- Home

- »

- Electronic & Electrical

- »

-

North America Household Washer And Dryer Market, Report 2030GVR Report cover

![North America Household Washer And Dryer Market Size, Share & Trends Report]()

North America Household Washer And Dryer Market Size, Share & Trends Analysis Report By Product, By Load Type, By Structure, By Type, By Capacity, By Price Range, By Technology, By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-375-9

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

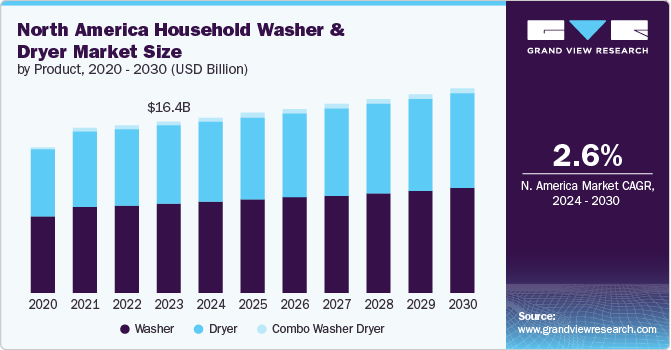

The North America household washer and dryer market size was estimated at USD 16.37 billion in 2023 and is expected to grow at a CAGR of 2.6% from 2024 to 2030. Busy lifestyles and a growing emphasis on convenience encourage consumers to invest in appliances that can save time and effort, such as washers and dryers with faster cycles and advanced features. In addition, innovations such as energy-efficient models, smart features, and automation contribute to market growth by enticing consumers to upgrade their appliances for improved performance and convenience.

Moreover, the demand for all-in-one washer and dryer combos is a key factor driving the market growth. An all-in-one washer-dryer combo is a single machine designed to both wash and dry clothes within the same enclosed drum. Equipped with programmed controls, these devices can perform both functions in tandem or separately. These innovative appliances streamline laundry routines by eliminating the need to transfer damp clothes from the washer to the dryer. According to a 2020 survey conducted by GE, which included over 90,000 households in North America, consumers typically leave clothes in the washer for an average of 130 minutes before moving them to the dryer. With all-in-one machines, there is no risk of forgetting to transfer clothes, as the washer automatically transitions to the drying cycle.

Numerous brands operating in the market are introducing all-in-one washer-dryer combos to meet the increasing consumer demand. These companies include Magic Chef, Black+Decker, GE, Equator, LG, Whirlpool, and Samsung. These machines are easily available at big retailers such as Lowe’s and Home Depot, as well as at dedicated home appliance stores. These players offer washer and dryer combos integrated with high-tech features, vibrant colors, and sleek carbon finishes.

All-in-one washer and dryer units are also renowned for their energy efficiency, consuming less power than traditional dryers. Moreover, these combination units offer a space-saving solution for the laundry area, particularly beneficial if consumers have limited space for two separate machines. Being ventless, they are not constrained by the need for an exhaust vent, allowing flexibility in placement along any wall with access to a water line, even within kitchens or bathrooms. According to data published by Consumer Reports, Inc. in April 2024, all-in-one washers and dryers are highly energy efficient and consume 28% less energy than traditional dryers.

Furthermore, the growing number of households in the region significantly contributes to the rising demand for washers and dryers. According to data released by the U.S. Census Bureau and the Department of Housing and Urban Development, the sales of new single‐family houses were at a seasonally adjusted annual rate of 662,000 in February 2024, 14.3% above the revised rate of 625,000 in February 2023. Washers and dryers are the most prevalent home appliances in every household due to the significant features and benefits they offer. This is expected to keep product demand high over the course of the forecast period.

Market Concentration & Characteristics

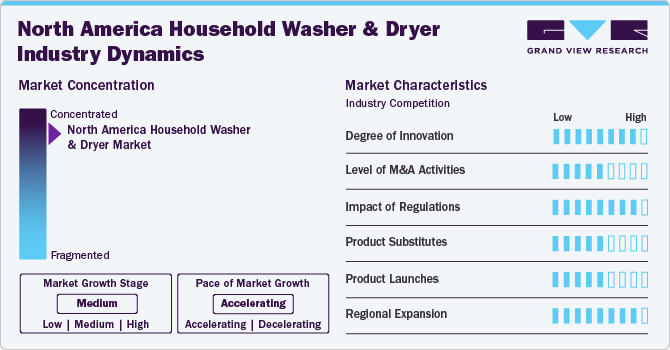

The household washer & dryer industry in North America has witnessed a notable degree of innovation in recent years. There has been a significant shift towards energy-efficient washers and dryers that meet or exceed ENERGY STAR standards. These models use less water and energy per cycle, reducing utility costs and environmental impact.

