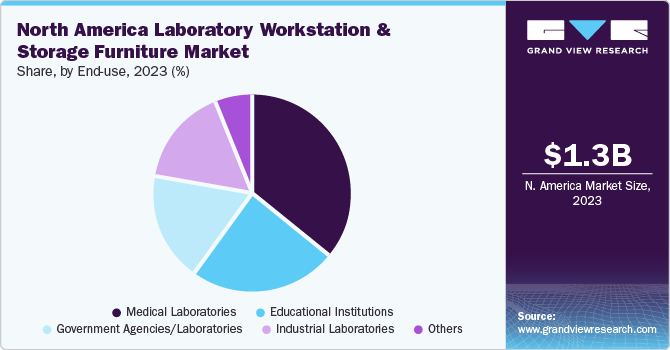

The North America laboratory workstation & storage furniture market size was estimated USD 1.33 billion in 2023 and is expected to grow at a CAGR of 8.3% from 2024 to 2030. The continuous expansion of R&D activities in sectors such as biotechnology, pharmaceuticals, and healthcare significantly drives the need for well-equipped laboratory spaces. Rising government support for new research facilities highlights the significant growth of and demand for modern, innovative, and collaborative laboratory infrastructure.

In March 2024, the Government of Canada announced an investment of USD 63.2 million in constructing new laboratory facilities as part of the Regulatory and Security Science Main (RSS Main) Project. This initiative aims to furnish federal scientists from various departments and agencies with an advanced, versatile, sustainable, and collaborative facility. The objective is to supplement existing government science laboratories and enhance their capabilities.

As laboratories evolve to address emerging challenges and priorities, such as those related to healthcare, agriculture, and environmental sustainability, there is a growing demand for furniture solutions that can accommodate diverse research needs while adhering to stringent regulatory standards. This investment highlights the importance of providing federal scientists with leading-edge facilities equipped with world-class furniture solutions to support their critical research activities.

One major restraint in the North America laboratory workstation and storage furniture market is the high cost associated with lab furniture, particularly advanced workstations and specialized equipment like fume hoods. These pieces of furniture often incorporate advanced technologies and specialized materials to ensure safety, efficiency, and compliance with regulations. However, the complexity and sophistication of these features can drive up manufacturing costs, making such furniture prohibitively expensive for research institutions and businesses operating on tight budgets.

Emerging players and new entrants can differentiate their products by focusing on unique features, designs, materials, or functionalities that cater to specific customer segments or unmet needs in the market. Offering customizable solutions or innovative designs can help attract customers and gain a competitive advantage.

In September 2023, Hanson Lab Solutions’ launched innovative M-Series workstations are modular bench systems with advanced field adaptability features to address the evolving needs of modern laboratories for flexible and technologically integrated furniture solutions. Startups can invest in research and development to create innovative products that offer unique value propositions to customers.

Market Concentration & Characteristics

The North American market for laboratory workstations and storage furniture is characterized by a high degree of innovation, driven by continuous advancements in laboratory technologies and the evolving needs of various industries such as pharmaceuticals, biotechnology, and academic research. Companies in this market are investing heavily in research and development to create ergonomic, flexible, and modular furniture solutions that enhance laboratory efficiency and safety.

The impact of regulations on the North American laboratory workstation and storage furniture market is significant, as stringent safety and quality standards govern the design, manufacturing, and installation of laboratory furniture. Regulatory bodies such as the Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA) set rigorous guidelines to ensure that laboratory environments are safe for researchers and compliant with environmental standards.

The market for laboratory workstations and storage furniture in North America exhibits a high degree of end-user concentration, with significant demand coming from key sectors such as healthcare, pharmaceuticals, biotechnology, and academic institutions. Large pharmaceutical and biotechnology companies, as well as major research universities and medical centers, represent a substantial portion of the market, driving demand for high-quality, specialized laboratory furniture.

