- Home

- »

- Sensors & Controls

- »

-

North America Industrial Component Market Size Report, 2030GVR Report cover

![North America Industrial Component Market Size, Share & Trends Report]()

North America Industrial Component Market Size, Share & Trends Analysis Report By Product (Bearing, Roller Chain & Sprocket, Shaft Couplings), By Industry Vertical, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-488-9

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

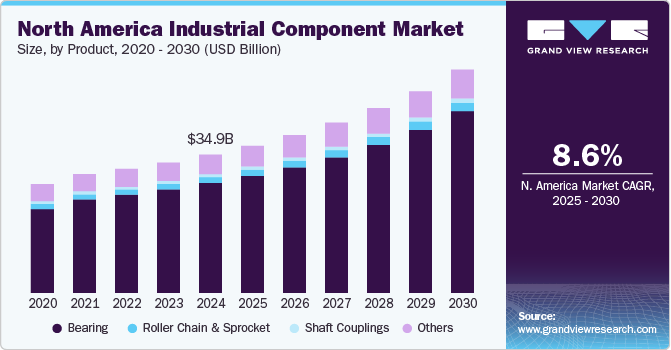

The North America industrial component market size was estimated at USD 34.85 billion in 2024 and is projected to grow at a CAGR of 8.6% from 2025 to 2030. The rise of advanced manufacturing technologies, such as additive manufacturing (3D printing), is transforming the market in North America. Additive manufacturing allows for the production of complex components with reduced material waste and shorter lead times. As companies explore the benefits of 3D printing, demand for materials and components that support these processes is increasing. This technology also enables customization and rapid prototyping, allowing manufacturers to respond quickly to changing market demands. As advanced manufacturing technologies continue to gain traction, they will play a significant role in shaping the market’s future.

The rise of renewable energy sources, such as wind and solar, significantly influences the industry. As governments and organizations prioritize sustainability and clean energy initiatives, the demand for components used in renewable energy technologies is rising. For instance, manufacturers require specialized components for wind turbines, solar panels, and energy storage systems. This growth in the renewable energy sector creates new opportunities for industrial component suppliers and encourages innovation in materials and technologies. As the transition towards renewable energy continues, the market will see a sustained increase in demand driven by these green initiatives.

In addition, the adoption of Industry 4.0 principles, which emphasize the integration of digital technologies into manufacturing processes, is reshaping the industrial landscape in North America. Companies increasingly implement smart manufacturing practices that leverage IoT, artificial intelligence, and advanced analytics. This transition drives demand for industrial components that enable connectivity, automation, and real-time data analysis. As manufacturers adopt Industry 4.0 technologies, the need for advanced sensors, communication devices, and smart components will increase, further propelling market growth.

Furthermore, expanding end-user industries such as automotive, aerospace, electronics, and renewable energy drives market growth. The automotive industry, for example, is experiencing a transformation with the rise of electric vehicles (EVs) and autonomous driving technologies. This shift necessitates advanced components such as batteries, power electronics, and smart sensors, contributing to market growth. Similarly, the aerospace sector is seeing increased demand for lightweight materials and precision components to enhance fuel efficiency and performance. As these end-user industries continue to grow and evolve, they will drive the demand for specialized industrial components tailored to their unique requirements.

Product Insights

Based on product, the market is segmented into bearing, roller chain & sprocket, shaft couplings, and others. Bearing dominated the market with a revenue share of 79.1% in 2024. The increasing adoption of electric vehicles (EVs) drives this segment's growth. As the automotive industry shifts towards electric mobility, there is a growing demand for specialized bearings that can operate in electric drivetrains and high-speed electric motors. EVs require durable bearings and can handle the unique demands of electric propulsion systems, such as higher rotational speeds and thermal loads. With the push towards reducing carbon emissions and increasing EV production, the demand for advanced bearings in this sector is set to grow. In December 2023, The Timken Company, a global provider of engineered bearings and industrial motion products, announced that its wheel bearings are being utilized in Ford's F-150 Lightning, the first electric light-duty pickup truck. Timken bearings in the F-150 Lightning add more components per vehicle than its gasoline-powered version. Timken's customized bearing solutions enable manufacturers such as Ford to transition to electric vehicle designs without overhauling their supply chain.