The level of mergers and acquisitions (M&A) in the North American household washer & dryer industry has been notable, reflecting strategic moves by major appliance manufacturers to expand their market presence, enhance product offerings, and achieve economies of scale.

The household washer & dryer industry in North America is significantly influenced by regulations that aim to ensure product safety, energy efficiency, and environmental sustainability. These regulations impact manufacturers, consumers, and the market dynamics in several ways.

In the North American washer & dryer industry, consumers have several product substitutes and alternatives to washers and dryers. These substitutes cater to different consumer needs, preferences, and living situations. These substitutes include public laundromats and shared laundry facilities, hand washing of clothes followed by air drying, and others.

The North American household washer & dryer industry experiences frequent product launches driven by technological advancements, consumer preferences for efficiency and convenience, and environmental considerations. Manufacturers continually innovate to introduce new features, improve performance, and enhance user experience.

Regional expansion in the North America household washer & dryer industry involves strategic initiatives by manufacturers to broaden their market reach, increase brand presence, and cater to diverse consumer preferences across different regions.

Product Insights

Household washer segment accounted for a revenue share of 52.3% in 2023. The market for washers in North America is driven by factors that reflect both consumer preferences and broader economic trends. One significant driver is the increasing focus on energy efficiency and sustainability. With growing concerns over environmental impact, consumers are increasingly seeking washers that offer higher energy efficiency ratings and utilize less water. Manufacturers are responding to this demand by developing washers with advanced technologies such as high-efficiency motors, water-recycling systems, and improved insulation, all aimed at reducing energy and water consumption.

The combo washer & dryer segment is expected to grow at a CAGR of 3.6% from 2024 to 2030. The compact nature of combo washer-dryers appeals to people living in smaller spaces, such as apartments, condos, or tiny homes, which are increasingly common in urban areas where space comes at a premium. With limited square footage, consumers seek appliances that can perform multiple functions without taking up excessive space, making combo washer-dryers an attractive choice. Combo washer-dryers offer the convenience of having both washing and drying functions in a single unit, eliminating the need to transfer clothes from one machine to another. This appeals to busy individuals and families who value time-saving solutions in their daily routines.

Load Type Insights

The top load washer & dryer segment accounted for a revenue share of 61.6% in 2023. Convenience plays a significant role in the popularity of these appliances. Top-load washers and dryers are known for their ease of use, with many consumers appreciating the simplicity of loading and unloading laundry from the top rather than bending down to load from the front. This feature appeals to a wide range of consumers, particularly people with mobility issues or those simply looking for a more user-friendly laundry solution. Secondly, the efficiency and effectiveness of top-load washer-dryer units contribute to their popularity.

The front load washer & dryer segment is expected to grow at a CAGR of 3.0% from 2024 to 2030. There is a growing demand for energy-efficient and sustainable household appliances across North America. Front-load washers and dryers are known for their superior energy efficiency compared to top-load variants, as they typically use less water and electricity per cycle. With increasing concerns about environmental impact and rising energy costs, consumers are actively seeking appliances that can help reduce their carbon footprint and save on utility bills.

Structure Insights

The standalone washer & dryer segment accounted for a revenue share of 62.9% in 2023. Advancements in technology have led to the development of more energy-efficient and feature-rich standalone washers and dryers. Energy efficiency is a major consideration for consumers looking to minimize their environmental footprint and reduce utility costs. Modern standalone units often come equipped with advanced features such as smart connectivity, customizable wash cycles, and sensors that optimize water and energy usage, appealing to tech-savvy consumers seeking convenience and efficiency. Moreover, in larger homes and multi-story dwellings, there is often ample space available to accommodate separate laundry appliances, further fueling product demand.

The side-by-side washer & dryer segment is expected to grow at a CAGR of 2.1% from 2024 to 2030. The side-by-side washer & dryer segment in North America caters to the evolving needs and preferences of consumers. The growing awareness and emphasis on sustainability and eco-friendliness are driving the adoption of energy-efficient appliances, including side-by-side washer & dryer units. Manufacturers are increasingly focusing on developing products that consume less energy and water, thereby reducing environmental impact and lowering utility bills for consumers.

