North America Ice Hockey Equipment Market Size, Share & Trends Analysis Report By Product (Protective wear, Sticks, Skates, Others), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-283-6

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

The North America ice hockey equipment market size was estimated at USD 1.31 billion in 2023 and is expected to grow at a CAGR of 6.0% from 2024 to 2030. The increase in participation of players in ice hockey and the rising availability of synthetic ice arenas are the major factors anticipated to drive the market. Additionally, favorable government initiatives to promote ice hockey are expected to increase the participation rate, thereby propelling market growth during the forecast period.

The popularity and widespread participation in ice hockey in North America significantly contribute to the robust demand for ice hockey equipment. Ice hockey includes many participants, ranging from youth leagues to adult recreational players. For instance, according to a 2022 survey by Ampere Sports, a sports technology company in the U.S., North America’s ice hockey league ranks eighth in the list of the most popular competitions.

In addition, factors such as rising social media influence encourage consumers to adopt a healthy lifestyle and focus on maintaining fitness, which has encouraged people across all age groups to participate in a variety of sports activities, including ice hockey. This trend is expected to drive the demand for ice hockey in the region.

The growing popularity of ice hockey in the country, coupled with favorable government initiatives for the sport, is boosting the demand for ice hockey equipment. For instance, as per the U.S. Hockey Organization, the number of players in 2022 was 547,429 and count increased to 556,186 in 2023.

Further, according to a survey conducted by Ampere, a U.S.-based sports technology company, U.S. fans of the National Hockey League (NHL) have demonstrated a higher willingness to pay to watch sports compared to the typical sports fan. The survey revealed that NHL fans were willing to pay 54 percent more than the average U.S. sports fan to watch sports. Additionally, they reported spending 2.3 hours more per week watching live sports matches compared to the average fan in the U.S.

The presence of renowned professional hockey leagues, such as the NHL in North America, serves as a significant driver. Major events like the Winter Olympics also increase interest and equipment sales. Manufacturers are forming strategic partnerships with hockey leagues.

In December 2023, CCM Hockey and Bauer Hockey were announced as official partners of the Professional Women’s Hockey League (PWHL), leading a consortium of equipment companies set to provide gear to PWHL players for the upcoming season. This collaboration will allow players access to custom-fit equipment from CCM, Bauer, Sherwood, TRUE Sports, Warrior, and other leading brands, allowing them to sample the latest performance lines.

Market Concentration & Characteristics

The market is characterized by a diverse product range, including hockey sticks, skates, protective gear, and accessories. Technological advancements play a crucial role in product differentiation, with companies continuously striving to introduce innovations that enhance performance, durability, and safety. Features such as lightweight materials, enhanced impact resistance, and personalized customization options are frequently used to attract consumers seeking high-quality equipment.

Consumer preferences are influenced not only by brand reputation but also by the endorsements and sponsorships of professional players. Major hockey leagues, particularly the NHL, have a substantial impact on the market, as fans often aspire to use the same equipment as their favorite players. This dynamic creates a feedback loop where the success and visibility of professional players drive sales and market trends.

Product Insights

Ice hockey sticks market accounted for a share of 38.2% of North America market in 2023. The popularity and widespread participation in ice hockey in North America significantly contribute to the robust demand for ice hockey equipment. Ice hockey includes many participants, ranging from youth leagues to adult recreational players. For instance, according to a 2022 survey by Ampere Sports, a sports technology company in the U.S., North America’s ice hockey league ranks eighth in the list of the most popular competitions.

In addition, factors such as rising social media influence encourage consumers to adopt a healthy lifestyle and focus on maintaining fitness, which has encouraged people across all age groups to participate in a variety of sports activities, including ice hockey. This trend is expected to drive the demand for ice hockey in the region.

Ice hockey skates are anticipated to grow at a CAGR of 6.1% from 2024 to 2030. Player preferences play a crucial role in driving the market for ice hockey skates. Professional players and amateur enthusiasts alike seek skates that suit their playing style, foot shape, and individual needs. Customization options, such as heat-moldable liners and adjustable features, allow players to tailor their skates for optimal comfort and performance. As players become more aware of the impact of well-fitted and technologically advanced skates on their game, the demand for skates in the market continues to grow.