Product Insights

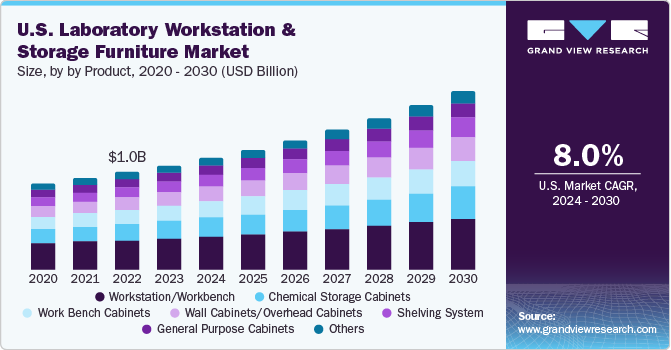

The North America workstation/workbench market segment accounted for a revenue share of around 30% in the year 2023. The segment is expected to continue witnessing substantial growth from 2024 to 2030, owing to advancements in technology and the increasing demand for efficient laboratory setups. Workstations and workbenches are designed to provide ergonomic solutions for various laboratory tasks, with the aim of enhancing productivity and safety. Manufacturers in the region are focusing on incorporating features such as height adjustability, modular designs, and customizable options to meet the diverse requirements of laboratories across different industries.

The demand for chemical storage cabinets in North America is projected to grow at a CAGR of 9.6% from 2024 to 2030. The demand for chemical storage cabinets in North American laboratories stems from the critical need to safely store and handle hazardous chemicals and materials used in various scientific research and industrial processes. Laboratories across diverse sectors, such as pharmaceuticals, biotechnology, healthcare, and manufacturing, require robust storage solutions to comply with safety regulations and mitigate risks associated with chemical exposure and accidents.

End-use Insights

The medical laboratories end use accounted for a revenue share of around 35% in 2023. The growing demand for well-trained laboratory professionals in medical labs across North America co-relates with the demand for specialized lab furniture solutions. In January 2023, ARUP Laboratories, a national reference laboratory for hospitals and health centers, and the University of Utah secured USD 3 million in federal funding from the Health Resources and Services Administration to establish the Advanced Practice Clinical Laboratory Training Center. This will allow ARUP Laboratories to invest in functional and specialized laboratory furniture, likely favoring the growth of the market.

The demand for laboratory workstations & storage furniture in industrial laboratories is expected to grow at a CAGR of 9.4% from 2024 to 2030. The surge in availability of life sciences laboratory space across the U.S., with a particularly high concentration in Boston and San Francisco Bay areas, coupled with the growing confidence in biotech investment, is poised to drive the demand for laboratory workstations and storage furniture in industrial laboratories in North America. The demand is particularly driven by smaller entities, transitioning from the post-incubator stage, as they seek efficient and tailored laboratory infrastructure.

Distribution Channel Insights

The direct sales channel segment accounted for a revenue share of around 33% in 2023. One major driver for the sale of laboratory workstations & storage furniture is the need for highly customized and specialized equipment. Laboratories often require furniture that meets specific scientific, safety, and ergonomic standards, which can vary depending on the type of research or work being conducted. Direct sales channels allow manufacturers to work closely with laboratory managers and designers to create bespoke solutions that fit the exact specifications of the lab, likely favoring the sale through direct sales channels.

The e-commerce sales segment is estimated to grow at a CAGR of 9.4% over the forecast period. E-commerce allows for easy comparison of features, specifications, and prices across different brands and manufacturers, empowering buyers to make informed decisions based on specific requirements. Furthermore, the streamlined ordering and delivery process offered by e-commerce platforms ensures quick and efficient procurement, ideal for commercial settings where time is of the essence.

Country Insights

U.S. Laboratory Workstation & Storage Furniture Market Trends

The U.S. laboratory workstation & storage furniture market size was estimated at USD 1.12 billion in 2023. The presence of numerous life sciences research institutions, universities, and biotech companies in the U.S. leads to a continuous demand for research space. As these research organizations expand their activities and programs, there is a growing need to construct new laboratories to accommodate the increasing demand for specialized facilities.