Type Insights

The free-standing washer & dryers segment accounted for a revenue share of 66.6% in 2023. Freestanding washers and dryers can be placed anywhere with access to water, drainage, and electricity. They do not require special installation like built-in units, making them suitable for various spaces, including apartments, rental homes, and even temporary setups. These appliances typically do not require professional installation or modifications to existing cabinetry or countertops, reducing both the time and costs associated with setup. Freestanding washers and dryers are generally portable, allowing for easy relocation if needed. This is particularly useful for renters or homeowners who may move frequently.

The built-in washer & dryer segment is expected to grow at a CAGR of 3.0% from 2024 to 2030. Built-in units are designed to fit seamlessly into cabinets or closets, maximizing floor space in homes. This is particularly advantageous for smaller living spaces, such as apartments or condominiums. Integrating washers and dryers into cabinetry creates a streamlined and cohesive look in homes, enhancing their overall aesthetic appeal. They can blend in with the surrounding décor and architecture, contributing to a more organized space. Moreover, built-in units can be customized to match specific design preferences and requirements. Consumers can choose cabinetry, finishes, and configurations that complement their interior design scheme, creating a cohesive and personalized space.

Capacity Insights

Washer & dryer with capacity 8 kg to 12 kg accounted for a revenue share of 58.1% in 2023. Technological advancements have played a significant role in driving the market growth for 8kg to 11kg capacity washer & dryer units. Manufacturers have been incorporating innovative features, such as smart connectivity, energy-efficient designs, and advanced washing and drying capabilities. These technological advancements not only improve the efficiency and performance of the appliances but also enhance the overall user experience. Another driving factor is the increasing emphasis on energy efficiency and sustainability. Consumers are becoming more environmentally conscious and are seeking appliances that consume less energy and water. Many washer & dryer units with an 8kg to 11kg capacity now come with energy-saving features, such as low water usage, shorter wash cycles, and higher energy efficiency ratings. This not only helps consumers reduce their utility bills but also minimizes their environmental footprint.

Washer & dryer with a capacity of over 11kg is expected to grow at a CAGR of 2.4% from 2024 to 2030. The increasing size of American households and the corresponding need for appliances that can efficiently handle larger loads of laundry are primary factors driving the market for washer dryer units with a capacity of over 11kg. With families getting bigger or living in multigenerational households, the demand for washers and dryers capable of accommodating more clothes has surged. The driving force behind the popularity of washer & dryer units with a capacity of over 11kg is the growing emphasis on convenience and time-saving solutions. Larger machines allow users to complete more laundry in fewer cycles, reducing the time and effort required for household chores. This is particularly appealing to busy families and individuals who value efficiency and convenience in managing their daily routines.

Price Range Insights

Washers & dryers ranging between USD 501 to USD 1,000 accounted for a revenue share of 36.6% in 2023. There is a growing emphasis on sustainability and eco-friendliness within the appliance industry. Many consumers are willing to invest a bit more in exchange for appliances that are energy-efficient and environmentally responsible. Washers and dryers in the $500 to $1000 price range often come equipped with energy-saving technologies like sensor drying, which can help reduce energy consumption and lower utility bills over time. This eco-consciousness resonates with a significant portion of the consumer base, further driving demand within this price segment.

Washers & dryers ranging between USD 1,001 to USD 1,500 are expected to grow at a CAGR of 2.8% from 2024 to 2030. Consumers are increasingly seeking appliances that offer advanced features and technologies to simplify household chores and improve efficiency. Washers and dryers within this price range often come equipped with innovative functionalities such as energy-efficient settings, multiple wash/dry cycles, and smart connectivity options. These features appeal to modern consumers who prioritize convenience and performance in their appliances. Moreover, there is a growing emphasis on sustainability and environmental consciousness among consumers, leading to a preference for energy-efficient appliances. Washers and dryers in the USD 1,001 to USD 1,500 range often boast higher energy efficiency ratings, helping households reduce their utility bills and minimize their carbon footprint. This aligns with the eco-conscious mindset of many consumers today, driving the demand for greener home appliances.

Technology Insights

Conventional machines accounted for a revenue share of 71.8% in 2023. The market for conventional washers and dryers in North America is primarily driven by consumer demand for convenience, ease of use, and efficiency. Conventional models, although not as technologically advanced as their smart or connected counterparts, are still highly efficient in washing and drying clothes, meeting the basic needs of consumers. Brand loyalty and reputation play a major role in this segment. Established appliance manufacturers with a long history of producing reliable washers and dryers often enjoy a loyal customer base. Consumers trust these brands for their durability and performance, leading them to opt for conventional models from trusted manufacturers.

