North America Industrial Vending Machine Market Size, Share & Trends Analysis Report By Type (Carousel, Coil), By Product (MRO Tools, PPE), By End-Use (Manufacturing, Construction), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-079-7

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

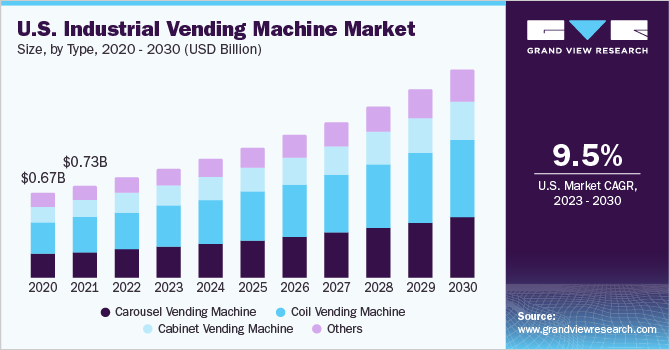

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Report Overview

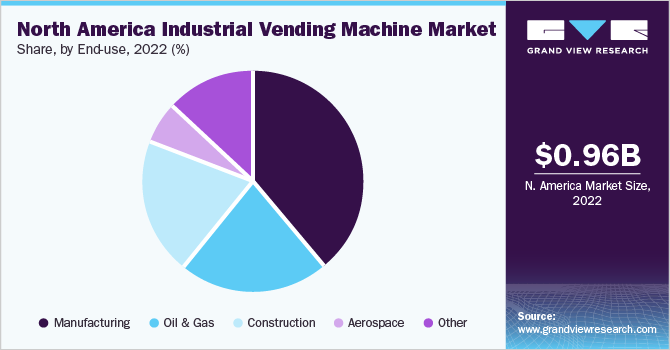

The North America industrial vending machine market size was valued at USD 0.96 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.6% from 2023 to 2030. Industrial vending machines have grown in popularity in North America, where they can be found in diverse locations such as manufacturing factories, warehouses, and distribution centers. These machines let staff easily access equipment and supplies while allowing management to check usage and limit expenditures. Furthermore, the need for improved inventory management, cost control, and increased safety measures is driving the adoption of North America industrial vending machines. As technology advances, the market for industrial vending machines is projected to witness more inventive applications in the forthcoming years.

One of the primary factors driving the North America industrial vending machine market is the increasing demand for vending machines for manufacturing organizations to improve their inventory management operations. Inventory management is a challenge for numerous enterprises, often resulting in insufficient stocks and production setbacks. Industrial vending machines present a viable solution to this issue by enabling live inventory monitoring and automated restocking. Furthermore, industrial vending machines provide industrial workers with 24-hour access to tools and supplies and reduce the time and effort required to acquire supplies. This is anticipated to drive the demand for industrial vending machines.

Additionally, the need to reduce waste and control production costs is anticipated to drive the growth of the North America industrial vending machines market. Businesses can avoid waste and save money on unwanted purchases by tracking inventory levels and distributing only the amount of goods required. Smart industrial vending machines tend to be more beneficial to companies as they offer data analytics solutions that help companies observe & track product usage patterns and maintain the inventory accordingly. For instance, in September 2021, Silkron, a vending machine manufacturer, announced the launch of new industrial vending machines. This machine avoids critical stock-outs by alerting the operator to restock in time and avoids overstocking by analyzing consumption trends.

Moreover, COVID-19 has increased the demand for PPE and other safety equipment, such as eTools and MROs, which can be efficiently distributed through industrial vending machines. These machines provide a contactless and convenient method of obtaining vital supplies while reducing the risk of transmission. Workers can rapidly get the components and supplies they need to keep production operations smooth via the placement of vending machines on the shop floor. This saves time and contributes to better inventory management. These machines aid in managing consumable spending while providing workers access to a large range of goods and services that are frequently used.

Furthermore, hospitals and other healthcare facilities focus on adopting industrial vending machines to streamline the supply chain and eliminate waste. Hence, such industries provide lucrative opportunities for the growth of the market. For instance, in June 2021, Chula Med, in collaboration with Sun Vending Technology Public Company Limited, a provider of intelligent vending machines, announced the launch of automatic vending machines to sell medical products from the researchers of King Chulalongkorn Memorial Hospital and Chula Med.

Type Insights

The coil vending machine segment dominated the market and accounted for nearly 37.0% of revenue share in 2022. These machines store more inventory than other machines, such as vertical lift machines and cabinet vending machines. The coil vending machine also consumes less power and has low maintenance costs. These machines allow goods to be stacked from front to back and offer high storage density, but they are only suitable for smaller items.

The carousel vending machine segment is expected to register a 10.1% CAGR over the forecast period. Carousel vending machines use intelligent software that analyzes data on customer preferences, product demand, and sales trends. This data is then used to optimize product offerings, prices, and even the layout of the machine to maximize sales and profits. To personalize the user experience, they are integrated with touch screens, cashless payment systems, and even facial recognition technologies. These mentioned factors are expected to support the segment’s growth.

Product Insights

The personal protective equipment (PPE) segment dominated the market and accounted for approximately 41.0% share of revenues in 2022. Technological advancements have resulted in the development of more effective PPE, such as respirators, gloves, protective gear, and footwear. These improvements have increased the comfort, durability, and effectiveness of PPE, making it more attractive to workers. The demand for these PPE machines is also anticipated to rise due to strictrules regarding worker safety.