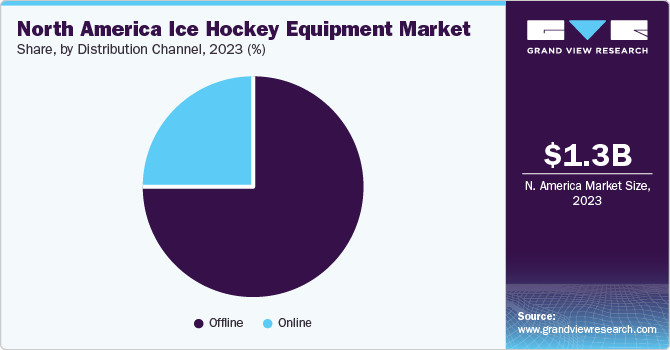

Distribution Channel Insights

Sales of ice hockey equipment through offline channels accounted for a share of around 74.7% of the North America revenues in 2023. Sales through offline channels are primarily fueled by the widespread existence of retail outlets from North America manufacturers. The extensive presence of sports specialty stores also contributes significantly to the high visibility of these products, further driving sales through offline channels. Additionally, the necessity for hockey players to acquire equipment in the right size and fit for optimal comfort during play serves as a key factor influencing the preference for offline purchases.

Online sales of ice hockey equipment are projected to grow at a CAGR of 6.8% from 2024 to 2030. Factors such as ease of convenience and the presence of a wide range of brands are driving the sales of ice hockey equipment through online channels. Online availability allows customers to browse and purchase products after the working hours of a physical store. Moreover, online stores include diverse product catalogs featuring various ice hockey equipment from various brands. This, in turn, allows consumers to explore products from well-established brands and discover ice hockey gear from niche or emerging brands.

Canada-based Hockeystore.com offers a vast selection of high-quality hockey gear, including skates, sticks, jerseys, and helmets. The store provides quick home delivery throughout North America. The online store offers hockey sticks and other equipment from major players such as CCM, Bauer, and Warrior

Country Insights

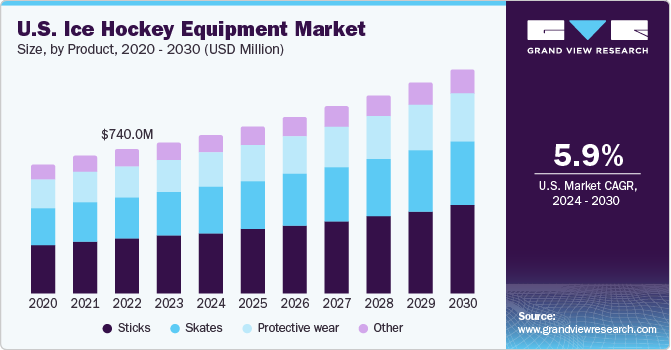

U.S. Ice Hockey Equipment Market Trends

The U.S. ice hockey equipment market accounted for a share of over 59.3% of the North America ice hockey equipment market in 2023. The demand for ice hockey equipment in the USA is driven by initiatives such as the national youth sports strategy released by the U.S. Department of Health and Human Services. This strategy is designed to boost youth participation in sports and physical activity. The implementation of such strategies is anticipated to significantly enhance the popularity of sports, particularly among the youth, thereby contributing to the increased demand for ice hockey equipment in the country.

In response, several companies are launching ice hockey equipment to cater to the high demand. In November 2023, G8RTech, Inc., a U.S.-based company that offers specialized protective equipment, announced the launch of G8RSkin Ice. G8RSkin Ice is designed to significantly reduce the risk of injury to hockey players, especially concussions and lacerations. The product consists of a lightweight, cut-resistant collar and a balaclava-like shell.

Additionally, the growth of youth and amateur hockey programs in the area has contributed to the expansion of the sport's equipment market. As more young players become involved in organized hockey leagues and programs, there is an increasing demand for equipment, and related services, which has helped to boost the overall market for ice hockey equipment market in Nashville.