Smart machines are expected to grow at a CAGR of 3.9% from 2024 to 2030. The increasing adoption of smart home technologies is a growing trend across households in North America. As consumers seek more convenience and efficiency in their daily lives, they are turning to smart appliances that offer remote monitoring and control capabilities. Smart washers and dryers fit into this trend perfectly, allowing users to schedule laundry cycles, monitor energy usage, and receive alerts on their smartphones, enhancing convenience and efficiency. The proliferation of the Internet of Things (IoT) is a major factor driving the demand for smart appliances, including washers and dryers. These interconnected devices enable seamless communication between appliances, smartphones, and other smart home devices, creating a more integrated and streamlined user experience.

Distribution Channel Insights

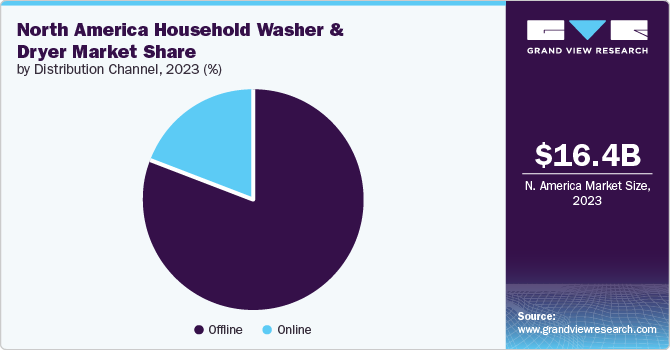

The sales of washer & dryer through offline channel accounted for a revenue share of 81.1% in 2023. Consumers in North America pay attention to product lifecycle and the price/value while purchasing a washer or dryer and find retail shops the most convenient place to check products before making a purchase. Offline retail stores across the region house a wide range of washers and dryers from numerous leading brands to suit the varying preferences and needs of consumers. In December 2021, Whirlpool Corporation announced the launch of top-load washing machines with 2-in-1 removable agitators in major retailers in the U.S. and across the globe. The company focuses on targeting consumers and providing them with various options for upgraded products in the top-load washer category.

The sales of washer & dryer through online channels is expected to grow at a CAGR of 4.5% from 2024 to 2030. The online distribution channel for the washer & dryer market in North America is primarily driven by the convenience and accessibility that online shopping offers consumers. With the proliferation of e-commerce platforms and the increasing comfort of online transactions, consumers are turning to the Internet to research and purchase household appliances like washers and dryers.

Many leading companies are entering the e-commerce marketplace to increase their customer base, streamline their revenues, and decrease operational costs. For example, Whirlpool Corporation, Panasonic Corporation, and General Electric have a significant online and offline presence in the region and are the leading manufacturers of washing machines and other electronic products.

Country Insights

U.S. Household Washer And Dryer Market Trends

The U.S. household washer & dryer market accounted for a 91.7% share of the North America market in 2023. With a larger population and higher density compared to Canada, the U.S. has more households and homeowners, driving greater demand for household appliances like washers & dryers. Moreover, the country's ongoing trends of new home construction, renovation, and household formation drive the demand for washers & dryers. As a result, the U.S. is expected to maintain its dominance as the primary market for household washers & dryers in the region during the forecast period.

Canada Household Washer And Dryer Market Trends

The Canada household washer & dryer market is expected to grow at a CAGR of 3.6% from 2024 to 2030. The significant expansion of retail channels, including brick-and-mortar establishments and online platforms, along with the influx of newer brands and models into the Canadian market, results in greater accessibility to a wide range of brands and machines with innovative and advanced features for consumers. This is driving the sales of washers & dryers in Canada.

Key North America Household Washer And Dryer Company Insights

The North America household washer & dryer industry is characterized by the presence of numerous well-established players such as Electrolux AB; Alliance Laundry System LLC; GE Appliances (a Haier Company); Avanti Products; Fisher & Paykel Appliances Ltd; Kenmore (Transform Holdco LLC); LG Electronics Inc.; Danby; Miele; Crosley; Robert Bosch GmbH; Samsung Electronics America, Inc.; ASKO; Midea; and Whirlpool Corporation, among others. The market players face intense competition from each other as some of them are among the top washer & dryer manufacturers with diverse product portfolios for washers and dryers. These companies have a large customer base due to the presence of established and vast distribution networks to reach out to both regional consumers.