The maintenance, repair, and operations (MRO) segment is estimated to register a CAGR over the forecast period. MRO supplies such as tools, spare parts, sealants, coatings, tool kits, and testing equipment are required the most during downtime. Hence, MRO equipment is stocked as well as maintained on a large scale in industries with high downtime costs. MRO tools are one of the most important components of inventory and tracking them is critical for a variety of end-use industries, including oil and gas, manufacturing, and aviation. Industrial vending machines make tracking and maintaining MRO supplies simple, which drives segment growth.

End-use Insights

The manufacturing segment accounted for approximately 38.0% market share in 2022. Cost reduction is a primary factor expected to increase the adoption of industrial vending machines among end-users. The approach of companies toward lowering labor costs associated with inventory management is resulting in the increasing deployment of industrial vending machines at work sites. These machines aid in automating the inventory management process with advanced features such as real-time inventory tracking. Industrial vending machines can help in minimizing the occurrence of stock-outs and overstocking. These advantages of industrial vending are expected to support market growth.

Industrial vending machines are widely used in manufacturing to reduce operational downtime and speed up maintenance and repair. Industrial vending machines also help to improve operational efficiency and maintain track of inventory availability. Furthermore, growing urbanization and rising industrialization have fuelled the growth of the North America industrial vending machine industry.

The aerospace segment is expected to register the highest CAGR over the forecast period of 2023-2030. Industrial vending machines help boost productivity and reduce downtime by providing 24/7 access to the tools and consumables required for the manufacturing process. Workers may simply obtain the resources they require without having to wait for authorization or seek things. Hence, such factors drive the segment’s North America industrial vending machine industry growth.

Regional Insights

The U.S. dominated the North America industrial vending machine market and accounted for nearly 80.0% of revenue share in 2022. Many industrial vending machines are designed to promote safety in the workplace. They can be programmed to dispense hazardous materials only in certain quantities thereby reducing the risk of accidents. Furthermore, before accessing supplies, some machines require workers to log in and verify their identity, ensuring that only authorized personnel have access to hazardous materials.

Canada segment is expected to register the highest CAGR over the forecast period 2023-2030. The rising presence of companies in Canada promises to increase regional demand over the forthcoming years. These industrial vending machines can dispense various items such as safety equipment, tools, and maintenance supplies.

Key Companies & Market Share Insights

The North America industrial vending machine market is highly competitive and entry for new players is difficult due to the high investment required for setting up infrastructures, such as factories and warehouses, and manufacturing the machines. In the global market, existing players provide additional services such as consulting, maintenance, and supply of inventory, which creates entry barriers for new companies.

Subsequently, small-scale players in the market collaborate or partner with major players to enter the industry. Key players also focus on joint ventures to stay ahead of the competition. Industry players are increasingly focusing on adopting inorganic growth strategies by acquiring smaller industry participants and other ecosystem players. For instance, in February 2022, Neon, an NFT & digital platform, announced the launch of the globe’s first NFT vending machine in New York. The vending machine, the first of its kind globally, makes it possible for almost anybody to enter the realm of NFTs without a prior understanding of blockchain or cryptocurrencies. Some prominent players in the North America industrial vending machine market include:

-

Airgas, Inc.

-

Apex Industrial Technologies, LLC.

-

AutoCrib

-

CRIBMASTER

-

Fastenal Company

-

IMC Companies

-

MSC Industrial Direct Co., Inc.

-

SECURASTOCK

-

SupplyPro, Inc.

North America Industrial Vending Machine Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 1.05 billion |

|

Revenue forecast in 2030 |

USD 2.00 billion |

|

Growth rate |

CAGR of 9.6% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million, CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Type, product, end-use, country |

|

Regional scope |

North America |

|

Country scope |

U.S., Canada, Mexico |

|

Key companies profiled |

Airgas, Inc.; Apex Industrial Technologies, LLC.; AutoCrib; CRIBMASTER; Fastenal Company; IMC Companies; MSC Industrial Direct Co., Inc.; SECURASTOCK; SupplyPro, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Industrial Vending Machine Market Report Segmentation

The report forecasts revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America industrial vending machine industry report based on type, product, end-use, and country.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Carousel Vending Machine

-

Coil Vending Machine

-

Cabinet Vending Machine

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

MRO Tools

-

PPE

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Oil & Gas

-

Construction

-

Aerospace

-

Other

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

The U.S.

-

Canada

- Mexico

-

-

Frequently Asked Questions About This Report

b. The North America industrial vending machine market size was estimated at USD 0.96 billion in 2022 and is expected to reach USD 1.05 billion in 2023.

b. The North America industrial vending machine market is expected to grow at a compound annual growth rate of 9.6% from 2023 to 2030 to reach USD 2.00 billion by 2030.

b. Personal Protective Equipment (PPE) dominated the market with a share of nearly 41.0% in 2022. The growth of PPE in the workplace in North America has been driven by a combination of regulatory requirements, increased awareness of workplace safety, technological advancements,

b. Some key players operating in the North America industrial vending machine market include Airgas, Inc.; Apex Industrial Technologies, LLC.; AutoCrib; CRIBMASTER; Fastenal Company; IMC Companies; MSC Industrial Direct Co.,Inc.; SECURASTOCK; SupplyPro, Inc.

b. One of the primary factors driving the North America industrial vending machine market is the increasing demand for vending machines for manufacturing organizations to improve their inventory management operations. Inventory management is a challenge for numerous enterprises, often resulting in insufficient stocks and production setbacks. IVMs present a viable solution to this issue by enabling live inventory monitoring and automated restocking.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."