Canada Laboratory Workstation & Storage Furniture Market Trends

The laboratory workstation & storage furniture market in Canada is expected to grow at a CAGR of 9.3% from 2024 to 2030. The growing emphasis on scientific research and innovation necessitates advanced and ergonomic laboratory furniture that enhances efficiency, safety, and workflow in lab environments, is driving the market growth in Canada. Additionally, stringent regulatory standards for laboratory operations and safety drive the demand for high-quality, durable, and compliant furniture solutions.

Key North America Laboratory Workstation & Storage Furniture Company Insights

The market features both established regional firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive regional distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key North America Laboratory Workstation & Storage Furniture Companies:

- Kewaunee International Group

- Hemco Corporation

- Thermo Fisher Scientific Inc.

- SteelSentry Inc.

- Mott Manufacturing Ltd. & Mott Manufacturing LLC.

- PSA Laboratory Furniture

- Labconco Corporation

Recent Developments

-

In April 2022, Labconco Corporation expanded its dedication to sustainability by offering laboratory equipment that assists in meeting rigorous sustainability objectives. Its biosafety cabinets, fume hoods, and glassware washers are designed to contribute to environmentally friendly practices. Labconco products are crafted from top-grade recycled steel, highlighting its commitment to responsible manufacturing practices by employing recycled and regional materials whenever possible.

-

In January 2022, Kewaunee Scientific Corporation finalized long-term agreements with its two primary dealer partners, Nycom and ISEC, both renowned specialty sub-contractors within the industry. Henceforth, the territories historically serviced directly by Kewaunee will be under the management of Nycom and ISEC. This strategic shift in Kewaunee's go-to-market approach aims to enhance focus on delivering top-quality manufactured products.

North America Laboratory Workstation & Storage Furniture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.43 billion

Revenue forecast in 2030

USD 2.30 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, distribution channel, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

Kewaunee International Group; Hemco Corporation; Thermo Fisher Scientific Inc.; SteelSentry Inc.; Mott Manufacturing Ltd. & Mott Manufacturing LLC.; PSA Laboratory Furniture; Labconco Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Laboratory Workstation & Storage Furniture Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America laboratory workstation & storage furniture market based on product, end use, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Workstation/Workbench

-

Work Bench Cabinets

-

General Purpose Cabinets

-

Chemical Storage Cabinets

-

Wall Cabinets/Overhead Cabinets

-

Shelving System

-

Others

-

-

End-use Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Educational Institutions

-

Medical Laboratories

-

Government Agencies/Laboratories

-

Industrial Laboratories

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Sales

-

Distributors/Wholesalers

-

Contractors

-

E-commerce

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America laboratory workstation & storage furniture market was estimated at USD 1.33 billion in 2023 and is expected to reach USD 1.43 billion in 2024.

b. The North America laboratory workstation & storage furniture market is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030 to reach USD 2.30 billion by 2030.

b. U.S. dominated the North America laboratory workstation & storage furniture market with a share of around 84% in 2023. The expansion of academic and research institutions, coupled with substantial government funding for scientific research, fuels the demand for laboratory workstation & storage furniture in the country.

b. Some of the key players operating in the North America laboratory workstation & storage furniture market include Kewaunee International Group; Hemco Corporation; Thermo Fisher Scientific Inc.; SteelSentry Inc.; Mott Manufacturing Ltd. & Mott Manufacturing LLC.; PSA Laboratory Furniture; Labconco Corporation.

b. Key factors that are driving the North America laboratory workstation & storage furniture market growth include Advances in laboratory technologies, and the continuous expansion of R&D activities in sectors such as biotechnology, pharmaceuticals, and healthcare significantly drives the need for well-equipped laboratory spaces.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."