Key North America Household Washer And Dryer Companies:

- Electrolux AB

- Alliance Laundry System LLC

- GE Appliances (a Haier Company)

- Avanti Products

- Fisher & Paykel Appliances Ltd

- Kenmore (Transform Holdco LLC)

- LG Electronics Inc.

- Danby

- Miele

- Crosley

- Robert Bosch GmbH

- Samsung Electronics America, Inc.

- ASKO

- Midea

- Whirlpool Corporation

Recent Developments

-

In April 2024, GE Appliances announced a new range of five top-load washing machines available under the GE and Hotpoint brands. This innovative lineup introduces the new Cold Plus cycle, which enhances the effectiveness of cold water washing to promote environmental sustainability and financial savings for consumers. By optimizing cold water washing, these machines enable users to lessen their carbon footprint and reduce utility expenses, all without compromising on wash performance.

-

In January 2024, LG Electronics introduced the latest addition to its laundry lineup, the 5.0 cu. Ft. Mega Capacity Smart WashCombo All-in-One Washer/Dryer (WM6998HBA). This innovative appliance features Inverter HeatPump Technology and a Direct Drive Motor, completing a wash and dry cycle in under two hours without the need for transferring clothes. With its space-saving ventless design, it offers energy efficiency, using up to 60 percent less energy than vented models.

-

In August 2023, Samsung Electronics Co., Ltd. announced its latest innovation, the BESPOKE AI Washer & Dryer Combo featuring Digital Inverter Heat Pump technology, at IFA 2023, a renowned consumer electronics trade show in Berlin. This model streamlines the laundry process by eliminating the need to transfer clothes between the washer & dryer, completing laundry loads in a single step. With a large washing capacity of 25kg and a drying capability of 13kg, this combo offers substantial convenience. Backed by intelligent functions, it also provides consumers with enhanced flexibility in their laundry routines.

North America Household Washer And Dryer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.75 billion

Revenue forecast in 2030

USD 19.49 billion

Market Volume in 2024

USD 18,302 Thousand Units

Volume forecast in 2030

USD 19,883 Thousand Units

Growth rate (revenue)

CAGR of 2.6% from 2024 to 2030

Growth rate (volume)

CAGR of 1.4% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in thousand units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, load type, structure, type, capacity, price range, technology, distribution channel, country

Regional scope

North America

Country scope

U.S. and Canada

Key companies profiled

Electrolux AB; Alliance Laundry System LLC; GE Appliances (a Haier Company); Avanti Products; Fisher & Paykel Appliances Ltd; Kenmore (Transform Holdco LLC); LG Electronics Inc.; Danby; Miele; Crosley; Robert Bosch GmbH; Samsung Electronics America, Inc.; ASKO; Midea; and Whirlpool Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Household Washer And Dryer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America household washer and dryer market report on the basis of product, load type, structure, type, capacity, price range, technology, distribution channel, and country

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Washer

-

Dryer

-

Combo Washer Dryer

-

-

Load Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Front Load

-

Top Load

-

-

Structure Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Stacked

-

Side-by-Side

-

Standalone

-

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Freestanding

-

Built-In

-

-

Capacity Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Up to 8 kg

-

8 kg to 11 kg

-

Above 11 kg

-

-

Price Range Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Up to USD 500

-

USD 501 to USD 1,000

-

USD 1,001 to USD 1,500

-

USD 1,501 to USD 2,000

-

USD 2,001 to USD 3,000

-

Above USD 3,000

-

-

Technology Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Smart Machines

-

Conventional Machines

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America household washer and dryer market size was estimated at USD 16.37 billion in 2023 and is expected to reach USD 16.75 billion in 2024.

b. The North America household washer and dryer market is expected to grow at a compounded growth rate of 2.6% from 2024 to 2030 to reach USD 19.49 billion by 2030.

b. Washers dominated the North America household washer & dryer market with a share of 52.3% in 2023. With growing concerns over environmental impact, consumers are increasingly seeking washers that offer higher energy efficiency ratings and utilize less water.

b. Some key players operating in North America household washer & dryer market include Electrolux AB; Alliance Laundry System LLC; GE Appliances (a Haier Company); Avanti Products; Fisher & Paykel Appliances Ltd; Kenmore (Transform Holdco LLC); LG Electronics Inc.; Danby; Miele; Crosley; Robert Bosch GmbH; Samsung Electronics America, Inc.; ASKO; Midea; and Whirlpool Corporation.

b. Innovations such as energy-efficient models, smart features, and automation contribute to market growth by enticing consumers to upgrade their appliances for improved performance and convenience.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."