The shaft couplings segment is anticipated to register a notable growth rate over the forecast period. The rise of automation and smart manufacturing technologies is contributing to the growth of the shaft couplings segment. As industries increasingly adopt automated processes and Industry 4.0 technologies, precise and reliable power transmission solutions become more critical. Couplings are integral to computerized systems, connecting various machinery and enabling seamless operation. Integrating sensors and IoT technologies in modern manufacturing equipment also enhances the monitoring and control of coupling performance, allowing for predictive maintenance and improved operational efficiency. This trend towards automation and smart systems is driving the adoption of advanced shaft couplings that can meet the demands of modern industrial environments.

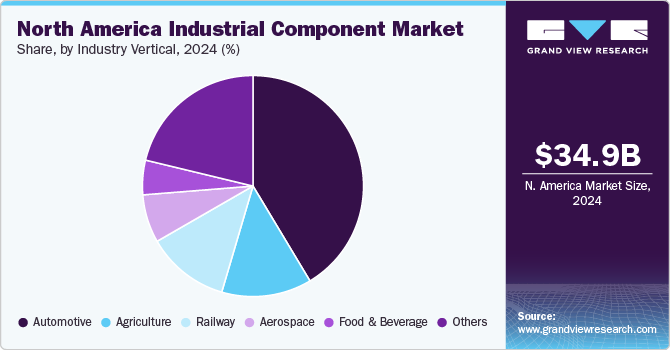

Industry Vertical Insights

Based on industry vertical, the market is segmented into automotive, agriculture, railway, aerospace, food & beverage, and others. The automotive segment dominated the market with a revenue share of 41.4% in 2024. The increasing production of vehicles in North America drives the industry. Despite short-term disruptions caused by supply chain issues, vehicle production is rebounding, and demand for industrial components such as fasteners, bearings, and seals is growing. With the rising popularity of SUVs, trucks, and commercial vehicles, which often require more robust and durable components, manufacturers are seeking high-quality industrial parts to meet production demands. These components play a crucial role in modern vehicles' structural integrity and functionality, further driving their demand in the market. According to the International Organization of Motor Vehicle Manufacturers, the U.S. produced approximately 10.6 million motor vehicles in 2023, including passenger cars, light commercial vehicles, heavy trucks, buses, and coaches. This marks an increase from the 2022 production of 10.1 million units.

The aerospace segment is expected to grow at a notable CAGR over the forecast period. Growing demand for air travel is a significant driver of the aerospace sector. As the global economy recovers from the COVID-19 pandemic, the demand for air travel has surged, increasing commercial aircraft production. This surge in demand translates to a need for a wide range of industrial components, including engines, avionics, landing gear, and cabin interiors. As airlines seek to upgrade their fleets to meet customer expectations for comfort and safety, the aerospace segment of the market is poised for significant growth.

Country Insights

The U.S. dominated the North America market with a revenue share of 75.9% in 2024. The rise in infrastructure development and modernization projects drives market growth. Government initiatives to upgrade aging infrastructure, such as roads, bridges, energy grids, transportation systems, and fuel demand for industrial components. These large-scale projects require various elements, including bearings, gears, fasteners, and other mechanical parts that play a vital role in construction equipment, machinery, and vehicles. The bipartisan Infrastructure Investment and Jobs Act (IIJA) has catalyzed infrastructure spending, ensuring a steady pipeline of projects that demand robust industrial component supply chains. In October 2024, The U.S. Department of Transportation's Federal Highway Administration (FHWA) announced USD 62 billion in Fiscal Year 2025 funding for 12 formula programs to improve the nation's infrastructure. These investments, part of the Biden-Harris Administration's Bipartisan Infrastructure Law, support road, bridge, and tunnel projects across all 50 states, the District of Columbia, and Puerto Rico. This marks the fourth year of funding under the law, with a USD 62 billion allocation for FY 2025 and a USD 18.8 billion increase compared to FY 2021, the final fiscal year before the law was enacted.

Mexico is expected to grow at the fastest CAGR of over 10.0% over the forecast period. The rise of maquiladoras (export-oriented factories) along the U.S.-Mexico border is crucial in Mexico’s market growth. These factories, which import raw materials and components duty-free for assembly and then export finished products, require a consistent supply of industrial components such as bearings, sprockets, sensors, and roller chains to keep production lines running smoothly. Maquiladoras are prevalent in electronics, textiles, and automotive manufacturing sectors, all relying on industrial components for efficient assembly. The maquiladora system has created a strong linkage between the Mexican market and global supply chains, driving further demand for these products. According to an article published by the Federal Reserve Bank of Dallas, stated that in 2021, maquiladoras represented 58% of Mexico's manufacturing GDP, making up the majority of the country's manufacturing exports, and accounted for 48% of industrial employment.