Canada Ice Hockey Equipment Market Trends

Canada ice hockey equipment market is expected to grow at a CAGR of 6.2% from 2024 to 2030. Ice hockey's cultural significance in Canada is anticipated to drive the demand for associated equipment. The sport is deep-seated in the national identity, and the popularity of ice hockey events, both at professional and amateur levels is driving the demand for equipment among enthusiasts and aspiring players in the country. Canada has a high rate of participation in organized ice hockey leagues. The widespread involvement in the sport is anticipated to create a consistent demand for equipment, including skates, sticks, helmets, and protective gear. According to the International Ice Hockey Federation, the total count of ice hockey players grew from 345,481 in 2020 to 513,674 in 2022.

Key North America Ice Hockey Equipment Company Insights

North America market is highly competitive owing to a large number of industry players. The market provides various opportunities for new entrants due to changing consumer preferences and the easy availability of raw materials. Companies are involved in product retailing through e-commerce, supermarkets, and hypermarkets. Furthermore, major players engage in competitive strategies such as new product launches, joint ventures, strengthening of online presence, and capacity expansions among others.

Key North America Ice Hockey Equipment Companies:

- Bauer (Peak Achievement Athletics Inc.)

- CCM (Birch Hill Equity Partners)

- STX

- Warrior (New Balance)

- SherWood (Canadian Tire Corp)

- TRUE

- ROCES SPORT S.R.L

- Vaughn Hockey

- Winwell

- Grafskates AG

Recent Developments

-

In December 2023, CCM Hockey and Bauer Hockey officially partnered with Professional Women’s Hockey League (PWHL). This collaboration was aimed at providing players the opportunity to access custom-fit equipment from CCM, Bauer, Sherwood, TRUE Sports, Warrior

-

In August 2023, Connor Bedard partnered with Sherwood Hockey that allowed Bedard to exclusively use Sherwood's Rekker Legend sticks and gloves from the 2023-24 season

-

In March 2022, CCM Hockey partnered with Augustana University's Director of Athletics, Josh Morton, to become the official equipment provider for the program, slated to hit the ice for the 2023-24 season

North America Ice Hockey Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.38 billion |

|

Revenue forecast in 2030 |

USD 1.95 billion |

|

Growth rate |

CAGR of 6.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, country |

|

Country scope |

U.S.; Canada |

|

Key companies profiled |

Bauer (Peak Achievement Athletics Inc.); CCM (Birch Hill Equity Partners); SherWood (Canadian Tire Corp); Warrior Sports (New Balance); True Temper Sports; STX; Grafskates AG; Winnwell; Vaughn Hockey; ROCES SPORT S.R.L |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Ice Hockey Equipment Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America ice hockey equipment market report based on product, distribution channel, and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Protective wear

-

Sticks

-

Skates

-

Other

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. North America ice hockey equipment market size was valued at USD 1.31 billion in 2023 and is expected to reach 1.38 billion in 2024.

b. North America ice hockey equipment is expected to grow at a compounded growth rate of 6.0% from 2024 to 2030 to reach USD 1.95 billion by 2030.

b. Protective wear accounted for a share of 36.3% of the global revenues in 2023. The demand for protective wear in ice hockey equipment, including helmets, shoulder pads, elbow pads, gloves, and shin guards, is primarily driven by the need for player safety. Ice hockey equipment is a fast-paced, physical sport that involves constant movement and the use of a hard puck and can result in collisions. Ice hockey equipment is a contact sport, and players are at risk of various injuries due to collisions, falls, and the high-speed nature of the game. Protective gear helps minimize the risk of injuries such as concussions, fractures, cuts, and bruises.

b. Some key players operating in the North America ice hockey equipment market are Bauer (Peak Achievement Athletics Inc.), CCM (Birch Hill Equity Partners), SherWood (Canadian Tire Corp), Warrior Sports (New Balance), True Temper Sports, STX, Grafskates AG, Winnwell, Vaughn Hockey, ROCES SPORT S.R.L

b. The popularity and widespread participation in ice hockey in North America significantly contribute to the robust demand for ice hockey equipment. Ice hockey includes many participants, ranging from youth leagues to adult recreational players.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."