Key North America Industrial Component Company Insights

Some key players operating in the market include SKF, NTN Corporation, and The Timken Company.

-

SKF is a multinational corporation specializing in developing, manufacturing, and supplying bearings, seals, lubrication systems, and services such as technical support and condition monitoring. The company operates in two business segments: industrial and automotive. Under the industrial segment, the company offers a range of bearings, seals, and lubrication systems. These products cater to more than 40 industries globally, and SKF directly and indirectly distributes products and services through a network of more than 7,000 distributors.

Hangzhou Donghua Chain Group Co., Ltd. and Webster Industries Inc. are some of the emerging market participants in the target market.

-

Webster Industries Inc. specializes in engineered class chains, sprockets, and vibrating equipment products. Webster’s core product offerings include engineered conveyor chains, sprockets, vibratory conveyors, and apron pan conveyors. The engineered conveyor chains include SBR chains, HSB rollerless chains, port alloy mill chains, port alloy drag chains, combination chains, cast chains, apron conveyors, and ENDURO-FLITE. These products are essential for industrial operations that require the efficient movement of materials, whether in bulk material handling or production processes.

Key North America Industrial Component Companies:

- SKF

- NTN Corporation

- The Timken Company

- Schaeffler Group

- JTEKT Corporation

- Renold plc

- Webster Industries Inc.

- Regal Rexnord

- NSK Ltd.

- Hangzhou Donghua Chain Group Co., Ltd.

Recent Development

-

In July 2024, Webster Industries Inc. partnered with MPE Partners to acquire Bar Holdings, Inc. (Allor Manufacturing and Plesh Industries). Allor Manufacturing is a prominent supplier of new replacement parts and refurbished components, primarily serving the steel industry. The company manufactures aftermarket products, including levelers, work rolls, chains, wheels, and bearings. The acquisition of Allor Manufacturing marked a valuable addition to Webster Industries Inc. Allor Manufacturing's strong leadership team has positioned the company for ongoing commercial and operational success.

-

In May 2024, NTN Corporation launched a large-diameter deep groove ball bearing tailored for the coaxial e-axle, an essential part of electric vehicles (EVs). These large-diameter bearings are designed to resist electrical pitting, which helps reduce the size and weight of coaxial e-axles. This innovation enhances the efficiency of the e-axle, enabling higher-speed rotation while keeping torque low.

North America Industrial Component Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 37.12 billion

Revenue Forecast in 2030

USD 56.07 billion

Growth rate

CAGR of 8.6% from 2025 to 2030

Actual data

2017 - 2024

Forecast Period

2025 - 2030

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, industry vertical, country

Country Scope

U.S.; Canada; Mexico

Key Companies Profiled

SKF; NTN Corporation; The Timken Company; Schaeffler Group; JTEKT Corporation; Renold plc; Webster Industries Inc.; Regal Rexnord; NSK Ltd.; Hangzhou Donghua Chain Group Co., Ltd.

Customization Scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, country & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Industrial Component Market Report Segmentation

This report forecasts revenue growth at country levels and offers a qualitative and quantitative analysis of the market trends for each segment and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the North America industrial component market based on product, industry vertical, and country.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Bearing

-

Ball Bearing

-

Roller Bearing

-

Plain Bearing

-

Others

-

-

Roller Chain & Sprocket

-

Shaft Couplings

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Agriculture

-

Railway

-

Aerospace

-

Food & Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America industrial component market size is valued at USD 34.85 billion in 2024 and is expected to reach USD 37.12 billion in 2025.

b. The North America industrial component market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2030 to reach USD 56.07 billion in 2030.

b. The bearing segment dominated the market with a revenue share of 79.1% in 2024. The increasing adoption of electric vehicles (EVs) is driving the bearing segment growth. As the automotive industry shifts towards electric mobility, there is a growing demand for specialized bearings that can operate in electric drivetrains and high-speed electric motors.

b. Some of the key players operating in the market include SKF, NTN Corporation, The Timken Company, among others.

b. The rise of renewable energy sources, such as wind and solar, significantly influences the North American industrial component market. As governments and organizations prioritize sustainability and clean energy initiatives, the demand for components used in renewable energy technologies is rising.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."